Airline Holiday Travel Demand Looks Healthy

U.S. airline web traffic has returned to pre-pandemic levels

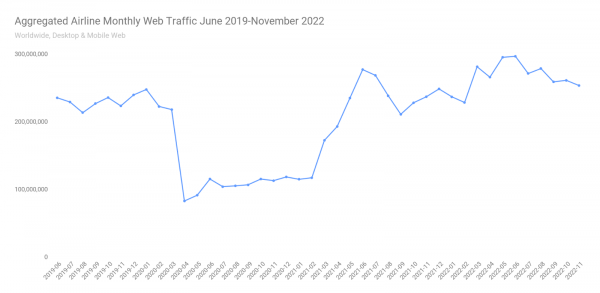

While Similarweb data shows a seasonal decline in U.S. airline web traffic after a red-hot summer, traffic remains elevated above pre-pandemic levels, indicating a healthy demand environment. Given this dynamic amid a continued shortage of planes, pilots and other key staff, holiday flights are likely to be crowded and expensive compared with last year.

Key takeaways

- Aggregated web traffic for the nine largest U.S. airlines rose 7% in November 2022, year over year, but declined 3% from October. November traffic was up 110% over November 2020 (during the pandemic), and was flat compared with 2019 (pre-pandemic).

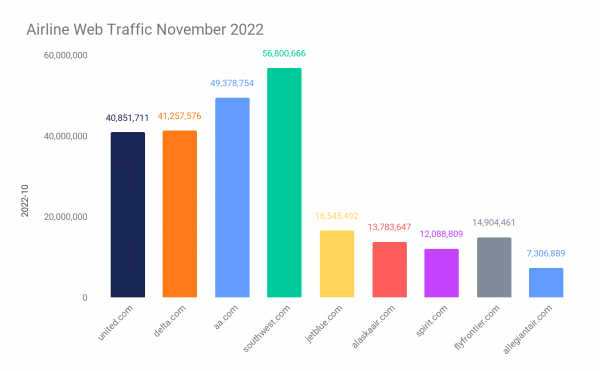

- Southwest Airlines leads the industry in web traffic, with 57 million web visitors on desktop and mobile web in November 2022, followed by American (49 million), Delta (41.3 million), and United (40.9 million).

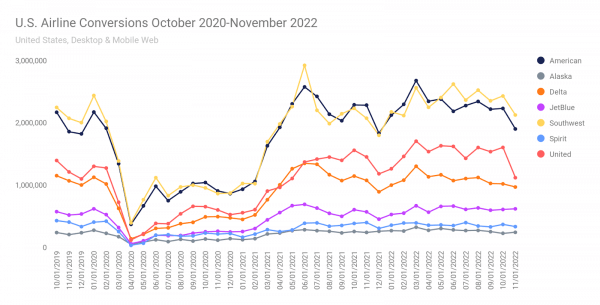

- Similarweb data on airline conversions (percentage of web visits that end up in a sale) suggests healthy demand, with November 2022 conversions flat with November 2019.

Aggregated traffic for top nine U.S. airlines suggests demand strength

Taking a look at aggregated web traffic to the nine largest U.S. airlines landing pages, shows that while airlines are seeing a seasonal decline in web traffic after a red-hot summer, overall fall web traffic remains elevated over similar periods in prior years, including pre-pandemic.

Southwest leads the pack in web traffic, followed by American

In terms of U.S. airline market share, Southwest is the leader in the space, based on web traffic. In November 2022, Southwest had 57 million visitors to its website on desktop and mobile web, followed by American (49 million), Delta (41.3 million), and United (40.9 million).

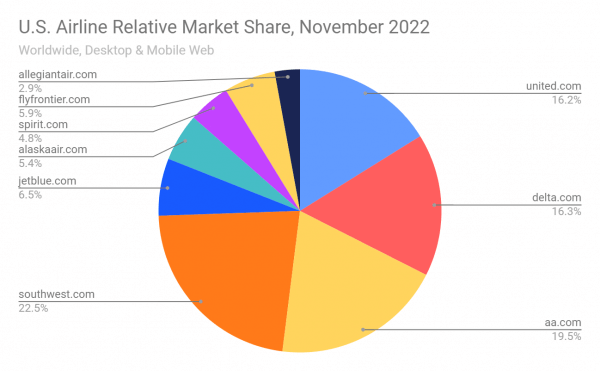

As a percentage of the group, Southwest made up 22% of the nine largest U.S. airlines’ web traffic in November 2022, followed by American 19%, Delta (16%), and United (16%). JetBlue was in fifth place with 5.5% of the top nine airlines, and if you add in Spirit (which they recently purchased), they had a roughly 11% market share.

U.S. Airline conversions dipped in November, but flat with 2019, a good sign for air travel demand

Similarweb data on airline conversions (visits to an airline website that lead to a sale) are back to pre-pandemic levels, which is indicative of healthy demand. November 2022 conversions in aggregate were flat with November 2019, and up over 2020 (+111%), but declined 10% from November 2021. Airline conversions are a leading indicator of future travel, so with conversions higher than 2019 against a backdrop of constrained capacity due to plane and pilot shortages, among other key staff, you would expect flights to be full and expensive versus the past few years.

In terms of the individual airlines, conversions are generally following market share, with Southwest in the lead with 2.1 million converted visits in November 2022, followed by American (1.9 million), United (1.1 million) and Delta (967k).

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Disclaimer: All data, reports and other materials provided or made available by Similarweb are based on data obtained from third parties, including estimations and extrapolations based on such data. Similarweb shall not be responsible for the accuracy of the materials and shall have no liability for any decision by any third party based in whole or in part on the materials.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!