SHEIN’s Digital Market Share, App Strength Make the Case for IPO

While web traffic is down, app usage is on the rise — which may be more important to SHEIN’s gamified ecommerce strategy

Ahead of the London IPO announcement expected any day now from SHEIN, I’ve been working with colleagues in the Similarweb Stock Intelligence team and refreshing my own analysis of SHEIN as an ecommerce player. While some web metrics are down, SHEIN’s app-first strategy makes me think that is more than offset by their growth in iOS and Android active users. SHEIN’s footprint on the web also remains larger than any of its “fast fashion” rivals such as Asos or Zara.

For this analysis, I’m defining the industry as “budget fashion,” including fast fashion and apparel resale companies like Poshmark and Vinted.

Key takeaways

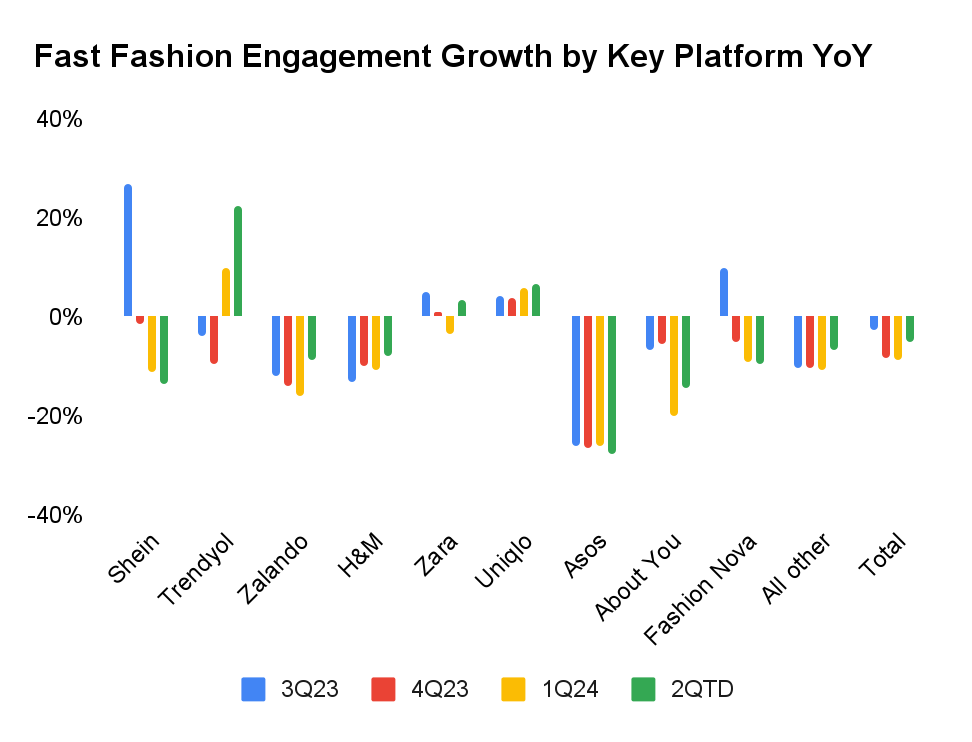

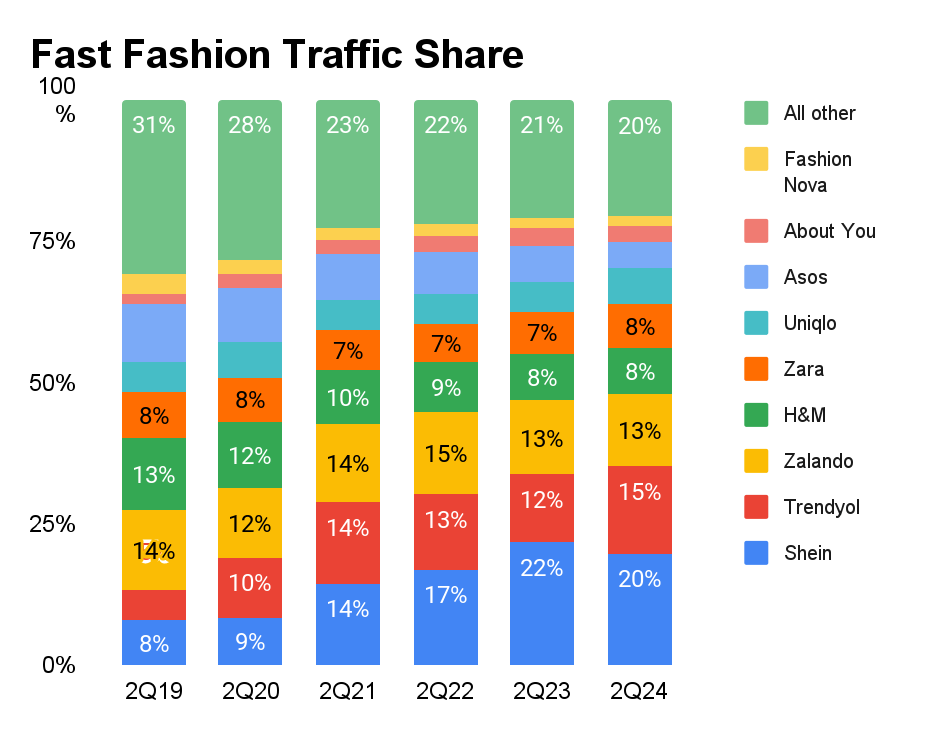

- Our Stock Intelligence team finds that SHEIN’s global web traffic is down -13% year-over-year (YoY), compared with an industry trend of -8% over the same period. Yet SHEIN continues to hold the top position by traffic share, at 20%. These figures are based on consolidated traffic for multiple country-specific domains including shein.com and shein.co.uk.

- The app engagement picture for SHEIN is much stronger in the US and the UK – two of the countries where we have the most complete app data model. In June, SHEIN’s monthly active users for iOS and Android combined were up 11% YoY in the US and 31% in the UK, according to Similarweb estimates.

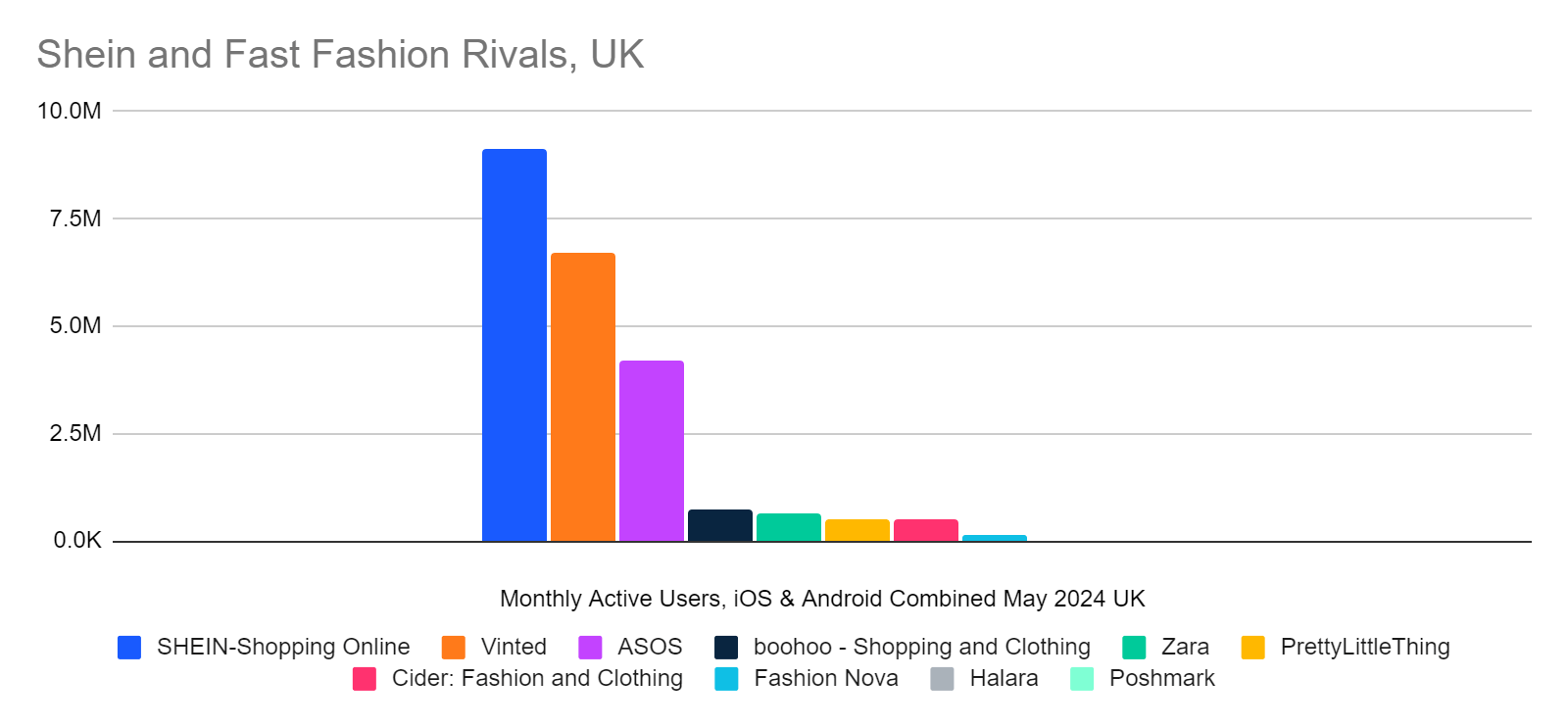

- In the UK, SHEIN’s app user count is growing faster than that of e-commerce juggernaut Temu, which was up 6.5% YoY in June. SHEIN is not far behind in scale, with Temu at 11.4 million and SHEIN at 9.1 million. For comparison, rival app-first fast fashion retailer ASOS was at 4.2 million monthly active users in the UK (see chart, below).

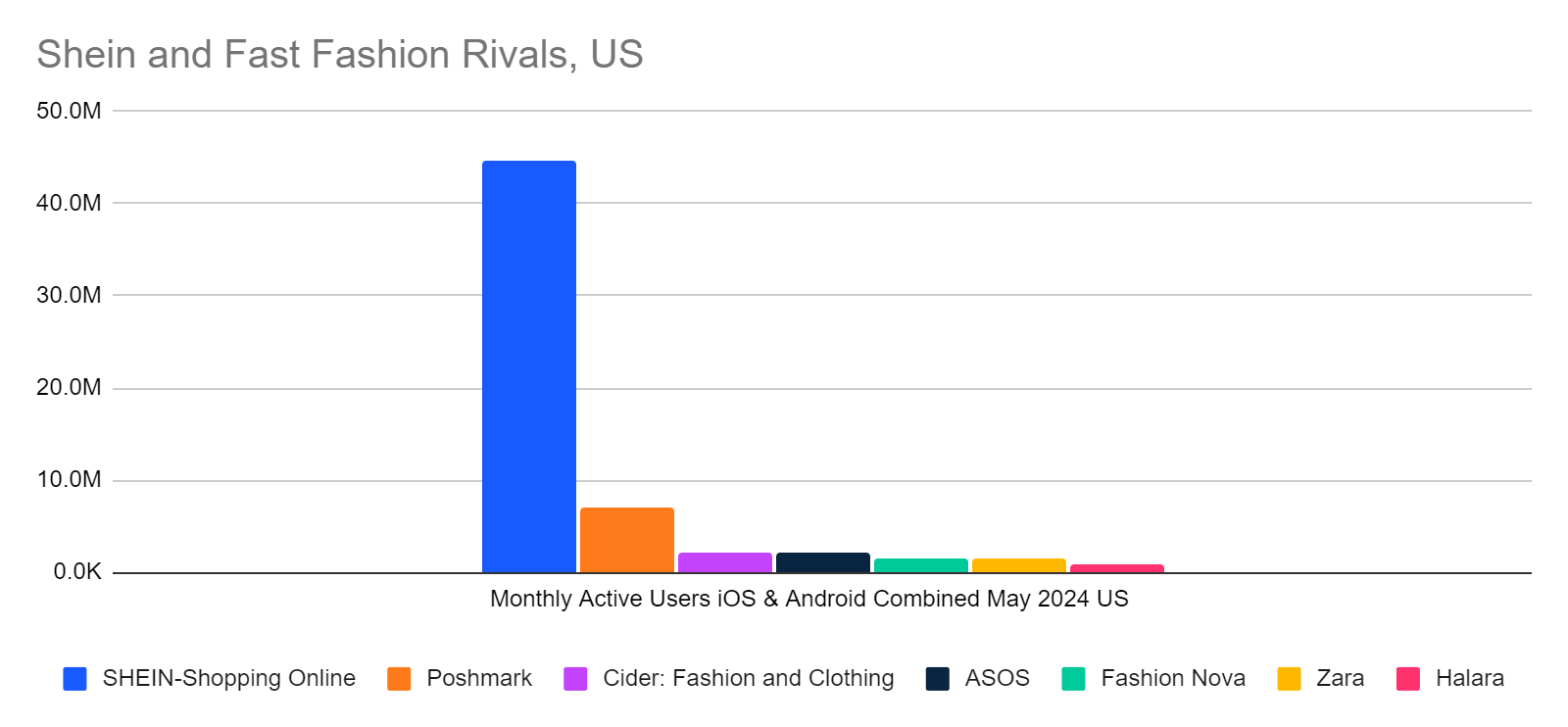

- In the US, there is a wider gap between SHEIN’s at 44.8 million app monthly active users and Temu at 146.4 million – but despite some overlap with fast fashion, Temu is more of a general discount retailer. SHEIN is well ahead of more direct US competitors in affordable apparel, such as Poshmark at 7 million monthly active users.

- If the digital economy shifts from search to AI as the primary traffic generator, SHEIN might have a problem. Similarweb’s monitoring of prompts and responses for tools like ChatGPT shows that users frequently ask about SHEIN by name indicating their brand strength, but the AI engines are less likely to recommend SHEIN than brands like H&M and Zara. I share a few thoughts about why below.

Global web traffic growth has stalled, but digital share is still huge

Research by Similarweb Stock Intelligence shows that the rapid growth in web traffic SHEIN enjoyed in late 2023 gave way to falling traffic in recent quarters. Possibly, some of that is due to shifting users from the website to the app – which is part of SHEIN’s digital marketing strategy.

Similarweb’s investor-focused research tends to focus on web data as more predictive than look at app engagement, but SHEIN’s heavy focus on getting consumers to shop with its app means that both are important.

Despite the poor YoY comparison, SHEIN continues to attract a greater share of global traffic than any rival and be the most visited fashion and apparel website.

SHEIN’s traffic share is 5% above the next ranked site, Trendyol. Over the last six months, Trendyol has grown on average 12% YoY, bucking the broader industry trend. Based in Turkey and owned by Alibaba, Trendyol.com has been growing its presence in the EU but has not yet entered the US market. The company leverages the economics of the Turkish textile industry to keep prices low.

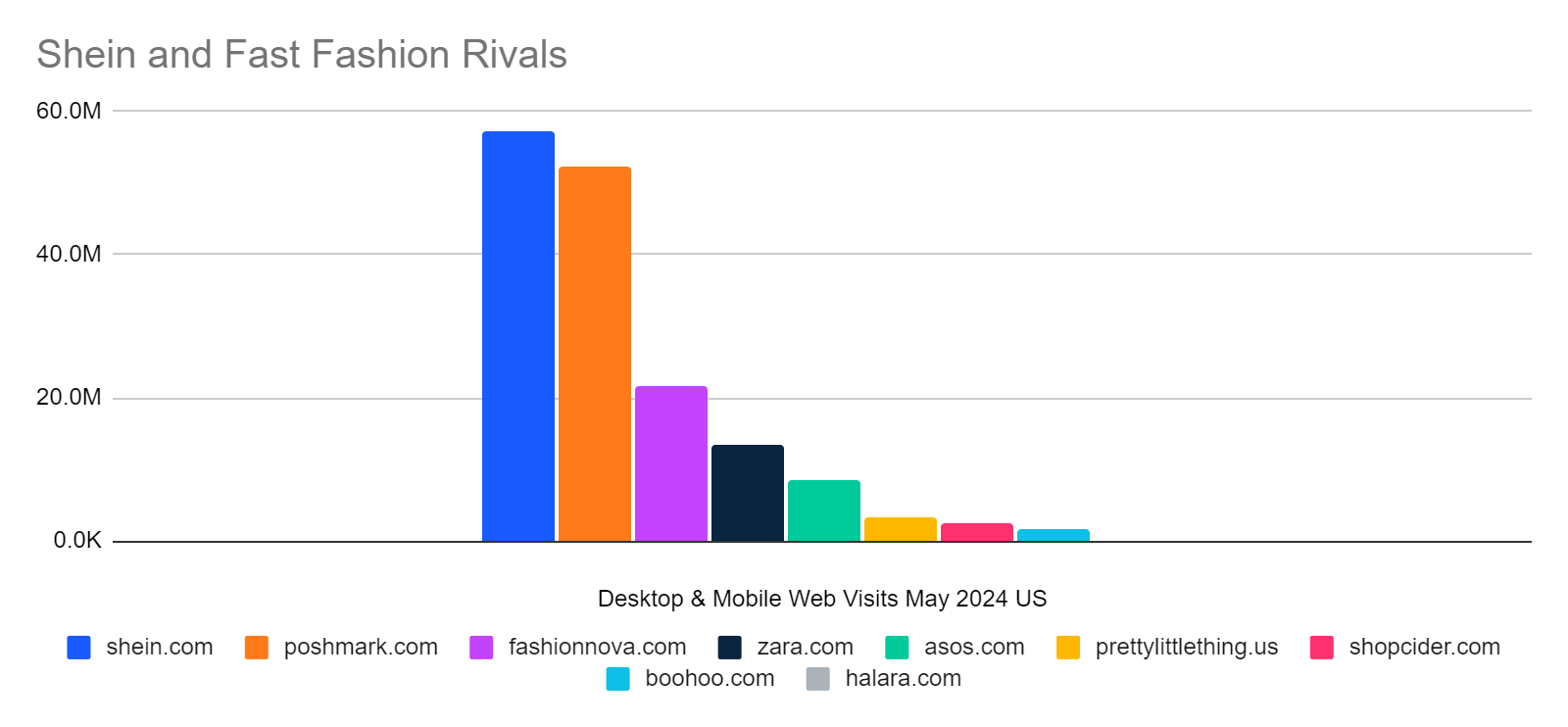

The standings are considerably different if we narrow our focus to the US, where Poshmark’s poshmark.com is the closest rival to shein.com.

However, SHEIN’s US web traffic was down -22% YoY in June, compared with -7% in the UK. Again, on a worldwide basis the sector is running -8% YoY for web traffic.

But what about in apps?

In app engagement, SHEIN is far ahead and growing

Driving app engagement is part of SHEIN’s strategy for continual consumer engagement, and the company has succeeded in making its app one of the leaders in ecommerce and the clear leader in budget fashion.

In the UK, SHEIN is well ahead of ASOS, which has also emphasized an app-first strategy, with second-hand clothing marketplace Vinted a closer rival.

In the UK, SHEIN’s app engagement has continued to grow, while for some rivals including ASOS it has stalled.

What does ChatGPT think of SHEIN?

Part of my research has been looking at the impact of AI chatbots on the digital economy, particularly in terms of the challenge they pose to traditional search engine optimization techniques of attracting traffic to websites (or, for that matter, to app download pages). Even if consumers don’t seek AI’s advice from a service like ChatGPT, they’re starting to be offered it in the context of Google search results.

A potential problem for SHEIN going forward is that AI chatbots don’t seem to think very highly of it.

The first line in the chart below represents how often consumers asked for information about the brand by name in prompts related to affordable apparel entered into ChatGPT, Bard/Gemini, Bing in Q1 2024. SHEIN ranks well there as a sign of brand awareness, as does Temu.

However, when consumers don’t ask for these brands by name, the chatbots don’t often mention them in response to general questions about where to buy affordable clothing. SHEIN is mentioned much less often (9.6% of the time) than H&M (88.9%), ASOS (48.9%), and Zara (45.9%). We didn’t detect any mentions of Temu at all in this context.

| SHEIN | TEMU | ZARA | H&M | ASOS | |

| Prompts | 37% | 31% | 14.8% | 12.6% | 9.6% |

| Answers | 9.6% | 0% | 45.9% | 88.9% | 48.9% |

These AI tools are designed to dispense the collective wisdom of the internet, and apparently they reflect poor sentiment about Chinese retailers.

To be clear, we’re in the very early stages of the transition of search and SEO as we know it to the AI focused future many are anticipating. In other words, SHEIN may need to boost its reputation not only with the bots but with the consumers expressing opinions about its service online – because the bots are watching.

Overall, SHEIN has many advantages

I’m not in the business of telling you whether the SHEIN IPO is a good investment, but overall they are in a strong position within the budget fashion segment. SHEIN has strong digital market share on the web and growth in app engagement, putting access to apparel retail in many consumers’ pockets.

That the app-first strategy is paying off particularly well in the UK may have a lot to do with why they turned to the London market for their IPO after running into regulatory obstacles in the US.

SHEIN is benefitting from the cost of living concerns. Some economists argue that GDP growth in the US and other positive metrics mean the economy is better than people think it is, but when we’re talking about consumer behavior, consumer perception is what matters. SHEIN has a great market fit for people who feel like they’re in a recession or whose personal finances feel squeezed.

Despite reports that SHEIN raised prices in anticipation of its IPO, their prices remain cheaper than those of fast-fashion. They also react faster to changes in consumer demand, which helps them maintain their lead.

The mixed consumer sentiment reflected in our AI chatbot research is a tradeoff with the fact that they sell cheap, almost disposable apparel. Yet when I compare them with their peers, I see a higher share of direct visits (indicating brand awareness and returning visitors) and strong social media referrals (high community engagement). A big part of that is the success of the gamification strategy SHEIN pioneered, which turns shopping into a treasure hunt for the best deals – and keeps people coming back.

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com.

Disclaimer: All names, brands, trademarks, and registered trademarks are the property of their respective owners. The data, reports, and other materials provided or made available by Similarweb consist of or include estimated metrics and digital insights generated by Similarweb using its proprietary algorithms, based on information collected by Similarweb from multiple sources using its advanced data methodologies. Similarweb shall not be responsible for the accuracy of such data, reports, and materials and shall have no liability for any decision by any third party based in whole or in part on such data, reports, and materials.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!