Auto Retailer Update January 2023: CarGurus leads with 41.6 million website visits, But Cars.com Growing Fastest

Similarweb’s latest look at the auto industry shows Cargurus.com led in share of traffic among car-selling peers for the month of January 2023 (based on a look at eight leading peers). In terms of web traffic growth Cars.com, for the second consecutive month, saw the most growth on a year-over-year basis (22%), with Vroom.com showing the month growth from the prior month (+49%), though the company is still suffering on a year over year basis (-44%). Carvana.com (-32% year over year) continues to suffer from declining web traffic.

Other metrics that stand out include:

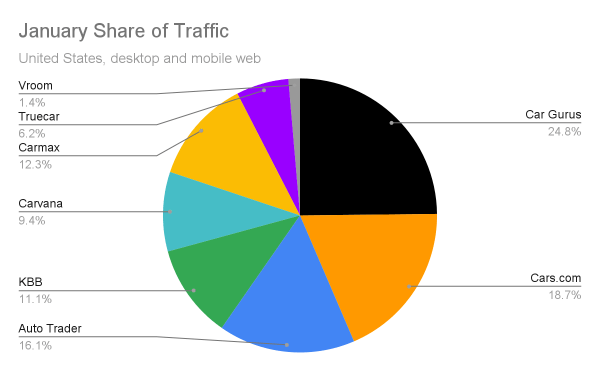

- CarGurus leads in share of traffic for the month of December with 25% of this peer group, followed by Cars.com with 19% and Auto Trader with 16%

- December was a good month across all the car retailers with the peer group we looked at up 14% over December, and up 2.5% over the prior year’s January.

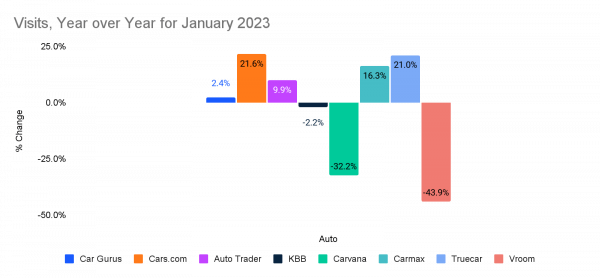

- Five or the eight peers we looked at in this report saw year-over-year growth in January. Those were Cars.com (+22%), Truecar (+21%), Carmax (+12%) Auto Trader (+10%) and Cargurus (+2%).

- Given their large drop in web traffic versus last year, unsurprisingly, Carvana lost a share of traffic among the peers in this group, but Vroom gained some share with a strong January versus December.

Year over year web traffic growth shows Cars.com performed best, Vroom, Carvana worst

We watch traffic to top auto retailers as a proxy for overall demand, as many of them sell cars directly online, and in many cases, consumers visit the websites before making in-person visits as well. The chart below shows the change in web traffic on a year-over-year basis. You can see clearly that Cars.com saw major growth while Carvana performed the worst. The peer group as a whole was up 2.5% in January versus the prior year.

Read More: Carvana Troubles Evident In Web Traffic Data

Month-over-month data shows Vroom making progress

Versus the month of December, you can see that Vroom staged a major comeback, though its share of traffic still remains very small versus peers. It grew 49% in January 2023, versus December, despite its large drop versus the prior year. It remains to be seen if this is the start of a major upswing for the company or just a blip against a terrible performance in December.

Other strong performers for the month included Carmax, Car Gurus, Auto Trader, and Cars.com. Notably, the entire group saw growth in January versus December. The peer group as a whole was up 14% in January versus December.

Share of Traffic shows CarGurus remains the leader

Of course, while momentum is important, size still matters. The below chart shows the relative market share of each company in the peer group relative to each other (share of traffic). You can see CarGurus leads with 25%, followed by Cars.com at 19%, Auto Trader at 16% and KBB at 11%. Vroom, despite showing 49% growth for the month versus December, still barely registers in this peer group with only 1.4% share.

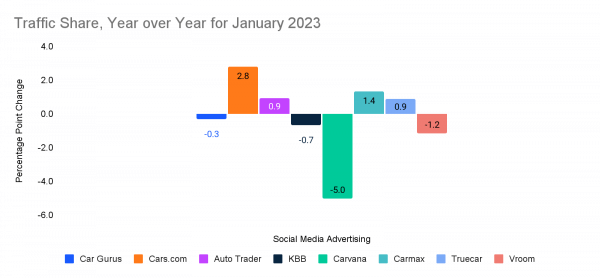

Year over year traffic share changes show Cars.com gaining share, Carvana, Vroom fading

Finally, we took a look at shifts in share of traffic year over year, and you can see that Carvana (-5.0%) and Vroom (-1.2%) performed terribly, while Cars.com (+3%) and Auto Trader (+1%) did the best.

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Disclaimer: All data, reports and other materials provided or made available by Similarweb are based on data obtained from third parties, including estimations and extrapolations based on such data. Similarweb shall not be responsible for the accuracy of the materials and shall have no liability for any decision by any third party based in whole or in part on the materials.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!