Ranked: Fastest-Growing Sports Nutrition Brands (+ Tips to Accelerate Performance)

Whether it was getting back into pre-pandemic shape, in the spirit of the Olympic Games, or the U.S. Open, Sports Nutrition brands were top of mind for many consumers this summer, reaching peak performance on Amazon just last month. In light of this, we’ll use Shopper Intelligence, our eCommerce solution, to rank the fastest-growing Sports Nutrition brands on Amazon this summer. Check out who’s sprinting ahead and why, plus we share tips for brands to improve their Amazon performance.

1. Optimum Nutrition optimizes for wins

Optimum Nutrition nabs first place as the fastest-growing sports nutrition brand, surging 37% to reach 2 million in sales from June – August 2021 — the highest among top sports nutrition brands. Its high protein, low carb, gluten-free protein bar was the top-ranked product in the category, with 649.2 thousand units sold and a solid $14.6 million in revenue.

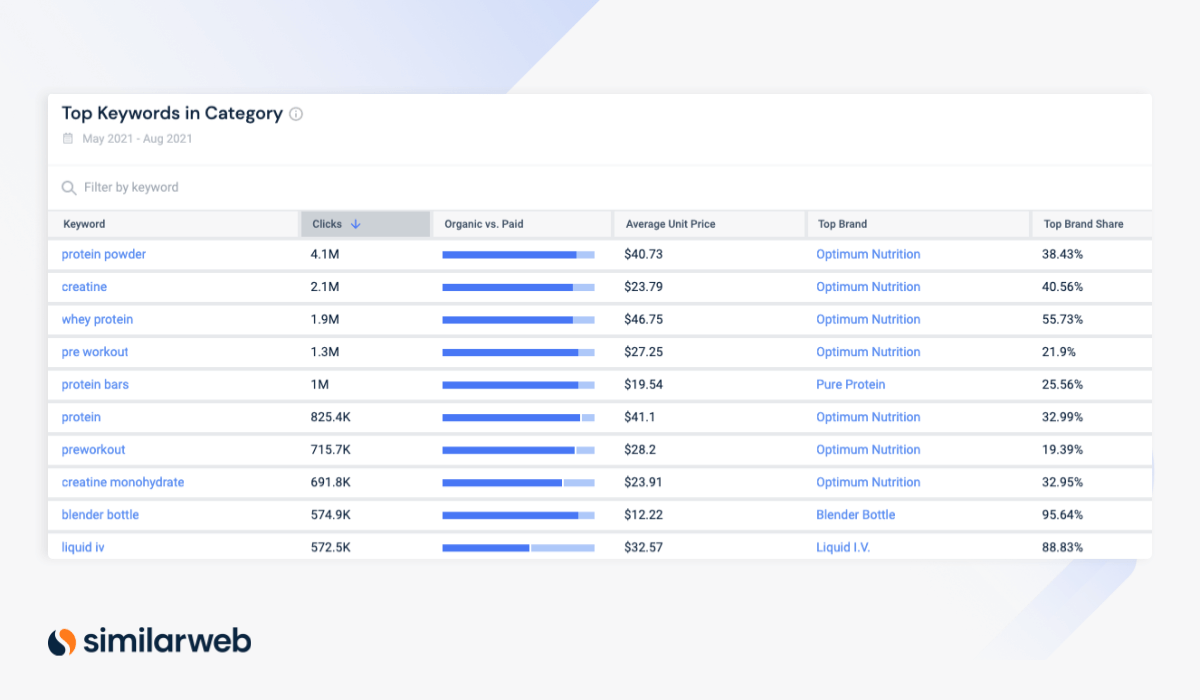

When it came to popular Amazon on-site search terms, protein-related words and phrases packed the most powerful punch. Specifically, “protein powder,” “whey protein,” and “creatine” garnered the most traffic to Optimum’s Amazon products.

The brand’s strong customer loyalty is likely due to its 15-year history on Amazon. Its Subscribe and Save revenue, which tapped the online marketplace’s subscription program, reflects especially covetable customer loyalty that raked in more than one-quarter (28.7%) of Optimum Nutrition’s revenue in March 2020, rising to nearly one-third (32%) today. These subscribe and save rates exceed the Sports Nutrition category averages – 24.7% in March 2020 and 31.2% in August 2021 – and rack up recurring revenue and lower customer acquisition costs for the brand.

2. Protein demand powers rankings

Optimum Nutrition wasn’t the only name benefiting from protein products. The crowd-pleasers also fueled growth for Scivation XTEND (XTEND) and Body Fortress, which ranked second and third fastest-growing sports nutrition brands, respectively.

XTEND generates most of its clicks from on-site search terms related to BCAA or Branched Chain Amino Acids, which refer to the chemical structure of protein-rich foods that help athletic recovery. Although “BCAA” is just the sixteenth most popular onsite search term for the Amazon category, XTEND bags 40% of the brand share for it with 325.3 thousand clicks.

Body Fortress, however, generates most of its clicks through more competitive keywords. Its top three keywords include “protein powder” and “whey protein,” which are also the first and third most-clicked keywords in the entire Sports Nutrition category. These are also the same, key terms driving clicks for competitor Optimum Nutrition.

Takeaway

Body Fortress may want to consider investing in paid clicks for these competitive terms to maintain its growth and catch up to competitors. Currently, the brand’s percentage of paid clicks for its top on-site search terms lags behind the category average by 5 percentage points (ppts). For Optimum Nutrition, 20.6% of clicks for “whey protein” were paid, helping it take 55% of the brand share for the term.

Moreover, paid clicks for “protein powder” comprised just 2.2% of clicks for Body Fortress, which again falls behind the category average of 12.3% by more than 10 ppts, and Optimum Nutrition, at 15.8%, even more.

3. Consider bundling with Blender Bottle to stand out

Blender Bottle, which boasts a popular shaker bottle for protein drinks, tied for fourth place with Liquid IV’s 27% growth this summer.

Over the past six months (March-August 2021) just over one-third of Amazon consumers that bought a Blender Bottle product also bought a product from Optimum Nutrition, and just over 5% bought a product from Body Fortress. However, Body Fortress’s average order value (AOV) share of 20.3% of consumers that buy both its and Blender Bottle products exceeds Optimum Nutrition at 18.7%

Takeaway

Blender Bottle, which frequents 18% of Optimum Nutrition consumers’ baskets, should consider making the pair-up official by teaming up with brands like the latter, or Body Fortress, which also makes protein powder.

By working together, the product pals can bundle complementary products– protein powders and bottles to mix them in– to be offered to consumers at a lower price than the individual items.

As the holidays are near and consumers hunt for value gift sets, bundles may be a particularly effective way to generate revenue for brands.

Final thoughts

Although Sports Nutrition recently reached peak Amazon performance, there are signs that the category may wane into the fall and winter. Already, overall category revenue generated through Subscribe and Save dipped 5.3% in August. For brands selling highly competitive products, the drop was even more drastic:

- For Optimum Nutrition, Subscribe and Save revenue declined by nearly 13% from July (42%) to August (32%).

- For Body Fortress, which peaked at 66% in July, Subscribe and Save revenue declined 51% in August (35%).

Lower Subscribe and Save numbers indicate that it is less likely for these brands to be certain of steady, recurring revenue into the winter months. Therefore, it is even more important than ever for Sports Nutrition brands and sports supplement brands, for that matter, to strategically manage their Amazon sales strategy by leveraging eCommerce intelligence tools.

To kickstart their strategy, brands can try out Similarweb Shopper Intelligence, which provides insights on consumer and purchase behavior across Amazon and online marketplaces.

Schedule a demo today to learn more.

Also, check out other resources for more sports and athletic insights, including:

The ultimate edge in retail insight

Put the full picture at your fingertips to drive product views and sales