Traffic Down 4% for Chewy, up 30% for Rover

A Pets Retail and Services market update for January 2023

Chewy was still in the doghouse in January, while Rover was a very good boy as judged by Similarweb traffic estimates.

Key takeaways

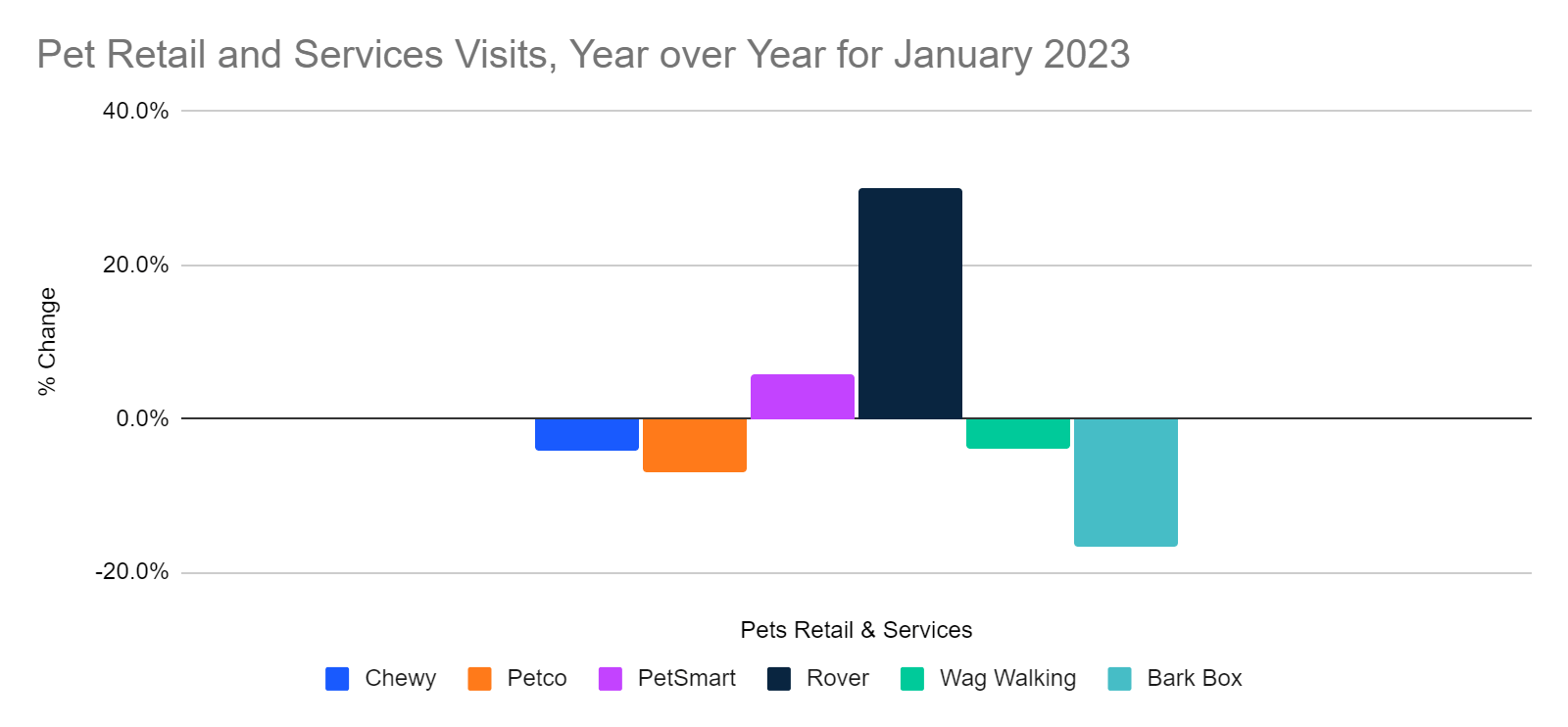

- Chewy attracts the most traffic in the pets segment, but its traffic was down 4% year-over-year in January.

- Petco saw a 6.9% traffic decline, while PetSmart’s traffic was up 5.9% year-over-year.

- The dog walking and pet sitting service Rover continues to demonstrate strong traffic growth, with traffic up 30% year-over-year in January (albeit 3.7% lower than in December).

We share these metrics as signs of market momentum. The Similarweb Investor Intelligence team tracks them in more detail.

Traffic is Down Year-over-Year for Chewy and Petco, up for PetSmart and Rover

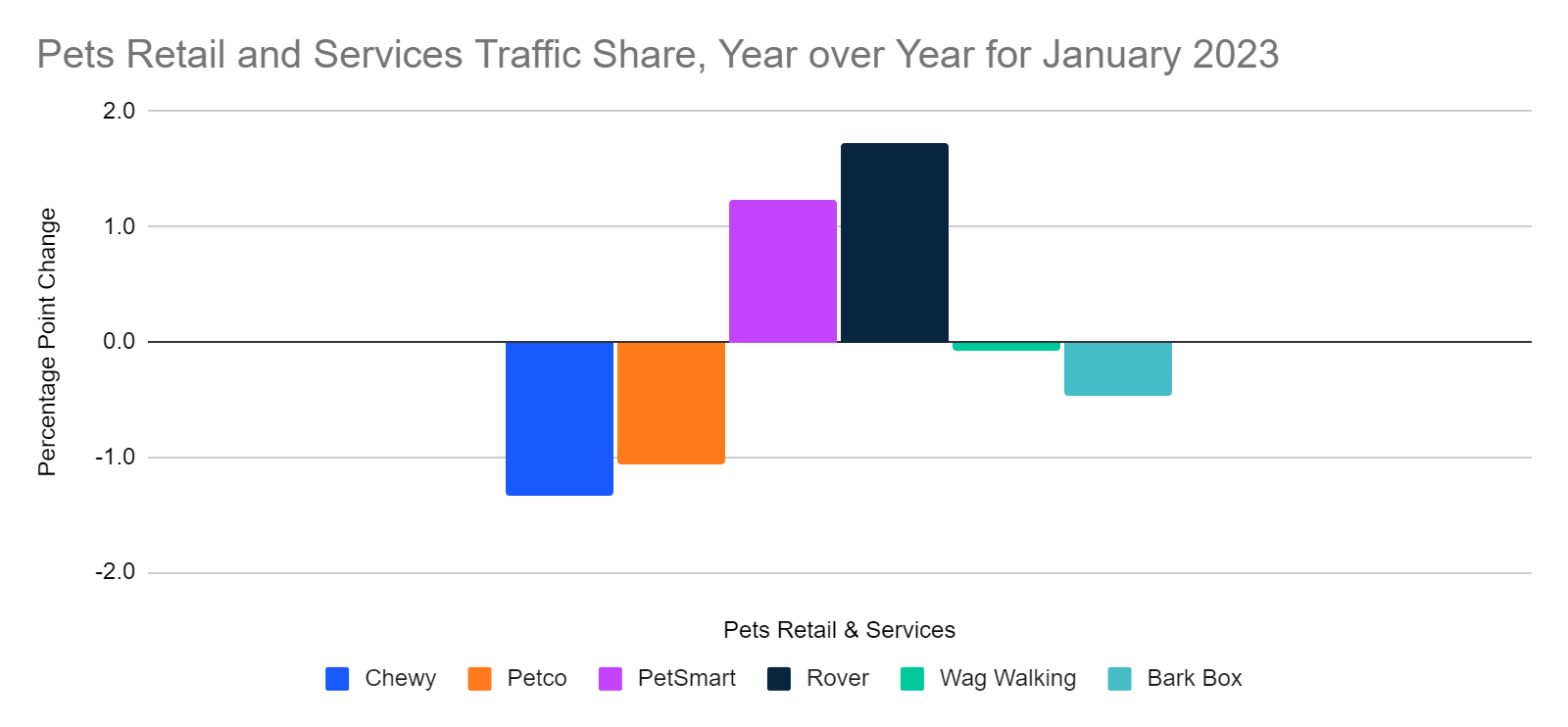

Chewy and Petco lost share, year-over-year

By share of traffic within this competitive set, Chewy and Petco lost about a percentage point, while PetSmart gained by more than a point and Rover gained 1.7 percentage points.

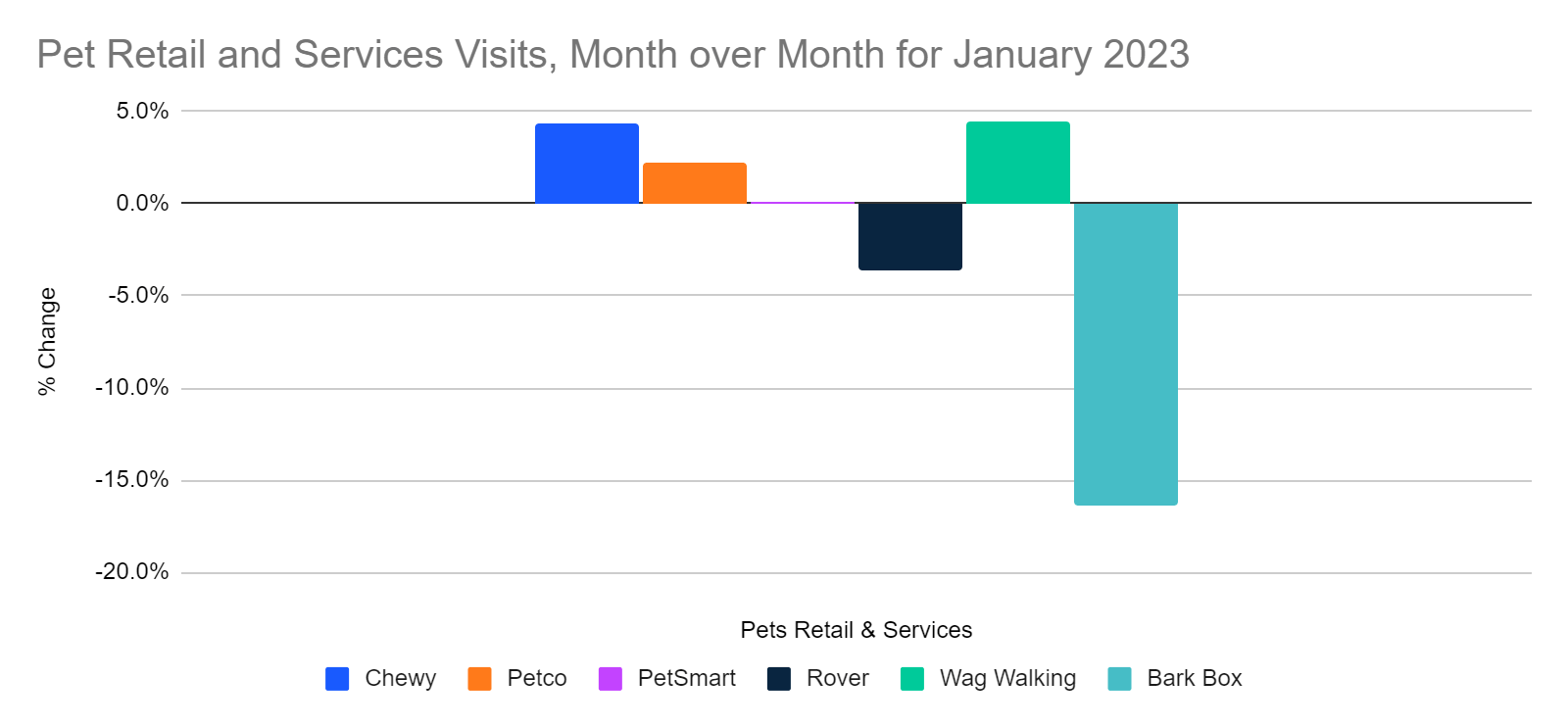

Month over month, Chewy and PetSmart gained

The month-over-month change was almost the inverse of the yearly trend, with Chewy and Petco up and Rover down.

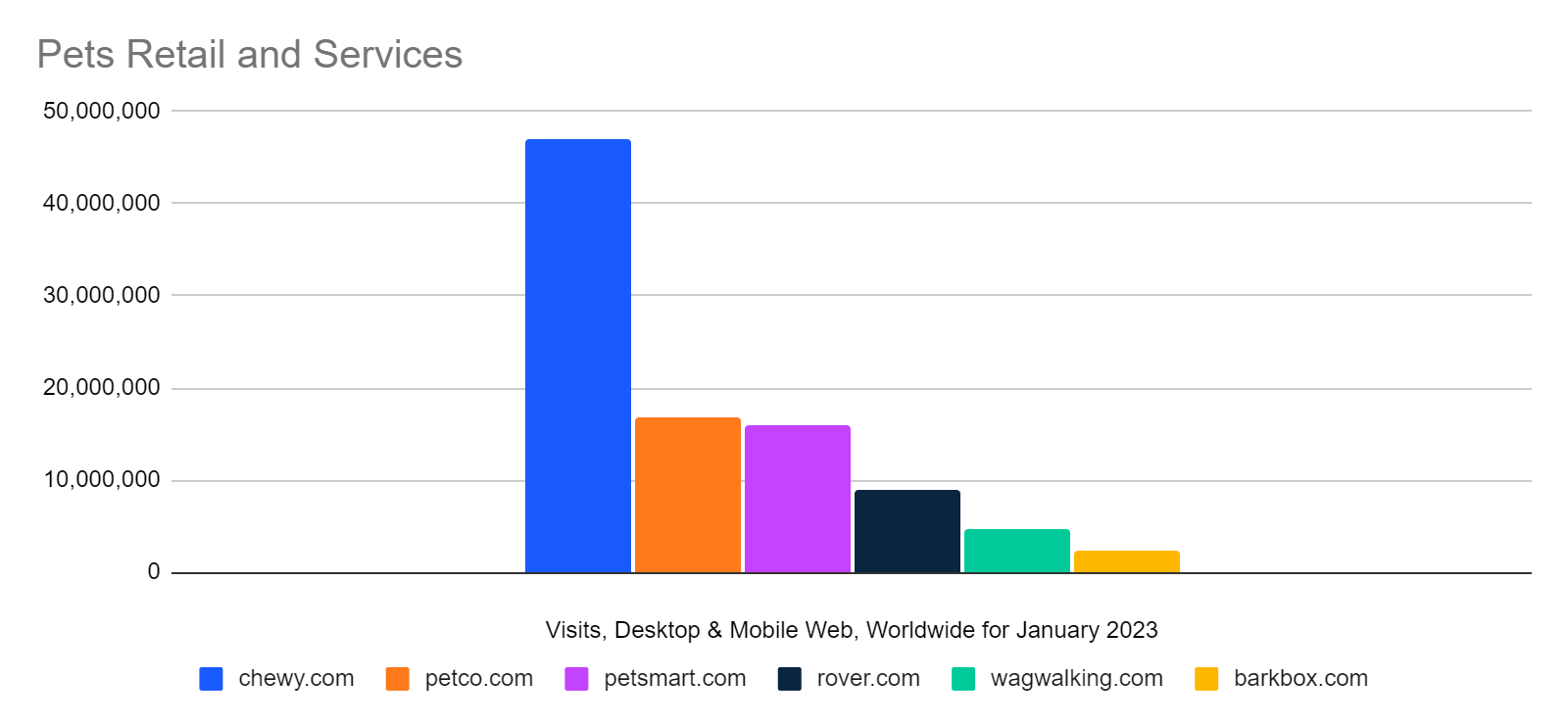

Ranking

For a sense of scale, here is how these sites stack up by total traffic.

Companies mentioned in this report include Chewy (NYSE: CHWY), Petco (NASDAQ: WOOF), PetSmart (NASDAQ: PETM), Rover (NASDAQ: ROVR), and Wag (NASDAQ: PET), and Bark Box (NASDAQ: BARK). The primary statistics cited in this report are for traffic from within the United States.

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Disclaimer: All data, reports and other materials provided or made available by Similarweb are based on data obtained from third parties, including estimations and extrapolations based on such data. Similarweb shall not be responsible for the accuracy of the materials and shall have no liability for any decision by any third party based in whole or in part on the materials.

Image by Donald Clark from Pixabay

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!