Health Products Top List of Fastest-Growing US Direct to Consumer Ecommerce Sites

Hismileteeth.com grew traffic 455% over the past year, while mushroom coffee seller ryzesuperfoods.com was up 408.6%

Similarweb identified the fastest growing direct-to-consumer (DTC) ecommerce sites in the US and found that health product websites dominated the list. Eight of the top 15 focus on getting consumers to eat foods and supplements associated with claims of better health, or to drink more water.

In DTC ecommerce, the manufacturer or brand sells its products directly to consumers rather than through an online retailer or marketplace (although they might sell through those channels as well).

This report is based on an analysis of 10,000 web domains classified as DTC ecommerce, ranking them by the change in their traffic over the last 12 months versus the prior year. To narrow the field to significant digital businesses that have achieved real growth, we excluded domains that failed to consistently attract more than 50,000 monthly visits We also edited out a few domains that were misclassified.

Key takeaways

- Dental care business Hismile (hismileteeth.com) grew 445.2% and ended April with 722.7K visits, according to Similarweb traffic estimates for the US.

- Mushroom coffee was a big winner, with traffic to ryzesuperfoods.com up 408.6% to 2.5M visits in April. Competitor everydaydose.com saw traffic rise 177.8% to 968.7K visits.

- Sex toys maker mysteryvibe.com grew traffic 284.5% to 616.3K visits.

- Water bottles also saw big gains, with owalalife.com up 275.7% to 940.6K visits and stanley1913.com up 162.6% to 2.9M visits.

- This list would not be complete without a nod to the economic power of Taylor Swift, whose store.taylorswift.com was up 175.6% to 3.6M visits.

“The health and wellness category has been one of the fastest growing categories in the CPG space, mostly driven by increased consumer health consciousness,” said Maria Pashi, Principal Solutions Architect at Similarweb. “These disruptor brands in this category tend to heavily invest in influencer marketing and paid search to build discoverability and brand awareness, but it is the switch towards direct and organic traffic which signals returning customers and success in brand building. This is what ultimately will determine if a brand will be successful in the long-term.”

Ranking the top 15

Here are the top 15 websites that met our criteria:

|

12-Mo Growth |

Visits in April |

Description |

||

|

1 |

hismileteeth.com |

445.2% |

722.7K |

Teeth whitening and dental care products |

|

2 |

ryzesuperfoods.com |

408.6% |

2.5M |

Mushroom coffee and superfoods |

|

3 |

mysteryvibe.com |

284.5% |

616.3K |

Sex toys |

|

4 |

275.7% |

940.6K |

Water bottles |

|

|

5 |

181.0% |

607.3K |

Health foods and supplements |

|

|

6 |

177.8% |

968.7K |

Mushroom coffee and superfoods |

|

|

7 |

175.6% |

3.6M |

Buy direct from Taylor Swift |

|

|

8 |

173.3% |

2.6M |

Nicotine pouches |

|

|

9 |

170.2% |

1.4M |

Learn to crochet kits |

|

|

10 |

169.4% |

273.7K |

Diet / bodybuilding products and services |

|

|

11 |

162.6% |

2.9M |

Water bottles |

|

|

12 |

157.0% |

282.1K |

Women’s bras and underwear |

|

|

13 |

151.9% |

369.0K |

Dietary supplements |

|

|

14 |

150.5% |

664.6K |

Pest repellent / pest traps |

|

|

15 |

145.1% |

289.7K |

“Simple, quality, and affordable golf clubs” |

Click on any links for more information about the domains mentioned, based on Similarweb data.

Below are a few highlights focused on where these sites get their traffic. One thing to watch, according to our analysts: startup websites tend to rely heavily on paid search to build their brands, whereas direct traffic and strong organic search indicate staying power.

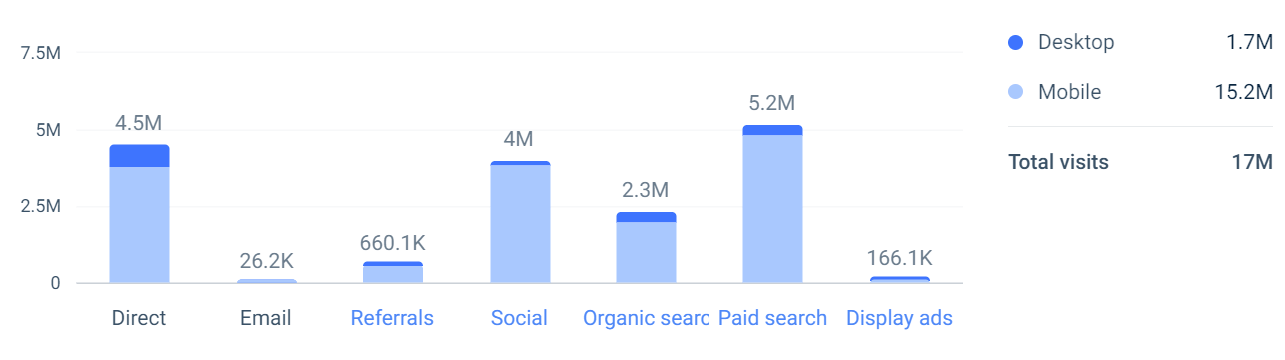

Channels overview for hismileteeth.com (April 2024, US)

Hismile has built its traffic with a strong paid search ads program, which brought in more traffic than any other single channel in April – although hismileteeth.com also ranks high for direct traffic and social media referrals. The company boasts of building its audience partly through connections with beauty bloggers and influencers.

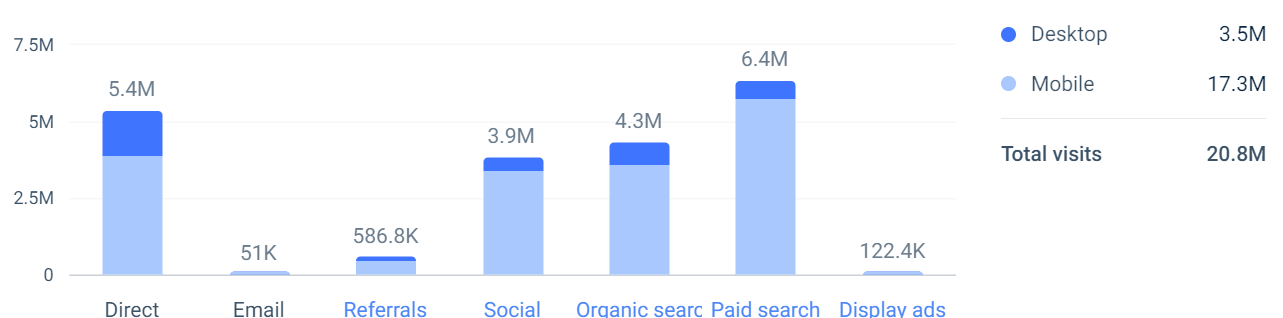

Channels overview for ryzesuperfoods.com (April 2024, US)

Paid search is also a primary source of traffic to the Ryze website, accounting for 30.7% of traffic from within the US in April, although organic search is also a strong traffic driver.

For everydaydose.com, a smaller competitor in the mushroom coffee category, paid search brought in 33.9% of traffic in April.

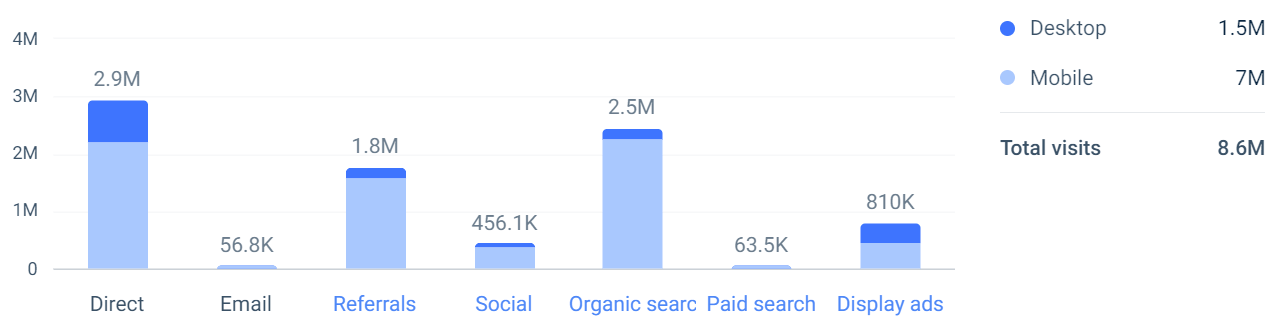

Channels overview for mysteryvibe.com (April 2024, US)

Sex toy maker MysteryVibe got less than 1% of its April traffic from paid search but 28.6% from organic search and 34.3% from people coming directly to the website.

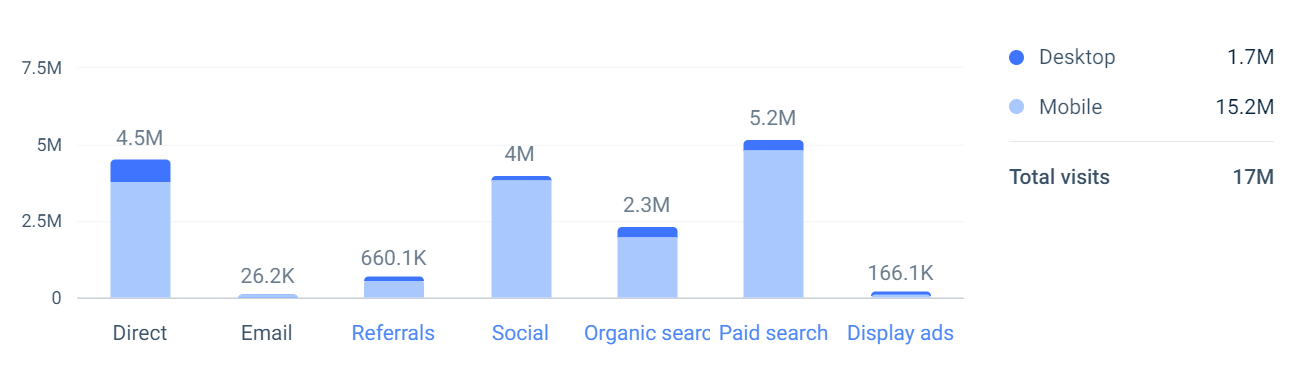

Channels overview for store.taylorswift.com (April 2024, US)

The Taylor Swift store enjoys high levels of direct traffic (35%), as well as healthy traffic driven by referrals, social media, and organic search, with just 2% from paid search.

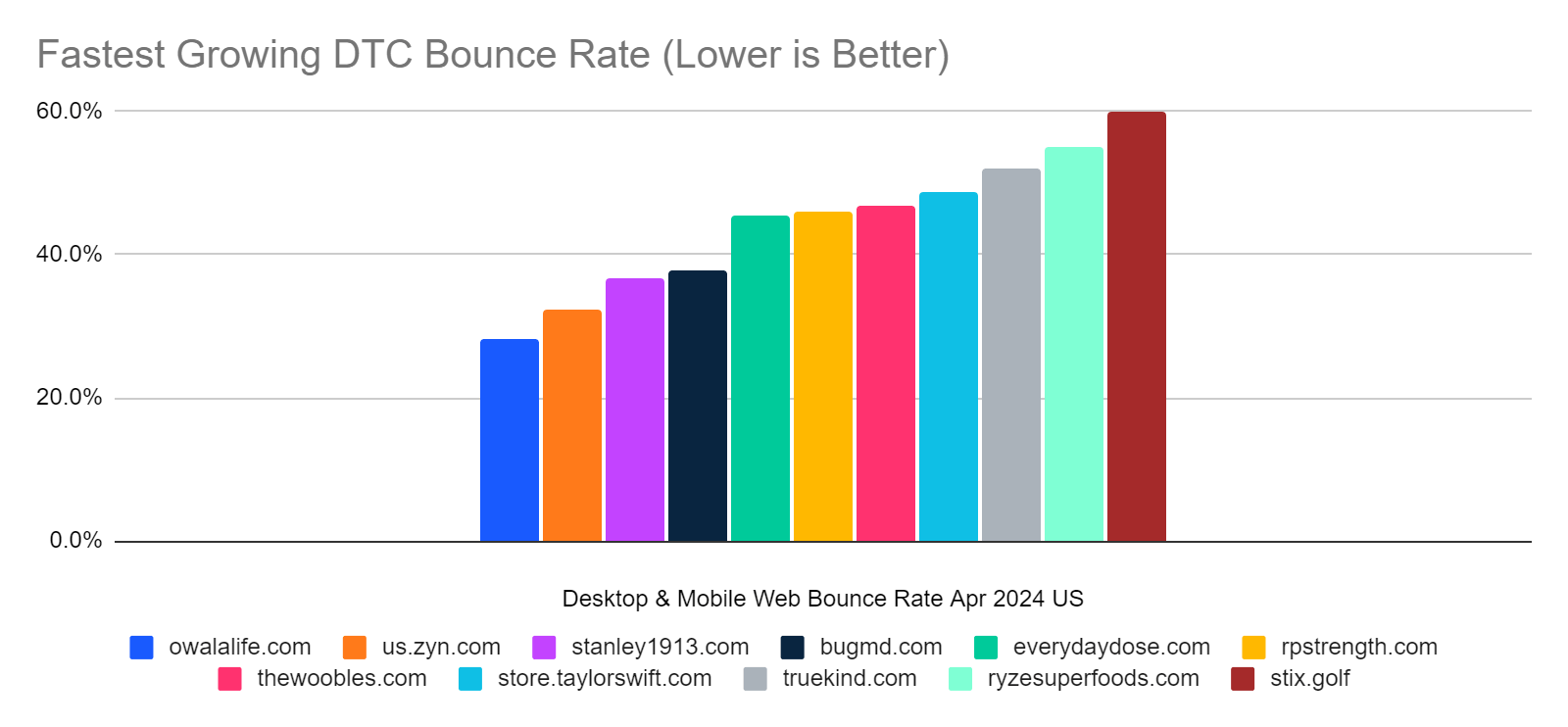

Comparison by Bounce Rate

Getting consumers to your website is a good start, but ecommerce companies also want to hold their attention long enough for them to take action. One metric where water bottle maker Owala scores well (and competitor Stanley is not far behind) is having a low bounce rate – the rate visitors land on a website but “bounce” or exit without exploring beyond a single page.

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com.

Disclaimer: All names, brands, trademarks, and registered trademarks are the property of their respective owners. The data, reports, and other materials provided or made available by Similarweb consist of or include estimated metrics and digital insights generated by Similarweb using its proprietary algorithms, based on information collected by Similarweb from multiple sources using its advanced data methodologies. Similarweb shall not be responsible for the accuracy of such data, reports, and materials and shall have no liability for any decision by any third party based in whole or in part on such data, reports, and materials.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!