U.S. Airline Web Traffic Declined 2% in April, Second Consecutive Month of Declines

Visits to airline websites are slowing, a sign that a dip in demand might be on the horizon. Among major airlines, Delta and United saw April growth, while American and Southwest saw their web traffic decline. Frontier posted 27% web traffic growth.

Key takeaways

- Aggregated web traffic to the ten largest US airlines declined 2% in April, based on Similarweb estimates of traffic from within the US. April’s decline followed a 3% drop in March. Prior to that, the year started out strong, with a 9% rise in Feb. and a 25% rise in January.

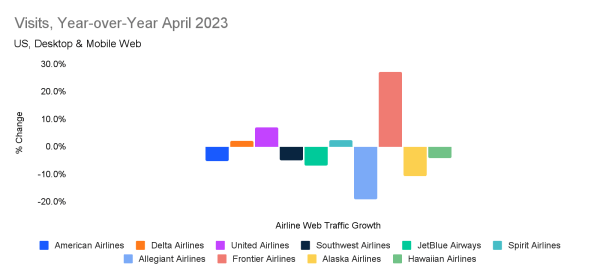

- Six of the ten largest US airlines saw web traffic declines in April, with the largest decline at Allegiant, which saw a 19% drop, followed by Alaska (-10%), JetBlue (-7%), American (-5%), Southwest (-5%) and Hawaiian (-4%). Among gainers, Frontier recorded 27% growth, Delta saw a 7% rise in visitors, while United and Spirit both saw a 2% rise in visitors.

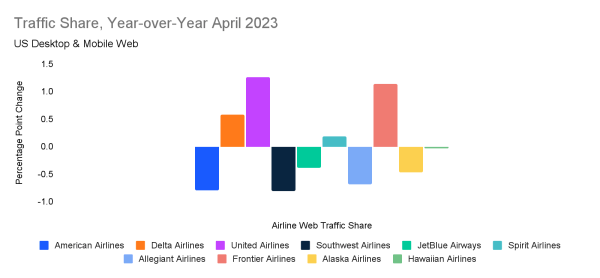

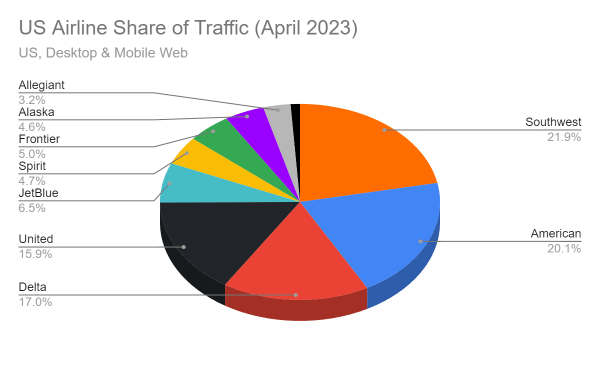

- Southwest still leads in share of traffic with 22% share, followed by American at 20%, Delta at 17%, and United at 16%. United gained 126 basis points of market share over peers in April, and Delta gained 58 basis points, while Southwest lost 81 basis points of traffic and American dropped 79 basis points.

Similarweb’s monthly market share report shows changes in web traffic and share of traffic among ten U.S. airlines.

April US Airline web traffic was down for a second consecutive month

A look at Similarweb data on website traffic for the month of April to the ten largest U.S. airlines shows that after the year got off to a strong start in January with 25% growth, year-over-year, and February saw 9% growth, March saw a decline of 3%, and April declined 2%. These could be signs of slowing demand.

Six of ten peers saw year-over-year traffic declines in April, with the worst being Allegiantair.com, which saw a 19% drop, followed by Alaska (-10%), JetBlue (-7%), American (-5%), Southwest (-5%) and Hawaiian (-4%). Among gainers, Frontier led the pack by a mile, with 27% growth, followed by Delta, which saw a 7% rise in visitors, while United and Spirit both saw a 2% rise in visitors.

United, Delta gained market share at the expense of American and Southwest

Using web traffic as a proxy for market share, you can see that United and Delta both gained share in the month of April, with United up 1.3% and Delta rising by 0.6%, while Southwest 0.8% versus the group and American lost 79 basis points of share. You can see relative changes in the chart below. Frontier, which saw the best web traffic growth, gained 1.1% of share in the peer group.

Southwest leads US carriers in share of traffic, followed by American

Southwest Airlines remains the largest US airline in terms of share of web traffic, with a 22% share among the ten peers we looked at in this report. American was second, at 20%, followed by Delta (17%) and United (16%). There was a large lag between these four major airlines and the next largest peer, JetBlue with a 7% share of traffic, followed by Spirit (5%) Frontier (5%), Alaska (5%), Allegiant (3%), and Hawaiian (1%). Due to rounding, this adds up to slightly above 100%.

Publicly traded companies including in this report include American Airlines Group (NASDAQ:AAL), Alaska Air Group (NYSE: ALK), Allegiant Travel Company (NASDAQ:ALGT), Delta Air Lines (NYSE:DAL), Frontier Group Holdings (NASDAQ:ULCC), Hawaiian Holdings (NASDAQ:HA), JetBlue Airways Corp. (NASDAQ:JBLU), Southwest Airlines (NASDAQ:LUV), Spirit Airlines (NASDAQ:SAVE) and United AIrlines Holdings (NASDAQ:UAL).

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Contact: For more information, please write to press@similarweb.com.

Report By: Jim Corridore, Senior Insights Manager

Disclaimer: All names, brands, trademarks, and registered trademarks are the property of their respective owners. The data, reports, and other materials provided or made available by Similarweb consist of or include estimated metrics and digital insights generated by Similarweb using its proprietary algorithms, based on information collected by Similarweb from multiple sources using its advanced data methodologies. Similarweb shall not be responsible for the accuracy of such data, reports, and materials and shall have no liability for any decision by any third party based in whole or in part on such data, reports, and materials.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!