Carvana Troubles Evident In Web Traffic Data

Carvana lags peers. Vroom is also in trouble as the environment becomes challenging

Carvana’s stock has plunged in recent days on fears the company will fall into bankruptcy. After being a huge beneficiary of pandemic stay-at-home trends, the company has been impacted by the reversal of this trend as well as by declining demand. It seems this trend of buying cars at home has faded. Vroom is also seeing a sharp decline in monthly visitors.

Key takeaways

- Monthly traffic to carvana.com plunged 17% on a month-over-month basis in November, accelerating recent monthly declines of 4.5% in October, 5.7% in September, and 6.4% in August. Carvana has seen monthly declines for six consecutive months.

- On a year-over-year basis, November 2022 fell 30% versus November 2021 after a 10% drop in September. As an indicator of demand, it’s clear that trends are worsening.

- While most peers are seeing a decline in monthly traffic, Carvana has fared worse than the peer average. Aggregate traffic to a peer group made up of 8 companies declined 8% on both a month-over-month and year-over-year basis in November, while Carvana’s decline was much more severe. Notably, Vroom, probably the company with the business model closest to Carvana’s, is also faring poorly. November traffic to vroom.com was down 21% versus October and 58% versus November 2021.

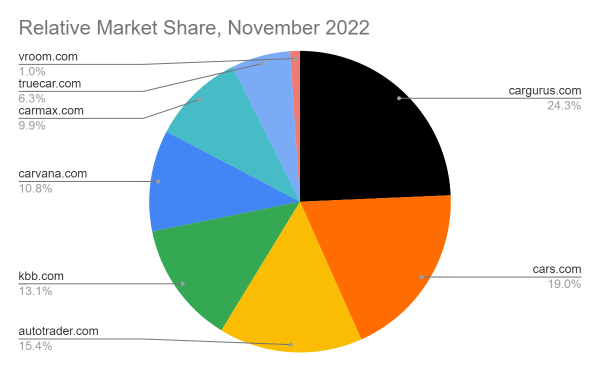

- Carvana has an 11% share of traffic among the peers we looked at in this report, with the leader being Cargurus, with a 24% share for cargurus.com, followed by cars.com with 19%. Vroom has just a 1% share of traffic in this peer group.

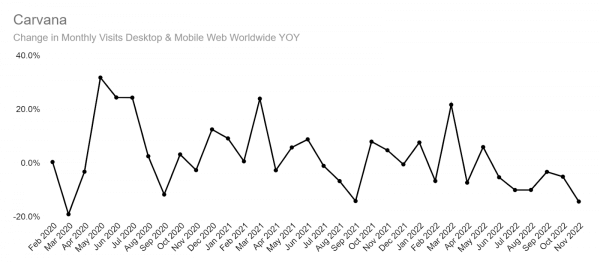

Monthly traffic for Carvana negative for six consecutive months

Taking a look at monthly growth for Carvana, you can see in the chart below that traffic growth peaked in early 2020 as the pandemic got underway, with subsequent spikes and declines in traffic in subsequent months. However, the trend has soured greatly, with negative growth in each of the past six months. November saw the decline accelerate, falling 17%, after declines of 5% in October, 6% in September, 6% in August, and 7% in July. The trendline does not look encouraging for demand, when you realize that web visits have to take place for revenue generating activity to occur.

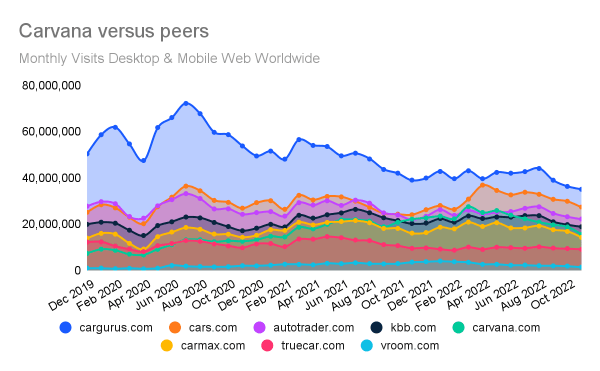

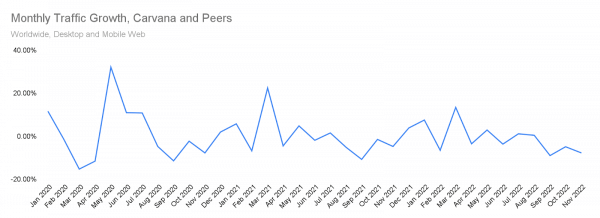

Peers seeing demand decline as well, with Vroom worst

Taking a look at monthly visits for peers, you can see that the entire industry is seeing a decline. By far the worst has been Vroom, which saw monthly traffic decline 21% in November, followed by Carvana with a 17% decline and Carmax with a 15% decline. Cargurus actually fared best in November with only a 4% decline, better than the peer average of an 8% drop.

Aggregated web traffic shows entire industry seeing slowdown

Another way to visualize the demand environment is to look at aggregated traffic to these eight car retailers over time. You can see the chart shows that the entire sector is seeing a slowdown in traffic over the past four months. Aggregated traffic to these eight companies declined 8% in November on a month-over-month basis, after falling 5% in October and 9% in September. On a year-over-year basis, web traffic fell 8% in November, 5% in October and 2% in September.

Cargurus leads the market, while Carvana is in middle of pack

A look at relative share among the eight peers in this report shows Cargurus leading with a 24% share of traffic, followed by cars.com with 19%, and Autotrader with 15%. Carvana sits in the middle of the pack with a 10% share and Vroom lags with just a 1% share of traffic.

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Disclaimer: All data, reports and other materials provided or made available by Similarweb are based on data obtained from third parties, including estimations and extrapolations based on such data. Similarweb shall not be responsible for the accuracy of the materials and shall have no liability for any decision by any third party based in whole or in part on the materials.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!