The Future of UK Finance: Top Trends to Watch in 2024

The past few years have been a rollercoaster for the economy. From the pandemic’s shockwaves to skyrocketing inflation and rising interest rates, many of us have been living through a cost-of-living crisis.

In the UK, consumers have had to tighten their belts to stay afloat, and this has had a lasting impact on their spending habits. Even now, as the economy stabilizes, they are still prioritizing ways to maximize value from every transaction.

So, with their expectations higher than ever, how can finance businesses meet consumer demands and get people to keep spending? With access to the best consumer trend data.

Using Similarweb Market Research Intelligence, we gathered fresh data on the most impactful economic trends and consumer behaviors that are, and will continue to, shape the future of spending in the UK in 2024 and beyond.

Let these insights be your guide to understanding demand within the finance sector, connecting with your target audience, and getting that crucial competitive advantage.

Here are just a few of our key findings:

1. Credit card rewards are all the rage

To say that consumers want more bang for their buck would be an understatement. Not only do they want more in return from every transaction, but they also demand solutions that cater to their busy, on-the-go lifestyles.

That’s why, when it comes to credit cards, it’s out with the cash-back cards and in with the reward schemes. People want their money to stretch over the long-term, so perks like travel Air Miles and supermarket loyalty schemes are ticking their boxes.

For example:

- Search volume for ‘reward credit’ and ‘travel credit’ increased by 12% and 70% respectively

- Credit card giant American Express, known for its Air Miles perks, has over 1 million monthly app users, more than its two closest competitors combined

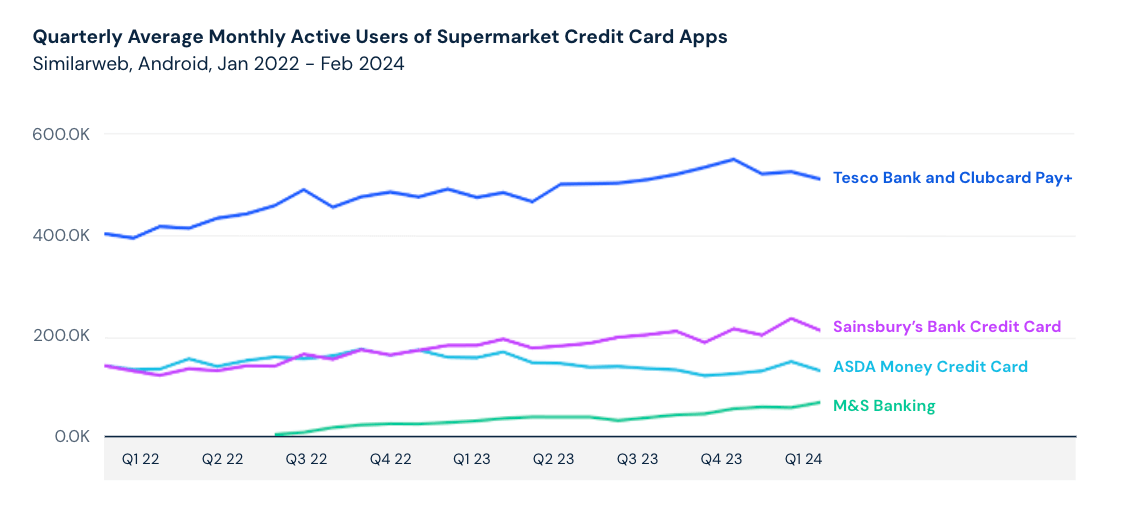

- Tesco’s doing something right with its Clubcard Pay+ scheme, helping them to grow their app user base by 25% between 2022 and 2024:

2. A quest to maximize spending power

It’s not just reward schemes getting cost-conscious consumers to spend. Here are some other key findings around their new value-driven spending habits:

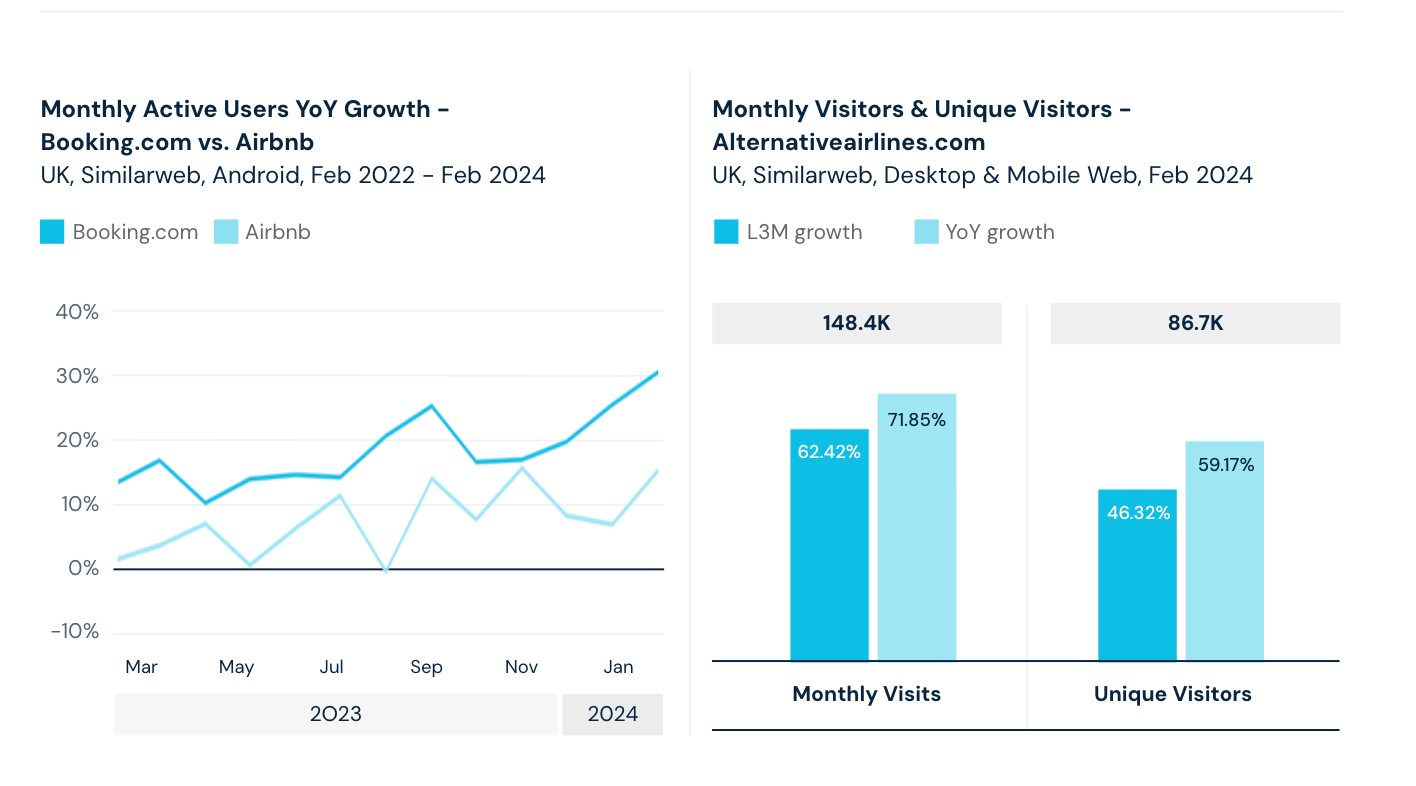

- Travel is King: traffic to travel sites was down YoY in early 2023, but it’s back on the rise as consumers prioritize travel over other expenses

- Buy Now, Pay Later (BNPL) solutions are helping consumers manage their spending, and some airlines offering BNPL saw up to 70% growth in 202

- Flexibility is (also) a winner: Booking.com has surpassed Airbnb in terms of user growth, in part due to their more flexible cancellation policies:

3. The rise of SMB banking

Businesses, especially small to medium enterprises, have also been feeling the squeeze. They’re on a mission to get the best possible banking and credit solutions to maximize their spending power.

And, it may surprise you to learn that it’s the smaller, challenger banks that are gaining traction in the SMB banking world. For example, digital bank Monzo has seen their share of traffic from business banking queries steadily increase by 2 ppts to 3% over the last two years.

This is because these emerging, innovative banks are taking a customer-centric approach, aiming to solve multiple problems at once with seamless, digital-first solutions.

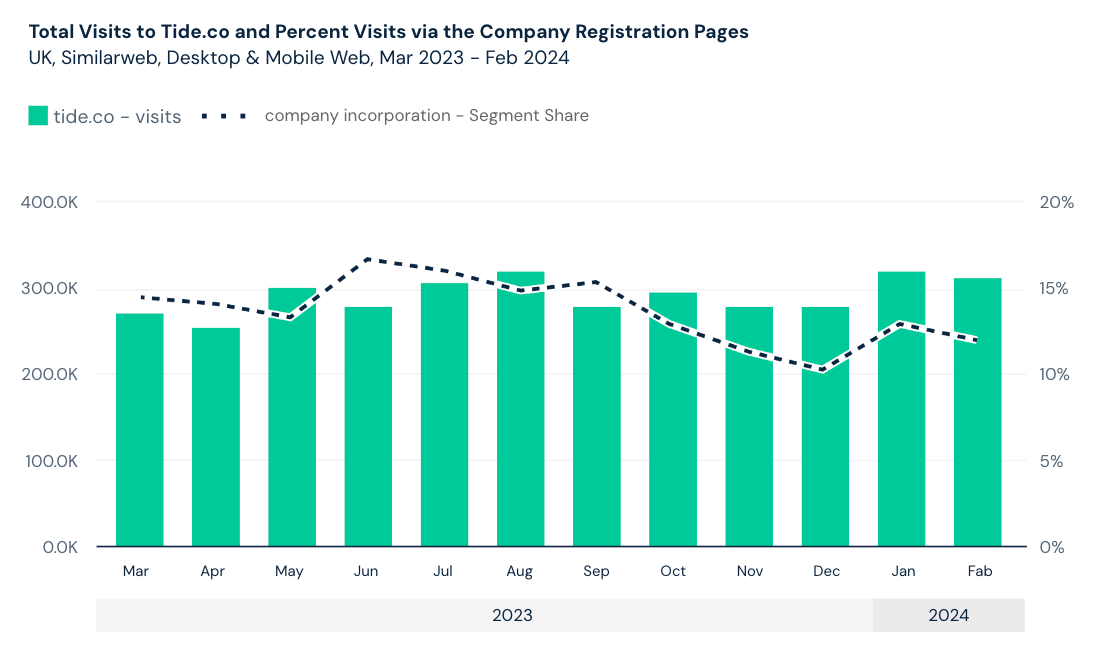

Take entrepreneurial bank, Tide, which incentivizes new clients by letting them register a new company directly through them for free, as well as register a website domain and open a business banking account. This all-in-one solution has earned them steady growth between 2023-24:

Want more insights? Find out what other innovative banking solutions, features, and benefits these disruptive challengers are offering to cut through the noise and outpace traditional banks. Download the full (and free) report to get the full scoop on emerging business banking trends.

A final word on the future of UK Finance

The evolution of consumer expectations, fueled by technological advancements and a shifting economic landscape, has set the stage for a new era of financial services – one where innovation, flexibility, and customer-centricity reign supreme.

Navigating this emerging landscape demands more than tracking trends; it requires strategic analysis, competitive intelligence, and of course, the most robust data and insights. That’s where Similarweb comes in.

Our 2024 economic trends report is a toolkit for financial businesses ready to lead the digital charge in today’s new financial landscape. Here’s what makes our consumer insights so invaluable:

- Actionable Data: Beyond-the-surface data to provide actionable insights that can directly inform your strategic planning.

- Consumer-Centric Analysis: Understand not just what changes are happening, but why they matter to your target audience – and most importantly, what they want going forward.

- Innovative Trends: From the rise of reward credit cards to the disruptive force of challenger banks, we spotlight the innovations that are setting new standards.

Whether you’re looking to refine your customer engagement strategies, improve your product or service, explore new market opportunities, or simply stay one step ahead of the competition, our data and insights will give you the advantage you need.

Are you ready to unlock the full potential of your financial services in 2024? Download the 30-page report below.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!