U.S. Airlines See Decelerating Web Traffic Heading into Fall

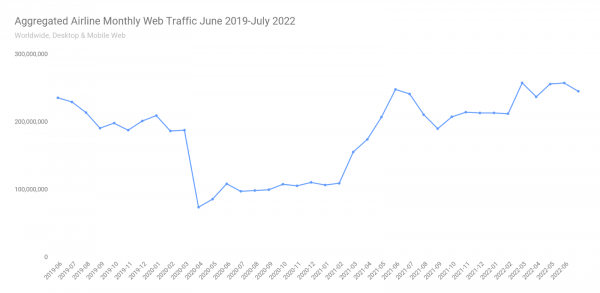

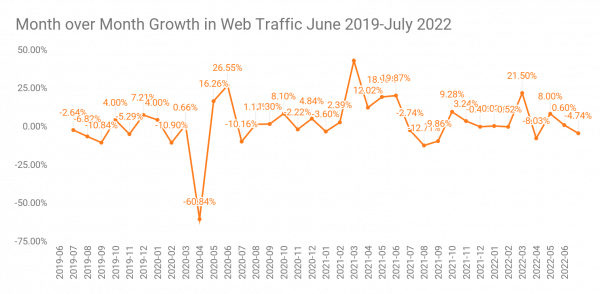

Traffic to leading U.S. airline websites has recovered from pre-pandemic levels, with growth soaring since the pandemic trough which occurred in April 2020. However, the pace of growth slowed sharply in June and July. While demand remains sharply above pandemic levels, falling traffic could be a warning for the fall travel season.

Key takeaways

- Web traffic for the nine largest U.S. airlines for the month of July 2022 was 7.0% higher than experienced in July 2019 (pre-pandemic), showing the recovery from COVID lows.

- However, recent web traffic growth has weakened, with July down 4.7% from June 2022, after June was only 0.6% higher than May.

- July was 1.7% higher year over year, with June up 3.8%, May up 24%, and April up 36%, highlighting how momentum has slowed. One notable exception is United Airlines, which saw July traffic rise 18% from the prior year.

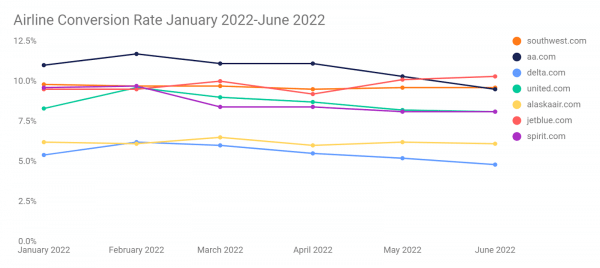

- Airline conversion rates (the percentage of website visits that leads to revenue-generating activity) declined for most U.S. airlines in June 2022, which could be a sign of weakening demand ahead

Airline web traffic highlights post-pandemic recovery, with deceleration heading into the fall

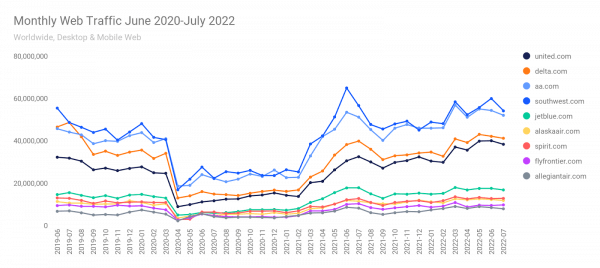

As a proxy for air travel demand, airline web traffic is a good leading indicator. The overwhelming majority of airline reservations are made online. For this reason, airline web traffic portends future air travel. For the nine largest U.S. airlines (American, Delta, United, Southwest, Jetblue, Alaska, Spirit, Frontier, Allegiant), from the pandemic low in April 2020, July 2022 monthly web traffic was 233% higher.

Web Traffic highlights the recovery from COVID

Aggregated web traffic for these nine airlines for the month of July 2022 was 7.0% higher than experienced in July 2019. This shows that demand is now above pre-pandemic levels. However, recent web traffic growth has weakened. July 2022 was down 4.7% from June 2022. This comes after June was only 0.6% higher than May 2022.

Looking at year-over-year comparisons, July 2022 was 1.7% higher than July 2021, after 3.8% year-over-year growth in June, a 24% increase in May, and 36% growth in April. This highlights how sharply momentum has slowed. This may be a warning sign for travel demand into the fall.

July 2022 web traffic continued to decelerate, except for United

A look at web traffic in July 2022 showed a continued deceleration in traffic trends, except for United Airlines. United.com saw traffic rise 18% from the prior year, delta.com was off 3.4%, aa.com down 1.7%, southwest.com was down 4.5% and jetblue.com fell 5.8%. The nine largest carriers aggregated web traffic was up 1.7%, but if you took United out of the calculations, the rest of the industry was down about 1%. The table below shows year-over-year changes in web traffic for the nine largest U.S. airlines.

| July 2021 | July 2022 | % Change | |

| United | 32.43 | 38.31 | 18.1% |

| Delta | 39.82 | 41.16 | 3.4% |

| American | 51.11 | 51.97 | 1.7% |

| Southwest | 56.59 | 54.07 | -4.5% |

| JetBlue | 17.81 | 16.78 | -5.8% |

| Spirit | 12.74 | 12.78 | 0.3% |

| Alaska | 11.46 | 11.81 | 3.1% |

| Allegiant | 8.2 | 7.89 | -3.8% |

| Frontier | 10.3 | 9.73 | -5.5% |

| Total | 240.46 | 244.5 | 1.7% |

Airline conversion rates declined in June from May

A look at conversion rate (the percentage of website visits that lead to a paid transaction, a good proxy for bookings), shows that from May to June 2022, the conversion rate declined for most U.S. airlines. This could be a sign that consumers are becoming warier to make purchases and book travel due to the general economy, the market downturn, and high inflation, plus sharply higher airfares in general.

While the conversion rate has not yet moved sharply lower, the decline from May to June could be an early indication that demand may be weakening somewhat. For example, American Airlines’ conversion rate in June was 9.5%, down from 10.3% in May, while Delta’s was 4.8% down from 5.2%.

Conclusion

While U.S. airline demand has clearly recovered from the deep decline that occurred during the pandemic, heading into the fall there are some signs of concern. Decelerating website traffic and a decrease in conversion rates could mean airlines will see weaker demand this fall.

The Similarweb Communications and Insights Team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Disclaimer: All data, reports and other materials provided or made available by Similarweb are based on data obtained from third parties, including estimations and extrapolations based on such data. Similarweb shall not be responsible for the accuracy of the materials and shall have no liability for any decision by any third party based in whole or in part on the materials.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!