Secondary Market Research: What It Is and How to Do It Fast

Secondary market research is cost-effective. There’s no professional training needed. And it’s a great place to find inspiration and ideas for growth, or explore a topic deeper before making strategic decisions. When you think about it, it’s how most types of research start out.

Whether you’re digging around on a rival’s website, reading industry news, or snooping on social media, it all counts.

So, sit back and take ten to discover everything you need to know about the what, why, and how to do secondary market research right.

For good measure, I’ve included examples of secondary market research and a detailed review of secondary research methods.

What is secondary market research?

By definition, secondary market research uses pre-existing data collected or published by a third party. It’s mainly used to establish key facts about a market, product, or service. It’s also known as desk-based research, and all you need is an internet connection to get started. There are plenty of places to obtain secondary data for free. These include internal and external sources, such as company sales and analytics data, industry or government reports, and published market research surveys.

To save time:

Choose the right secondary market research methods from the onset. And use a methodical approach to help you analyze a topic, spot trends, and decide whether further primary market research is worth it, or not.

Why is secondary market research important?

Finding cost and time-efficient ways to do market research is key. By leveraging prior efforts, you can build on existing research, uncover insights, and make informed decisions faster.

This type of market research presents a huge window of opportunity! As long as you’re willing to invest the time needed to gather and analyze the data. Particularly when you consider how much data is out there, and is never reviewed.

https://x.com/forrester/status/902218053768933377

Examples of secondary market research

All secondary market research types can be split into two subsets; internal and external.

- Internal sources come from data held within your organization.

These examples of secondary market research are for your eyes only. And because it’s data your rivals won’t be able to benefit from, it’s one of the most valuable activities you can do.

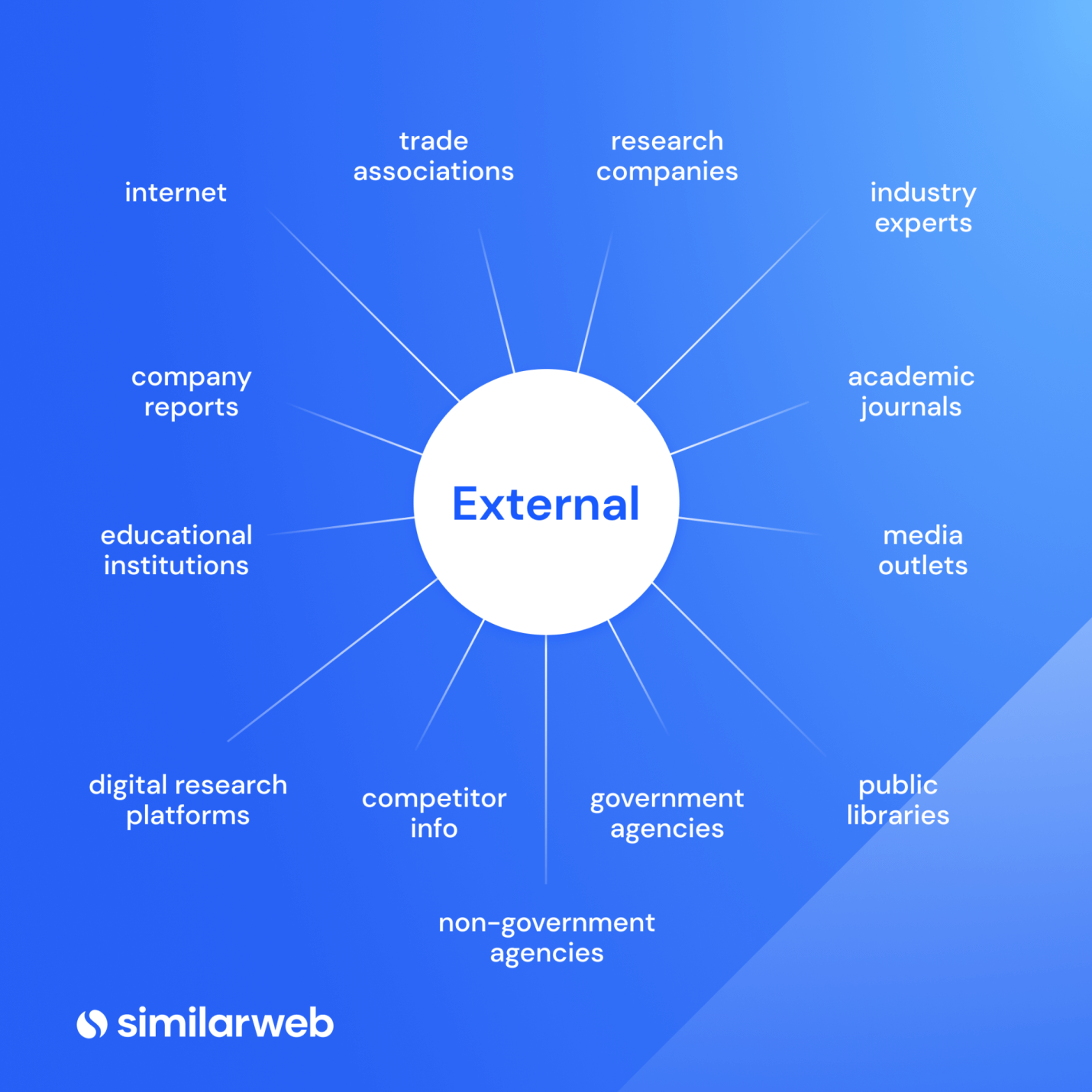

2. External sources come from outside your business.

External secondary research examples can be accessed by almost anyone, being openly available by nature.

By choosing the right secondary market research methods, you can significantly cut your research time and increase your speed to insight.

In June this year, over 500 business leaders and analysts shared their go-to sources of secondary market research with me via a survey on the HARO platform. The key ranking factors were speed, value, and ROI.

With these findings, I’ve collated a list of the best types of secondary market research.

Internal examples of secondary market research

1. Website and mobile app analytics

Think Google Analytics or your mobile app intelligence software. Both show data about people who interact with your business online. They can also help you understand the device split between desktop and mobile.

2. Customer data

Here, you get exclusive insights into your audience demographics. This is first-hand information about how people use your product or service, their likes, dislikes, and more.

3. Previously conducted research

Perhaps your business used analysts or carried out research in the past. So, even if it seems unrelated, it may be relevant to your research,

4. Historical marketing or campaign information

Things like conversions, website traffic, sales, and marketing data. It’s all going to help you build a picture that’ll impact your research.

External examples of secondary market research

Government and non-government agencies

Whether you want to view global or country-specific data, there’s lots of free information here. See below for a quick guide to some of the best secondary data sources in the US.

- Congressional Research Service – Information is authoritative, objective, and timely. Topics include economy, finance, commerce, technology, and policy. Sources include infographics, reports, and posts.

- US Census Bureau – Produces more stats than any other agency in the US. Tables, articles, studies, and reports show current and historical data.

- US Small Business Administration – If you’re a small business, the SBA website is a goldmine. Use it to access reports and other data that are ideal for secondary market research purposes.

Read More: Get Growing with Small Business Market Research

- The Bureau of Labor Statistics – As an independent national statistical agency, it produces timely, unbiased reports that are highly relevant to modern-day economic and social issues. Its data retrieval tool is a game-changer for fast access to relevant data.

- Bureau of Transportation Statistics – Access reports about transportation, economics, IT, airlines, geographic information systems, safety, and more. View trends and annual reports, or use the ask-a-librarian live-chat service.

- US Government Publishing Office – View Federal Government reports from three branches: the White House, US passport office, and congress publications. It’s also home to the complete catalog of past and present government publications.

- Childstats.gov – If you’re in a business geared toward families, this is a great place to find valuable stats and trends relating to family characteristics, health, behavior, economic security, and education.

- Internal Revenue Service – Get comprehensive stats using this tax stats link. Great for income data, easily sorted by zip code. Access publications, articles, tables, and reports that measure elements of the tax system.

Competitor websites and apps

Your rival’s websites and apps are a goldmine for secondary research. Define your competitors; then take the following actions for each. Also, ensure you set up a systematic way to collect and record what you find.

- Sign-up for their newsletters or subscribe to their blog.

- Do they offer a free trial, consultation, or product demo – go ahead and try it out.

- Review their products or services; look at the add-ons or upgrades on offer.

- If a rival has an app, download it to get a feel for what they offer and what works (or not).

- Record their price points, discounts, offers, and pricing model.

- What type of customer support do they offer; email, phone, live chat? Note any service level agreements (SLAs) they promise to customers.

- Read their customer and employee reviews with a fine toothcomb: note both pros and cons.

- Look at what social media channels they’re active on. View their activities, engagement, and size of their following.

While it seems like a lot, you can uncover some genuine pearls of wisdom about your target audience’s likes and dislikes. You can also use this data to inform pricing, positioning, social, and marketing tactics.

Read more: how to do competitive analysis right.

Using the industry analysis feature, I see the industry leaders and rising stars. When I look at who is gaining the most unique visitors with the longest visit duration; there’s a clear leader with above-average stats. By expanding and clicking compare, I see the competitive landscape, including marketing and social channels, keywords, ads, traffic, and engagement metrics for all.

Commercial and Trade Association Reports

Whatever your business, there’s bound to be a trade association that provides relevant intel about your sector. Here are a few links to save time if you’re in the US. Google trade associations in your region to see what’s available for anyone outside the US.

Online Media

Use the media to find out about stories and trends in any sector. But don’t just make it a one-and-done thing – sign-up for Google news alerts to be alerted to new things as they happen. You can create alerts in seconds based on competitors’ names, products, industries, popular keywords, and more.

Market Research Intelligence Tools

Get instant access to the most up-to-date insights about rivals, markets, or keywords for any audience or product. Another reason to use market research intelligence tools like Similarweb is the high dependency of data. It comes from reliable sources and is always up to date. You can instantly access web and mobile app intelligence from within a single platform, then drill down into any market to get actionable data – with key insights, trends, market intel, audience data, and more.

Traffic and engagement metrics are a gold mine when it comes to doing secondary research. Here’s a static shot of Similarweb Web Intelligence in action. Here, you can quickly compare sites, and see in an instant who is winning in any market, and how they’re doing it.

Research Associations

Many research associations will charge you for their data, but if you find a timely and relevant report, it could be money well spent. Some of the most prominent players include IBIS World, Gartner, Statista, Forrester, and Dun & Bradstreet.

Educational Institutions

When you consider how academic research papers and journals are researched, you know their value. If you find one connected to your topic, you get instant confidence in the credibility of that data.

See below – there are many other examples of secondary market research using external data.

As this article is about how to do secondary market research fast, I’ve highlighted the most compelling examples of secondary research data.

Pros and cons of secondary research

As with all things in life, there are good and bad aspects to consider. Knowing the best route requires some consideration. So, ask yourself these questions before deciding if secondary market research is right for you – and whether it will help you achieve your research goals:

- What do you want to learn from your research?

- Are there actions or decisions you can take from the data?

- How is the data relevant to your research questions?

- Is information the most up-to-date there is?

- Could there be a quicker way to do this?

Always keep your research questions front of mind. It’ll help you determine if you’re using the best secondary market research methods, and keep you focused on the end result.

Advantages of secondary market research

- It can be quick to conduct.

- No professional training is needed to do it.

- Low-to-no cost.

- Data is easy to access.

- Initial findings shape future research efforts.

- Gain a broad understanding of a topic fast.

Disadvantages of secondary market research

- Data can quickly become outdated.

- Lack of control over the research methodologies used.

- Topics aren’t always relevant to the researcher’s needs.

- Extra steps are needed to validate the credibility of the research.

- Data is not proprietary and offers little advantage compared to primary research.

For all the benefits secondary market research offers, it’s impossible to ignore the disadvantages. Things like credibility, reliability, relevance, and timeliness all matter when you want to uncover insights to give you a competitive edge.

That’s where we come in.

The Ultimate Tool for Secondary Market Research

Similarweb Web Intelligence is the only external secondary market research method that gives you all the pros and none of the cons. If you want to know what a successful example of secondary market research looks like; it’s this.

- It’s dynamic and updates on the fly – so you always get the most up-to-date information.

- Data collection methodologies are transparent, trustworthy, and reliable.

- Refine results to exactly match the research needs.

- The presentation of data is clear via an easy-to-use, intuitive platform.

Use it to uncover the most critical insights you need to succeed. Data about your rivals, market, product, topic-specific keywords, marketing effectivity, demographics, and consumer journey tracking – all from a single platform, and from the comfort of your desk.

How to do secondary market research in five steps

As you can see, there are many ways to approach it and even more secondary market research methods to choose from. One thing this post promised, was to show you how to do it better and faster. So without further ado, here are five quick steps to follow.

1 – Define research needs and establish goals.

2 – Choose the best sources of secondary market research.

3 – Access, collate, and verify research data.

4 – Analyze, compare, and identify trends.

5 – Confirm if the research questions are answered. If not, repeat steps 1-4 using different sources, or consider primary market research as an alternative.

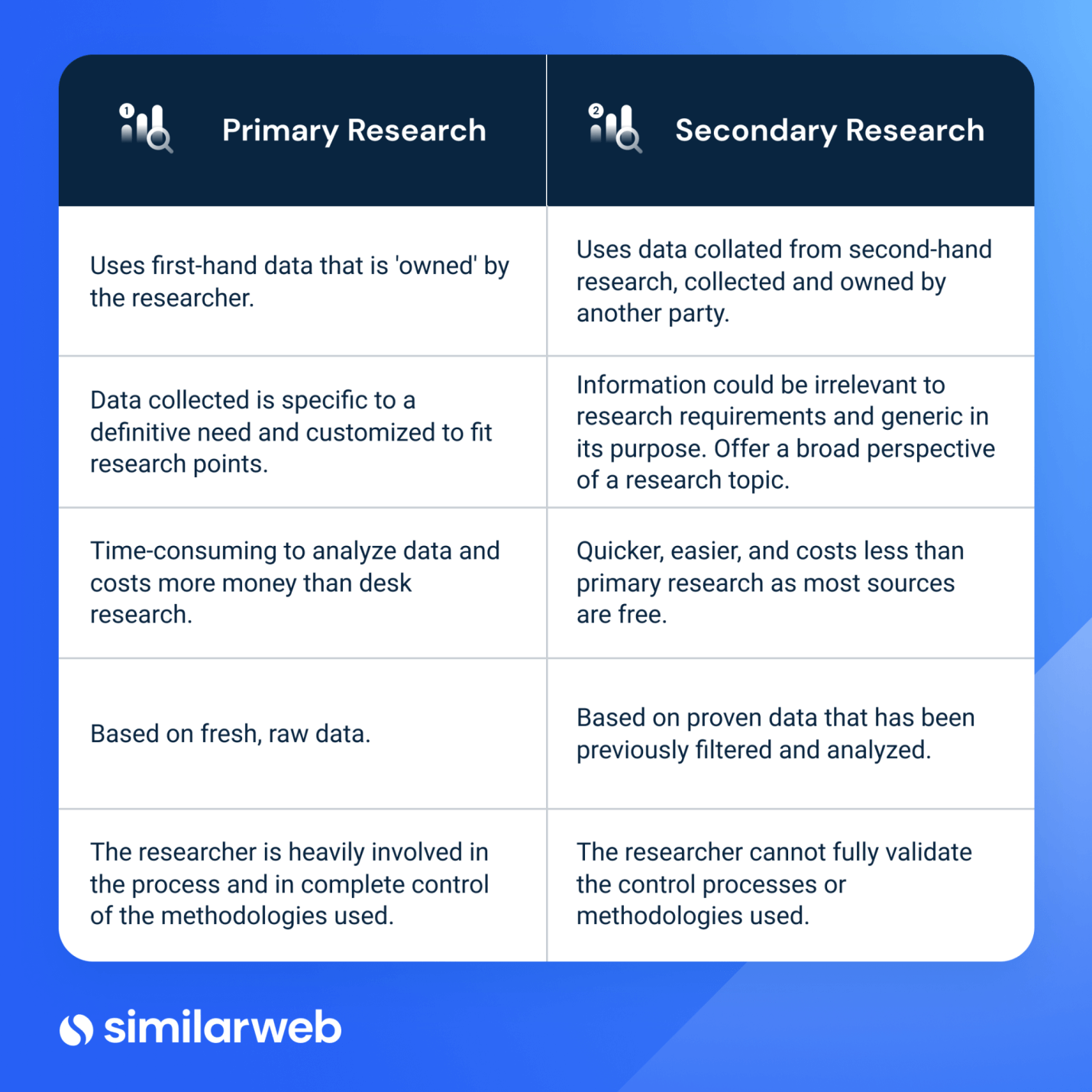

The difference between primary and secondary market research methods

Wrapping up…

Many believe that doing secondary market research is a quick, cost-effective route to uncover insights that fuel growth. So, whether it’s through diversification, slicker marketing, or new product development. But with credible constraints about the relevance and timeliness of secondary research methods and their data, choosing your tools has never been so important.

We might be biased, but for relevant, timely, trustworthy information that’s always on-point, Similarweb Web Intelligence is ideal. It’s the quickest way to get information about a target market, product, or audience. So, to get started doing secondary market research fast, sign-up for a free trial on the site today.

FAQs

What are secondary market research methods?

The most widely used secondary market research methods include: the internet, government and agency reports, research journals, trade associations, media outlets, libraries, digital intelligence tools, competitor data, internal sales or customer data, and website or app analytics.

How is secondary market research used?

Secondary market research provides a background from existing data. Organizations can save time and money by identifying key perspectives, facts, and figures to support a topic of interest. It adds credibility and helps shape further primary research.

Should you do primary or secondary market research first?

Because primary market research requires more resources, it’s best to use secondary market research first. Doing so gives you a clearer understanding of a research topic and can help you shape any further research stages before you invest money.

What are primary research and secondary market research?

Primary and secondary market research are two types of market research. Primary research refers to data that’s collected first-hand, such as a survey or interview. Secondary research uses existing data to explore a topic, such as the internet or journals.

Track your digital metrics and grow market share

Contact us to set up a call with a market research specialist