Top Economic Trends in Australia to Watch in 2024

Inflation has made its mark on the Australian economic landscape. Years of living through a cost-of-living crisis have created a new cohort of value-conscious shoppers.

This generation of consumers is determined to increase their spending power by getting the most out of every dollar; which puts a lot of pressure on financial services to meet their lofty demands and expectations.

So, how can you navigate these huge shifts and thrive in a new economic landscape? With the right data to guide the way.

And we’ve got just that. Our latest consumer and economic trends report on the Australian Financial Services industry has all the insight you need.

Using Similarweb Market Research Intelligence, we gathered data on the consumer behaviors changing the way people spend in 2024 and beyond.

These insights will be the key to understanding your target audience, anticipating trends in your category, and maintaining a crucial competitive advantage in a constantly changing market.

Here’s some of our favorite findings from the report:

A huge shift in credit card interest

This year consumers are making the most of credit. In fact, there’s been substantial growth in other similar products, like loans and Buy-Now-Pay-Later schemes, that help people manage their money and alleviate cost pressures.

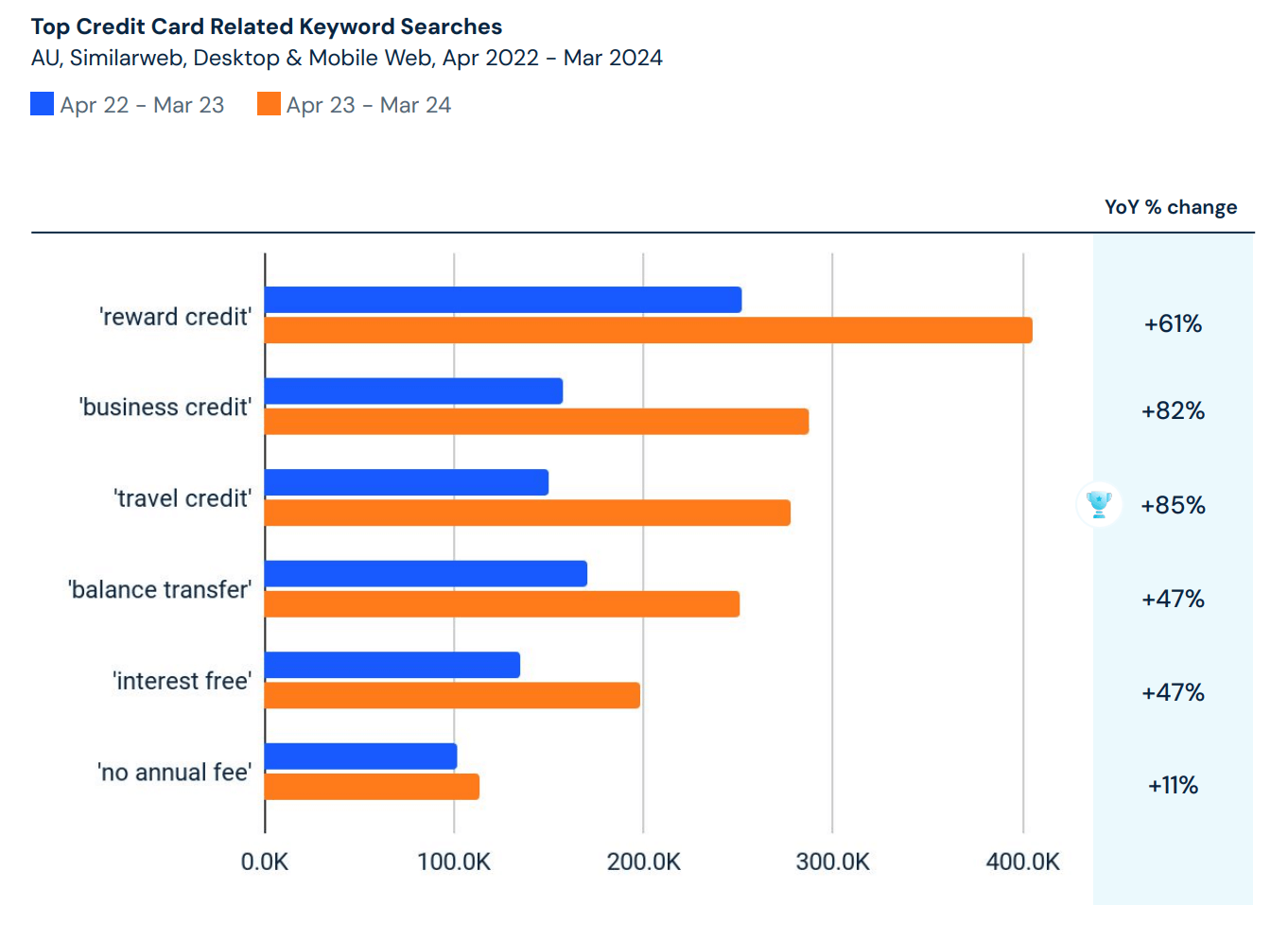

Here’s some of the biggest search trends from the report:

- Searches for ‘credit cards’ shot up by 46% YoY to 5.6m in March 2024

- Reward programs are the key to drawing these value-driven consumers: searches for ‘reward credit’ were up 61% in the last 12 months, and ‘travel credit’ was up 85%

- Balance transfers and interest-free terms are also gaining a lot of traction as people look for short-term financial relief

Consumers have the travel bug

In what can only be seen as ‘revenge travel’ following years of financial difficulty, consumers are setting their sights on getting away – despite the lingering cost of living crisis.

Here’s what we unearthed on the travel frenzy:

- Qantas Airlines is killing it, with its monthly app users regularly hitting over 500K in the last year, thanks to the wildly popular Frequent Flyer program, which allows customers to redeem points on flights and hotels

- Budget Airline Jetstar also enjoyed a spike in app users but is yet to catch up with Qantas and Virgin Australia

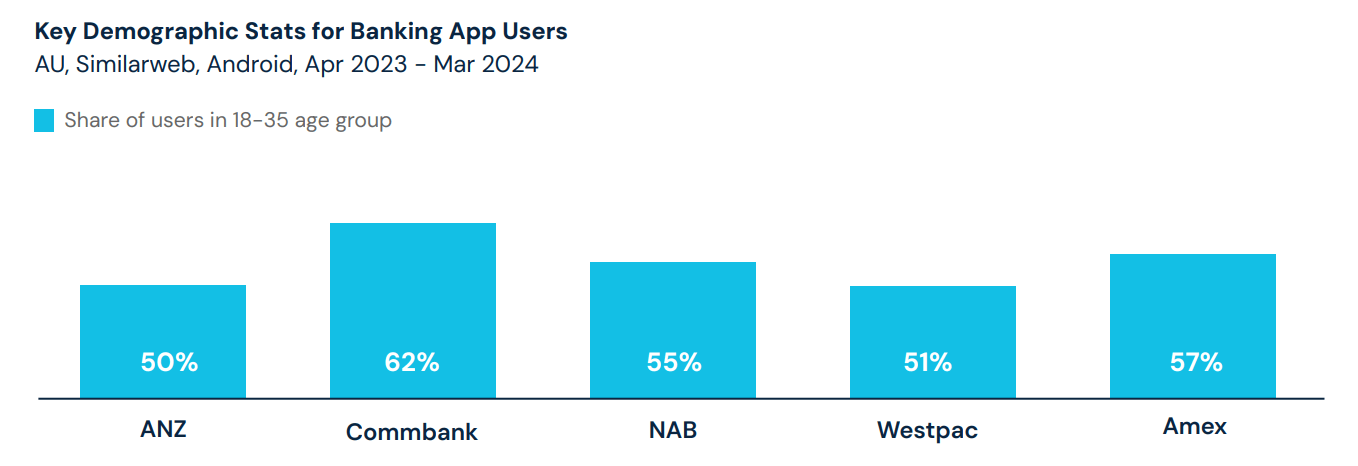

- Travel card consumers are younger than the general population of online banking services, with at least 50% of customers of top banks offering travel cards being under 35:

Want more insights like this? Download the full report now:

Convenience is key, but innovation is the future

Convenience is the overriding theme regarding the financial products consumers want most. This is especially true in the business banking sector, particularly for SMBs. Smaller businesses are seeking services that alleviate their challenges and streamline processes.

The traditional four banks in Australia, NAB, CBA, Westpac, and ANZ dominate in this area, providing solutions that prioritize convenience but, most importantly, innovative features.

Here’s a taste of what’s hot in SMB banking:

- The most popular banking apps offer small businesses one-stop-shop features, such as streamlined account integration, effortless invoicing, high-interest savings, etc.

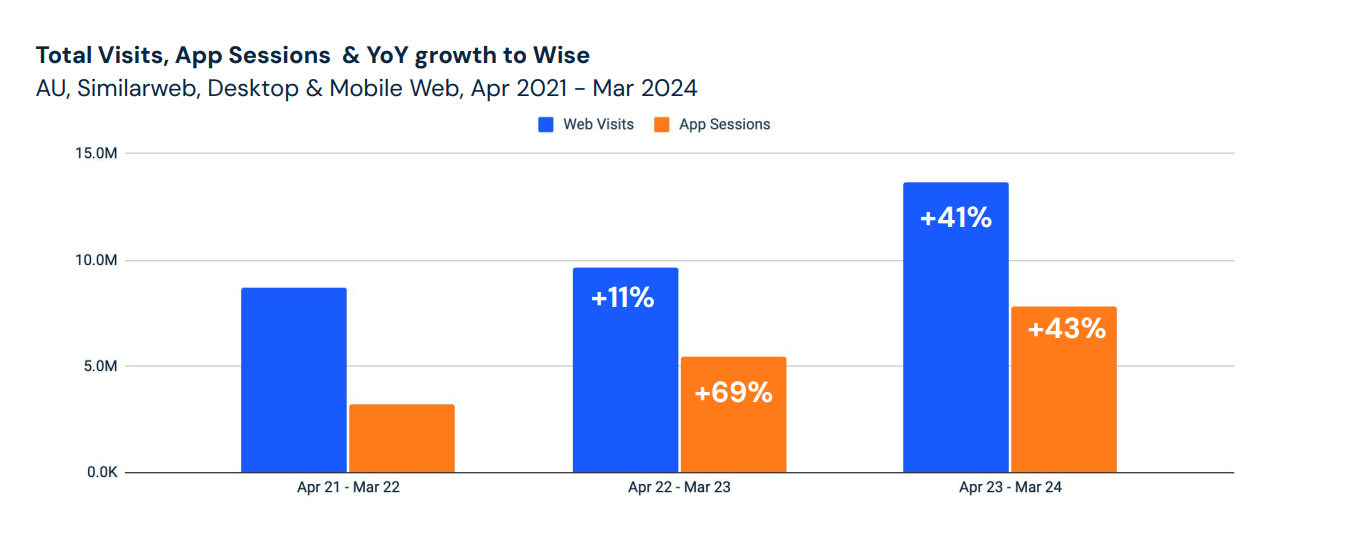

- Challenger banks like Wise are carving out a niche to get ahead of the traditional banks. They let customers send and receive payments in multiple currencies.

- Digital-first banking solutions are the future: Wise’s website and app visits grew by 41% and 43% YoY:

A final word on the future of AUS finance

As we navigate Australia’s evolving economic and consumer behaviors, 2024 presents a treasure trove of opportunities for innovation in financial services.

With inflation influencing consumer spending, our latest report delivers essential insights into the Australian Financial Services industry, highlighting trends like the surge in credit card use and Buy-Now-Pay-Later schemes, the rise in demand for travel-related financial products among younger consumers, and the importance of convenience and innovation in business banking, especially for SMBs adopting digital-first solutions.

This report is a strategic toolkit for financial companies looking to lead in a digital-first future with robust data and analysis to help refine customer strategies, enhance product offerings, and seize new market opportunities.

Are you ready to leverage these insights to transform your financial services in 2024? Download our report to stay ahead of emerging trends and meet the demands of the modern consumer:

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!