Twitter Ad Buying Traffic Down 21.7% as News of 59% Revenue Loss Leaks

Meanwhile, Snapchat shows increased advertiser interest, with ad portal traffic up 153.6%

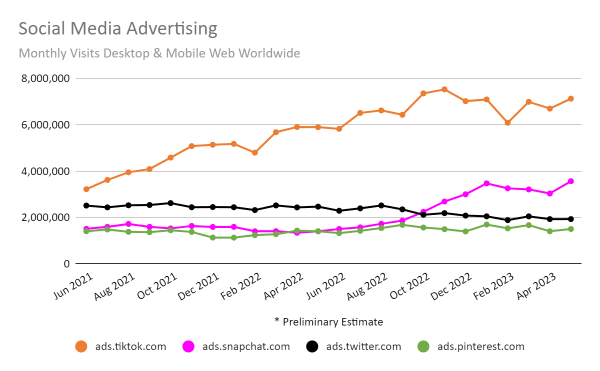

Traffic to Twitter’s ad sales portal has been declining for months, according to Similarweb data, even as Twitter CEO Elon Musk has claimed advertisers are returning to the platform. On Monday, the New York Times reported an internal company presentation shows ad revenue was down 59%, year-over-year, for the five weeks starting April 1.

In May, Twitter ad portal traffic was down 21.7%, year-over-year, based on a preliminary Similarweb estimate. Overall traffic to twitter.com has been down every month since January, by as much as 7.3% year-over-year in March. In May, traffic was down 6.7%. Regaining the interest of consumers and advertisers is about to become the central challenge facing Linda Yaccarino, the NBCUniversal executive whom Musk named as his successor, who is officially starting on the job this week.

Twitter’s online ad portal isn’t the only possible way for ad revenue to flow into the company – big advertisers might close deals with a sales representative – but the New York Times report shows the revenue decline has been even worse than what we could infer from the traffic numbers.

Meanwhile, Snapchat seems to be gaining some of the interest Twitter has lost.

Key takeaways

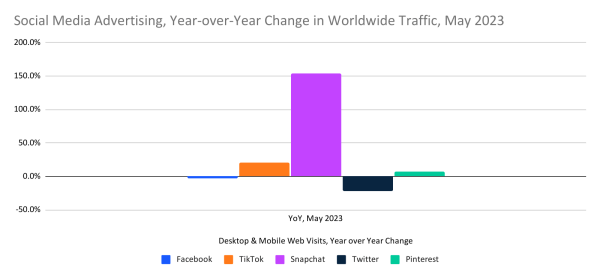

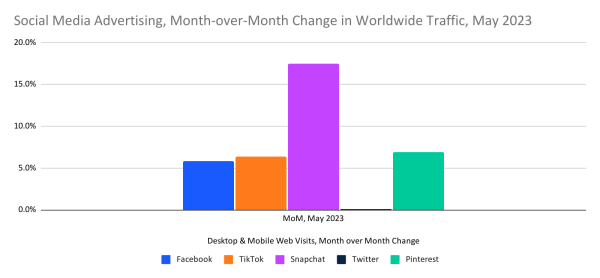

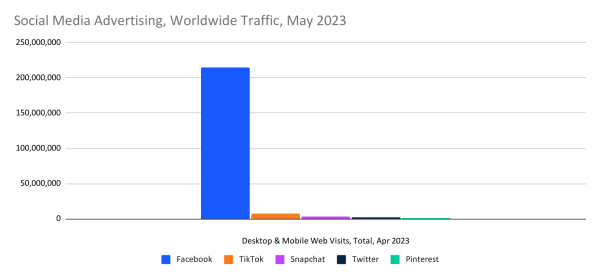

- Twitter’s ads portal, ads.twitter.com, is the primary gateway for its ad-selling business, and May’s traffic dropped to 1.9 million visits, compared with 2.5 million a year ago, a 21.7% drop. Traffic was basically unchanged from April to May.

- Traffic to the business.facebook.com business portal, which also serves Meta Platforms products like Instagram, was down 3.2% year-over-year. Although that portal is used for purposes other than advertising, it reflects overall business engagement with Meta.

- Other social media platforms showed gains in ad-buying traffic, which was up 153.6% for Snapchat, 20.8% for TikTok, and 6.9% for Pinterest.

Twitter is the farthest underwater as Snapchat rises

Here are the ups and downs for the social media advertising platforms on a year-over-year basis …

… and month-over-month, where Twitter is flat while others posted gains.

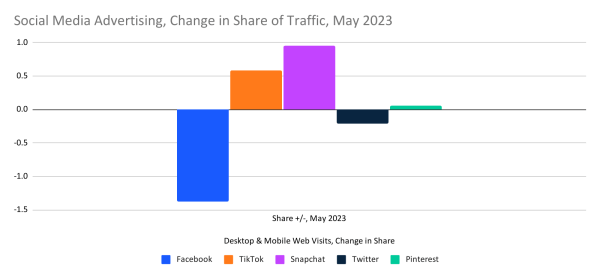

Facebook is the biggest loser by share of traffic

Within this competitive set, Facebook gave up 1.3 percentage points of share of traffic, and Twitter also lost a fraction of a point. Snapchat gained a full point.

These incremental changes still leave Facebook with the lion’s share of traffic from potential ad buyers, with both TikTok and Snapchat out ahead of Twitter.

Before Elon Musk took over at Twitter, Twitter and Snapchat were neck-and-neck for ad-buying traffic, but in late 2022 Snapchat pulled ahead. Snapchat parent company Snap hasn’t necessarily translated that traffic into strong business results yet, presumably meaning not enough visitors are buying ads at favorable prices.

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Contact: For more information, please write to press@similarweb.com.

Report By: David F. Carr, Senior Insights Manager

Disclaimer: All names, brands, trademarks, and registered trademarks are the property of their respective owners. The data, reports, and other materials provided or made available by Similarweb consist of or include estimated metrics and digital insights generated by Similarweb using its proprietary algorithms, based on information collected by Similarweb from multiple sources using its advanced data methodologies. Similarweb shall not be responsible for the accuracy of such data, reports, and materials and shall have no liability for any decision by any third party based in whole or in part on such data, reports, and materials.

Image: “frantic Twitter bird dropping money all over the floor,” Bing Image Creator