ChatGPT Traffic Declines for Second Month. Will Back-To-School Make It Surge Again?

In June and July, ChatGPT traffic dropped by nearly 10%. School being out for summer could be one reason – just ask Chegg.

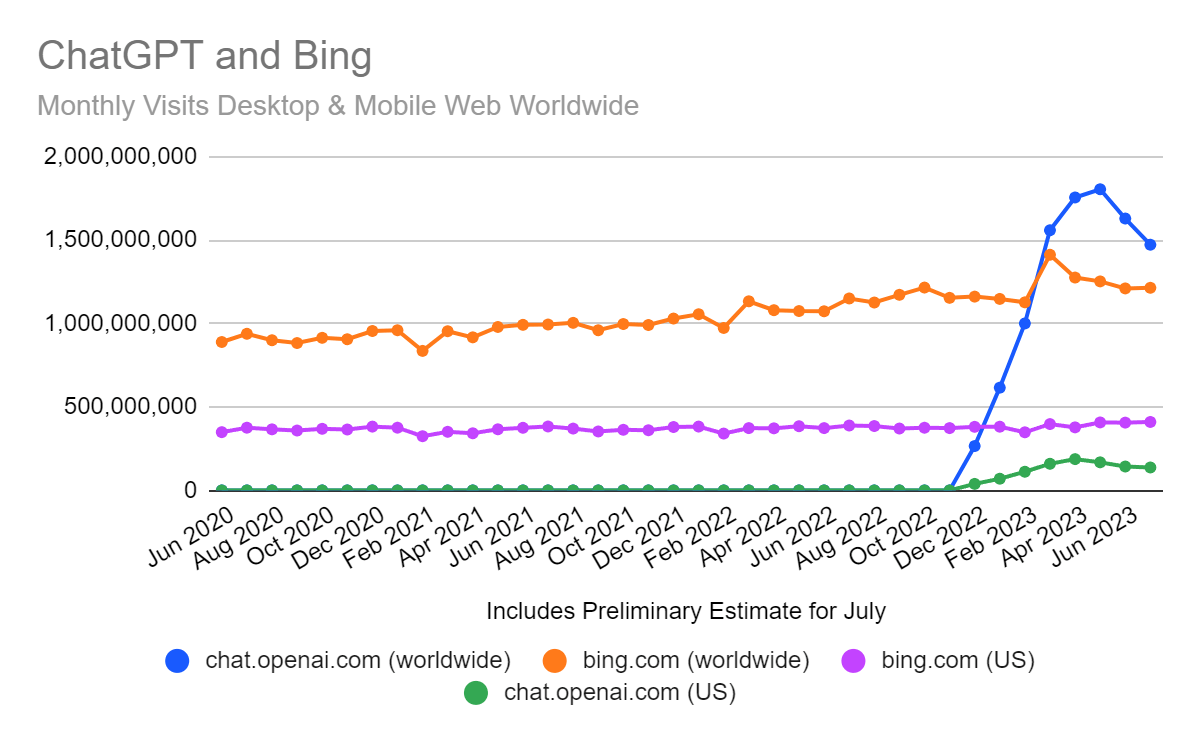

The decline in traffic to ChatGPT now looks like a sustained trend, given that June’s 9.7% drop was followed by a 9.6% decline in July, according to Similarweb estimates.

What we don’t know for certain is whether this will be revealed as a recurring seasonal “school’s out” dip in traffic – which is one theory about why visits to OpenAI’s chatbot oracle might be down. After all, EdTech specialist Chegg, recently acknowledged that the trend toward students using ChatGPT instead of its services for homework help was hurting its business.

US traffic to chegg.com was down 28.3% month-over-month in June. However, some of that could be written off as a normal seasonal variation in the wake of college finals and graduations. The year-over-year decline was a more modest 3.9%. We can’t yet offer year-over-year comparisons for ChatGPT’s website at chat.openai.com, which only launched in November 2022.

Key takeaways

- Worldwide traffic to chat.openai.com dropped 9.7% in June and 9.6% in July. In the US, ChatGPT traffic dropped 15% in June and another 4% in July.

- Chegg has been seeing web traffic to its site drop, but it’s not necessarily clear that ChatGPT is the cause. For example, traffic to chegg.com was down 16.8% year-over-year in May 2023, when college students would be expected to have been looking for help cramming for finals – but it was also down 19.1% in May 2022, months before the introduction of ChatGPT.

- College-age individuals make up more than a quarter of the adult audience for ChatGPT (28.6% in the US and 27% worldwide).

- By worldwide traffic, ChatGPT is still bigger than the Bing search engine (1.47 million visits in July for chat.openai.com to 1.2 million for bing.com), but the margin is falling. Some AI chat enthusiasts may be using Bing Chat, which is powered by the same OpenAI algorithms.

A worldwide traffic dip for ChatGPT

ChatGPT came out of nowhere late last year to become one of the world’s most-trafficked digital properties, but for now, its peak has passed. The chart below shows it in comparison with Microsoft’s Bing search engine. From the perspective of US web traffic, ChatGPT’s rise was never quite as dramatic but the decline is similar.

A big college-age demographic

More than one quarter of ChatGPT’s audience falls into the 18-24 age bracket in Similarweb’s website demographics model (which does not include children under 18). The chart below is for the US, but the worldwide numbers are similar.

The downturn for Chegg and competitors didn’t start with ChatGPT

Chegg may well be feeling the pain of competition with ChatGPT, but the traffic numbers seem to show that digital demand for Chegg and close rival Course Hero has been trending down since early 2022, before the arrival of OpenAI’s chatbot.

Chegg may have its own play in AI

Whether ChatGPT is the cause of Chegg’s woes or that’s just a “generative AI ate my homework” excuse is something the public company (NASDAQ: CHGG) will have to explain at its upcoming earnings call on August 7.

Chegg has not ignored the AI threat (and opportunity) and wants to put generative AI technology to work within its own products. Back in April, it announced the CheggMate AI assistant, built with OpenAI’s most advanced GPT-4 model. As generative AI transitions from novelty to essential ingredient, technology from OpenAI and competitors will be incorporated into more industry-specific and audience-specific products (including Similarweb’s own SimilarAsk AI assistant). OpenAI, which is not public but has a tight partnership with Microsoft, may profit as much or more from those opportunities as from direct traffic to ChatGPT.

Meanwhile, we’ll be watching to see if ChatGPT traffic comes rushing back when schools reopen in the coming months.

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Contact: For more information, please write to press@similarweb.com.

Disclaimer: All names, brands, trademarks, and registered trademarks are the property of their respective owners. The data, reports, and other materials provided or made available by Similarweb consist of or include estimated metrics and digital insights generated by Similarweb using its proprietary algorithms, based on information collected by Similarweb from multiple sources using its advanced data methodologies. Similarweb shall not be responsible for the accuracy of such data, reports, and materials and shall have no liability for any decision by any third party based in whole or in part on such data, reports, and materials.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!