Cruises: “2023 Wave Season”: Q1 Rose 52%, With All Cruise Lines Seeing Growth

Carnival leads in web traffic but lost a significant share versus peers. All seven leading cruise lines saw web traffic growth in Q1, with upstart Virgin Voyages growing the fastest, rising 205%.

Key takeaways

- Similarweb data shows a peer group of seven leading cruise lines (Carnival, Royal Caribbean, Norwegian Cruise Lines (NCL), Celebrity, Princess, Holland America, and Virgin) saw Q1 web traffic growth up 52%, year-over-year in aggregate. These statistics are based on Similarweb estimates of traffic from within the US.

- Virgin Voyages grew the fastest in Q1 up 205%, year-over-year.

- Carnival led in March’s share of traffic at 28% of the peer group but lost six percentage points of share. Second place was Royal Caribbean (24%) and NCL (16%). Though Virgin is the smallest at 4% of the peer group, its share of traffic has doubled in the past year.

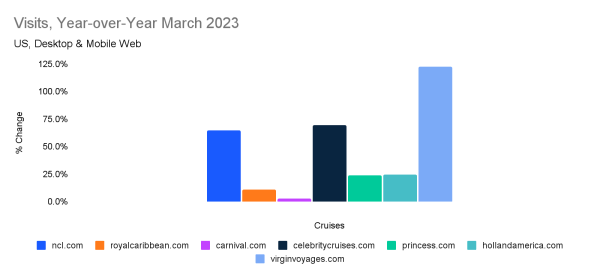

All seven major cruise lines saw web traffic growth in March 2023

A look at the chart below shows that all seven peers we looked at in this report saw year-over-year growth in March, led by Virgin’s 123% growth, followed by 70% growth at Celebrity, 65% at Norwegian, 25% growth at Holland America, 24% for Princess, 11% for Royal Caribbean, and 3% for Carnival.

This strong growth indicates that pent-up demand for cruises remains intact, and is a good omen for bookings and pricing for the industry for the rest of the year following wave season (consumers tend to book their annual cruises at the start of the year, between January and March). With a strong book of business to start the year, cruises are likely to see good pricing on remaining bookings throughout the year.

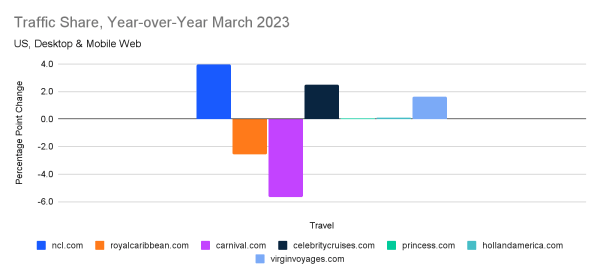

Despite slower than peer web traffic growth, Carnival has the highest share of traffic

Using share of traffic as a proxy for market share, since most consumers will visit a cruise line’s website before booking, you can see that Carnival leads this peer group with a 28% share of traffic, followed by Royal Caribbean at 24% and NCL at 16%. Notably, though Virgin trails all peers in this report with only a 4% share, they have doubled their share of traffic over the past year, as they had a 2% share of traffic in March 2022.

Carnival, by growing slowest, lost a major share of traffic

A look at changes in the share of traffic in March 2023 shows a huge drop in share for Carnival, which lost six percentage points of traffic, year-over-year, dropping to 28% from 34% a year earlier. Virgin gained 160 basis points of share, while Norwegian gained 390 basis points. You can see that represented in the chart below.

Web traffic growth indicative of strong demand

Cruises were among the last travel-related businesses to recover from the COVID-19 pandemic when the industry was shut down for over a year, while hotels and airlines continued to operate. We think there is still significant pent-up demand for cruises that are driving higher traffic. There are also a few new ships coming into service, including Royal Caribbean’s Icon of the Seas, which is driving increased excitement and fueling booking demand for other Royal Caribbean and other ships.

Publicly traded companies in this report include Carnival Corp. (NYSE:CCL), Norwegian Cruise Line Holdings (NYSE:NCLH), and Royal Caribbean Cruises (NYSE:RCL).

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Contact: For more information, please write to press@similarweb.com.

Citation: Please refer to Similarweb as a digital intelligence platform. If online, please link back to www.similarweb.com or the most relevant blog post.

Report By: Jim Corridore, Senior Insights Manager

Disclaimer: All names, brands, trademarks, and registered trademarks are the property of their respective owners. The data, reports, and other materials provided or made available by Similarweb consist of or include estimated metrics and digital insights generated by Similarweb using its proprietary algorithms, based on information collected by Similarweb from multiple sources using its advanced data methodologies. Similarweb shall not be responsible for the accuracy of such data, reports, and materials and shall have no liability for any decision by any third party based in whole or in part on such data, reports, and materials.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!