What Ecommerce Must Learn from Temu to Compete with Temu

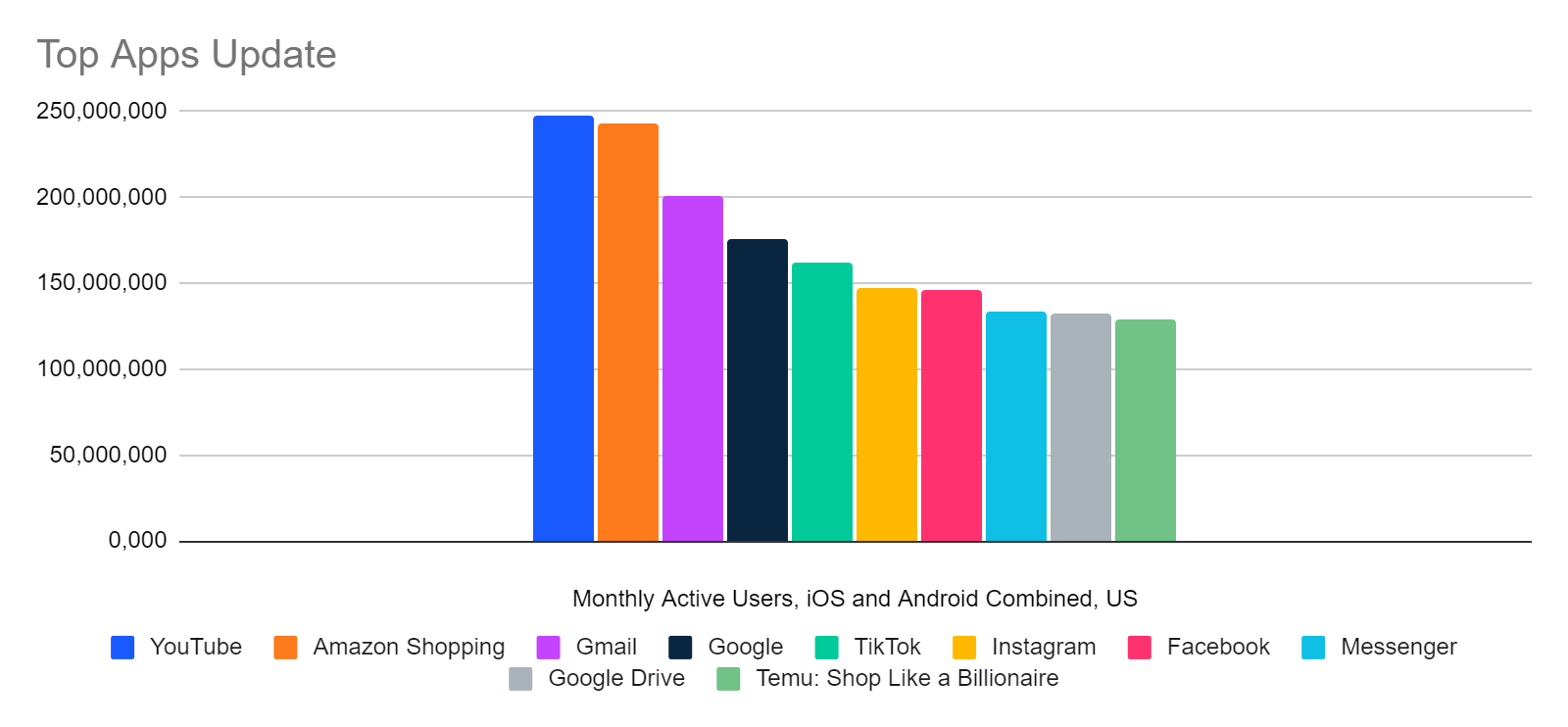

In the US, usage of the Temu app is up more than 8,000% since its September 2022 launch, making it one of the top 10 most popular apps and the #2 for ecommerce

Temu is a runaway success as an ecommerce player in the US, challenging Amazon and shaking up the online retail market in general. Run out of Boston, Temu was created by the Chinese ecommerce giant PDD Holdings, using many of the same marketing, mobile-first, and gamified customer experience strategies as its ecommerce app for the Chinese market.

Since its launch last September, Temu has established itself as the #2 ecommerce app in the US, outdistancing Chinese fashion retail rival, Shein. Other online sellers who want to remain competitive in a world that includes Temu need to learn from its success, said Marta Sułkiewicz, Vice President for the Global Research Solution at Similarweb.

“They are making massive marketing investments, both digital and offline, with a heavy strategic focus on app adoption,” Sułkiewicz said. “In less than a year for them to have become one of the top 10 apps in the US, almost as big as Facebook and Instagram, is nothing short of incredible.”

Temu will be the prime example of how next-gen manufacturing is changing the ecommerce industry in an upcoming webinar on October 24, 2023, at 11 am ET / 3 pm GMT (register here) and a live presentation by Sułkiewicz at The Marketing Research Event in Denver. “Temu benefits from a next-gen manufacturing model that competing ecommerce players will not be able to duplicate easily, but we can suggest a framework for how other companies can use digital data similarly as the basis for operational excellence,” Sułkiewicz said. “Temu uses data at scale, including timely consumer insights, not only in their marketing strategy but also to forecast demand and optimize manufacturing and supply chain.”

Key takeaways

- Temu is currently the #2 most popular ecommerce app in the US, behind only Amazon Shopper according to Similarweb estimates of monthly active users for iOS and Android combined, and the #10 most popular app overall, trailing only apps operated by tech giants like Google and Meta-owned platforms.

- US web traffic to temu.com is up more than 1,000% year-over-year, reaching nearly 99 million visits per month in September. Globally, Temu’s web traffic reached over 326 million visits, up more than 4,000% year-over-year.

- Despite also selling on the web, Temu strongly encourages visitors to get its app, allowing the service to build a tighter relationship with them. They can also collect richer first-party data from app users.

- Temu’s conversion rate – the percentage of website visitors who make a purchase – was 4.6% in September or a little less than that of Shein (4.7%), but better than Forever 21 (3.6%) and ASOS (3.3%). However, no one comes close to Amazon (11.8%). These figures are based on desktop web data for the US.

Suddenly, one of the most popular apps

In our recent roundup of The 40 Apps Americans Love the Most, Temu came in at #8, just behind Facebook. When we updated the data based on September numbers, Temu ranked #10, with 129 million monthly active users in the US for iOS and Android combined, according to Similarweb estimates. That puts it in the same ballpark as longer-tenured apps like Facebook, Facebook Messenger, and Google Drive, and makes it the second most popular ecommerce app – albeit well behind Amazon Shopper’s 243 million monthly users.

The app’s popularity in the US has grown rapidly, although its user count actually seems to have fallen slightly from a peak over the summer (when it may have briefly been more popular than Facebook).

Cost-effective marketing

Temu not only spends on digital marketing, positioning itself squarely between the most growth-oriented and the most cost-efficient players.

Cost efficiency quadrant, by Period-over-Period Visits Change & PPC Spend for Temu and other marketplaces (bubble size in Monthly Visits)

US, Desktop & Mobile Web, July – September 2023 vs April – June 2023

Temu is splashing more cash on paid marketing than its competitors. Over the three months ending in September 2023, the company had the second-highest PPC spend estimated at $242.4M, versus $171M for Walmart, for instance. Temu also had the third-highest growth rate, growing traffic by about 5%. Traffic to Amazon.com, with more than 90% more budget than Temu ($463.2M), grew faster period-over-period, although some of that may be related to activities other than ecommerce such as its streaming and cloud businesses. However, when comparing with Costco, just behind Temu in monthly web traffic, we can see that Temu may slightly lack efficiency in paid marketing: while Costco only spent $147.6M, it was the fastest growing marketplace, with visits up 6.4% versus the previous period.

Despite the popularity of the new marketplace, there is still a learning curve for customer acquisition efficiency. Sułkiewicz suggests Temu is doing well, considering that it may not even have begun to optimize for cost efficiency yet.

Huge in the US but also growing worldwide

Worldwide, we can make some comparisons of the success of the Temu app based on Android data.

Here’s where it fits in currently, for the UK …

… Germany …

… and France

A force to be reckoned with

Temu’s success has gained attention from both admirers and critics, but any competitor in ecommerce ought to take note of what it does well and consider how to counter its advantages. Similarweb will have more to share about Temu and the broader trends it represents in Tuesday’s webinar.

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Disclaimer: All names, brands, trademarks, and registered trademarks are the property of their respective owners. The data, reports, and other materials provided or made available by Similarweb consist of or include estimated metrics and digital insights generated by Similarweb using its proprietary algorithms, based on information collected by Similarweb from multiple sources using its advanced data methodologies. Similarweb shall not be responsible for the accuracy of such data, reports, and materials and shall have no liability for any decision by any third party based in whole or in part on such data, reports, and materials.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!