Peloton Sprints Ahead with Prime Day but Cancellations a Danger Sign

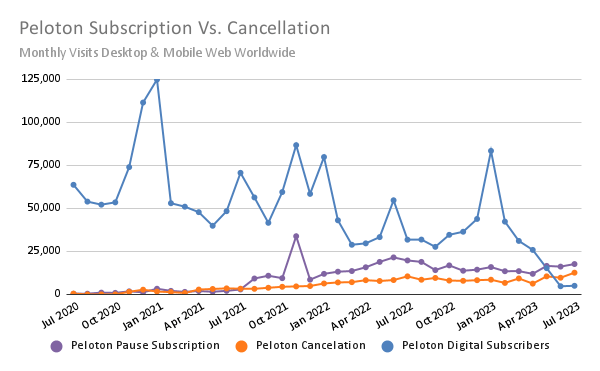

More than 2.5 times as many cancellations as new digital subscriptions detected in July 2023

When Peloton reports earnings on Wednesday, it is likely to be able to point to several positive signs about reigniting sales of its bikes and digital subscriptions – but we don’t expect the news to be all good. The company may be able to point to strong Amazon Prime Day sales as evidence of how its diversification of sales channels is succeeding, although Prime Day fell after the June 30 close of the second quarter. But the unanswered question about those new customers is how many will go on to renew or upgrade their subscriptions to Peloton’s digital subscriptions.

The most worrying sign we see is that digital subscription activity appears to be falling behind cancellations. On the plus side, Peloton’s push to rebrand as primarily an app-first company rather than a bike company shows signs of increasing app usage, including with the new free tier of access.

Key takeaways

- Worrying sign: Peloton makes more money on ongoing subscriptions to its connected fitness programs than it does on equipment sales, and subscriptions seem to be falling as cancellations are rising. This finding is based on tracking the segment of onepeloton.com web traffic associated with confirmed sales of digital products versus confirmed cancellations. In July, there were more than 2.5 times as many cancellations as new subscriptions, according to Similarweb estimates.

- In addition, there were 3.5 times as many confirmed subscription pause requests, compared with subscription purchases – people putting their subscriptions on hold but not permanently canceling.

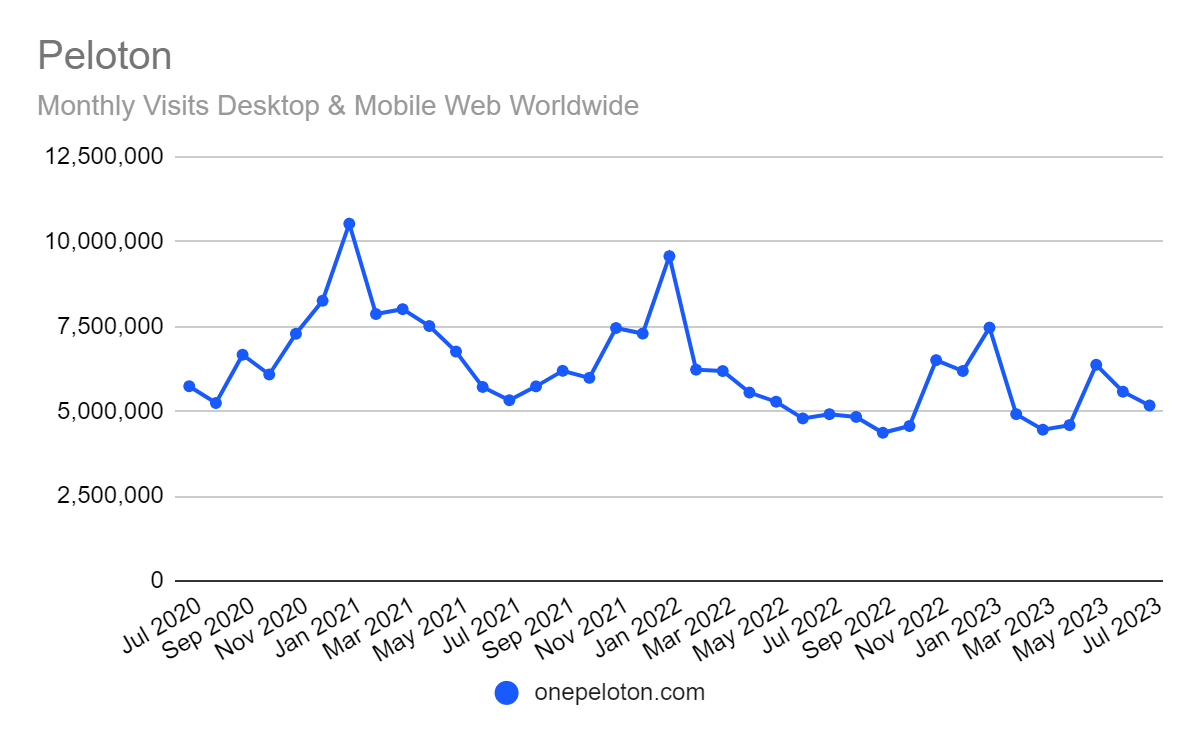

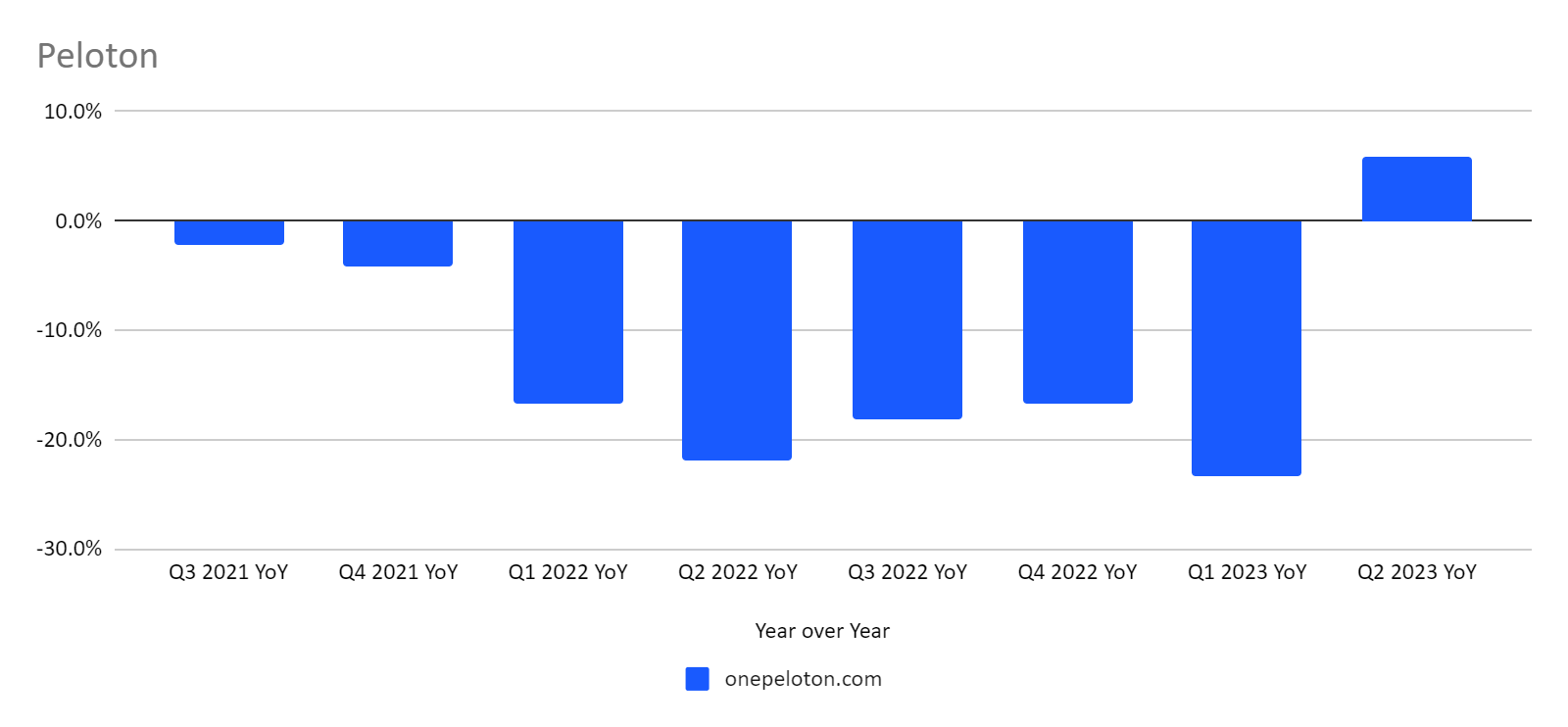

- More positive: Over the past three months, traffic to onepeloton.com has been trending up on a year-over-year basis. In July, it was up 5.9% year-over-year.

- Traffic for the second quarter also was up 5.9%, year-over-year – reversing a pattern of traffic declines that goes back to 2021.

- Peloton has improved its website conversion rate over the past year. Based on a three-month snapshot, the percentage of website visitors who made a purchase increased from 2.4% in 2022 to 5.6% in 2023.

- Peloton scored big in July with a $300 off Amazon Prime Day deal on its bikes. Peloton brand sales for exercise bikes were up 628.8% by revenue and 596.9% by units sold, from June to July, according to estimates from Similarweb Shopper Intelligence. That made Peloton the top brand in the exercise bikes category by revenue, estimated at $5.2 million, although less expensive brands like Yosuda led by units sold.

- Total Peloton brand sales on Amazon.com, including products other than bikes, hit $7.7 million in July, up from less than $1 million in June. The previous high was $7.96 million in October 2022, associated with that year’s Fall Prime Day promotion.

- However, the Amazon.com revenue for the Peloton brand was down 39% from Q1 to Q2, which ended before the Prime sales event.

- Usage of the Peloton fitness app was up nearly 20% year-over-year in July. That statistic is based on monthly active users in the US for iOS and Android, combined. Peloton’s mobile app has been updated to offer lessons to consumers who don’t necessarily have to own a bike, treadmill, or rower, which should help expand the audience for subscriptions.

- After app enhancements and the introduction of a free pricing tier, worldwide Android app downloads rose 81.6%, from May to June, and were up 100% year-over-year.

More cancellations and pauses than new digital subscriptions

Based on Similarweb tracking of the segments of website traffic associated with new confirmed digital subscriptions versus subscribers pausing or canceling their subscriptions, the number of customers starting new subscriptions seems to be falling behind pauses and cancellations. That’s a worrying sign, given that Peloton counts on subscriptions as opposed to sales of new bikes, rowers, and treadmills for the majority of its revenue.

These numbers may not reflect the impact of all those Prime Day equipment purchases, with which customers got a 30-day free trial before they will need to subscribe.

Prime Day sale was a hit

During Prime Day, Amazon.com customers were able to get bikes at a $300 discount, resulting in a surge of new purchases that could pay off handsomely over the long term if those customers maintain their subscriptions.

Prime Day lifted Peloton to the top of the exercise bikes category on Amazon.com

Over the first six months of 2023, Peloton was #4 by revenue (and much farther behind the leaders in units sold) in the exercise bike category on Amazon.com.

The trend in Peloton sales on Amazon.com

Peloton at Dick’s Sporting Goods

Since Peloton began selling bikes and treadmills through Dick’s Sporting Goods, Peloton has been a significant traffic driver to Dick’s website, drawing more than 10,000 visitors per month. We don’t have detailed transaction-level estimates for Dick’s the way we do for Amazon.com, and this doesn’t necessarily reflect the attention Peloton attracts with in-store shopping and purchases. On the other hand, modern consumers tend to research products online even when buying in person, so traffic is a good indicator of interest.

Overall traffic is down from pandemic peaks but improving

Peloton is one of the companies that enjoyed a boom in interest and sales during the pandemic that is hard to match now. However, on a year-over-year basis, traffic to onepeloton.com was up 20.6% in May, 16.4% in June, and 5.2% in July, suggesting a pattern of improvement.

Here’s what the pattern looks like in year-over-year traffic change by quarter, with an upturn for the latest quarter.

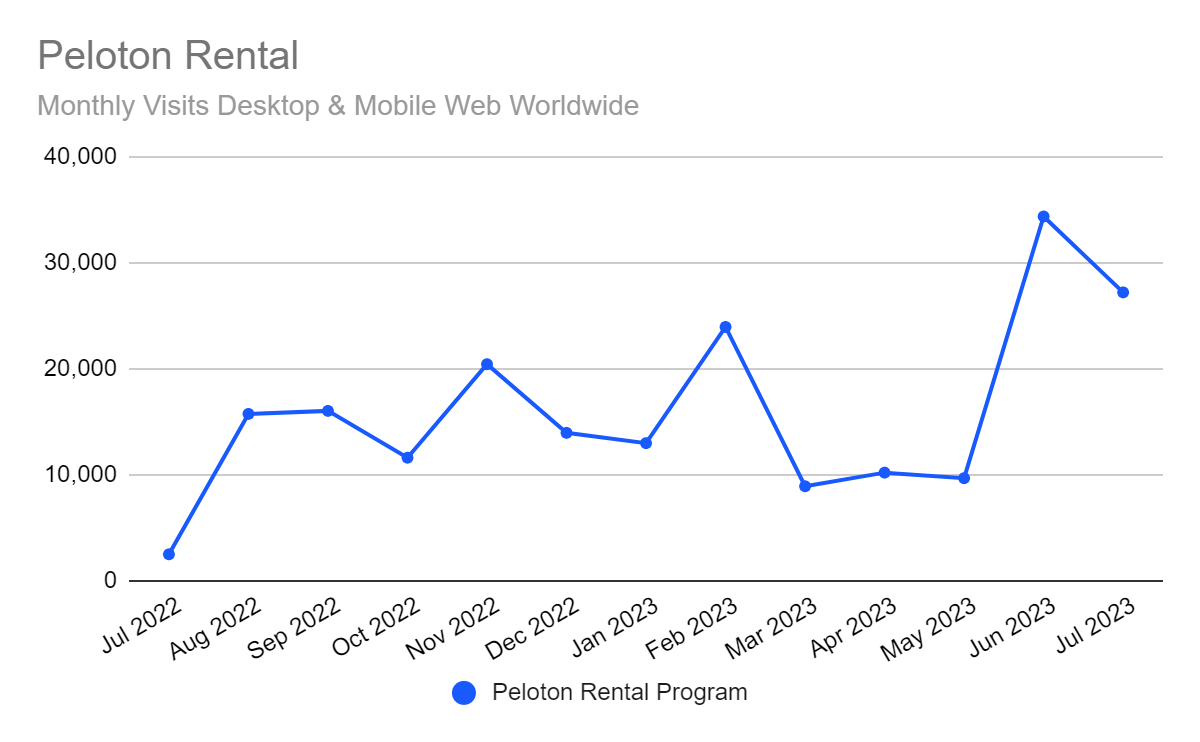

Peloton is attracting interest with rental options

Peloton’s equipment rental options, which include an option to buy at a later date, aim to make owning a bike, treadmill, or rower affordable to more people. Traffic to the pages of onepeloton.com offering details on the program attracted more than 34,000 visits in June and more than 27,000 visits in July.

Apps kick into high gear

After Peloton enhanced its mobile apps and introduced a free pricing tier, worldwide Android app downloads rose 81.6%, from May to June, and were up 100% year-over-year. Downloads slowed in July but were still up almost 80% year-over-year.

Usage of the Peloton fitness app was up nearly 20% year-over-year in July. That statistic is based on monthly active users in the US for iOS and Android, combined. Peloton’s mobile app has been updated to offer lessons to consumers who don’t necessarily have to own a bike, treadmill, or rower, which should help expand the audience for subscriptions.

Meanwhile, app usage was up nearly 20% year-over-year in July. That statistic is based on monthly active users in the US for iOS and Android, combined.

Still pedaling with high resistance, but gaining by many measures

Many of the initiatives Peloton has launched to regain its momentum as a connected fitness leader seem to be paying off. Yet Peloton needs to keep convincing customers that its subscription services are worth paying for, month after month, and the cancellations and account suspension trend is a worrying sign.

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Disclaimer: All names, brands, trademarks, and registered trademarks are the property of their respective owners. The data, reports, and other materials provided or made available by Similarweb consist of or include estimated metrics and digital insights generated by Similarweb using its proprietary algorithms, based on information collected by Similarweb from multiple sources using its advanced data methodologies. Similarweb shall not be responsible for the accuracy of such data, reports, and materials and shall have no liability for any decision by any third party based in whole or in part on such data, reports, and materials.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!