How to Do an Amazon Seller Competitor Analysis in Under 30 Minutes

Did you know 1.6 billion products were sold on amazon.com in August 2024 – an 8% increase year-on-year (YoY), according to Similarweb.

There is money to be made on Amazon. But it’s competitive.

You need marketplace intelligence to understand your competitors’ strengths and strategies. So you can sharpen your own and keep ahead of the pack.

With a powerful Amazon seller toolset like Similarweb Shopper Intelligence, you can analyze critical areas like:

- 💰 Sales performance

- 📣 Traffic optimization

- 📱 Consumer browsing behavior

- 💸 Share of wallet

Shopper Intelligence allows you to do a competitor analysis on Amazon in less than 30 minutes and without stepping off the platform.

Remember, this is a quick overview and you can get so much more out of the platform. Shopper Intelligence can take you deeper and reveal the hidden insights you need to gain a lasting competitive advantage.

So set your timer ⏲️. Let’s go!

What category are we going to launch in?

First, we need to analyze a product category. For this, we are going to look at what it takes to launch a video game chair.

We have the SW10, the very latest gaming chair, with built-in virtual reality, realistic suspension, and a cup holder. We’ve even tested it out 😉. Indeed, our nephew sat in a prototype for six weeks straight.

Now, we just have to launch on Amazon. It can’t be that hard. Can it?

We’ll let you be the judge of that. But we can guarantee that you will be able to find the information you need to make an informed analysis in less than 30 minutes.

Understanding sales performance

Sales performance metrics are the heartbeat of any competitor analysis. They give you a clear sense of how your competitors are doing and whether they’re gaining ground – or falling behind.

For Amazon sellers, these numbers help you figure out what’s working for them and where there might be opportunities for your own business.

Key sales performance metrics to keep an eye on:

- Total sales: This one’s the big picture–how much product are they moving? It shows you just how much your competitors are dominating the category

- Sales growth: Are their numbers going up or down? This tells you if their strategies are paying off and whether their success will last

- Market share: How big of a slice of the pie are they capturing? This helps you see their overall presence compared to others in the space

- Product pages: Look at the top sellers. What are their pages like? Is it A+ content? Are they getting reviews?

These metrics give you a snapshot of your competitors’ health and show where you can tweak your own strategy – whether to seize on their weaknesses or learn from their wins.

Using Shopper Intelligence for sales performance (9 minutes)

So we need to look into the sales performance of Video Game Chairs. Just to get an idea of where the market is and what our competitors are seeing.

First, let’s head to Sales Performance, where we can drill all the way down through furniture to our target sub-category. Here, we can look at things from a brand level as well as drill deeper into the sub categories.

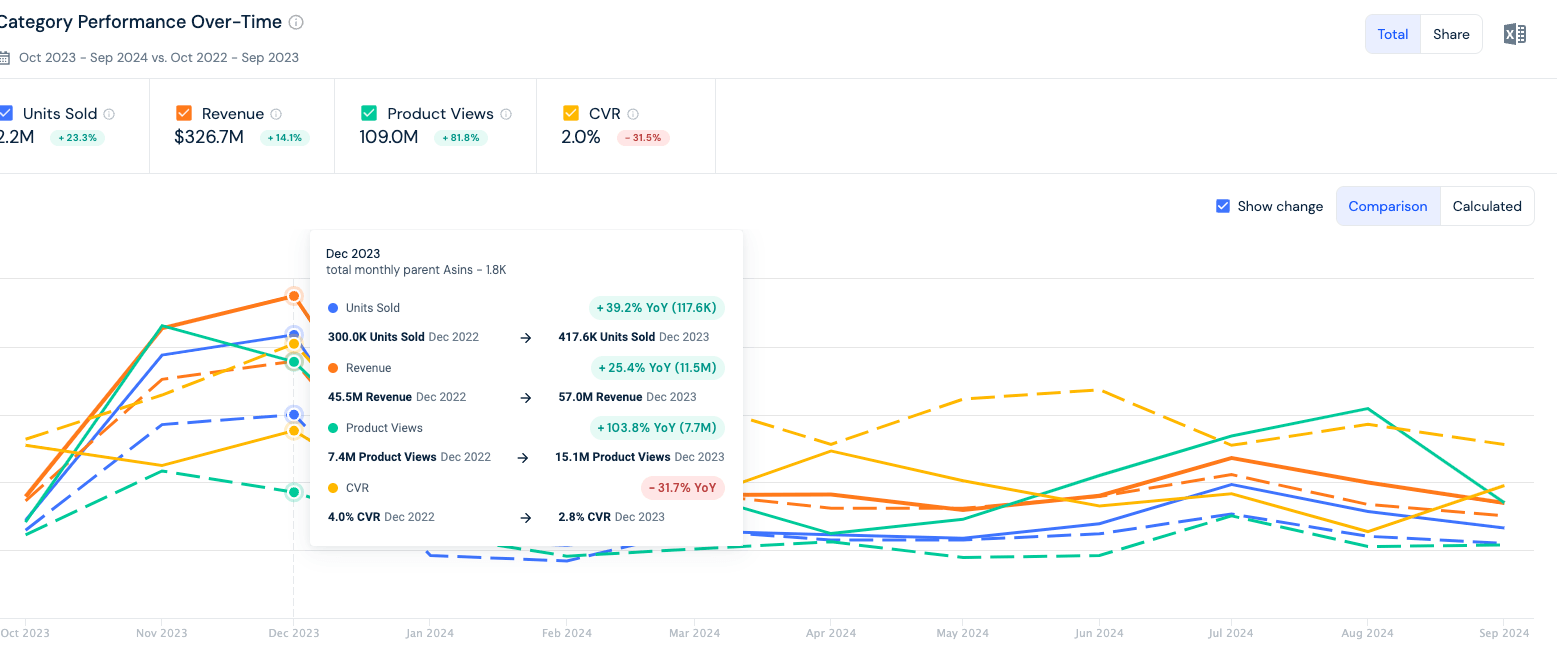

The table above provides us with a number of key insights. These include:

- We have a seasonal market that peaks in the fall and leads up to the holidays

- Total revenue generated is $326.7 million, which represents a +14.1% increase compared to the previous year. Good

- The YoY conversion rate has been falling throughout the year. So products are getting a lot of views, and the interest is there

Now let’s look at who our competitors are.

Top brands in the gaming chair space

Here we will:

- Share a step-by-step guide on how to use Shopper Intelligence to check competitor sales performance

- Identify top-performing brands in our chosen category

- Interpret the data to understand market positioning

The same page shows us the top brands in the gaming chair category. We can break this table down by revenue, sales, and product views.

The standout insight here is that GTPlayer is the number one and its sales are on the up by +8% YoY. While revenue and views are hovering around the +6% mark.

The number of reviews for the top-performing products can also be analyzed. The top-selling product has only 32 ratings, which is good news.

We can also see all of the brands are struggling with falling conversion rates. Let’s look into this further…

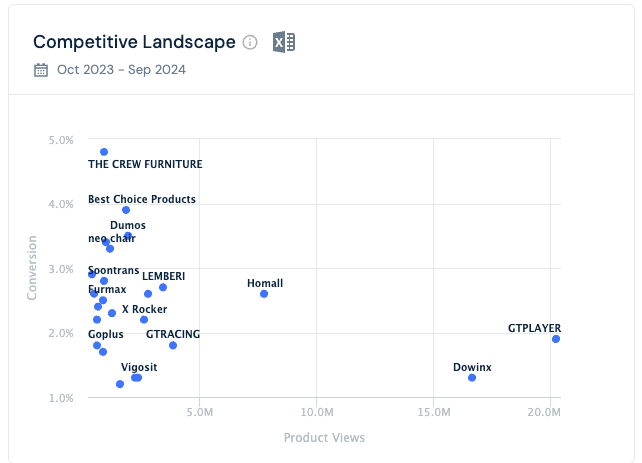

In the Competitive Landscape table above, we can see who’s winning in terms of sales.

The outliers are the leading brands GTPlayer and Dowinx. Both generate millions of views but have poor conversion rates. While ‘The Crew Furniture’ has a conversion rate of just under 5%.

However, the biggest-selling product is Hormall’s S-RACER chair.

Lastly, we can benchmark any brands of interest against each other. Looking at units sold in the Monthly Brand Performance report we can see GTPlayer and Dowinx have had a big fall. This page will be useful when we launch and need to match our performance.

👉 Takeaways: Both GTPlayer and The Crew Furniture’s acquisition and conversion strategies are worth investigating later when we examine traffic generation and keyword analysis.

Homall is well-positioned, showing significant growth and a strong conversion rate. They could be a model for other brands, balancing visibility with sales efficiency.

Benchmarking marketing channels

Internal vs. external traffic

To sell anything, you need to get your product views. But we can safely assume that they will either be internal or external.

Internal traffic is generated from within Amazon, such as organic searches (Highlighting the importance of doing SEO in Amazon as well), product recommendations, Amazon Ads, and organic search on Google.

Conversely, external traffic is anything outside Amazon: social media, ads, or affiliate blogs. External traffic can also lift your internal traffic from Amazon’s algorithm.

Understanding both is crucial.

Sellers who balance internal and external traffic can achieve higher growth and stability, especially when Amazon’s internal algorithm changes. Benchmarking your traffic sources helps determine where to invest more and how to outpace competitors. Don’t overlook either – they’ll both play a vital role in your long-term success.

Competitor benchmarking for traffic generation (5 minutes)

Here we’ll look at how our competitors are bringing traffic onto their pages.

We’ll focus on:

- Comparing your traffic performance with competitors

- Steps to benchmark internal and external traffic against other brands

- Interpreting traffic sources to build out a future marketing strategy

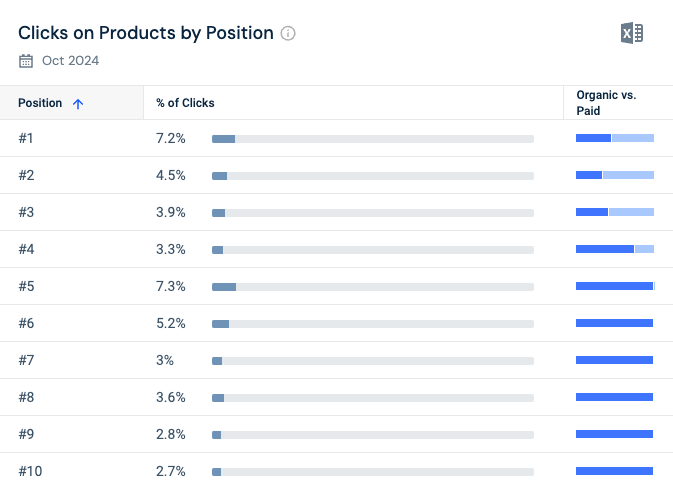

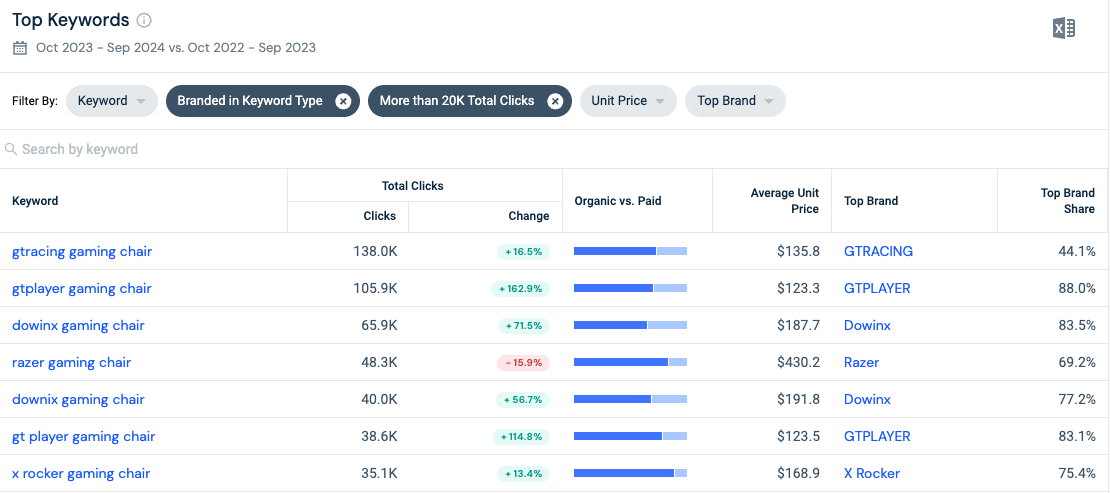

After leaving the Sales Performance page, we’ll head over to the Search Optimization page. Here we can see that GTPlayer is dominating search in terms non-branded terms like ‘gaming chair’.

Additionally, a high proportion of the top terms here have a high proportion of paid advertising against them.

Indeed, this is born out separately on the page where we can see the top three products in the category (above) rely mostly on paid traffic.

Branded search is clearly a big thing here too. In the table below we can see that GT and Dowinx have a high profile in the market, even if a large proportion of their traffic is paid (77.2%).

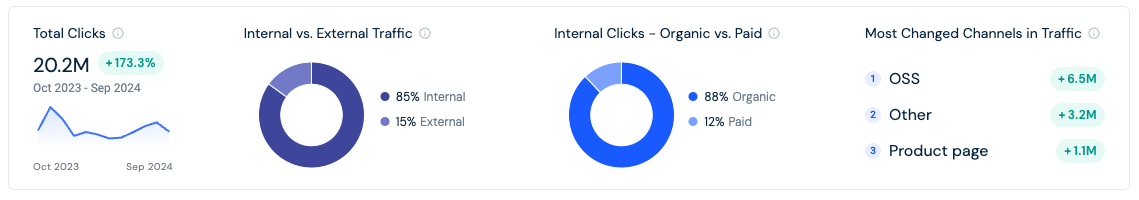

Lastly, let’s take a quick look at external traffic. For this, we’ll use market leader GTPlayer. In the table below we can see that while external traffic is important, internal traffic generates the bulk of its views – 85%.

Looking at all of this, here are our findings:

- A successful seller in this category generates a lot of traffic via branded search on Amazon

- We’ll need to use paid traffic on Amazon if we want to get into the top positions

- External traffic is being under-utilized and could generate a lot of traffic. It’s also worth noting that external traffic provides an uplift via Amazon’s algorithm

Analyzing competitor brands in the consumer purchase journey

Understanding how competitor brands influence the consumer journey helps you uncover growth opportunities and refine your marketing strategies.

Consumer browsing behavior

Consumers often browse multiple brands before making a purchase, ie, your competition. Knowing who and what they are can give you great customer insights that will generate more sales.

What does this entail?

Look for clues about the features, pricing, and value propositions that click with potential buyers. By analyzing the other brands your audience is considering, you can use this information to highlight your strengths or pinpoint weaknesses.

So let’s open our consumer analysis tool…

Doing consumer analysis (10 minutes)

Here is what we are going to do:

- Analyze which competitor brands consumers are visiting during their purchase journey

- See how we can use this data to set our marketing tactics and capture market share

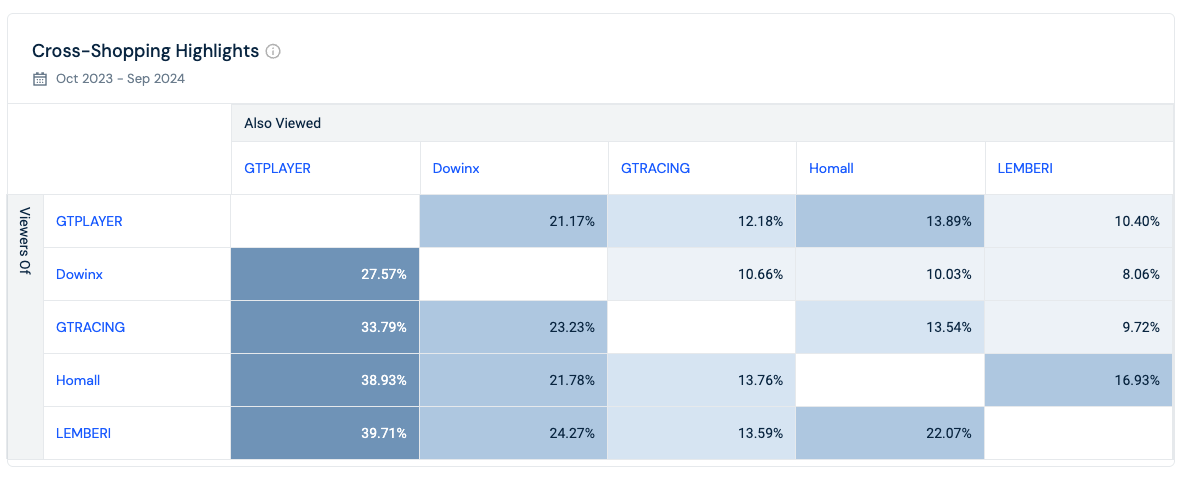

Analyzing cross-shopping behavior can provide an excellent idea of how our target market is thinking. The table below from the Cross-Shopping Highlights overview shows that Dowinx is GTPlayer’s main competitor. While it is competing effectively with Hormall and Lemberi.

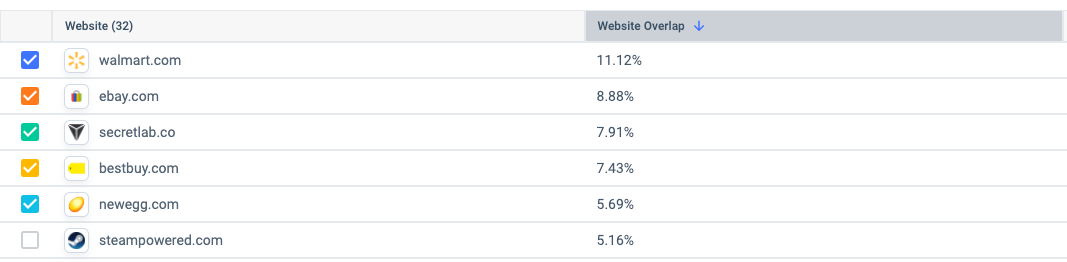

Remember, our competitors are not only on Amazon. Here we can see other stores our audience visited on the same day:

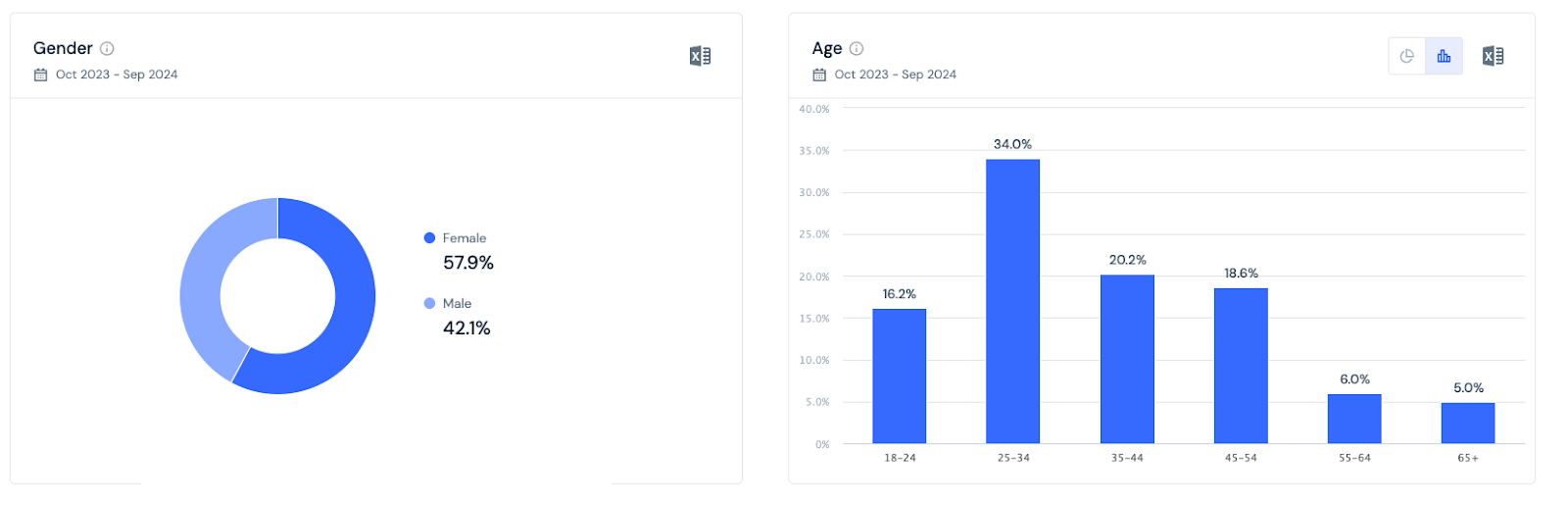

And just to round off our consumer analysis. Let’s get a picture of who they are. We can see they are slightly more likely to be female and in the 25-34 age range. Additionally, the bulk are college-educated and in full-time employment, suggesting a higher disposable income and a tech-savvy profile.

Analyzing share of wallet

Evaluating your share of wallet vs. your competitors can highlight growth opportunities and guide your sales planning.

Share of wallet refers to the percentage of a consumer’s total spending within your category.

How?

Knowing the number and type of products in consumers’ baskets gives you insights into your target customer’s purchasing behaviors and preferences. It’ll also highlight any gaps you might have.

Share of wallet data can also help you tailor your marketing and product offerings and understand customer loyalty. Use it to adjust pricing, promotions, and positioning to capture a larger portion of their spending.

Using Shopper Intelligence to analyze the share of wallet (5 minutes)

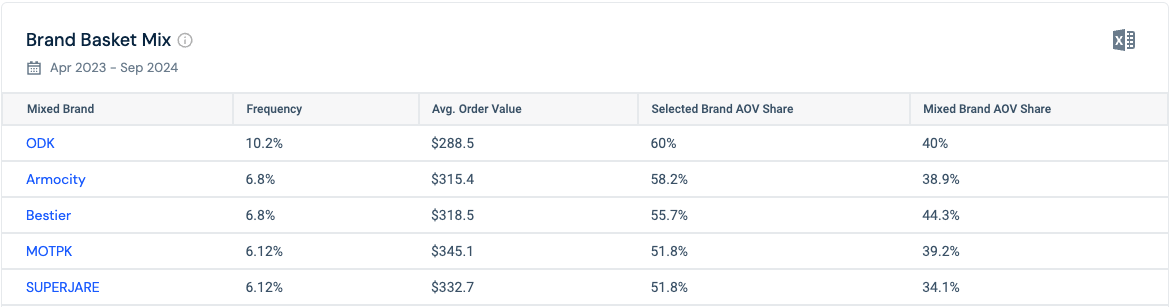

Shopper Intelligence can show us how much people are spending with other brands while buying from you. In the table below, from the Brand Market Mix report, we can look at Dowinx’s share of basket in terms of leading brands.

For example, we can see Dowinx takes 60% of the order value for computer desk brand ODK. This could provide an opportunity to expand its range and launch a similar product.

It’s clear that people are entering Amazon with the idea of kitting out their gaming environment. They are also spending a lot of money but on relatively few items.

Sitting back and enjoying your gaming chair (1 minute)

As promised, this Amazon competitor analysis takes less than 30 minutes, leaving you at least a minute to get comfy in your gaming chair—or any chair you’re in—while optimizing your online sales performance.

What have we learned about the market and our competitors?

We learned a lot about gaming chairs and Amazon’s competitors. But these can be easily applied to any product line and industry. Here are some essential points to help us put together our launch plan:

- 🕤 Best Time to Sell: People often buy gaming chairs in the fall and before the holidays. We should focus on selling more during these peak times to maximize our success

- 💸 Getting People to Buy: Many people look at gaming chairs, but not all decide to buy. Homall does a great job converting interest into sales, so we should learn from their approach to improve our own

- ⛰️ Big Brands: GTPlayer generates a lot of revenue but still struggles to get more people to convert. We can outperform them if we focus on helping potential buyers feel confident enough to make a purchase

- 🗺️ Where Shoppers Come From: Most shoppers find gaming chairs through internal Amazon searches or ads. We should also try to attract people from outside Amazon by using social media, blogs, and other marketing channels to expand our reach

- 🎯 Competing Brands: GTPlayer and Dowinx are leading brands in this space. If we make our chairs stand out with unique features, more people might choose us over them

To succeed, we need to increase our visibility on Amazon, make it easier for people to buy, and focus on selling during the best times of the year.

The outcome? We can carve out a strong position in the gaming chair market. All by conducting an effective Amazon competitor analysis, learning from our competitors, and utilizing different traffic sources.

Grow your Amazon sales with Similarweb

No matter if your Amazon store is into gaming, pet health, or guitar accessories, Similarweb’s Shopper Intelligence is here to help you increase Amazon sales.

Think of it as your go-to toolkit for Amazon mastery:

- 🔍 See the full picture of your traffic to drive more eyes to your products

- 📊 Benchmark smarter by stacking your marketing against the category’s best

- 💡 Uncover competitor moves and learn exactly how they’re driving their clicks

- 🚀 Optimize your product pages with top-performing keywords for maximum visibility

And here’s the real magic:

Similarweb’s Shopper Intelligence gives you unique cross-shopping and loyalty insights that go beyond the basics.

Spot which brands are competing for your audience, track your share of your wallet, and build a balanced strategy. One that builds both acquisition and retention.

FAQs

Why is competitor analysis important for Amazon sellers?

Competitor analysis helps you understand what other sellers are doing well and where they fall short. By examining their strengths and weaknesses, you can refine your own strategy to outperform them, identify market gaps, and adjust your pricing, marketing, or product features accordingly.

How do I identify my main competitors on Amazon?

Start by searching for products similar to yours. Look for the top-ranking listings and analyze sellers dominating your category. You can also use tools like Similarweb Shopper Intelligence to find top-performing competitors based on metrics like sales, traffic, and market share.

What key metrics should I focus on during competitor analysis?

Focus on metrics such as total sales, market share, conversion rates, customer reviews, and product rankings. Understanding these metrics will help you evaluate which strategies are working for your competitors and identify areas where you can improve.

How can I analyze Amazon pricing strategies?

Monitor how competitors adjust their pricing during promotions, seasonal events, or when they introduce new products. Consider using dynamic pricing tools to stay competitive. Look at their pricing trends and evaluate how their pricing affects customer reviews and sales volume.

The ultimate edge in retail insight

Put the full picture at your fingertips to drive product views and sales