U.K. Airline Demand Remains Strong, But Weakened in November

U.K. airline web traffic is above pre-pandemic levels, but seeing seasonal decline after strong spring/summer

While Similarweb data shows a seasonal decline in U.K. airline web traffic after a red hot summer, traffic remains elevated above pre-pandemic levels, indicating healthy demand. Given this dynamic, holiday flights are likely to be crowded and expensive compared with last year.

Key takeaways

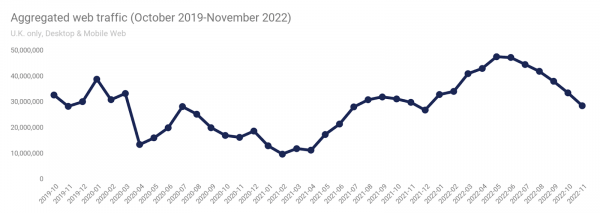

- Aggregated web traffic for seven large UK. airlines (Ryanair, EasyJet, Wizz Air, Jet2, British Airways, Virgin Atlantic and Lufthansa) fell 5% in November 2022, year over year, and was down 15% from October, in what we see as a normal seasonal decline. November traffic was up 77% over November 2020 (during pandemic), and was up 1% over November 2019 (pre-pandemic).

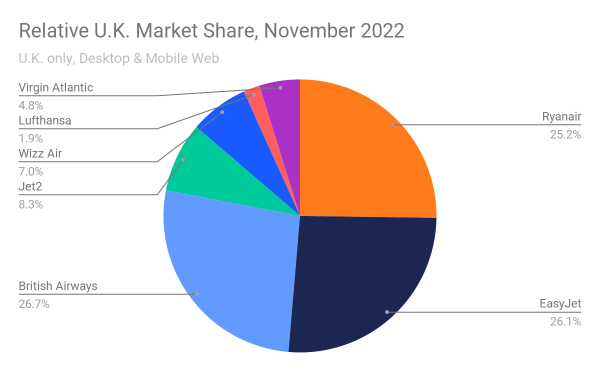

- British Airways led the industry in web traffic in November 2022, with 7.6 million web visitors on desktop and mobile web in November 2022, representing a 27% share of traffic among the seven airlines. Easyjet (7.4 million or 26% share) and Ryanair (7.1 million, or 25%) are second and third place, respectively, in terms of web traffic while Jet2 is in fourth place with 2.4 million visitors (8%).

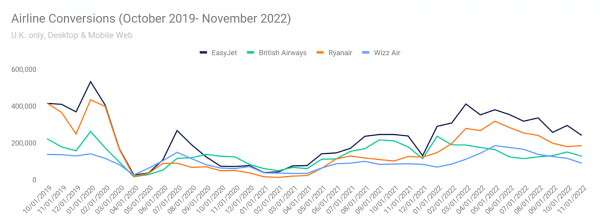

- Similarweb data on airline conversions (percentage of web visits that end up in a sale) suggests healthy demand, with October 2022 conversions up 15% over October 2021.

Aggregated traffic for seven large U.K. airlines suggests demand strength with normal seasonality returning

Taking a look at aggregated web traffic to seven of the largest U.K. airlines landing pages, shows that while airlines are seeing a seasonal decline in web traffic after a red hot summer, overall fall web traffic remains elevated over similar periods in prior years, including pre-pandemic.

The airlines used in the below chart include EasyJet, Ryanair, British Airways, Wizz Air, Jet2, Lufthansa and Virgin Atlantic. While the chart is trending downward, this is normal seasonality after a very strong summer. The industry saw similar dips in web traffic in each of the past three years as well. Overall, this chart is indicative of still-solid demand for the holidays.

British Airways leads the pack in web traffic, followed by Easyjet and Ryanair

In terms of U.K. airline market share, British Airways was the leader in November 2022, based on web traffic. British Airways had 7.6 million web visitors on desktop and mobile web in November 2022, representing a 27% share of traffic among the seven airlines. Easyjet had 7.4 million visits for a 26% share and Ryanair had7.1 million for a 25% share. Jet2 is in fourth place with 2.4 million visitors (8%).

You can see the relative market shares, based on web traffic, in the chart below:

U.K. Airline conversions still below 2019, but above past two years

Similarweb data on airline conversions (visits to an airline website that lead to a sale) were still well below pre-pandemic levels in November 2022, but have shown significant improvement over the past two years.

November 2022 conversions in aggregate (Similarweb has conversion data for Easyjet, Ryanair, British Airways and Wizz Air) were 4% higher than November 2021, and were up 113% over November 2020. However, conversions still lagged November 2019 by 41%, a sign of how far the U.K. air travel industry has to go to fully recover from the pandemic. Airline conversions are a leading indicator of future travel, so with conversions higher than the past two years, you would expect flights to be fuller and more expensive versus the past two holiday travel seasons.

In terms of the individual airlines, EasyJet is in the lead with 239k converted visits in November 2022, followed by Ryanair (184k) British Airways (127k) and Wizz Air (88k).

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Disclaimer: All data, reports and other materials provided or made available by Similarweb are based on data obtained from third parties, including estimations and extrapolations based on such data. Similarweb shall not be responsible for the accuracy of the materials and shall have no liability for any decision by any third party based in whole or in part on the materials.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!