Ticketmaster Up 27%, Even as Competitors Steal Traffic Share

A relatively small player, SeatGeek, grew traffic by 67% and converted visits by 60%

Ticketmaster remains far and away the leader in online sales of concert and event tickets sites in the US, despite mishaps like fumbling the rush of orders for a Taylor Swift tour. However, the competitive landscape is in flux with players like StubHub gaining in share of digital voice and the relatively small upstart SeatGeek gaining share of traffic and converted visits.

Ticketmaster is dominant enough that it comes under fire for monopoly power, but not so dominant as to scare off all competitors.

Key takeaways

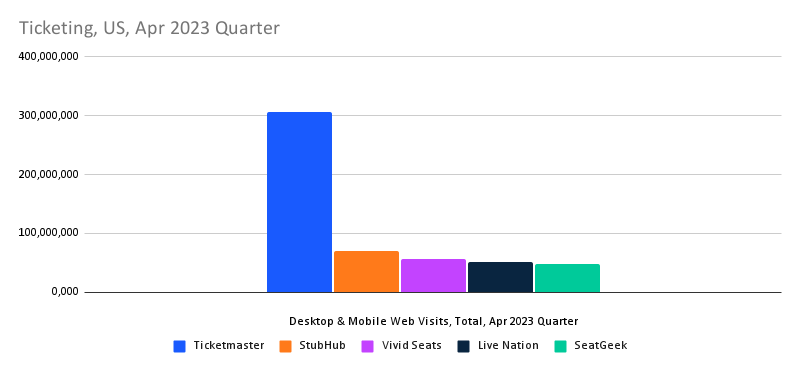

- For the three months ended in April, Ticketmaster attracted about 305.6 million total visits from within the US, according to Similarweb estimates, and LiveNation attracted another 50.8 million. LiveNation is the parent company.

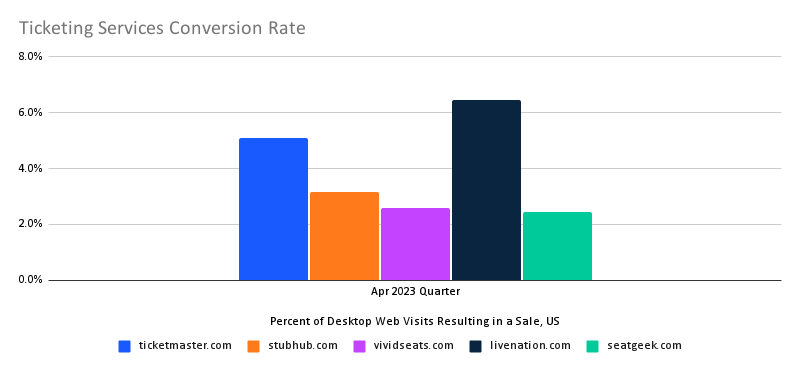

- Within the desktop web portion of that traffic, 5.1% of ticketmaster.com visits resulted in a sale. The conversion rate was even higher for livenation.com, at 6.5%.

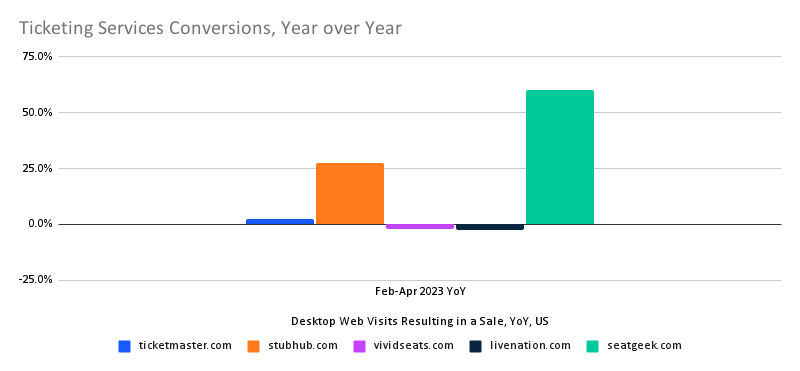

- A relatively small competitor, SeatGeek, did the best job of improving the volume of converted visits for seatgeek.com, up 60% year-over-year, and also incrementally gained in share of traffic at Ticketmaster’s expense.

Similarweb market share reports use web traffic as a leading indicator of consumer demand, and the ticketing services sector is one for which we have developed conversion metrics showing how many website visits result in a sale. This analysis is focused on the US market.

Who’s turning traffic into transactions?

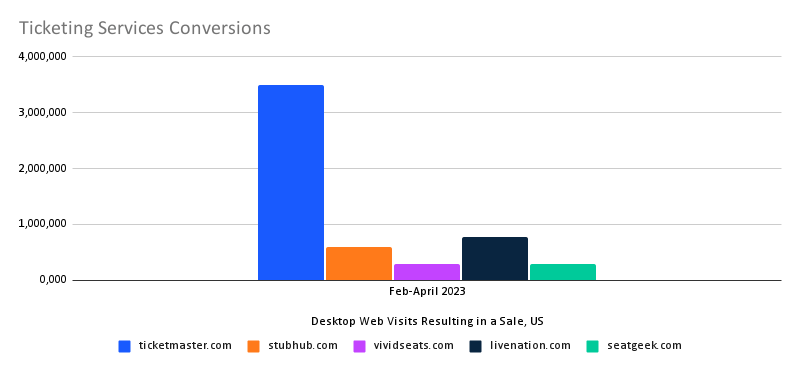

For the last three months, Ticketmaster and LiveNation had the greatest volume of converted visits – traffic that resulted in a sale.

They also had the best conversion rates, with LiveNation’s conversion rate even a bit higher at 6.5% to 5.1% for Ticketmaster.

On the other hand, SeatGeek and StubHub did the best job of increasing their volume of converted visits, year-over-year.

Ticketmaster loses some share of traffic to SeatGeek and StubHub

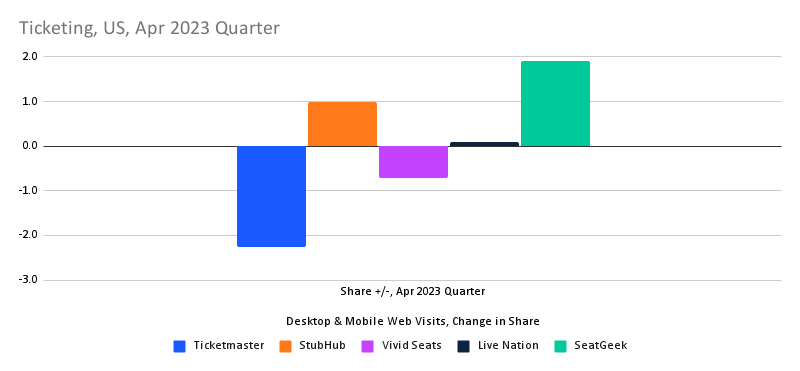

Within this pool of competitors, Ticketmaster lost 2.3 points of share of traffic, while SeatGeek gained nearly that much (1.9 points).

On the other hand, SeatGeek is the least trafficked of the services covered in this comparison, while Ticketmaster commands the most traffic.

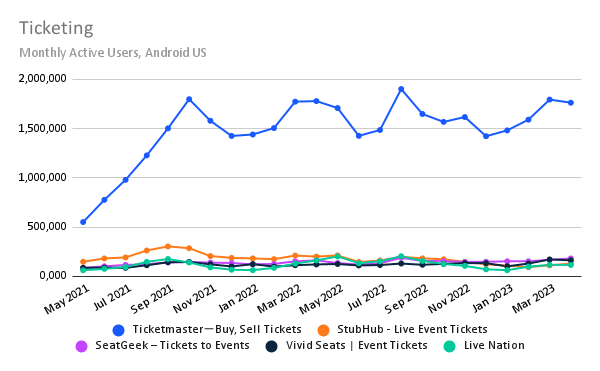

Vivid Seats and SeatGeek biggest gainers in mobile engagement

Based on monthly active users for Android, Vivid Seats app and SeetGeek were the biggest gainers in mobile engagement, up 39% in the last three months for Vivid Seats and 14% for SeatGeek app.

On mobile as on the web, these competitors are fighting for share in a market where Ticketmaster app dominates.

Public companies referenced in this report include Live Nation Entertainment Inc. (NYSE: LYV) and Vivid Seats (NASDAQ: SEAT).

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Contact: For more information, please write to press@similarweb.com.

Report By: David F. Carr, Senior Insights Manager

Disclaimer: All names, brands, trademarks, and registered trademarks are the property of their respective owners. The data, reports, and other materials provided or made available by Similarweb consist of or include estimated metrics and digital insights generated by Similarweb using its proprietary algorithms, based on information collected by Similarweb from multiple sources using its advanced data methodologies. Similarweb shall not be responsible for the accuracy of such data, reports, and materials and shall have no liability for any decision by any third party based in whole or in part on such data, reports, and materials.

Photo by Dylan Mullins on Unsplash

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!