Bankrate and NerdWallet Win Share in Consumer Credit

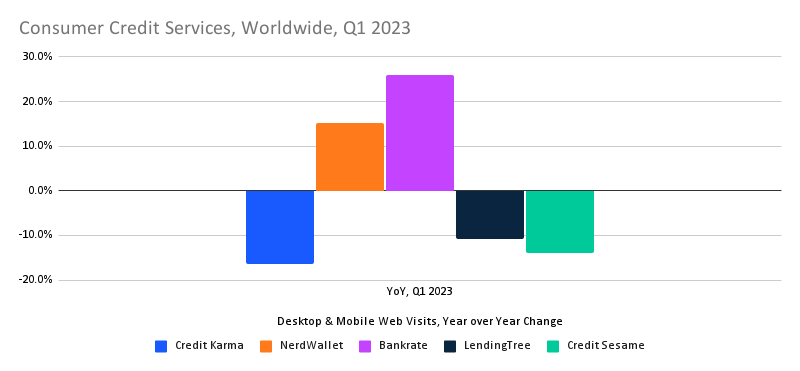

Q1 2023 market update for Consumer Credit Services shows Bankrate traffic up 25.9%, NerdWallet up 15.2%

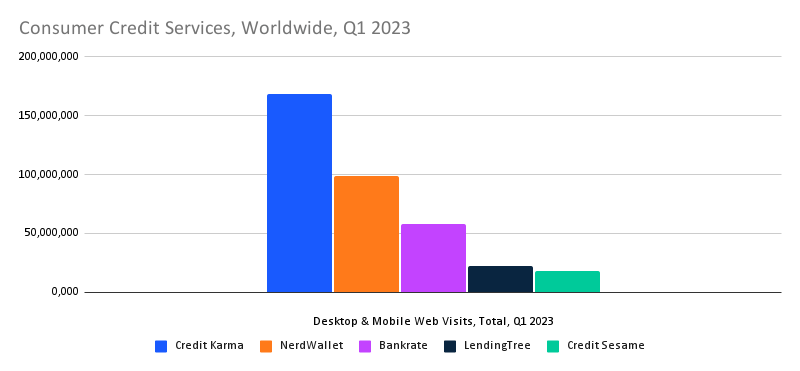

In the race for consumer attention, NerdWallet gained on traffic leader Credit Karma in the first quarter, with a 15.2% gain in year-over-year traffic, according to Similarweb estimates. NerdWallet ranks second among the set of competitors we looked at, which also includes Bankrate, LendingTree, and Credit Sesame – improving its share of traffic to 26.9%. Bankrate, which ranks third, saw an even bigger year-over-year traffic gain of 25.9%.

These play an important role in helping consumers understand their credit ratings and gain access to credit and other financial services, including credit and debit cards, mortgages, and bank accounts. The services make money by generating leads but also offer consumers the promise of objective ratings and reviews, in addition to news and feature content on financial matters.

This report is part of a series of market updates that use traffic as an indicator of market momentum.

Key takeaways

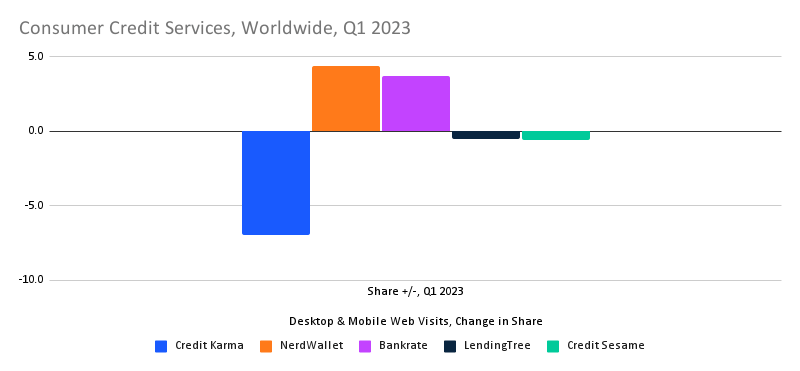

- In the first quarter, traffic to Bankrate was up 25.9% and Nerdwallet was up 15.2%, year-over-year. NerdWallet showed the greatest gain in traffic share within this set of competitors, up 4.4 points to 26.9%.

- The largest Q1 year-over-year declines in traffic were to Credit Karma (-16.3%), Credit Sesame (-14%), and LendingTree (-10.9%). Credit Karma’s share of traffic dropped by 7 points, although it remains in the lead with 46% of the traffic divided among the competitors listed here.

- Preliminary traffic totals for April show Bankrate up 22% and NerdWallet up, year-over-year, while Credit Karma was down 14%, LendingTree down 12.5%, and Credit Sesame down 20%.

NerdWallet (NASDAQ: NRDS) has repeatedly surpassed earnings expectations, including in its recent first-quarter report. Meanwhile, following a first-quarter earnings report, LendingTree (NASDAQ: TREE) saw its stock price drop, despite beating analyst expectations, after issuing a pessimistic outlook for the remainder of the year related to weakness in the housing market.

Bankrate and NerdWallet had the biggest percentage gains

On a year-over-year basis, Bankrate and NerdWallet showed the biggest traffic gains.

NerdWallet and Bankrate also gained in share of traffic

While NerdWallet and Bankrate gained, Credit Karma lost 7 points of share in this comparison.

Credit Karma retains a substantial lead

Credit Karma commands nearly half the traffic among these competitors, attracting about 168.5 million visits in Q1, compared with 98.5 million for the next largest player, NerdWallet.

Public companies mentioned in this report include Lending Tree (NASDAQ: TREE) and NerdWallet (NASDAQ: NRDS). Credit Karma is owned by Intuit (NASDAQ: INTU).

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Contact: For more information, please write to press@similarweb.com.

Report By: David F. Carr, Senior Insights Manager

Disclaimer: All names, brands, trademarks, and registered trademarks are the property of their respective owners. The data, reports, and other materials provided or made available by Similarweb consist of or include estimated metrics and digital insights generated by Similarweb using its proprietary algorithms, based on information collected by Similarweb from multiple sources using its advanced data methodologies. Similarweb shall not be responsible for the accuracy of such data, reports, and materials and shall have no liability for any decision by any third party based in whole or in part on such data, reports, and materials.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!