Tesla Q1 Conversion, Deliveries Strong Versus Prior Year, But Weaken from Q4

Amid spiking gas prices in the wake of the Russia-Ukraine war, and with interest in sustainability and electrification increasing in general, Tesla, the world’s leading electric vehicle manufacturer, seems well positioned to capitalize on these trends.

- Similarweb data shows Q1 conversion in the United States is up 82% vs. the prior year (excluding Cybertruck), but down 11% vs. 2020’s Q4

- Conversion rates could be an indicator of future sales, so a quarterly sequential slowdown (Q4 into Q1) could be a cause for concern

- March 2022 conversion was particularly strong, up 107% over February 2022, likely spurred by rising gas prices across the U.S.

- The company announced Q1 deliveries of 310k on April 2, a growth of 68% year over year, but up less than 1% over Q4

- Tesla Inc. reports Q1 2022 earnings on April 20th after market close

Conversion Data Strong for Q1 and March 2022

Similarweb data provides a unique look into the Tesla sales funnel across each car brand. The web traffic data shows visits to the Tesla sales checkout webpage and is a strong indicator of future sales.

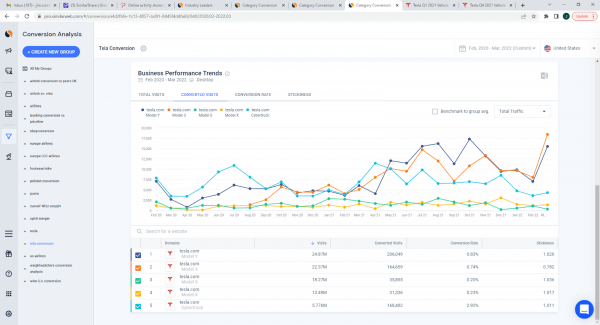

Similarweb’s estimates on Tesla conversions ahead of its Q1 earnings report on April 20th appear very strong on a year-over-year (YoY) basis. Against a backdrop of already reported Q1 deliveries, which were up 68% YoY, and up less than 1% over Q4, conversion trends look similar. Using U.S. desktop data, conversions of all models (except Cybertruck) were up 82% YoY. However, they were down 11% versus Q4. We exclude Cybertruck here due to the absurdly low $100 deposit to reserve a truck, which we do not think is indicative of real demand. Also, the timing of delivery of the Cybertruck is nebulous and continually shifting.

Part of the reason for decelerating sequential deliveries could be supply chain issues related to shutdowns in China. However, this does not explain why conversion data would decline sequentially. See the table below for Tesla conversion data by model in Q1 2022 and 2021.

However, given that Tesla’s Giga Berlin plant opened toward the end of Q1 and that Giga Texas just opened last week, Tesla has increased its ability to meet future demand and continue to scale as they add new models (Cybertruck, Semi, new Roadster, possible $25K car, etc…). Tesla has increased its ability to grow deliveries of existing models over time as well.

| Converted Visits Q1 2022 vs. 2021 | ||||

| January | 2022 | 2021 | % change | |

| Model 3 | 9605 | 6128 | 56.7% | |

| Model Y | 9821 | 4633 | 112.0% | |

| Model S | 532 | 2823 | -81.2% | |

| Model X | 1432 | 1259 | 13.7% | |

| Subtotal | 21390 | 14843 | 44.1% | |

| February | Model 3 | 7990 | 4071 | 96.3% |

| Model Y | 6995 | 3621 | 93.2% | |

| Model S | 1026 | 2689 | -61.8% | |

| Model X | 1150 | 740 | 55.4% | |

| Subtotal | 17161 | 11121 | 54.3% | |

| March | Model 3 | 18404 | 5053 | 264.2% |

| Model Y | 15493 | 5985 | 158.9% | |

| Model S | 290 | 2220 | -86.9% | |

| Model X | 1320 | 1527 | -13.6% | |

| Subtotal | 35507 | 14785 | 140.2% | |

| Q1 Total | Total | 74058 | 40749 | 81.7% |

What also stands out to us in this data is the strength of March 2022, up 107% over February. This rise in March conversions coincides with the Russia-Ukraine war and the subsequent spike in fuel prices, which could be sharply accelerating purchase decisions, helping to drive interest in Tesla Given the continuing high fuel price environment in April, this may be a good sign for Q2 conversions as well.

Despite the YoY strength in conversion, the sequential conversion rate has been faltering, down 11% in 1Q 2022 from 4Q 2021. In 4Q 2021, Tesla’s conversions totaled 83,561 versus 74,058 for Q1 2022. Looking at conversions over time, this does not seem to be a seasonal decline. However, given the spike in conversions in March 2022 and due to the likelihood that a higher fuel price environment will continue to drive interest in electric vehicles overall, and Tesla, in particular, we do not think the growth story for Tesla is currently at risk. Still, the sequential slowdown should be watched carefully, particularly if there is a moderation in gas prices.

Traffic to Tesla’s Landing Page Jumps With Fuel Prices

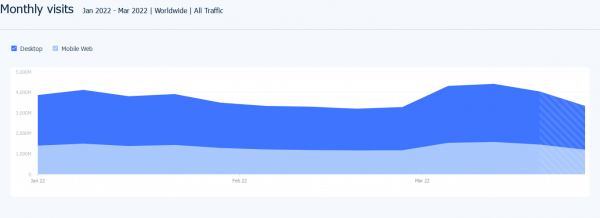

The spike in visits to Tesla’s homepage, tesla.com, has coincided with the initial spike in fuel prices. Looking at data from the U.S. Energy Information Administration, gas prices first started to spike the week of March 7, averaging $3.71 a gallon, up from $2.86 the prior week. The price increases have continued since that time, with the most recent gas prices for the week of April 4-8 averaging $3.81. We took a look at Tesla’s web traffic since March 7 on a daily basis, which was the week gas prices spiked 32%, and though it has declined somewhat since, traffic has remained above levels prior to the rise in gas prices. Assuming steady conversion rates (which is not a given), increased visits should drive higher sales over time. See the chart below on weekly web traffic for Q1 2022.

Conclusion

First-quarter conversion data looks strong for Tesla in comparison to the prior year but weakened against Q4 of last year. March 2022 looked particularly strong, rising sharply versus the prior month; the continuing inflation in gas prices could extend this trend into 2Q 2022. Tesla has already reported strong deliveries for Q1, and Similarweb data suggests that conversions will remain strong in upcoming months.

The Similarweb Insights Newsroom is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Citation:

Please refer to Similarweb as a digital intelligence platform.

Disclaimer:

All data, reports and other materials provided or made available by Similarweb are based on data obtained from third parties, including estimations and extrapolations based on such data. Similarweb shall not be responsible for the accuracy of the materials and shall have no liability for any decision by any third party based in whole or in part on the materials.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!