Online Sports Betting Continues Rapid Growth in the US, Dovetailing with Fantasy Sports

ESPN Bet is an interesting new entry, but ESPN Fantasy Sports has more than twice the app users of the leading betting app

As online sports betting accelerates its growth in the US, betting and fantasy sports seem to be tag teaming more than competing in the race to win the attention of sports lovers.

Fantasy sports gained popularity partly as a legal way of wagering that the states and the courts generally have not classified as gambling, back when gambling was widely prohibited by law. In 2018, the US Supreme Court struck down the federal law prohibiting most forms of sports betting, clearing a path for states to legalize it and eventually allow the activity to move online. Sports betting on the web and apps has gained great momentum over the past couple of years, but to some extent it’s still drafting on fantasy sports. Fantasy sports players like FanDuel, DraftKings, and now ESPN have bet on the betting market.

While the audiences overlap, fantasy sports players bet on the outcome of fictitious games where players act as managers vying to assemble the best teams. The outcome of fantasy sports competitions is statistically related to the performance of the real players drafted onto the fantasy teams, but the activity is a step removed from actual sports betting. That’s why it’s considered a game of skill, which many players appreciate independent of its resemblance to sports betting.

As 2023 comes to a close, both are growing overall, although some players are growing faster than others.

Key takeaways

- In November, usage of sports betting services was up 21% year-over-year on apps and 53% on the web in November, according to Similarweb estimates. Over the past 12 months, usage is up 43% on apps and 81% on the web compared with the prior year.

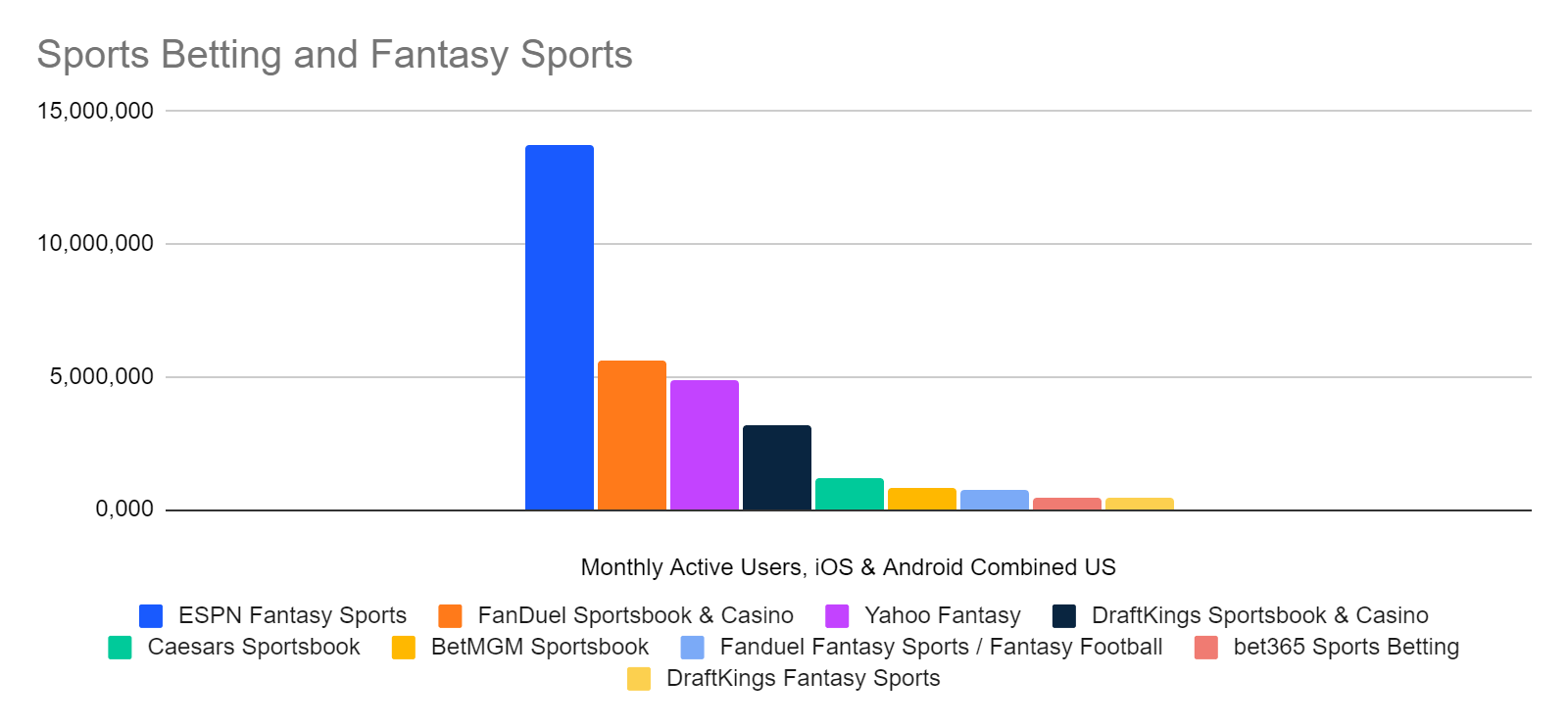

- The intertwined online markets for fantasy sports and sports betting continue to grow in parallel, with fantasy sports still commanding bigger audiences by some measures. For example, the ESPN Fantasy Sports app has more iOS and Android monthly active users than any of the betting apps. On the web, FanDuel (fanduel.com) still owes its top rank to fantasy sports even as it diversifies into betting. One reason: online sports betting is subject to state-by-state regulation, whereas fantasy sports apps generally are not.

- ESPN Fantasy Sports is also experiencing strong growth on mobile, with app users up 125% year-over-year in November. Website visitors were up a more modest 6%.

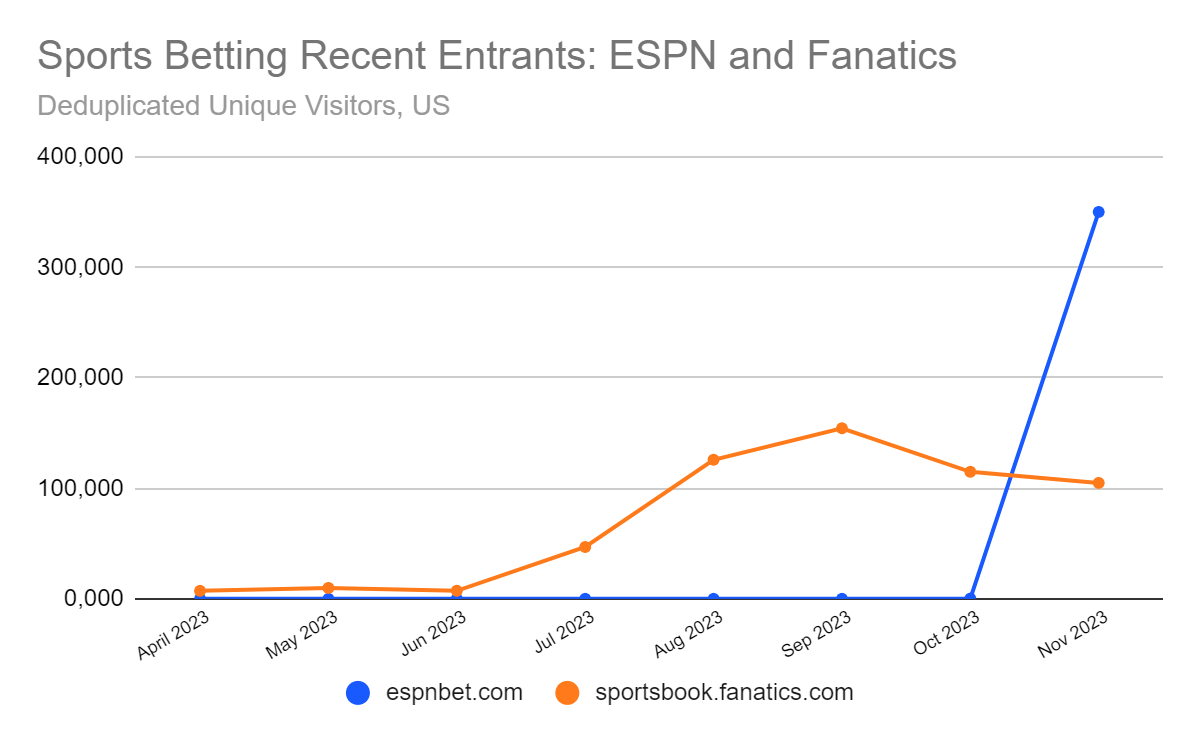

- ESPN’s entry into sports betting is likely to be significant in the long haul, both because of ESPN’s cable TV might and its standing as one of the leading fantasy sports purveyors. However, so far ESPN Bet is just getting started, with 350K unique visitors to espnbet.com and 249K monthly active users of ESPN Bet app in November, versus competitors boasting millions of each.

- International sports betting player Bet365 is relatively small in the US but growing fast, with users of its mobile apps up more than 7,000% year-over-year and website unique visitors up 141%.

Sports betting grows rapidly in the US

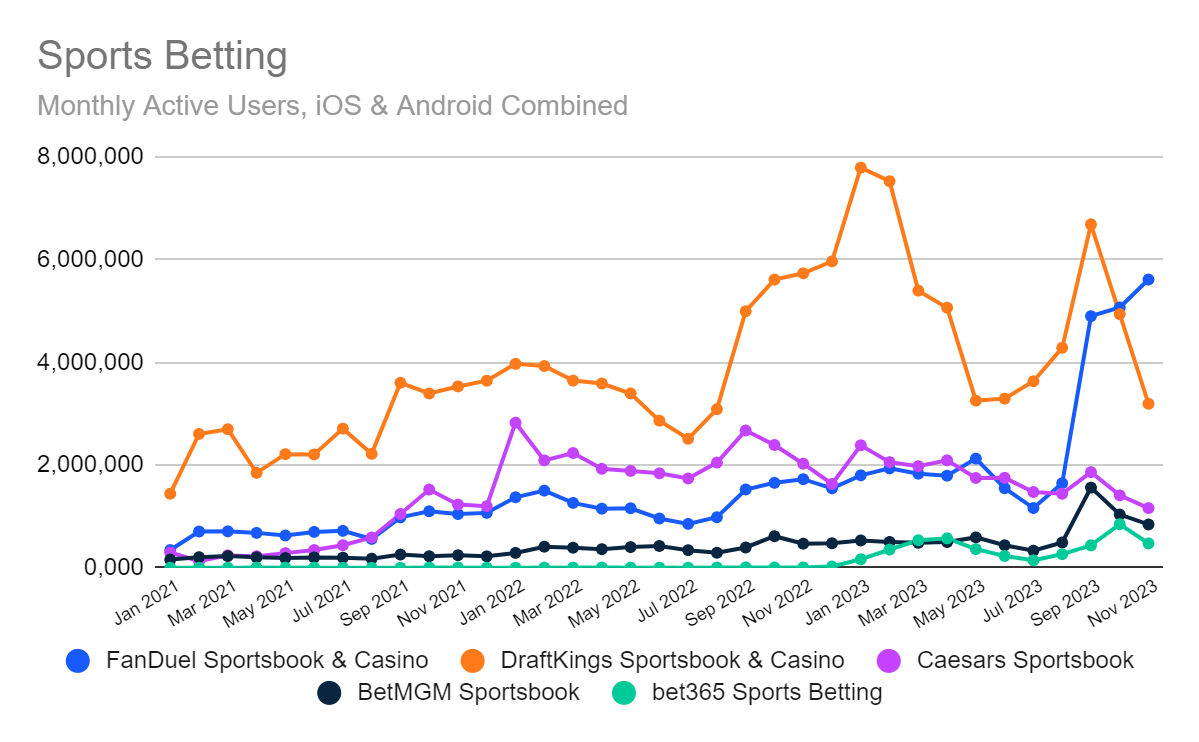

The metrics predicted in the graph below are roughly comparable for the web and mobile apps – monthly tallies of unique website visitors versus iOS and Android app active users, aggregated across multiple brands – but show a steady climb in usage across both modes of interaction. The numbers peaked in September with the opening of the American football season, before dipping in October and November. However, betting activity was still up 21% year-over-year on apps and 53% on the web in November.

Most popular betting apps: FanDuel and DraftKings

FanDuel and DraftKings are also growing rapidly, with FanDuel usage jumping ahead in November, up 10.7% month-over-month and 225% year-over-year, as measured by monthly active users for iOS and Android.

The traffic spikes tend to correspond with the NFL season start and playoffs, more than other sporting events such as March Madness.

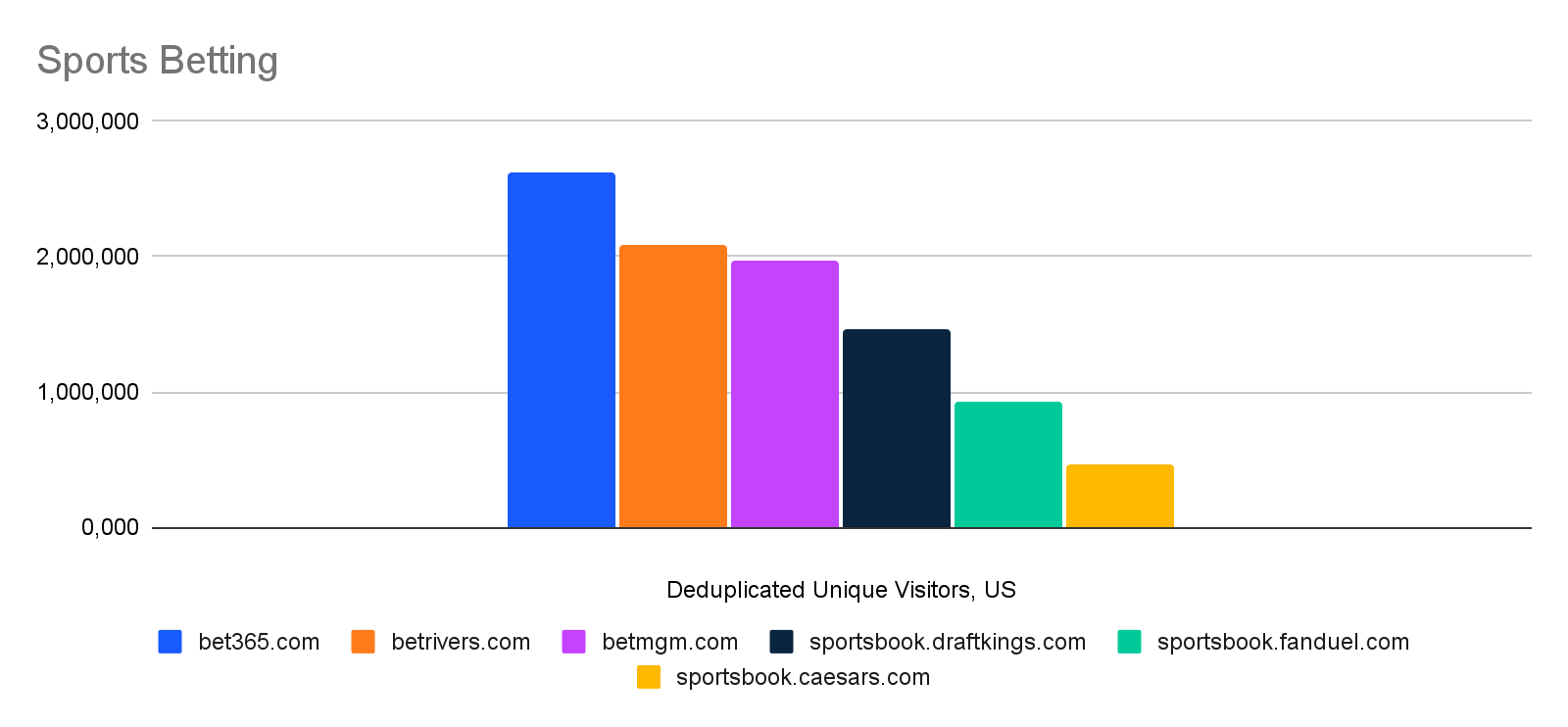

On the web, Bet365 (bet365.com) has the biggest audience at 2.6 million unique visitors in November, up 103.6% year-over-year, while BetRivers (betrivers.com) and BetMGM (betmgm.com) rank ahead of DraftKings and FanDuel’s sportsbooks.

Fantasy sports and sports betting, side by side

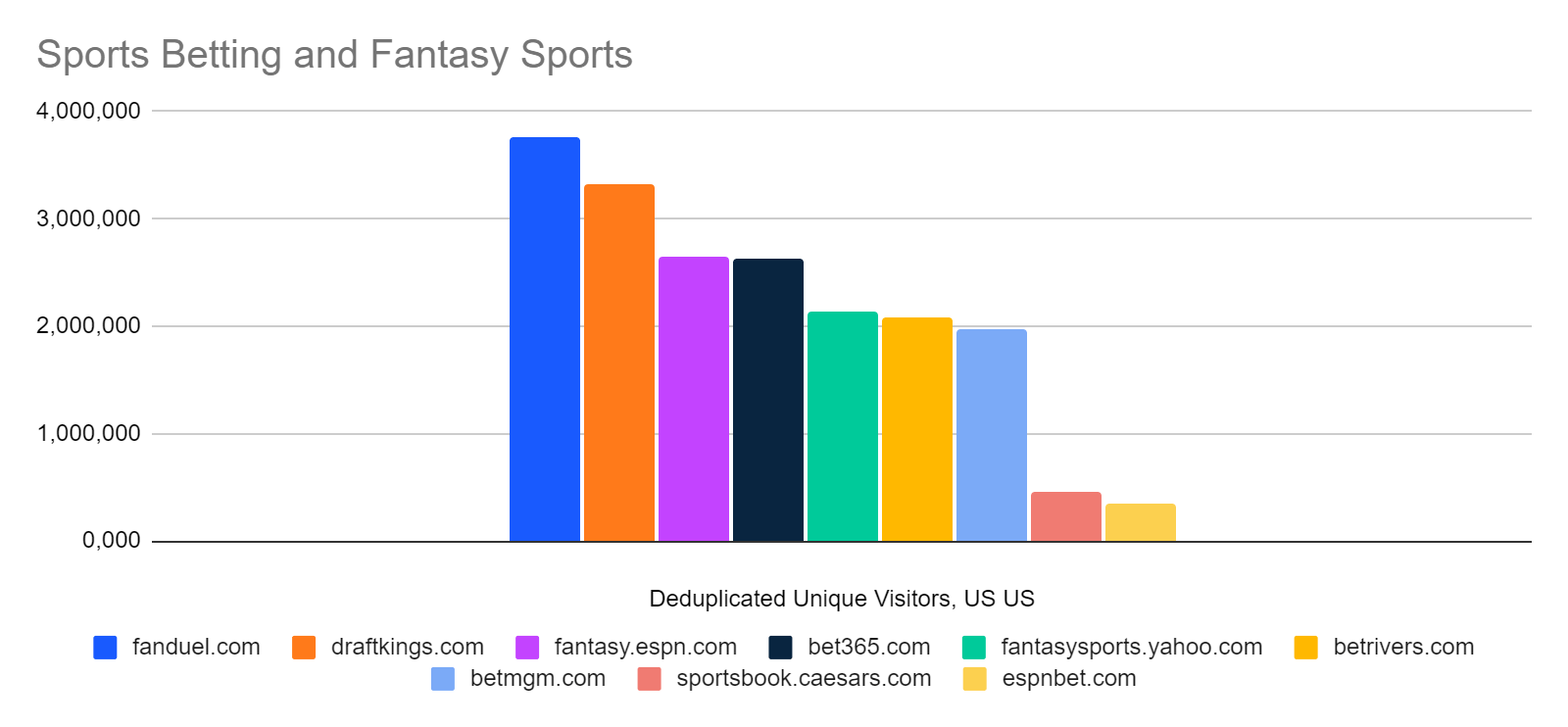

Looked at as a continuum of sports oddsmaking entertainment, the combined fantasy sports and sports betting audiences are still dominated by fantasy sports. That may change as sports betting continues to become more widely legitimized.

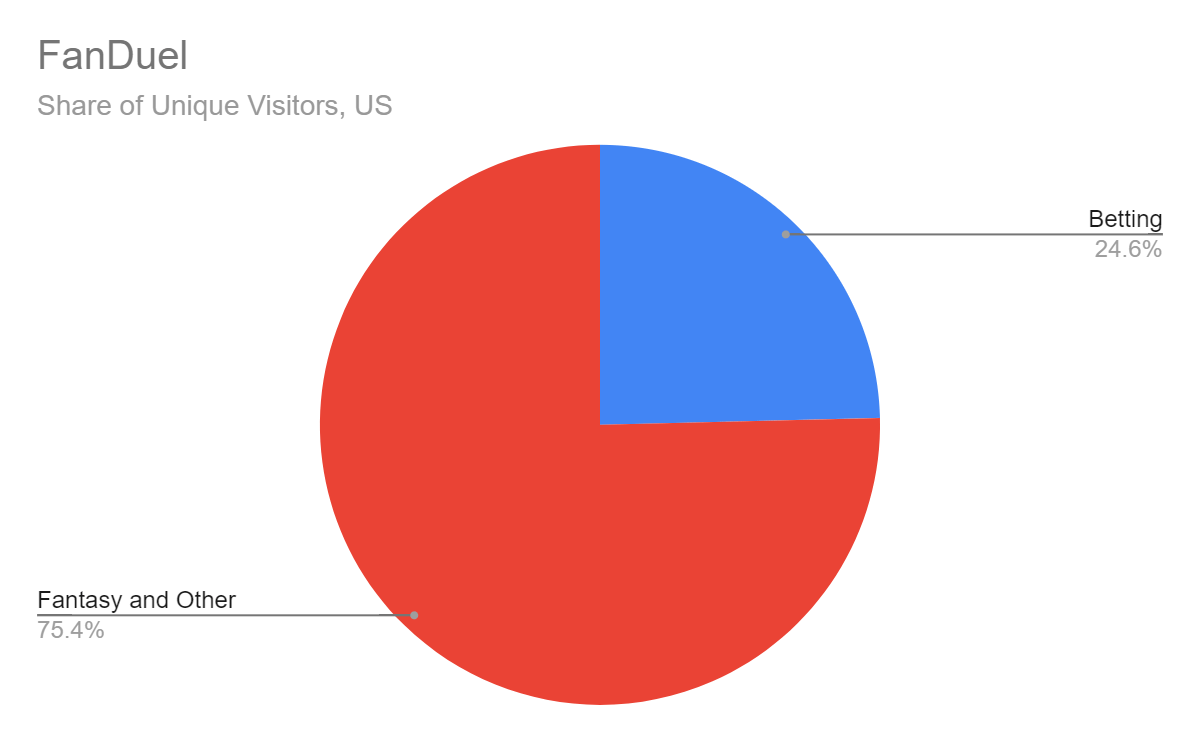

FanDuel and DraftKings come out on top in the combined ranking shown below, which is based on unique visitors of the websites of these services. Both have sportsbook subdomains, counted here as part of their overall total, but fantasy sports users continue to represent a slightly bigger part of their audience (see the breakdown in the next section). Even with traffic to sportsbook.fanduel.com subtracted out, FanDuel would rank highest based on its fantasy sports and other non-betting traffic, representing about 2.8 million out of 3.8 million total visits in November. That’s slightly ahead of fantasy.espn.com with 2.6 million visits for the month.

On mobile, the ESPN Fantasy Sports app holds a commanding lead and the Yahoo Fantasy Sports app also ranks high. But one difference from the pattern seen on the web is that the betting apps for both FanDuel and DraftKings have bigger audiences than their fantasy sports counterparts, based on Similarweb estimates of iOS and Android monthly active users. Getting a betting app in a user’s pocket is arguably more important for building an enduring habit.

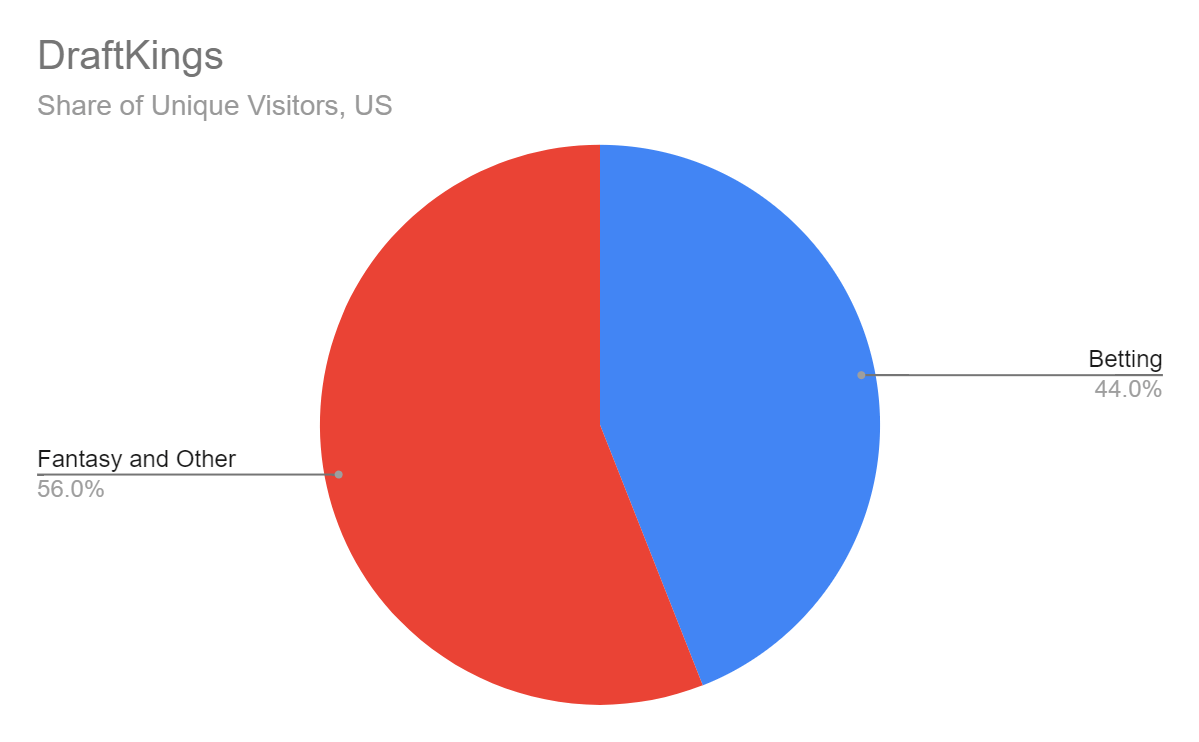

Bettors represent a bigger share of the audience of DraftKings vs. FanDuel, at least on the web

Both DraftKings and FanDuel are active in the sports betting market, in addition to fantasy sports, but about 44% of the traffic to draftkings.com goes to the sportsbook.fanduel.com subdomain for betting, as opposed to other areas of the site mostly focused on fantasy sports. FanDuel has a similar website structure, but only a quarter of its traffic is related to its betting subdomain.

Fanatics made a splash. Then came ESPN’s cannonball

Two of the most recent entrants in online sports betting both generated excitement, but the power of the Fanatics sports merchandising brand couldn’t match ESPN’s quick climb in usage, shown below by website unique visitors.

Care to make a bet?

Sports betting and fantasy sports websites and apps continue to grow. So far, rather than cannibalizing the audience for fantasy sports by adding betting, the players in this market seem to be growing the market overall.

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Disclaimer: All names, brands, trademarks, and registered trademarks are the property of their respective owners. The data, reports, and other materials provided or made available by Similarweb consist of or include estimated metrics and digital insights generated by Similarweb using its proprietary algorithms, based on information collected by Similarweb from multiple sources using its advanced data methodologies. Similarweb shall not be responsible for the accuracy of such data, reports, and materials and shall have no liability for any decision by any third party based in whole or in part on such data, reports, and materials.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!