Robinhood Engagement Down 36.8% on Web, 34% on Apps

Q1 2023 digital market share analysis shows Robinhood performing better than crypto competitors like Coinbase, worse than key retail trading apps

Robinhood became a consumer investing phenomenon on the strength of its mobile app and by promising to simplify access to both traditional and crypto investing. But the decade-old company is no longer the shiny new thing in retail trading, and both web and app engagement stats have been falling.

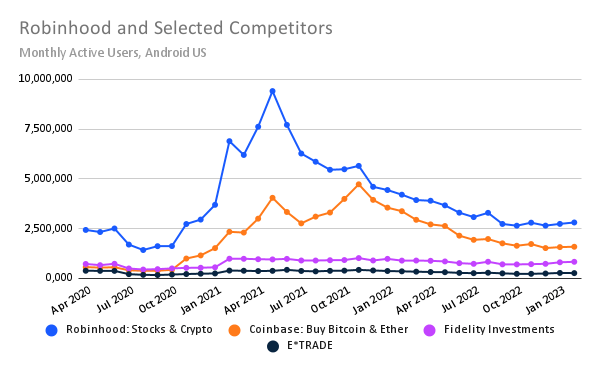

During some frenzied (and controversial) peaks of activity in 2021, Robinhood’s primary app for Android attracted nearly 10 million monthly active users. In March, it had 2.7 million Android users, according to Similarweb estimates. Other once-hot retail investing companies, particularly those associated with crypto, are also in a downturn, and Robinhood looks better (not great, but better) in comparison with crypto pure-plays like Coinbase.

Robinhood Markets, Inc. (NASDAQ: HOOD), which has scheduled a first-quarter earnings announcement for May 10, gets 94.7% of its web traffic from the US, so we’ve focused our analysis on the competitive landscape there. We use Android as our primary indicator of app usage trends, but the patterns are similar for iOS.

Key takeaways

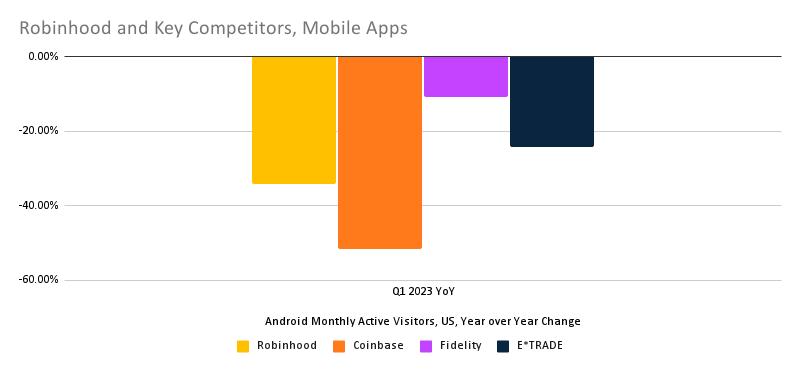

- In Q1, usage of Robinhood’s mobile app was down 34%, judging by Similarweb estimates of monthly active users on Android. That’s better than the Coinbase app (-51.5%) but worse than, for example, Fidelity app stats (-10.9%) or E*TRADE (-24%). In general, trading app usage seems to be in a slump.

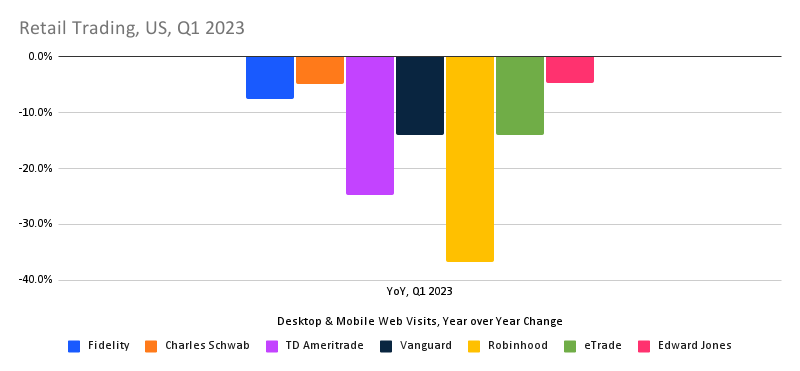

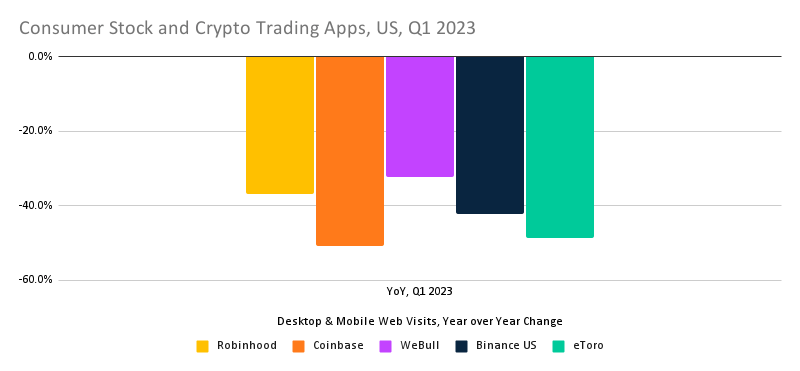

- Website visits to robinhood.com were down 36.8% in Q1. Again, that’s better than Coinbase (-51%), Binance US (-42.2%), or eToro (another retail trading plus crypto service, -48.7%). More established retail trading brands also saw a decline, but less of one: for example Fidelity (-7.5%), Schwab (-4.8%), and Edward Jones (-4.7%). However, traffic to TD Ameritrade was down 24.7% for the quarter.

- Robinhood’s share of web traffic, in comparison including Fidelity, Charles Schwab, TD Ameritrade, Vanguard, eTrade, and Edward Jones, dropped by 3.3 points, while Fidelity gained 2.9 points.

Losing app engagement

Robinhood’s initial claim to fame was that its app provided easy access to commission-free trades of stocks and other securities, but the app is not engaging users the way it once did.

Here’s what the trend looks like over the past few years, with the surge in 2021 entangled with controversy over meme stocks and how the company handled trading with them – for which it has already faced regulatory penalties.

Although Robinhood still enjoys more app engagement than competitors like the E*TRADE app, some of the engagement tactics it has employed, such as gamification of the trading experience, have also been at the center of its controversies. The company is currently defending itself against charges in a lawsuit brought by the state of Massachusetts, where one of the accusations is that the company took advantage of novice investors by making the “game” a little too fun.

Robinhood in the context of retail trading

In Q1, Robinhood saw the biggest loss of web traffic of any of these retail trading services.

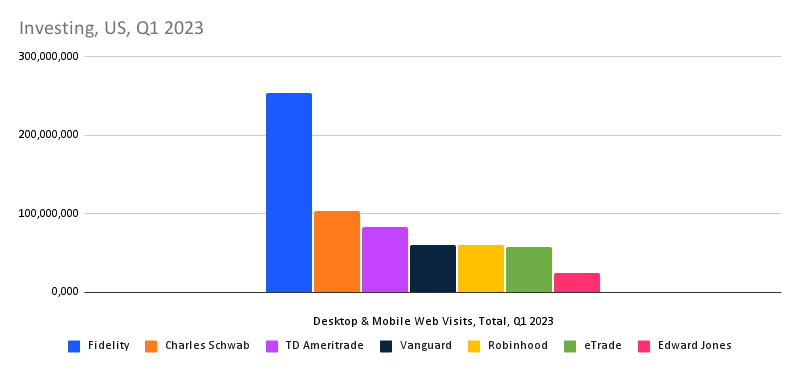

Robinhood remains a significant player in total US web traffic, well behind traffic leader Fidelity but at about the same level as E*TRADE.

Robinhood in the context of consumer trading and crypto

Compared with competitors more purely in the crypto space, Robinhood’s fall in traffic is not outside the norm – and not as bad as for Coinbase.com or traffic to Binance. Like Robinhood, eToro mixes its crypto services with access to other types of trading, and its Q1 traffic decline (-47.8%, year-over-year) was worse than Robinhood’s (-36.8%).

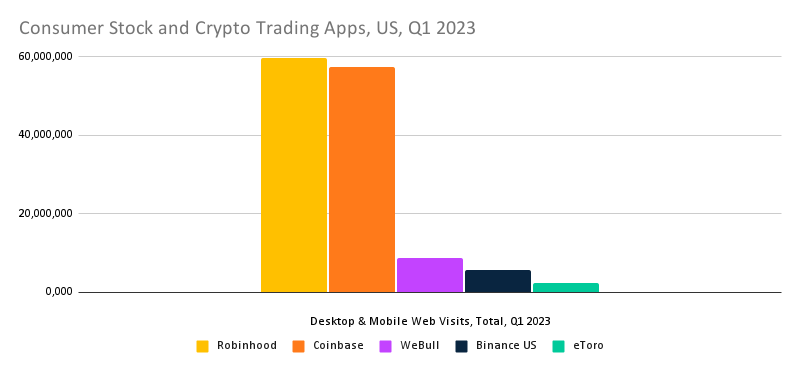

In total US traffic, Robinhood is a little bigger than Coinbase and far ahead of the others shown here.

Robinhood reaped the rewards of engaging with crypto when the market was hot and is suffering by association with it now that it’s not. On the other hand, it helps that they are more diversified than the pure-play crypto companies. And Robinhood continues to look for the upside in the crypto space, recently releasing a new app that aims to simplify access to web3 assets.

Robinhood remains a player in a tough market

A report from Zacks suggests Robinhood’s stock could rise if it beats consensus estimates – which is not to predict a turnaround or a big move toward profitability, just that the earnings might not be as bad as some are expecting. That’s sort of what we see in the web and app trends. Not great. Could be worse.

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Contact: For more information, please write to press@similarweb.com.

Report By: David F. Carr, Senior Insights Manager

Disclaimer: All names, brands, trademarks, and registered trademarks are the property of their respective owners. The data, reports, and other materials provided or made available by Similarweb consist of or include estimated metrics and digital insights generated by Similarweb using its proprietary algorithms, based on information collected by Similarweb from multiple sources using its advanced data methodologies. Similarweb shall not be responsible for the accuracy of such data, reports, and materials and shall have no liability for any decision by any third party based in whole or in part on such data, reports, and materials.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!