The Amazon Prime Day Deals Consumers Are Searching For

Robot vacuum and mop combo, kids Kindle, Ninja air fryers among the most sought out products in the weeks since Prime Day was announced

Amazon’s Prime Day 2-day event officially starts today, but it’s been driving consumer behavior on amazon.com since the dates were officially announced at the end of June. We can see the influence in search activity on the Amazon platform, as monitored by Similarweb Shopper Intelligence.

In addition to taking advantage of widely promoted early Prime Day deals, consumers immediately began researching products they might want to buy, reading the reviews, and checking out competitive products.

Most searched for products

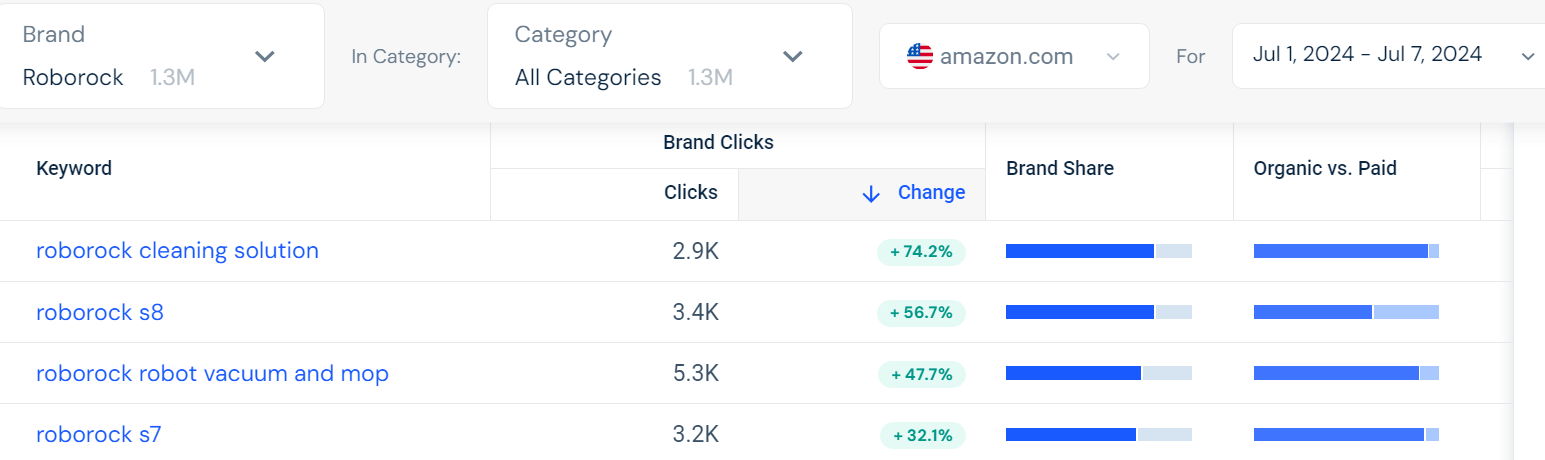

We used Shopper Intelligence’s brand search feature to look at the fastest growing searches for some of the brands most active in offering Prime Day deals, picking out the ones that gained the most search traction the week the Prime Day dates were announced, versus the week before. Based on amazon.com “brand clicks” – the number of searches that resulted in the user clicking to see more details, the Prime Day deals users have been eagerly awaiting include:

- Robot vacuum and mop combos. Searches on “roborock robot vacuum and mop” produced 3.6K brand clicks, up more than 2,000% from the week before, and clicks on “roborock s8” were up 228.6% to 2.2K. Search clicks for “irobot vacuum and mop combo” were up 100.2% to 1.7K.

- Ninja kitchen appliances. Search clicks for “ninja air fryers” were up 223.6% to 1.1K.

- Paris Hilton kitchen products. Search clicks for “paris hilton kitchen collection” were up 143.3% to 1.7K and for “paris hilton cookware” they were up 46.1% to 11.0K .

- Amazon’s own products, particularly the Kindle Kids. Amazon features its own branded products prominently among Prime Day deals, so people interested in those products tend to take Prime Day as a buying opportunity. Clicks on “kids kindle” were up 128.5% to 12.6K, while “kindle scribe” was up 78.7% to 29.1K, and “kindle paperwhite” was up 33.5% to 121.K. Amazon also owns Ring, a producer of video cameras and security devices, and “ring doorbell” clicks were up 104.0% to 188.1K.

- Apple products (of course). Search volume for Apple products is high to begin with, so the percentage increases aren’t quite as impressive. For example, search clicks for “ipad” were up 8.3% to 146K, while search for “apple headphones” were up 10.4% to 18.2K.

Most of these trends continued to accelerate during the following week, ending July 7. For example, search clicks on “roborock vacuum and mop” rose another 47.7% and “ninja air fryer” climbed another 17.4%. Search clicks for “portable air conditioner” were up 38.5% and Black and Decker was getting the biggest share of them, but as Prime Day began Wynter was the brand running a Prime Day deal.

Meanwhile, clicks “airpods” were down 8.7% while “ear buds” (non-Apple budget alternatives) were up 38.3%. Amazon was capturing some of that traffic for itself on Prime Day with deals on Echo Buds.

Amazon sales trends

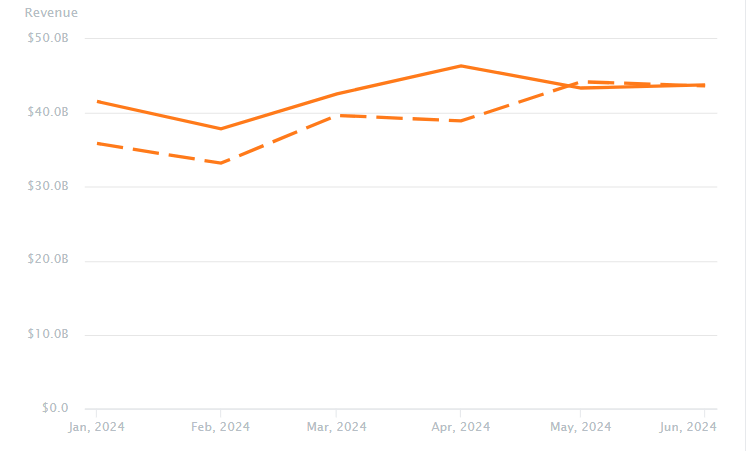

- Based on Similarweb Shopper Intelligence tracking of amazon.com sales trends for the first half of the year, we’re expecting Prime Day revenue to be up more than 14% compared with the July 2023 Prime Day event.

- For amazon.com, revenue for the first half of 2024 was up 8.5% to $255.5 billion and unit sales were up 12%, according to Similarweb Shopper Intelligence estimates.

- Sales volume and revenue metrics have been trending up, but the average selling price is down 3% year-over-year (YoY), possibly due to consumer concerns about inflation – an indication that shoppers are looking for deals. That’s good news for Amazon’s tentpole deals event.

- Traffic for the 7 days ending July 11 was about 6.7% higher than for the first half of the year.

As in past years, consumer electronics are predicted to be one of the most popular categories for Amazon Prime Day deals. The research published as part of Similarweb’s State of Ecommerce 2024 report series found that consumer electronics was the only ecommerce category for which traffic was down 2.1% year-over-year. Amazon saw electronics revenue dip in May (perhaps a sign of of consumers holding back purchases in anticipation of deals), although it recovered in June.

“We see evidence of bargain shopping across the digital economy,” said Inès Durand, Solution Business Manager, Advisory Services, and one of Similarweb’s ecommerce research leaders. “Price sensitivity helps explain the rise of Amazon competitors like Temu, with its sales of Chinese manufactured goods, but Amazon is still the king of ecommerce. Amazon Prime Day represents a huge online bargain hunting opportunity for name brand buyers, and we see it growing every year.”

Amazon revenue has been trending up, even without Prime Day

Similarweb Shopper Intelligence estimates show revenue has been higher throughout the first half of 2024 (the solid line in the chart below) versus the same six months of 2023 (the dotted line) – revenue up 8.5%, with unit sales up 12%. Those estimates are for amazon.com, which serves the US market.

Sales are not quite as strong in some other regions, for example with the comparable figures for amazon.co.uk at first half of 2024 revenue up 0.3% YoY to £10.6B and unit sales up 4.4%.

Out now! Get the data on Prime Day 2024’s best selling products here:

More updates to follow

We’ll be updating our coverage in a few weeks with a deeper analysis for ecommerce professionals on the lessons of Prime Day 2024.

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Contact: For more information, please write to press@similarweb.com.

Report By: David F. Carr, Senior Insights Manager

Disclaimer: All names, brands, trademarks, and registered trademarks are the property of their respective owners. The data, reports, and other materials provided or made available by Similarweb consist of or include estimated metrics and digital insights generated by Similarweb using its proprietary algorithms, based on information collected by Similarweb from multiple sources using its advanced data methodologies. Similarweb shall not be responsible for the accuracy of such data, reports, and materials and shall have no liability for any decision by any third party based in whole or in part on such data, reports, and materials.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!