FTX Collapse Drives Interest in Crypto Wallets Over Exchanges

The abrupt collapse of FTX – until recently a rising star among cryptocurrency exchanges – has certainly prompted those not inclined to abandon crypto entirely to consider competitors such as Coinbase or Binance. However, another trend emerges when we look at patterns in search and web traffic: rising interest in putting less trust in centralized exchanges, overall.

Instead of allowing a centralized exchange to take custody of crypto assets, more people may make the effort to learn how to work with decentralized crypto wallets – or even stash their digital money in offline “cold” wallets.

Key takeaways

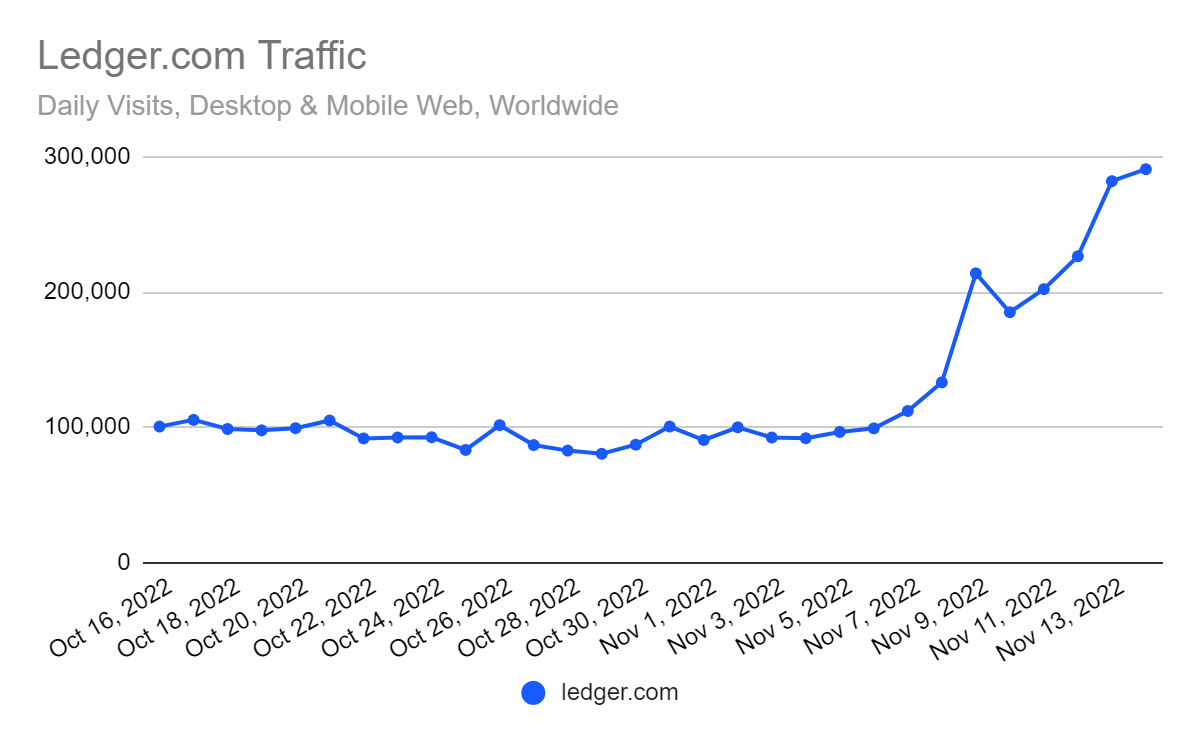

- Daily visits to the website of ledger.com, one of the leading makers of hardware wallets (which can also function as cold wallets) have tripled in the days following FTX’s adverse publicity, freezing of withdrawals, and subsequent bankruptcy filing.

- Over the past month, search activity related to crypto wallets in general, and hardware / cold wallets, in particular, has increased dramatically (see charts below).

The FTX collapse repeats, on a larger scale, an argument that has been made after other cryptocurrency disasters that happened earlier this year, such as the halt to withdrawals and subsequent bankruptcy of Celsius and problems with other crypto lenders (see report).

Now as then, believers in the ideals of decentralized finance opine that the problem is trusting what are supposed to be decentralized digital assets to centralized players. Rather than banking crypto with a corporate exchange, they say, participants in the market should take charge of controlling their own coins on their own devices and trading on decentralized exchanges such as Uniswap.

Dealing with a centralized exchange tends to be easier, which has why exchanges such as FTX have facilitated the adoption of crypto among consumer investors. The decision to choose a wallet or let the exchange function as your wallet is not necessarily all or nothing. Crypto investors can keep some of their assets in exchange, some in a convenient mobile wallet, and an untouchable reserve in an offline cold wallet (where the assets can’t be used in transactions such as smart contracts but are protected against hacking).

Coinbase offers a cold mobile and FTX had a partnership with one of the larger hardware wallet makers, Ledger.

In earlier phases of this tough year for cryptocurrency, FTX had projected strength and stability, for example offering to buy out or shore up other stumbling players. For FTX to now be revealed as a house of cards and an operation that (by some accounts) misused customer funds may make more crypto investors inclined to investigate shifting funds to decentralized wallets.

Searching for a crypto wallet

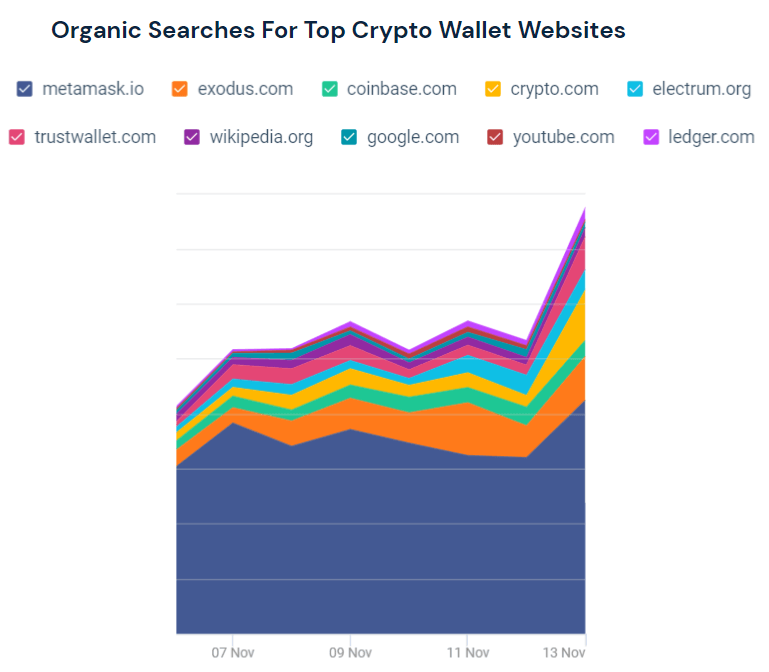

Search volume is up for information on crypto wallets in general.

All wallets allow users to take greater control over their cryptocurrency assets rather than depositing them in an account with an exchange, acting like a pseudo-bank.

Some wallets, like MetaMask, can be used as browser extensions, while others are offered as mobile apps or dedicated hardware devices. These offer varying degrees of security, privacy, and reliability while requiring the user to take on more responsibility for maintaining the related security keys and access passphrases.

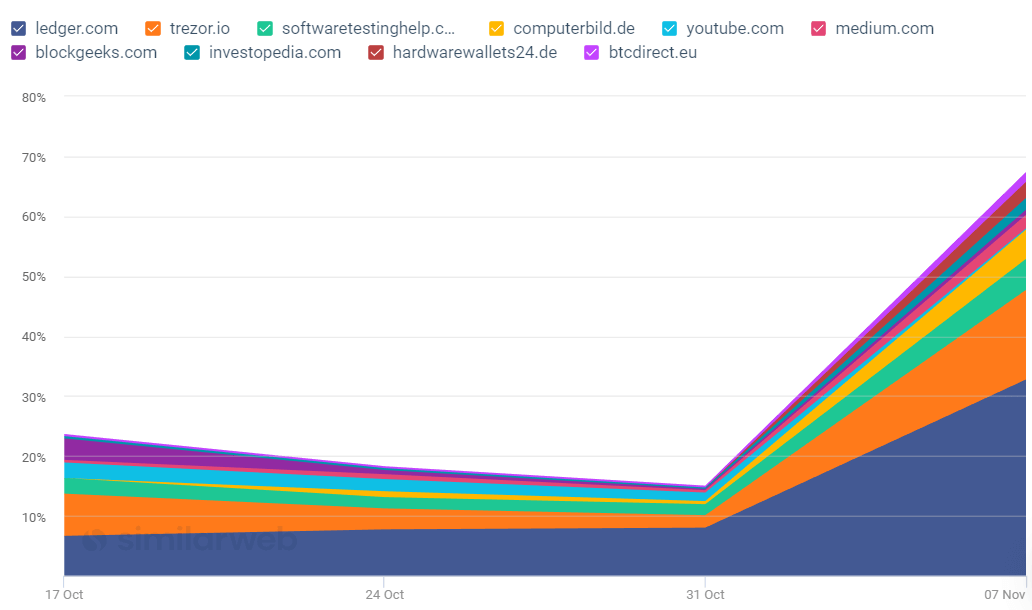

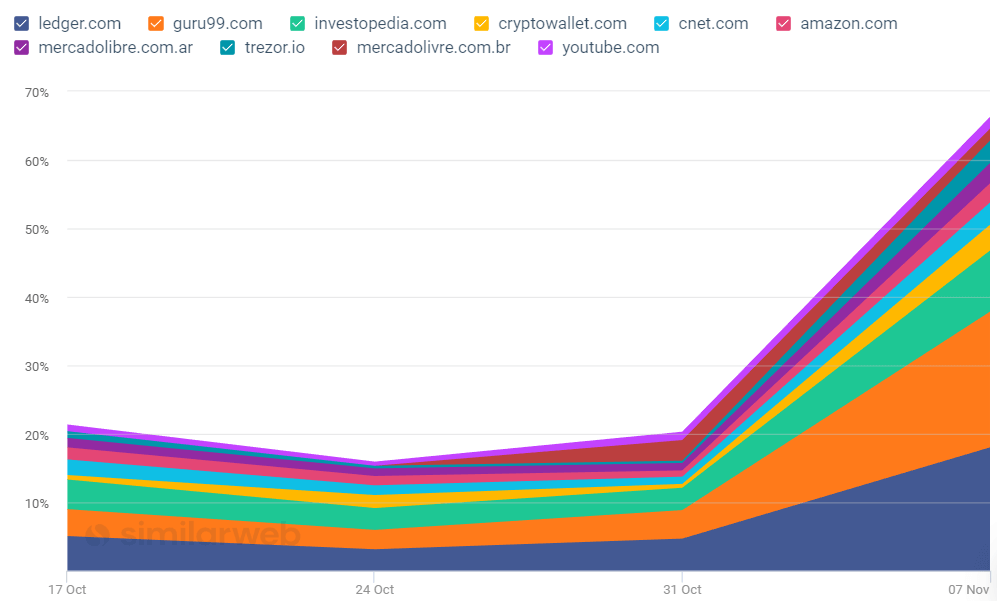

The hardware category of wallets and the more specialized category of cold wallets are seeing a particular surge in interest.

Increase in search for “hardware wallet” and related terms

Increase in search for “cold wallet” and related terms

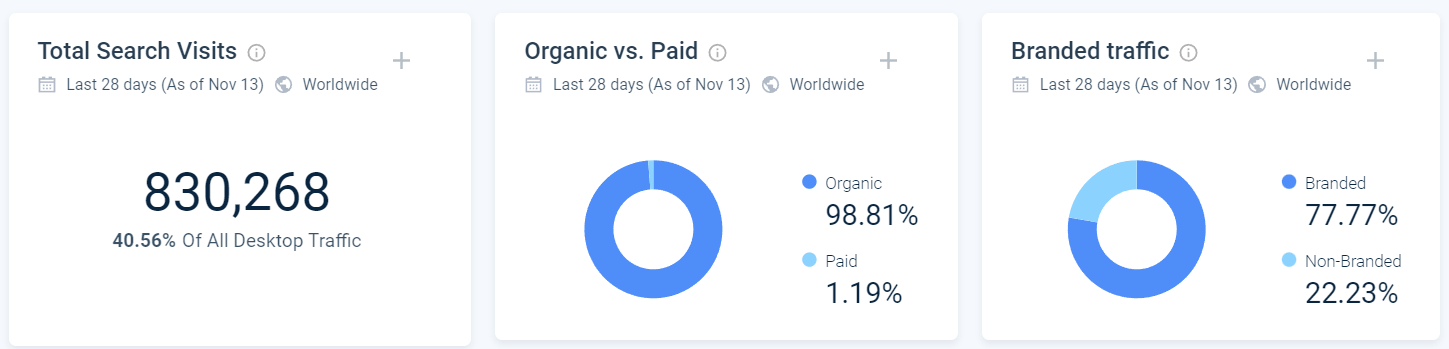

Traffic to ledger.com, the website of hardware wallet maker Ledger, rose to nearly 300,000 daily views following the FTX news, compared with about 100,000 daily views earlier in the month. Both Ledger and rival Trezor have reported an uptick in sales.

Most of the incoming search traffic for Ledger is both organic and branded, meaning that visitors have good things about the company and products and are searching for them by name.

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Disclaimer: All data, reports and other materials provided or made available by Similarweb are based on data obtained from third parties, including estimations and extrapolations based on such data. Similarweb shall not be responsible for the accuracy of the materials and shall have no liability for any decision by any third party based in whole or in part on the materials.

Photo by Max Saeling on Unsplash

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!