Cyber 5: Less Traffic, More Ecommerce Revenue

Ecommerce websites saw fewer but more motivated visitors during the 5 days including Thanksgiving, Black Friday, and Cyber Monday

Updating our analysis of the sales period stretching from Thanksgiving and Black Friday through Cyber Monday, we’ve been working on reconciling our finding that traffic dropped with reports from other sources that revenues were up. We also looked at the winners in the key categories of Consumer Electronics, Fashion & Apparel, and Beauty & Cosmetics.

These findings are excerpted from a longer report, Unwrapping Cyber 5 Insights 2023, which also goes deeper into Amazon-specific sales trends.

Inflation eased to 3.2% YoY in October 2023. Nevertheless, consumer confidence remains subdued. While external revenue data indicates an 8% increase in spending, Similarweb Digital Data reveals a 7% decline in traffic during Cyber 5. Notably, top retailers experienced a decrease in unique users. However, a small number of shoppers exhibited a strong preference for deep discounts, ultimately driving revenue growth.

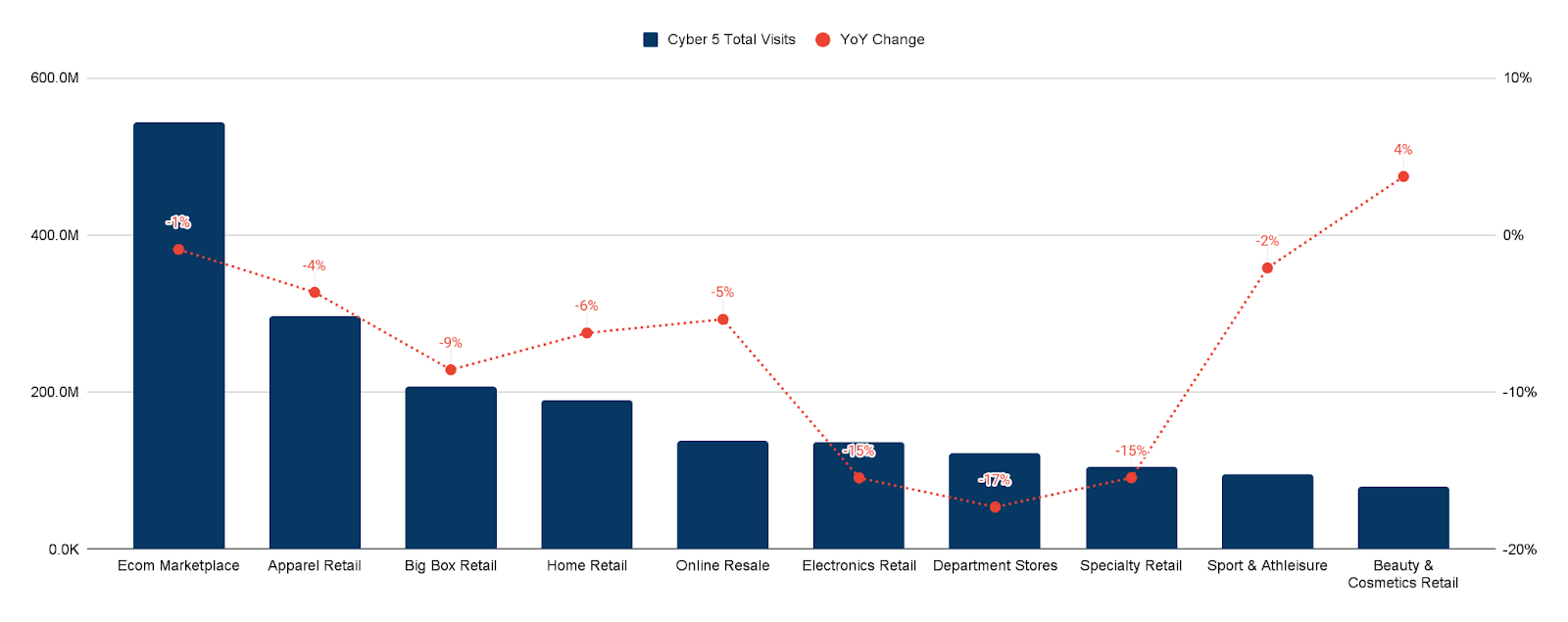

While Cyber 5 sales were even more successful for Beauty players than last year, traffic to Electronics sites, Department Stores and Specialty Retailers collapsed

During Cyber 5 2023, the top 704 ecommerce domains observed a -7% drop in visits year-over-year (YoY), showcasing lower shopper enthusiasm. According to a Similarweb survey of 1,668 US Consumers, 34% are spending less on holiday gifts than last year, with 56% diminishing the number of presents they will purchase.

A minority of shoppers drove an increase in sales at major retailers

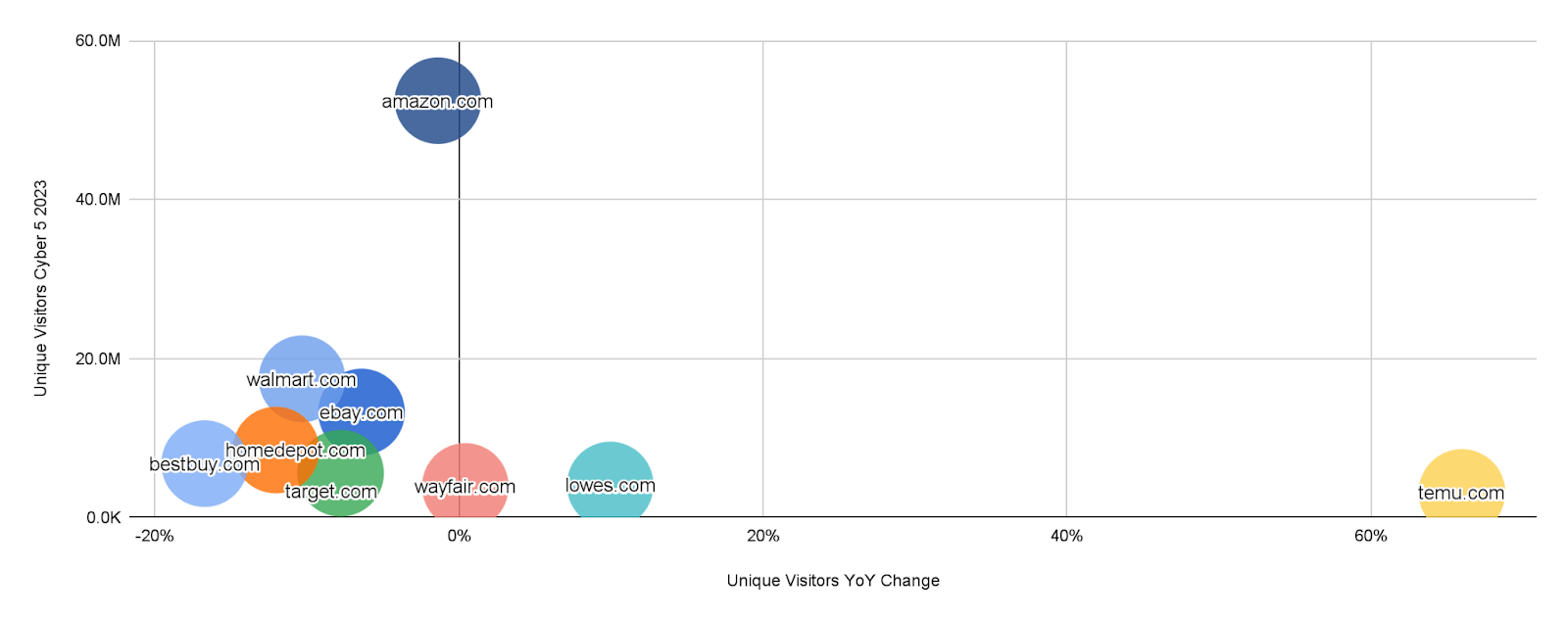

Unique Visitors are down YoY for most players besides Temu and Lowes.

Audience Size of Top Retailers on Cyber 5, 2023 vs. 2022

US, Desktop & Mobile Web

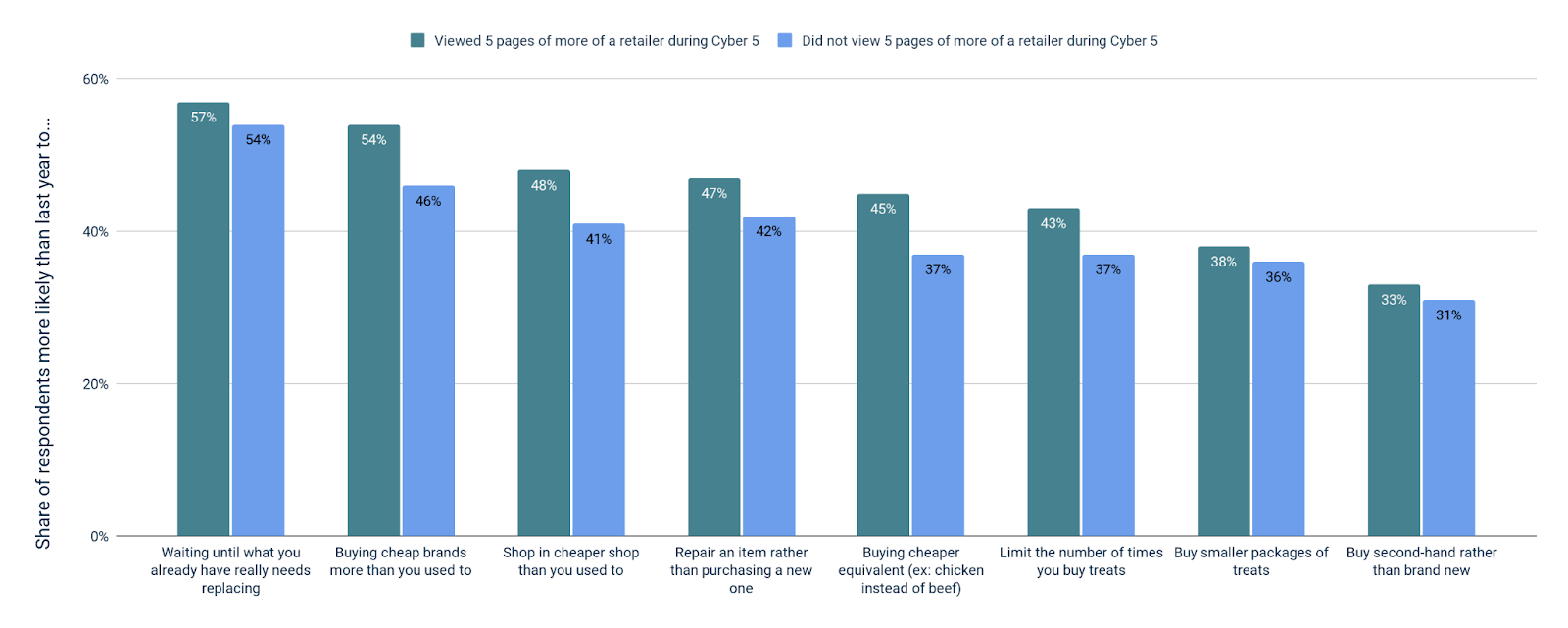

An 8% increase in spending (Digital360) most likely due to cash-strapped Cyber 5 shoppers who previously postponed purchases to benefit from the discounts.

Despite the traffic decrease we observed, Cyber 5 spending was up 8%, according to a Digital Commerce 360 report. We suspect this is explained by a motivated fraction of cash-strapped shoppers who previously postponed purchases, waiting for discounts.

Likelihood of Adopting Shopping Behavior More Than Last Year, Broken Down by Cyber 5 Levels of Visit Activity*

Similarweb Market Research Panel Survey, US, November 2023, n=1,039

- For any survey respondents that viewed 5 of more of one of the top 25 ecommerce players

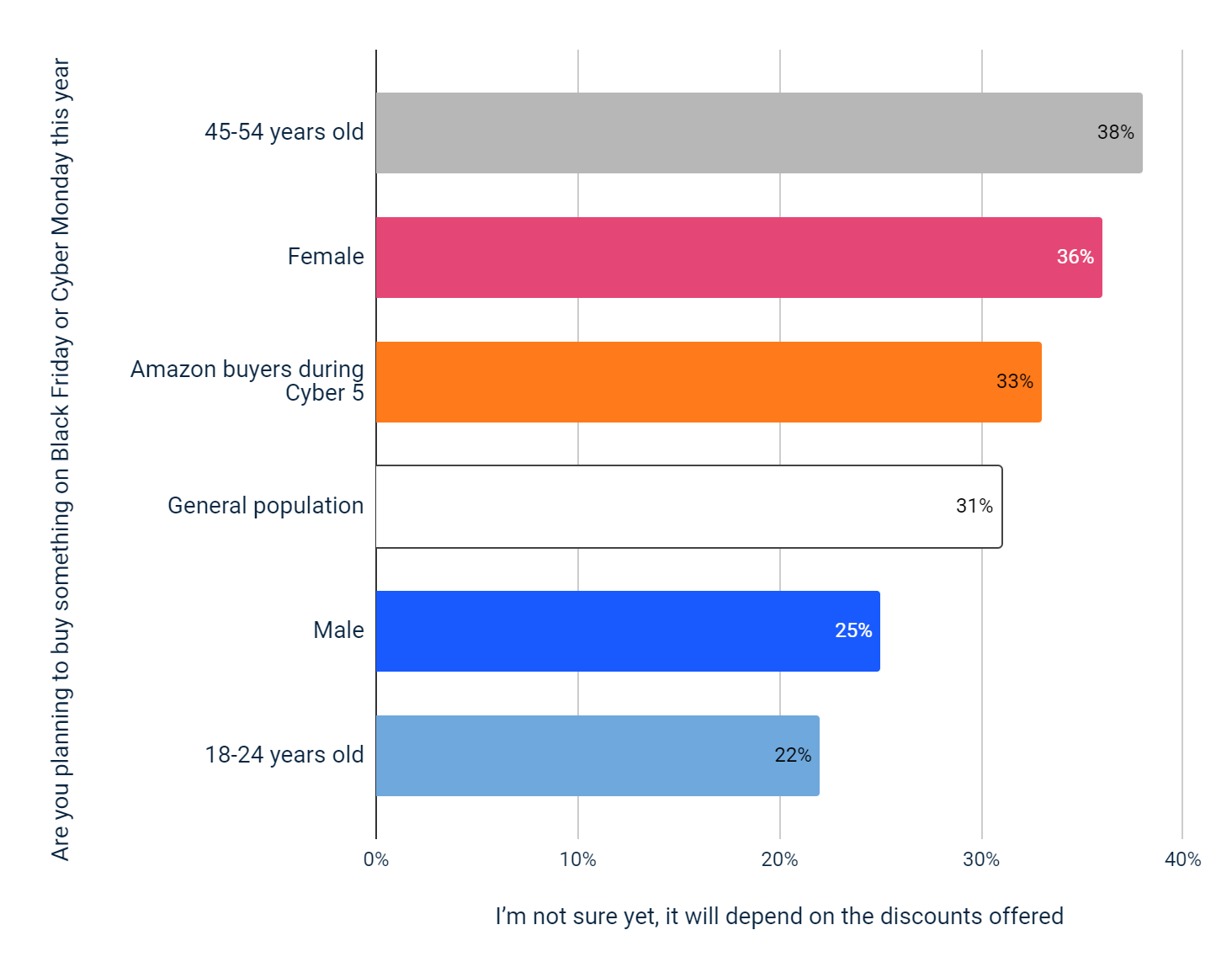

Share of Respondents Whose Cyber 5 Purchase Consideration is Driven by Discounts

Similarweb Market Research Panel Survey, US, November 2023, n=1,886

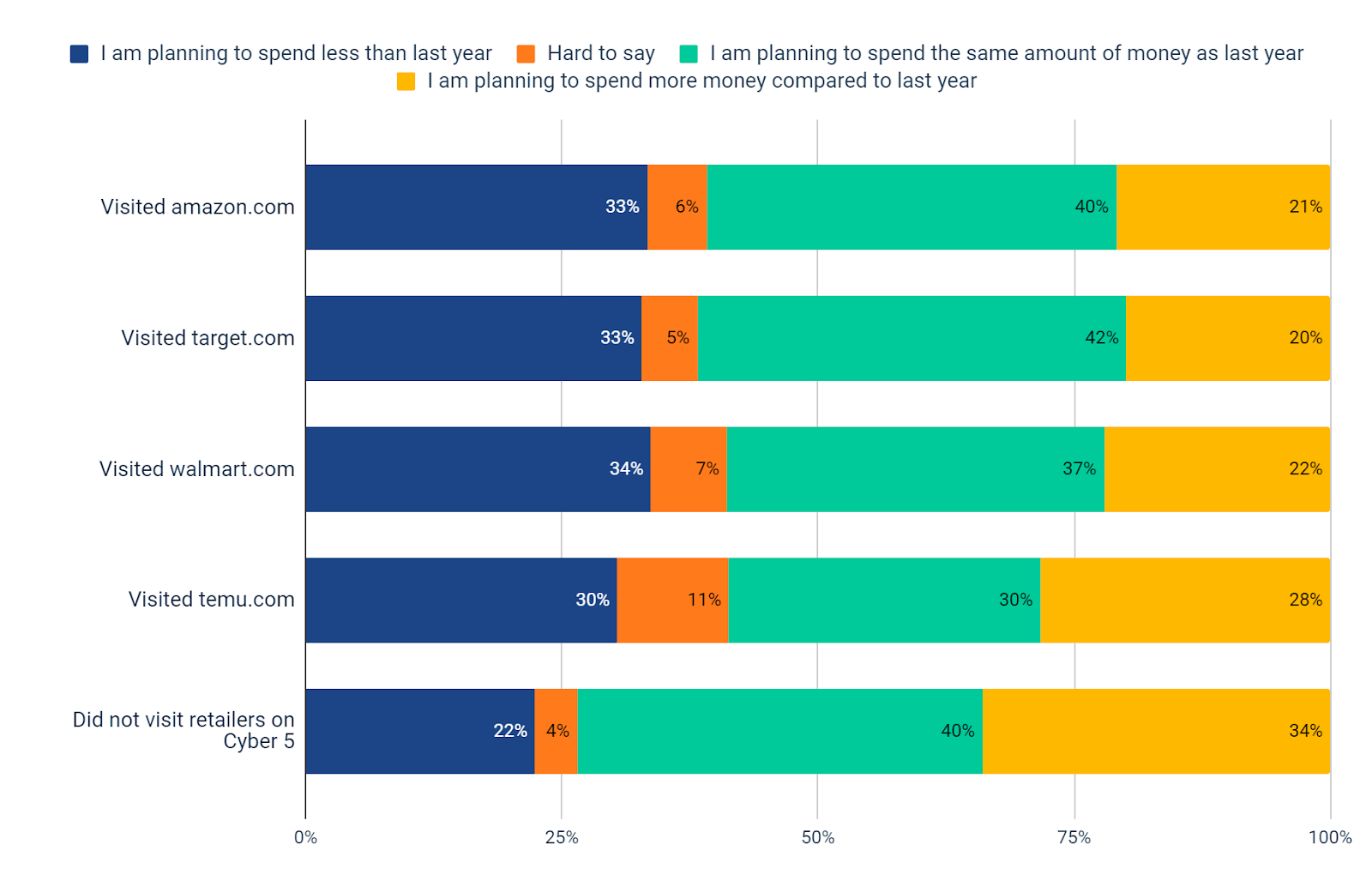

How Respondents Feel About Holiday Gifting This Year, per Retailer

Similarweb Market Research Panel Survey, US, November 2023, n=1,886

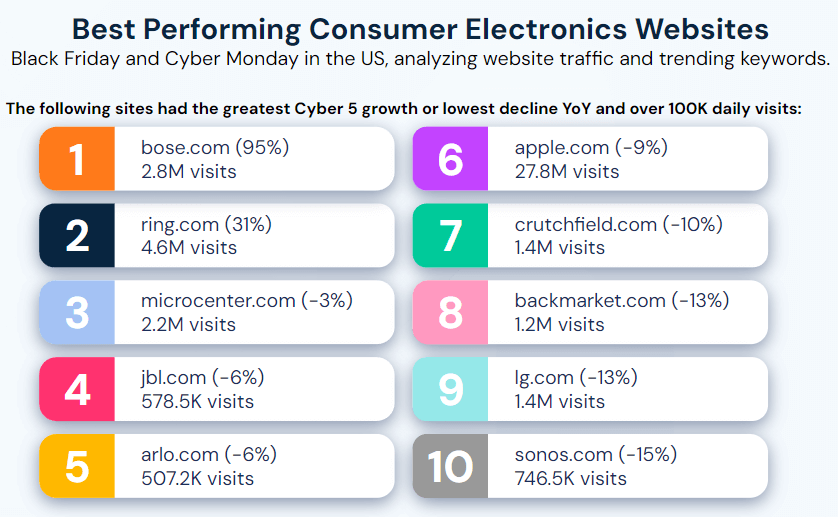

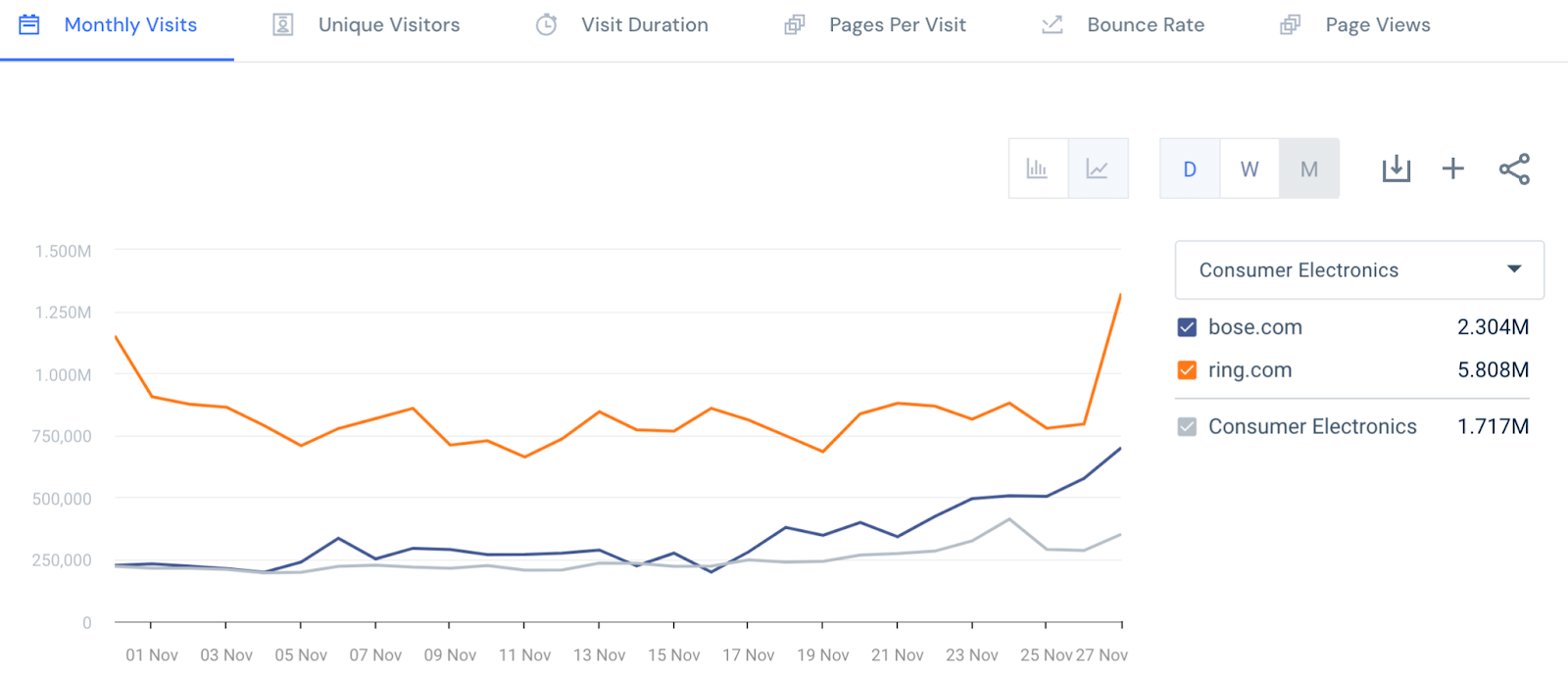

Bose and Ring were the only major Consumer Electronics retailers to see increased activity versus last year

Both retailers ran discounts of up to 50% on Cyber Monday and saw stronger performance vs Black Friday as a result with increased visits and visitors.

This is contrary to the ecommerce sector and Consumer Electronics in particular, where Black Friday tends to be stronger.

By offering deals explicitly tailored to Cyber Monday, they could draw in consumers more successfully than if they had only run general Black Friday promotions.

Daily Visits, Last 28 Days as of Nov 27, 2023 – bose.com, ring.com, CE Average

US, Desktop & Mobile Web

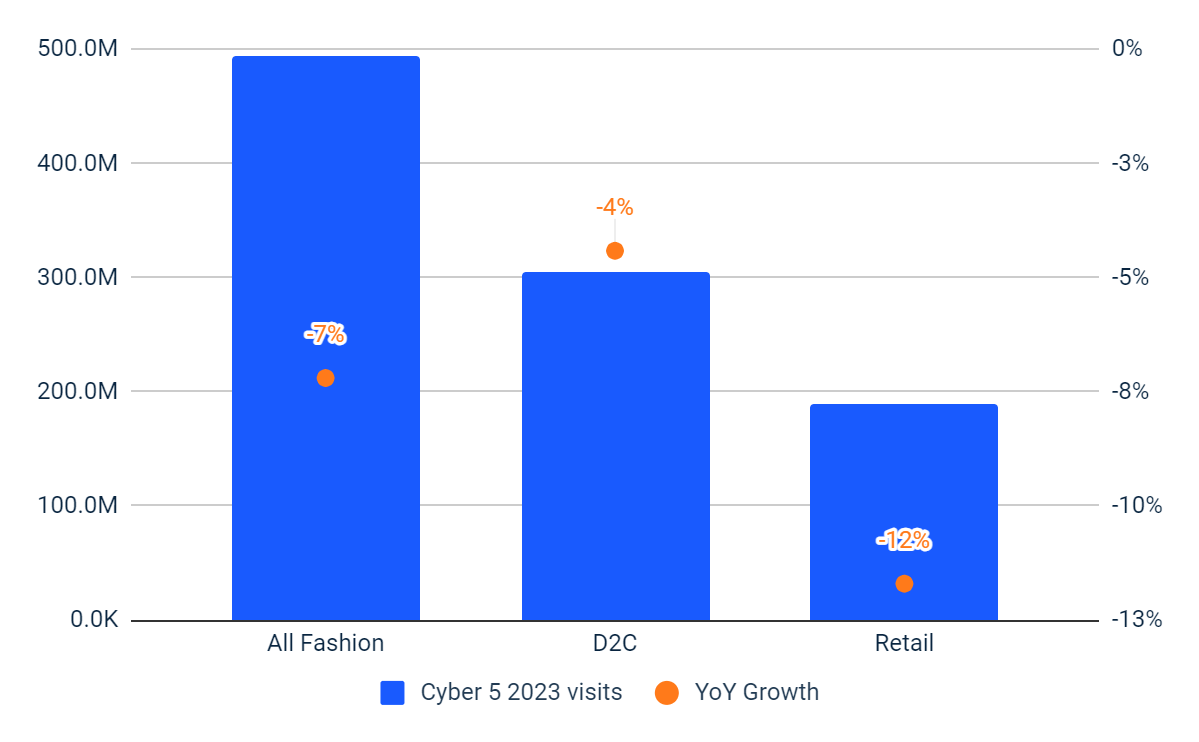

In Fashion & Apparel, direct-to-consumer sellers saw a milder decline than multi-brand retailers

D2C retailers can offer deeper discounts on a broader range of products within their brands, with potentially larger stocks of popular products.

Because of this, consumers shopping around for the best deals on wanted items were more likely to have ended up shopping directly with the brands themselves over the period.

D2C brands also run promotions less regularly than multi-brand retailers: Skims timed their bi-annual sale to coincide with the Black Friday period, generating even more hype around the viral brand.

Fashion Sector Growth: All vs. D2C vs. Retail

US, Desktop & Mobile Web, Cyber 5 2023 Visits and Growth

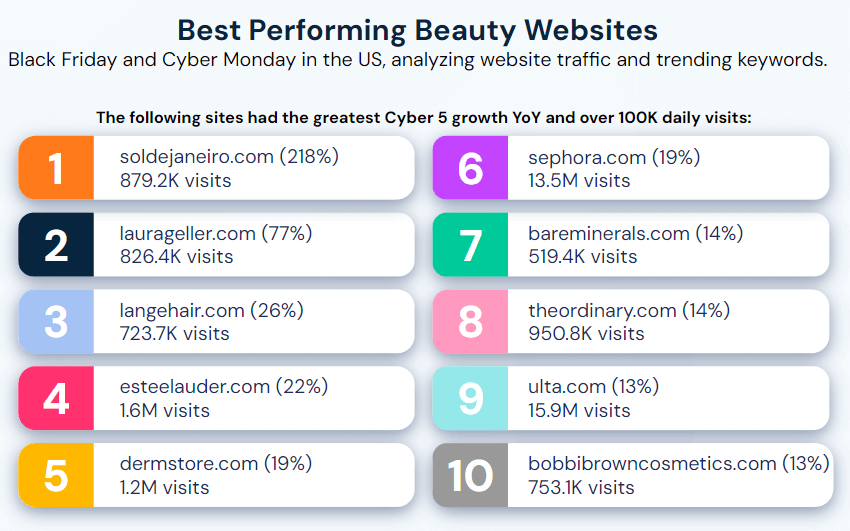

Beauty brand Sol de Janeiro was the overall winner of Cyber 5

A phenomenal traffic growth of 218% YoY not only placed Sol de Janeiro first in the US Beauty websites category but also made it the fastest-growing website across all categories in websites that had over 100K daily visits.

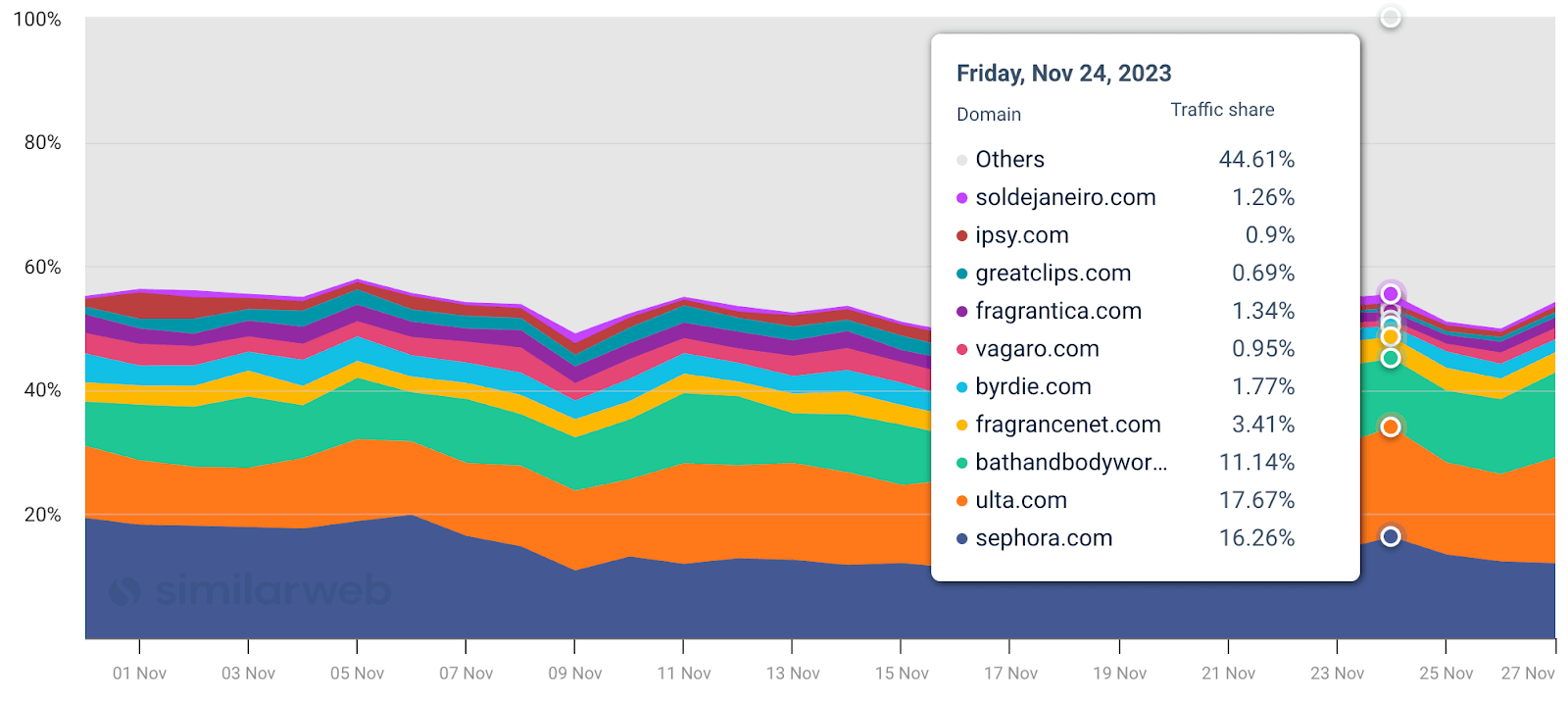

It increased its traffic share from 0.4% the previous week to 1.3% on Black Friday, the equivalent of over x5 increase in visits.

The brand had extensive positive news coverage around its sales activities and offered 25% off its viral Brazilian Bum Bum Cream products.

Traffic Share, Last 28 Days as of Nov 27, 2023

US, Desktop & Mobile Web

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Disclaimer: All names, brands, trademarks, and registered trademarks are the property of their respective owners. The data, reports, and other materials provided or made available by Similarweb consist of or include estimated metrics and digital insights generated by Similarweb using its proprietary algorithms, based on information collected by Similarweb from multiple sources using its advanced data methodologies. Similarweb shall not be responsible for the accuracy of such data, reports, and materials and shall have no liability for any decision by any third party based in whole or in part on such data, reports, and materials.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!