Brand Management on Amazon: Opportunities and Pitfalls

Amazon’s size and scale make it impossible to ignore for consumer brands. Even if brands decide to not sell their products directly on Amazon, third-party sellers will most likely emerge. This requires brand managers to take a careful and thoughtful approach to how they engage with the eCommerce behemoth.

Key Takeaways

-

Amazon represented over 40% of total U.S. eCommerce sales in 2021, and the place most consumers go to first, making a brand’s strategy on the site critical

-

Brand management on Amazon can be inherently more difficult for large brands than for smaller brands, especially in the consumer-packaged-goods (CPG) category

-

Estimates from Similarweb’s Shopper Intelligence platform suggest that even by avoiding first-party (1P) sales, a brand could still find itself sold by others on Amazon’s marketplace

-

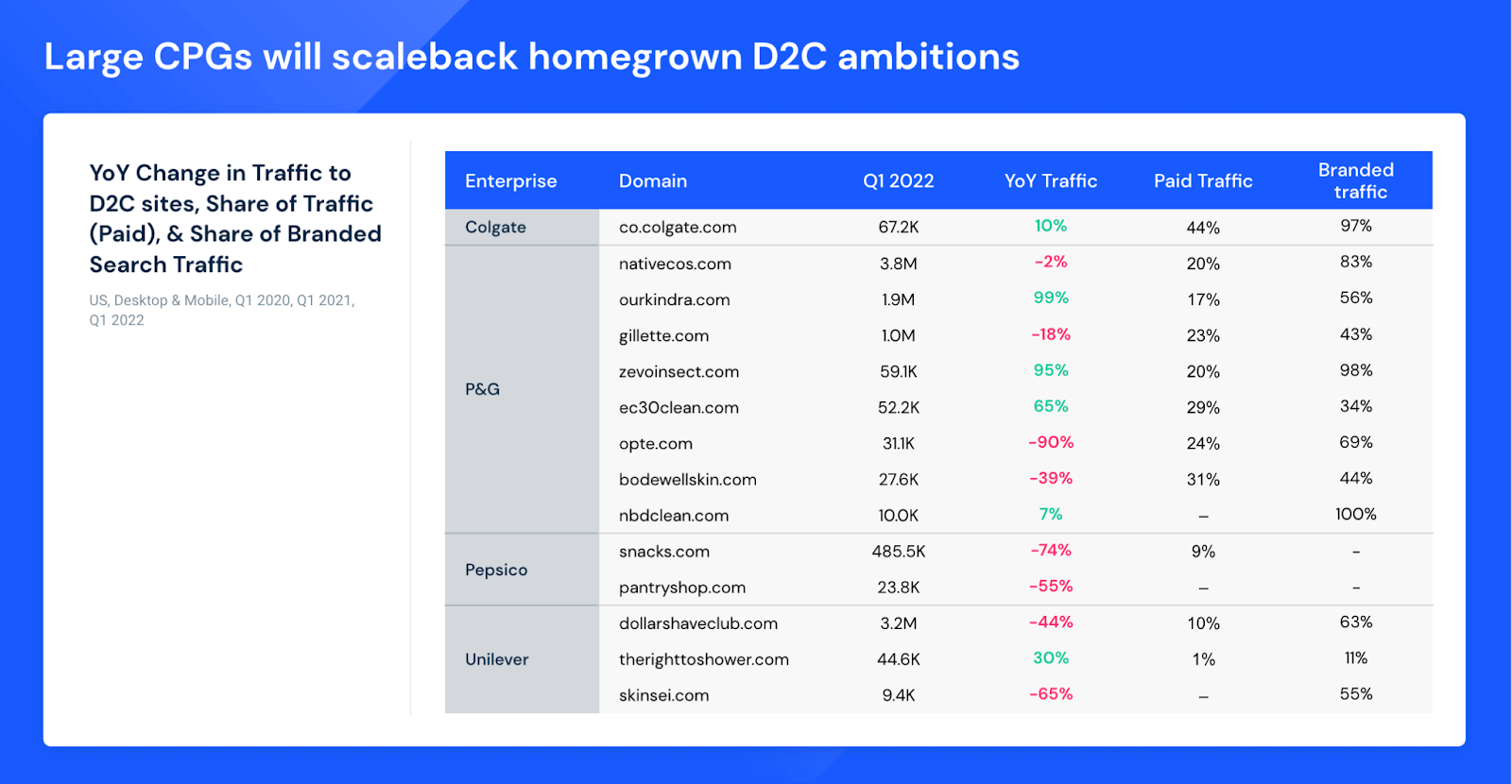

While many large CPGs have attempted to establish their own direct-to-consumer (D2C) channels, Similarweb estimates show the results have been mixed at best

-

-

Nike walked away from selling directly on Amazon yet revenues from Nike products were essentially unchanged due to offsetting third-party (3P) sales

-

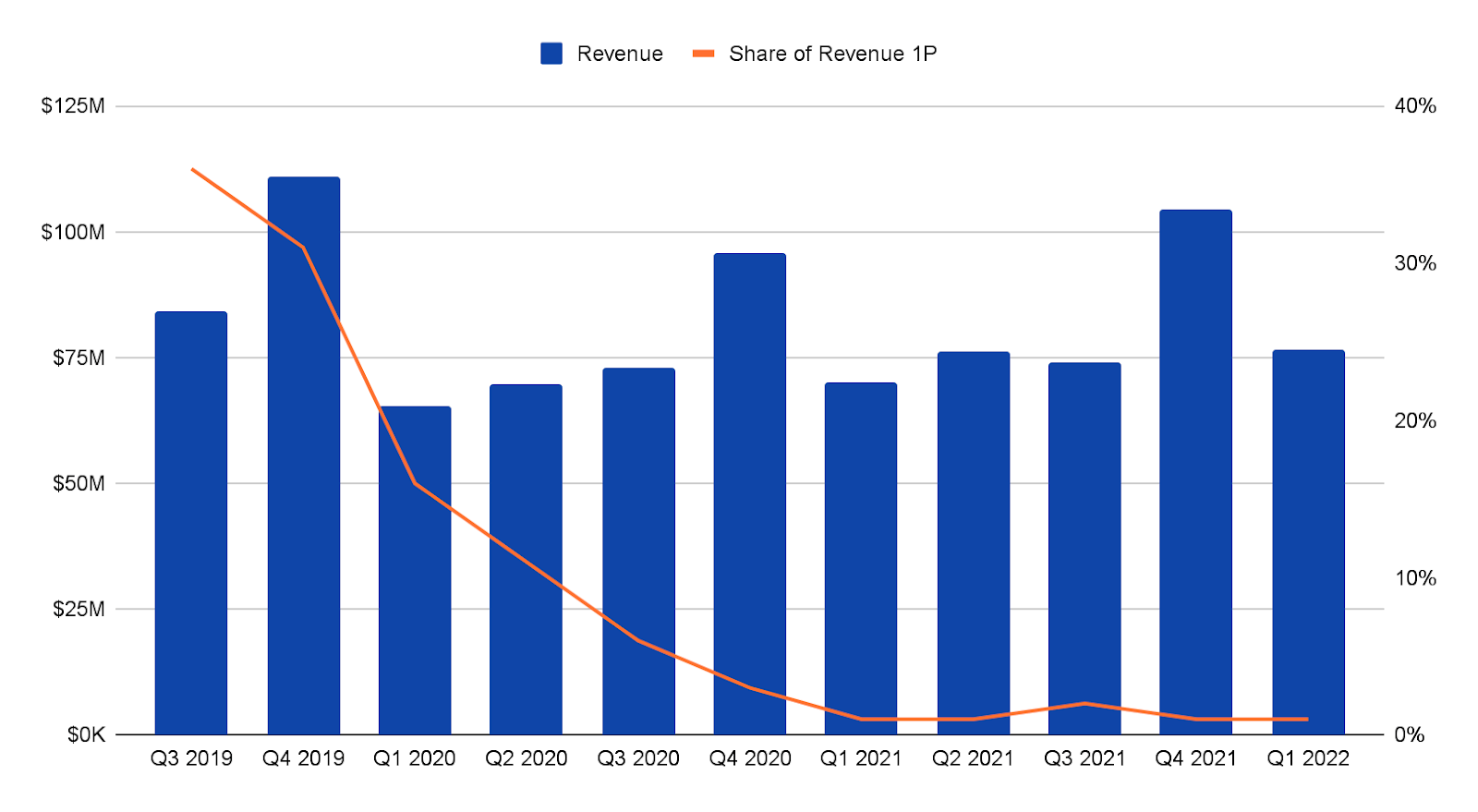

Per Similarweb estimates, in Q3 2019, Nike’s first-party (1P) sales on Amazon were $84M or approximately 36% of all Nike sales on the site while the other 64% accounted for 3P sales. After Nike walked away from selling directly on Amazon, the 1P percentage is now only about 1%

-

-

Apple keeps its latest iPhone models off of Amazon, yet older variants persist, which could hurt its brand image

Amazon reigns supreme as the top eCommerce company where customers can find practically any product desired accounting for over 40% of U.S. e-commerce sales in 2021. This makes the site impossible to ignore for consumer brands regardless of how large or small they may be. The first question brands have to contend with is should they sell their products directly on Amazon as a first-party (1P) seller? Third-party (3P) sellers of their products will most likely occur and can be difficult to stop or prevent. Brands can also choose to advertise on Amazon.

Especially for small brands, Amazon is a welcome platform giving them not just another outlet to sell their wares, but an important partner due to its size, scale, and prominence. However, for larger brands, selling on Amazon is a potential risk, as it can be difficult to control how the brand is presented and ultimately perceived by customers. So while smaller brands tend to rely on Amazon as a growth engine, larger brands typically establish other channels such as retail partnerships and their own direct-to-consumer sites to sell products. These larger brands want to ensure that Amazon is not cannibalizing these other channels, but rather adding to their total sales.

We examined a few case studies to better understand the dynamics of selling on Amazon. Similarweb’s Shopper Intelligence platform allows us to uncover the data that illustrates the opportunities and potential pitfalls of managing your brand on Amazon.

Nike’s Retreat from Amazon Results in Unintended Consequences

Nike began its direct relationship with Amazon in 2017 in a pilot partnership to offer footwear, apparel, and accessories. This was an attempt by Nike to better manage and control its brand on Amazon where counterfeit Nike products were being sold along with legitimate Nike products sold by 3P sellers. This followed several years of hesitation by Nike to be directly involved with Amazon. But by doing so, Nike hoped that Amazon would take an aggressive approach toward targeting sellers of counterfeit versions of Nike’s products by taking punitive actions against such sellers in order to prevent such practice.

They also hoped Amazon would use its algorithm to prioritize Nike products sold directly by Nike and minimize exposure of 3P sellers in order to deter them from selling its products. This would result in Nike receiving the lion’s share of revenues from its products sold on Amazon and it would be better positioned to control how its brand is presented on the site.

However, things played out a little differently. While Nike expected its 1P sales to crowd out 3P sales, 3P selling of Nike’s products only persisted. As a result, Nike decided to pull virtually all 1P direct sales from Amazon in December 2019.

What followed was notable. While Nike’s 1P sales effectively went to zero, the revenue of Nike’s products sold on Amazon did not change to a great degree due to an offsetting increase in 3P sales over time; essentially Nike lost sales that could have been directed to its 1P products.

Nike: Brand Revenue on Amazon.com & Share of Revenue from 1P Sales

US, Desktop & Mobile, Q3 2019 – Q1 2022

This case study shows that while Amazon endeavors to have close relationships with brands, the reality is it’s essentially agnostic when it comes to the source of its revenues.

Apple’s iPhone Sales on Amazon: 3P and Older Versions Dominate Sales

In sharp contrast to Nike’s experiment, Apple has taken a very hands-off approach to manage its product sales on Amazon. This is very deliberate as Apple doesn’t want to risk diluting its brand equity. Apple doesn’t want to cannibalize its own direct-to-consumer inventory by offering discounts and incentives on iPhones, which are often necessary to sell on Amazon given consumer behavior on the site.

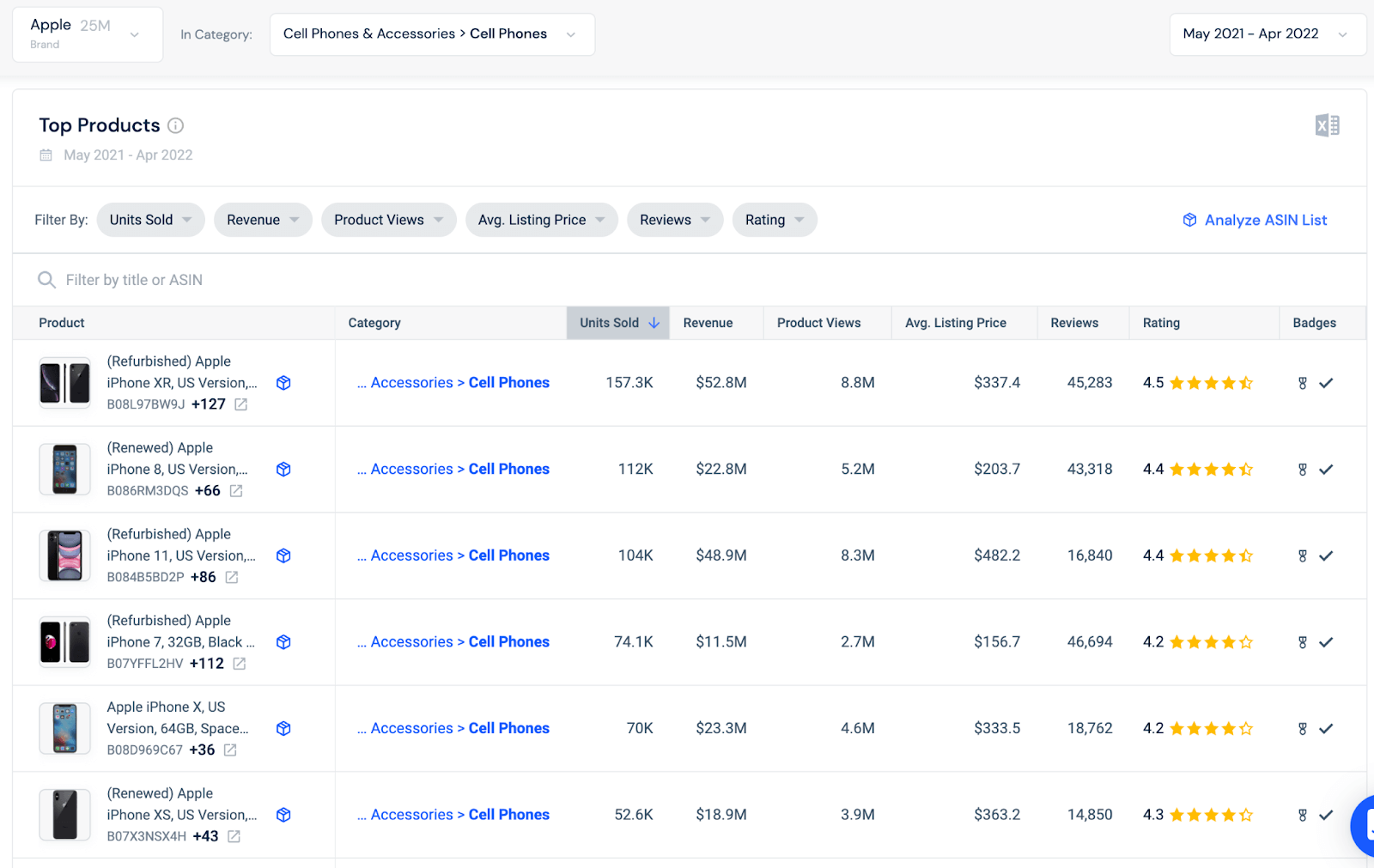

The iPhone is also Apple’s chief revenue driver and management doesn’t want to undercut iPhone prices sold in its own stores and on its website. Because of this, the latest version of the iPhone can be found on Amazon but not at a discount. However, older versions can be found at discounted prices and, based on Similarweb estimates, the majority of iPhones sold on Amazon are for older models, with well over 90% of these sold by 3P.

When compared to Samsung’s strategy of selling its latest model phones directly on Amazon, the results are telling. Over the past year (May 2021 – April 2022), Samsung phones have received 51% more views than Apple with 133 million views versus Apple’s iPhone which was viewed 88 million times, according to Similarweb estimates. This translated to more revenue for Samsung sales during that period with Samsung phone and accessory sales earning 81% more compared with Apple or $923M versus $510M.

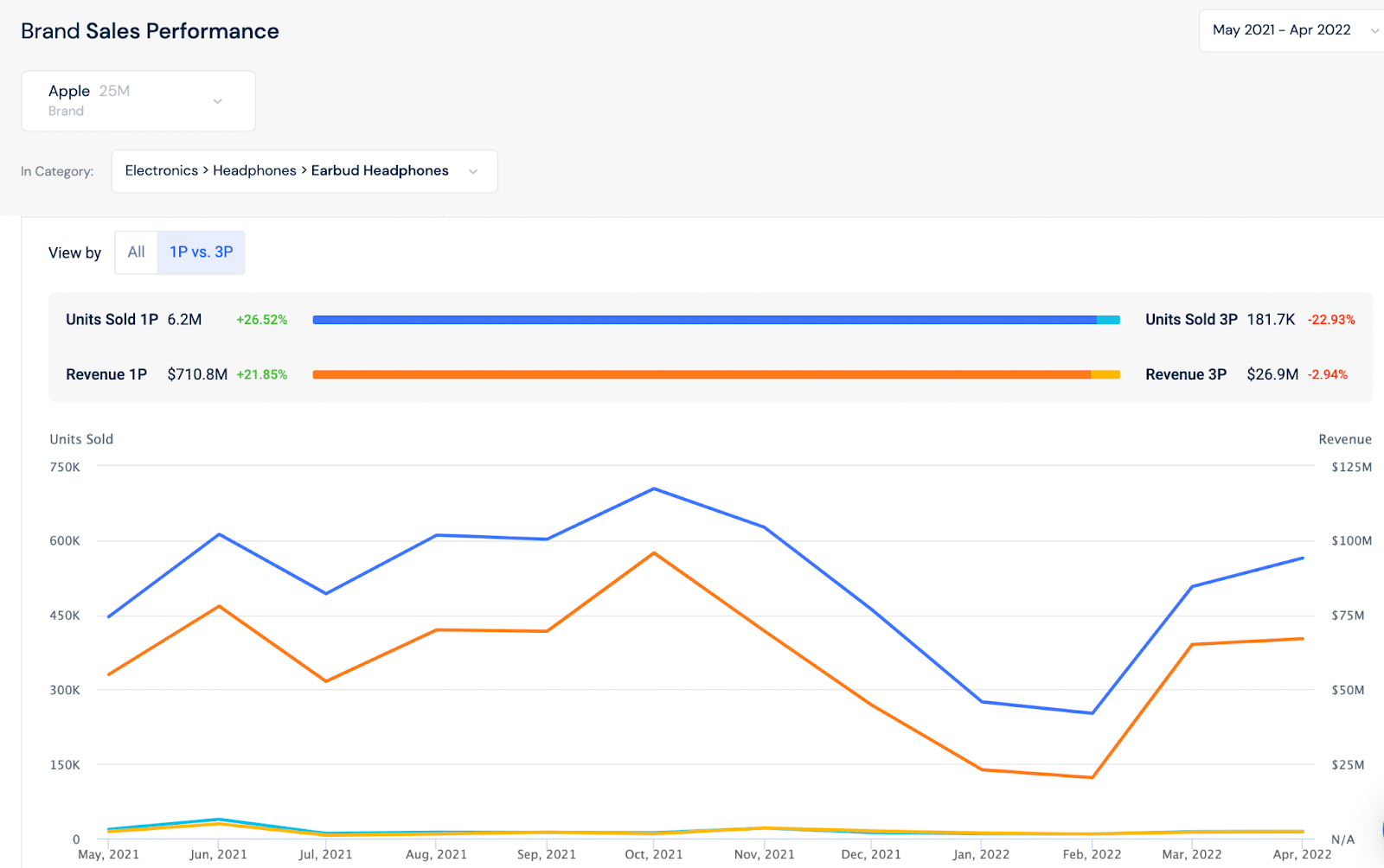

When it comes to Apple’s accessories, such as the ubiquitous Airpods, Apple has taken a different approach than it has with the iPhone when selling on Amazon. Similarweb estimates show the majority of Airpod sales on Amazon are 1P sales with 6.2 million units sold in the past year compared to only about 182 thousand units sold by 3Ps.

This illustrates a clear willingness to allow lower-end or entry-level products to be sold direct-to-consumer on Amazon, often at a discount, while only older models of its flagship iPhone can be found at a discount. In doing so, Apple is lowering the barriers to entry into its product ecosystem and increasing its ability to win new customers.

Johnson & Johnson Takes a Different Approach by Utilizing 3P Providers

Johnson & Johnson (J&J) has taken another approach to manage its selling strategy on Amazon. It has made a strategic decision to outsource all of its 1P sales to a 3P provider named Pharmapacks.com. Per the Pharmapacks website, “We directly purchase products and seamlessly handle tactical business operations, empowering brand owners to focus on their core competencies while maintaining control of the brand experience.” Typically, when purchasing products on Amazon that are listed as “Sold by Amazon”, these are the brand’s 1P products.

But, in the case of J&J, their “Sold by Amazon” products are being sourced through Pharmapacks, which also sells the same products on its website. In doing so, J&J is reaping the benefits of selling on Amazon, albeit at presumably wholesale prices, while effectively outsourcing its brand management and experience to a 3P. Since consumer-packaged goods (CPG) companies like J&J have little experience selling direct-to-consumer, the opportunity to work with a 3P allows them to partner with a company that has extensive experience managing Amazon.

This allows J&J to avoid some of the issues that Nike and Apple have experienced while still receiving an income stream from Amazon.

The graphic below highlights the difficulty large brands tend to experience when attempting to create new direct-to-consumer (D2C) channels. Using Similarweb estimates, we measured year-over-year (YoY) traffic changes for these domains. Even for large well-established brands, traffic declined YoY to their D2C websites. Large CPGs may need Amazon more than any other category because they’ve had little to no success in establishing D2C channels.

Managing Your Brand On Amazon Is Not a One-size Fits All Strategy

Amazon is impossible to ignore. Even if your brand refuses to work with the e-commerce behemoth, it can still impact your brand and your market, as evidenced by Nike’s experience. Rather, brands need to carefully gauge which strategic approach is right for them. Premium brands like Apple are being prudent by ensuring they can capture revenue from Amazon without diluting their brands.

For mid or lower-tier brands, management must decide whether to take a hands-on approach by selling 1P, or more of an outsourced approach like J&J’s. Ultimately, the goal is to maximize revenues from Amazon while minimizing logistical headaches and, most importantly, ensuring your brand is presented in a way that aligns with your overall brand placement and strategy.

The Similarweb Insights Newsroom is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to this post.

Disclaimer: All data, reports and other materials provided or made available by Similarweb are based on data obtained from third parties, including estimations and extrapolations based on such data. Similarweb shall not be responsible for the accuracy of the materials and shall have no liability for any decision by any third party based in whole or in part on the materials.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!