25 Fastest-Growing Activewear Brands – Who’s Sprinting Ahead?

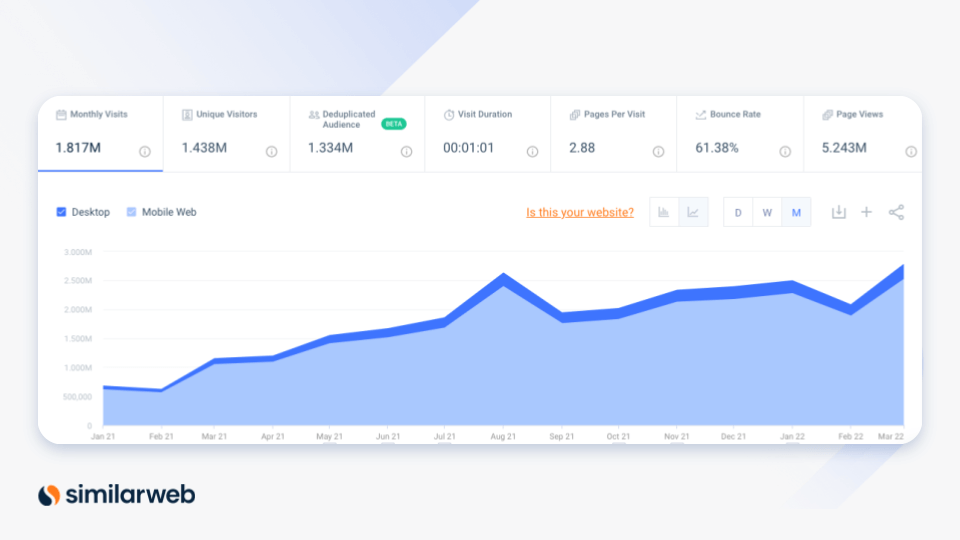

With a worldwide focus on achieving a healthier lifestyle, shopper behavior trends continue to reflect this growing preference. We pulled data from Research Intelligence, one of our eCommerce solutions, to identify the fastest-growing activewear brands by website visits in Q1 2022. We dove into the consumer trends fueling that growth in the U.S., and the winning strategies from the top brands.

Top 25 fastest-growing activewear brands of Q1 2022

- Kicks Crew

- Oofos

- JD Sports

- Fight Club

- 32 Degrees

- Vivobarefoot

- New Balance

- Kicks on Fire

- Fjӓllrӓven

- Alphalete Athletics

- DTLR

- S&S Activewear

- Sneaker Shouts

- WSS

- SwimOutlet

- Saucony

- Snipes

- Shiekh

- Dansko

- 686

- Red Wing Shoes

- Puma

- Augusta Sportswear

- Lululemon

- Sports Direct

For more information about each of these growing activewear brands – download the report.

Here’s a quick summary of the three main trends we found:

1. New year, new kicks

This quarter interest peaked for athletic shoe brands as streetwear amongst consumers. KicksCrew, a global eCommerce platform for sneakers and apparel, is the fastest-growing activewear brand. Traffic to kickscrew.com increased by an impressive 202% year-over-year (YoY).

In January 2022, kickscrew.com had 2.5 million visitors, which was approximately a 115% increase in traffic than the January prior (670,126).

Other athletic brands that focus on streetwear-style sneakers also made the top 25, including Fight Club, ranked fourth, and Kicks on Fire, ranked eighth. Traffic to these sites grew 51% and 44% respectively.

Marketing channels

Athletic shoe brands demonstrated a similar pattern with top marketing channels, winning traffic almost solely from direct, organic, and paid search.

When comparing Fight Club and Kicks on Fire marketing channel mix, we can see which brand is relying on paid traffic. KicksCrew brought in the most traffic from paid search (52.4%), followed by direct search (23.2%) and organic search (19.3%).

However, Kicks on Fire brought in more traffic than KicksCrew from direct search (35.4%) and organic search (58.1%).

Similarweb data reveals these brands are competing for traffic share from non-branded keywords. For example, consumers browsing for “Yeezy 350 V2” saw these three brands competing for the attention of digital shoppers. Fight Club gained the most traffic share with 57.9%, followed by KicksCrew with 22.2%, and Kicks on Fire with 19.9%.

2. Consumer concerns at the forefront of footwear brands

Whilst traditional footwear website ranking is high this quarter, niche products are standing out. Footwear brands that focus on deeper consumer concerns like foot recovery and environmental impact are gaining widespread popularity.

These companies include:

- Oofos, a recovery footwear brand focused on supporting joints.

- Vivobarefoot, a sustainable footwear brand with the goal of creating regenerative footwear.

- New Balance, a footwear brand catering to traditional athletic audiences, is committed to responsible leadership and giving back initiatives.

Oofos finds a successful social strategy

This quarter Oofos elevated its advertising in social marketing strategies. Their efforts paid off, as social traffic to their website increased 339% YoY, of which 83% of it came from Facebook. This impressive growth shows the power of Oofos’ brand awareness.

3. Activewear: comfortable and affordable

Apparel brands are also ranking on this quarter’s list – JD Sports, 32 Degrees, and Fjällräven take third, fifth, and ninth spots on our list respectively.

The fastest-growing D2C apparel brand on this list, 32 Degrees, offers consumers apparel that keeps wearers temperate despite the activity or temperature. Traffic to 32 Degrees increased by 50% YoY.

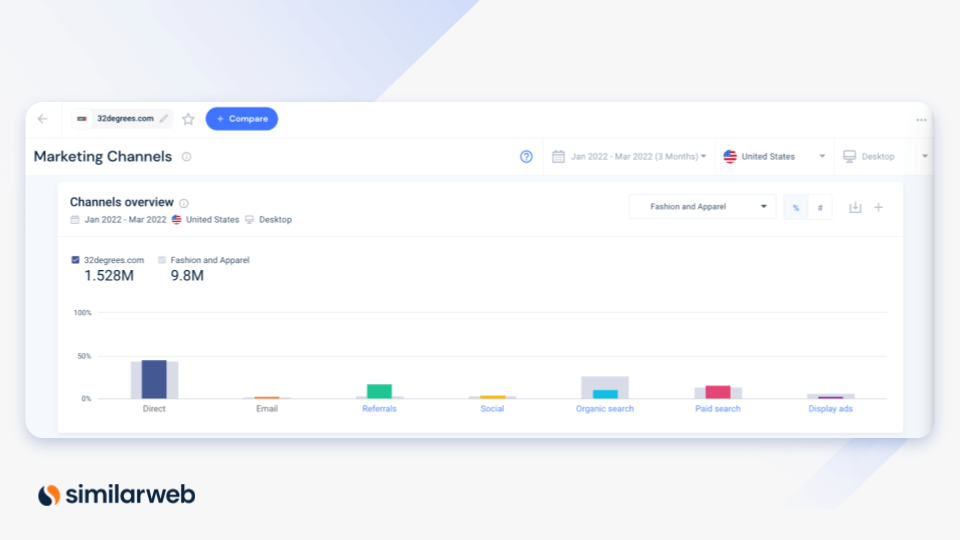

When benchmarking 32 Degrees’ marketing channels with the Fashion and Apparel industry, we can see that the online retailer approximately mirrors the industry benchmarks for direct, email, and social traffic. However, 32 Degrees received nearly 20% of their traffic from referrals this quarter, compared to the 3% average the wider industry receives.

Our selection process

We used Research Intelligence, part of our suite of eCommerce Intelligence solutions, to measure the QoQ performance of over 3,000 digital activewear brands to see which have the highest growth across categories. Results are limited to sites with at least 10,000 monthly visits to ensure brands have gained traction with consumers.

To get your own insights at any time, schedule a demo of Research Intelligence.

The ultimate edge in marketplace intelligence

Put the full picture at your fingertips to drive product views and sales