Nike Digital DTC vs Wholesale – Finding the Omnichannel Balance

Nike saw a 5.8% decline in digital DTC purchasing traffic for Q4 while wholesale traffic also declined

In 2020, Nike announced the Consumer Direct Acceleration strategy, which focused on direct, digital sales, building on the previous Consumer Direct Offense strategy from 2017. With the COVID-19 pandemic functioning as a catalyst, Nike’s shift to DTC sales accelerated, and the company began employing a combination of scaling back wholesale partnerships while expanding direct channels like the Nike website and Nike app. However, with pandemic eCommerce tailwinds slowing down and market dynamics changing, Nike has had to re-evaluate its distribution strategy and move towards a better balance between DTC and wholesale.

Key takeaways

- Nike’s digital conversion traffic decreased by 5.8% in the fourth quarter of FY 2023 compared to Q4 FY 2022

- In May 2023, while Nike held 42.5% digital market share, the largest amongst the top 10 sports apparel brands, its share declined 6.2% compared to the previous year

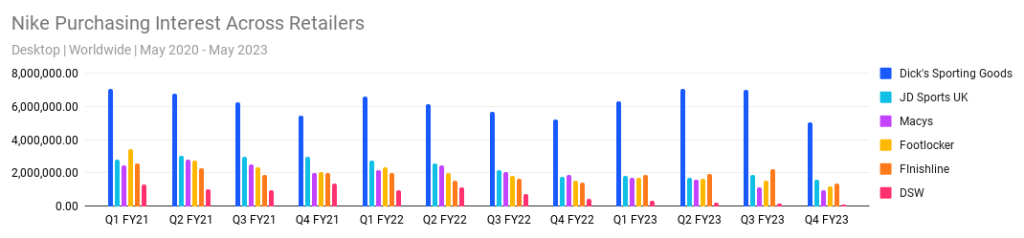

- Nike traffic to the Dick’s Sporting Goods website decreased by 3.4% in Q4 FY23 compared to Q4 FY22, while its UK retailer JD Sports UK was down 11.7%.

- Macy’s Nike traffic was down 51% Q4 FY23 and Footlocker’s Nike traffic decreased 21% Q4 FY23 compared to the previous year.

Digital Direct-to-Consumer Sales Decelerate

Nike’s digital conversion traffic decreased by 5.8% in the fourth quarter of FY 2023 compared to Q4 FY 2022. Conversion traffic declined 4.4% in March, 5.1% in April, and 7.6% in May respectively. This comes after a highly successful holiday sales quarter showcased by the company’s 27.5% year-over-year growth in purchasing traffic Q3 FY 23.

* Data does not include purchasing traffic from China

This drop in digital sales could be attributed to weaker demand as consumers cope with tighter wallets in a tough macroeconomic environment. While Nike had offered higher markdowns amid cost pressures, decreased discretionary spending may have impacted both DTC and wholesale channel growth.

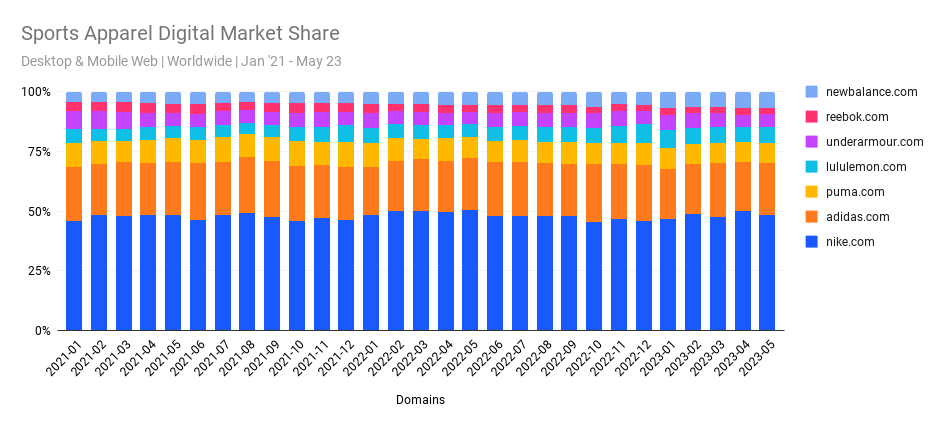

DTC Competition Has A Long Way To Go

While Nike’s key DTC competitors seem to have gradually decreased the company’s market share – a few points lower – the company’s dominance is not yet in serious danger. As of May 2023, Nike held 42.5% digital market share leading the industry when compared to top 10 sports apparel players like Adidas, Puma, Lululemon, etc.

Taking a look at other key players – adidas.com comes in second with a 19.2% digital market share, followed by puma.com at 7.4%, lululemon.com at 5.8%, and underarmour.com at 4.74%.

Slowly but surely, Nike’s DTC competitors are gaining on the footwear giant. In May 2023, Nike’s market share was down 6.2% compared to the previous year, while newbalance.com was up 19.3% – a testament to its renewed popularity in the cultural zeitgeist.

Nike’s Wholesale Strategy

Across the board, Nike’s wholesale retailers have seen year-over decelerations and a decline in growth this past quarter. Some can be attributed to curtailed product offerings after 2021, where companies like Macy’s, Zappos, Footlocker, Designer Brands, and Urban Outfitters began receiving fewer Nike products. However, Nike’s strongest partnerships have also been impacted.

Nike web traffic to the Dick’s Sporting Goods website decreased by 3.4% in Q4 FY23 compared to Q4 FY22, while its UK retailer JD Sports UK was down 11.7%. Retailers, where Nike scaled back its offerings, have also seen quarterly declines. Macy’s Nike traffic was down 51% Q4 FY23 and Footlocker’s Nike traffic decreased 21% Q4 FY23 compared to the previous year.

In recent years, Nike has been cutting down on its wholesale accounts as part of its strategy to prioritize DTC sales. By the end of 2021, the company had dropped about 50% of its retail partnerships. Nike’s strategic and selective return to wholesale partnerships comes ahead of the holiday season and amidst the company’s inventory issues.

Reinvesting in Wholesale – Strategic Omnichannel & Nike’s Negotiating Power

After Nike’s withdrawals from wholesale retailers, its competitors stepped in to bridge the gap. For example, Reebok expanded its product line at Macy’s, while Adidas further developed its Foot Locker partnership.

Despite Nike’s fallback and Adidas’s expansions, Nike’s digital demand on Foot Locker’s website remains significantly higher than its rival’s. Nike traffic on Footlocker was nearly 4x Adidas’s traffic this May 2023.

When Nike’s pulled back from DSW in 2021, Adidas took over Nike’s spot after expanding its deal with DSW. However, by the second half of 2022, Adidas traffic on DSW’s website has seen significant year-over-year declines – most recently, in May 2023 their traffic was down 23.6% compared to last year, while April also saw a 24.4% decline – highlighting declines in consumer interest.

Over the past few months, DSW and Macy’s announced the renewal of their wholesale partnerships with Nike in a surprising turn of events. Macy’s will offer an expanded collection of apparel and accessories while continuing to sell Nike footwear via Finishline and DSW will sell a variety of Nike products across physical and digital channels starting October 2023.

Nike’s recent reinvestment in wholesale distribution indicates a strategic omnichannel approach for the future. The company has likely learned from its 2022 reset year and better understands where it needs wholesale distribution and where it does not. Nike can now renew and renegotiate partnerships from a position of enhanced strength, while retailers like DSW and Macy’s are keen to reinstate their association with the footwear giant.

By leveraging the pandemic, Nike has reaffirmed its reputation as an omnichannel titan. It recognizes that strong distribution is becoming more critical as the consumer economy tightens and excess inventory issues pile up. Rebuilding relationships with wholesale partners like DSW, Foot Locker, and Macy’s helps Nike clear excess inventory faster, strengthen its market presence, and capture a broader customer base across various channels.

Omnichannel Future

Nike’s decision to pull back from partnerships with retailers in 2021, including Urban Outfitters and Dillard’s, was seen as a commitment to a direct-to-consumer sales approach. However, this maneuver stood out as Nike’s competitors continued to focus on both DTC and wholesale strategies. The move may have led to some customer attrition, underestimating the stickiness of multi-brand demand. Moving forward, it looks like Nike’s leadership is recognizing the importance of offering consumers the option to shop in the multi-brand channel while still driving DTC growth.

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Contact: For more information, please write to press@similarweb.com.

Disclaimer: All names, brands, trademarks, and registered trademarks are the property of their respective owners. The data, reports, and other materials provided or made available by Similarweb consist of or include estimated metrics and digital insights generated by Similarweb using its proprietary algorithms, based on information collected by Similarweb from multiple sources using its advanced data methodologies. Similarweb shall not be responsible for the accuracy of such data, reports, and materials and shall have no liability for any decision by any third party based in whole or in part on such data, reports, and materials.

The ultimate edge in marketplace intelligence

Put the full picture at your fingertips to drive product views and sales