Match’s Dating Websites Trend Lower, App Performance Mixed for Q1 2023

Update on traffic share and app usage finds gains for Bumble, up 12.5% on the web, 20.9% on Android

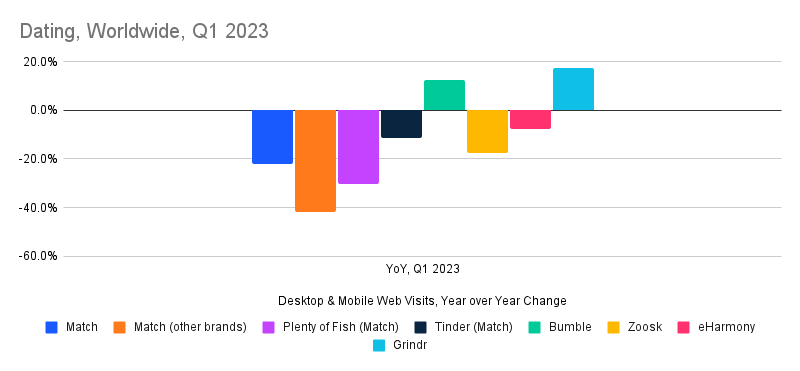

Traffic to dating websites remained in a slump, overall, for the first quarter of 2023, although for Grindr traffic was up 17.3% year-over-year, according to Similarweb estimates. The slump applied to all Match websites and most of its apps, with mighty Tinder down 11.5% on the web and app usage down 11.1% on Android.

Next to Grindr, Bumble performed best, with web traffic up 12.5% and app usage up 20.9% on Android.

Match Group is scheduled to announce first-quarter earnings on May 3, followed by Bumble on May 4. Grindr, the LGBT dating site that went public in November, has not yet announced when it will report Q1 earnings.

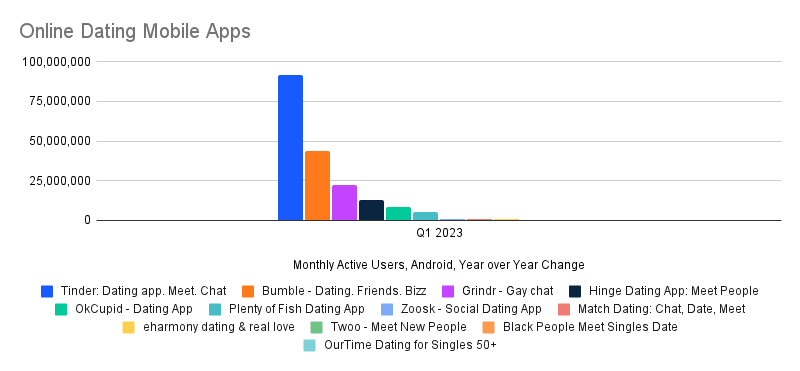

We track website traffic and mobile app usage as a leading indicator of digital business performance. For this report, we used monthly active users on Android as an indicator of each company’s mobile app performance because we have the best worldwide data for that platform.

Key takeaways

- Traffic to Match Group’s namesake match.com service was down 22%, year-over-year, while Plenty of Fish was down 30%, and other Match brands we track as a group were down 40%. Tinder traffic was down 11.5% on the web and app usage was down 11.1% on Android.

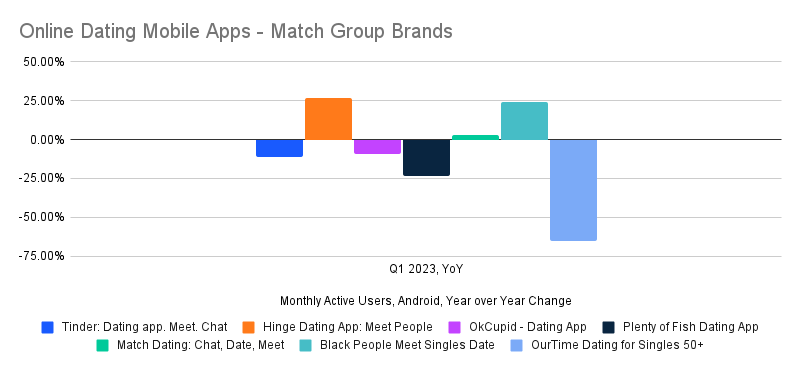

- The Match Group apps showing the greatest gains were Hinge and Black People Meet, up 26.6% and 24.3% year over year in Q1, based on monthly active users for Android.

- Traffic to grindr.com was up 17.3%, but monthly active users of its Android app were up just 2.6%.

- Bumble’s web traffic was up 12.5%, and app usage rose 20.9% on Android.

Traffic is down for Match websites, up for Bumble and Grindr

On a year-over-year basis, traffic for Q1 was down for Match Group websites by as much as 40%, while Grindr was up 17.3% and Bumble was up 12.5%.

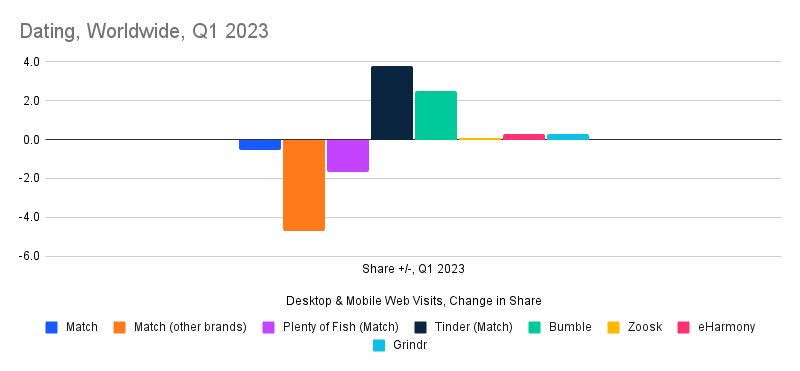

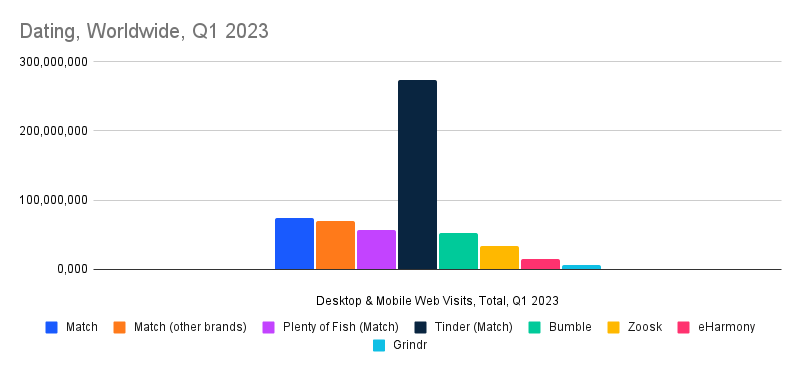

While some brands are losing share, Match owns most of web dating

Match is seeing some loss of traffic share, particularly for its miscellaneous brands, but Tinder’s share of traffic was actually up 3.8 points for Q1. Meanwhile, Bumble gained 2.5 points.

Match owns the most trafficked domains on the web. Tinder towers above all others with more than 273 million visits in Q1.

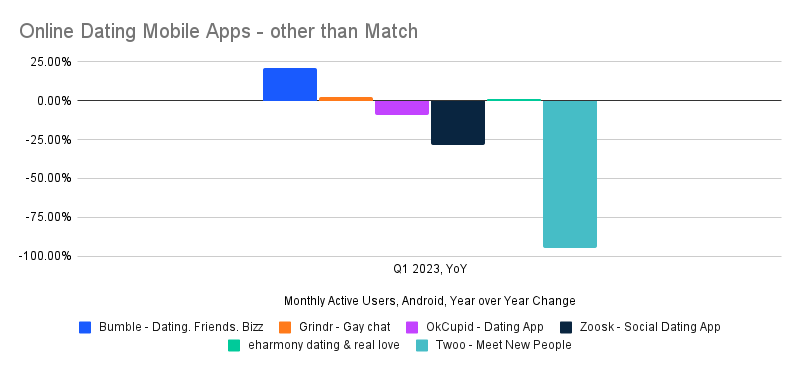

Match mobile apps performance mixed, while Bumble grows

Many Match Group apps saw usage declines, based on Similarweb estimates of monthly active users for Android, worldwide, although Hinge app and Black People Meet were exceptions, up 26.6% and 24.3% year over year, respectively, in Q1. Usage of the senior-oriented Our Time was down 65%, year over year.

Outside of Match, Bumble app saw a notable gain in monthly active users (+20.9% for the quarter), while Twoo’s app usage was down nearly 95%, perhaps propelled by negative reports about its data privacy practices.

Tinder remains the #1 dating app by a wide margin, with Bumble a strong #2,

Public companies referenced in this report include Match Group Inc. (NASDAQ: MTCH), Grindr Inc. (NYSE: GRND), and Bumble Inc. (NASDAQ: BMBL). Also Zoosk owner Spark Networks SE (NASDAQ: LOV).

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Contact: For more information, please write to press@similarweb.com.

Report By: David F. Carr, Senior Insights Manager

Disclaimer: All names, brands, trademarks, and registered trademarks are the property of their respective owners. The data, reports, and other materials provided or made available by Similarweb consist of or include estimated metrics and digital insights generated by Similarweb using its proprietary algorithms, based on information collected by Similarweb from multiple sources using its advanced data methodologies. Similarweb shall not be responsible for the accuracy of such data, reports, and materials and shall have no liability for any decision by any third party based in whole or in part on such data, reports, and materials.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!