Truth Social Stock Soars at IPO, but Digital Engagement Doesn’t

Even during IPO frenzy, active usage of Trump’s social media app was 23% lower than at this time last year

Many explanations have been offered for last week’s successful IPO and subsequent stock price surge for Truth Social’s parent company, Trump Media & Technology Group, but digital engagement isn’t one of them. If Truth Social was truly destined to be a successful social media app, we would expect usage to be rising – when, in fact, it’s lower than it was a year ago, according to Similarweb estimates.

Business or politics?

It’s worth asking whether those buying Truth Social stock are making an investment or a political statement. As noted in a CNN report, many experts think Truth Social’s valuation “defies logic.” Truth Social lost over $58 million on just $4.1 million in revenue during 2023, according to SEC filings released shortly after the IPO. On Monday, the stock dropped more than 50% following the news of the full year loss. But it shouldn’t have been a huge surprise to anyone, given that previously released figures for the first nine months of 2023 also showed a loss.

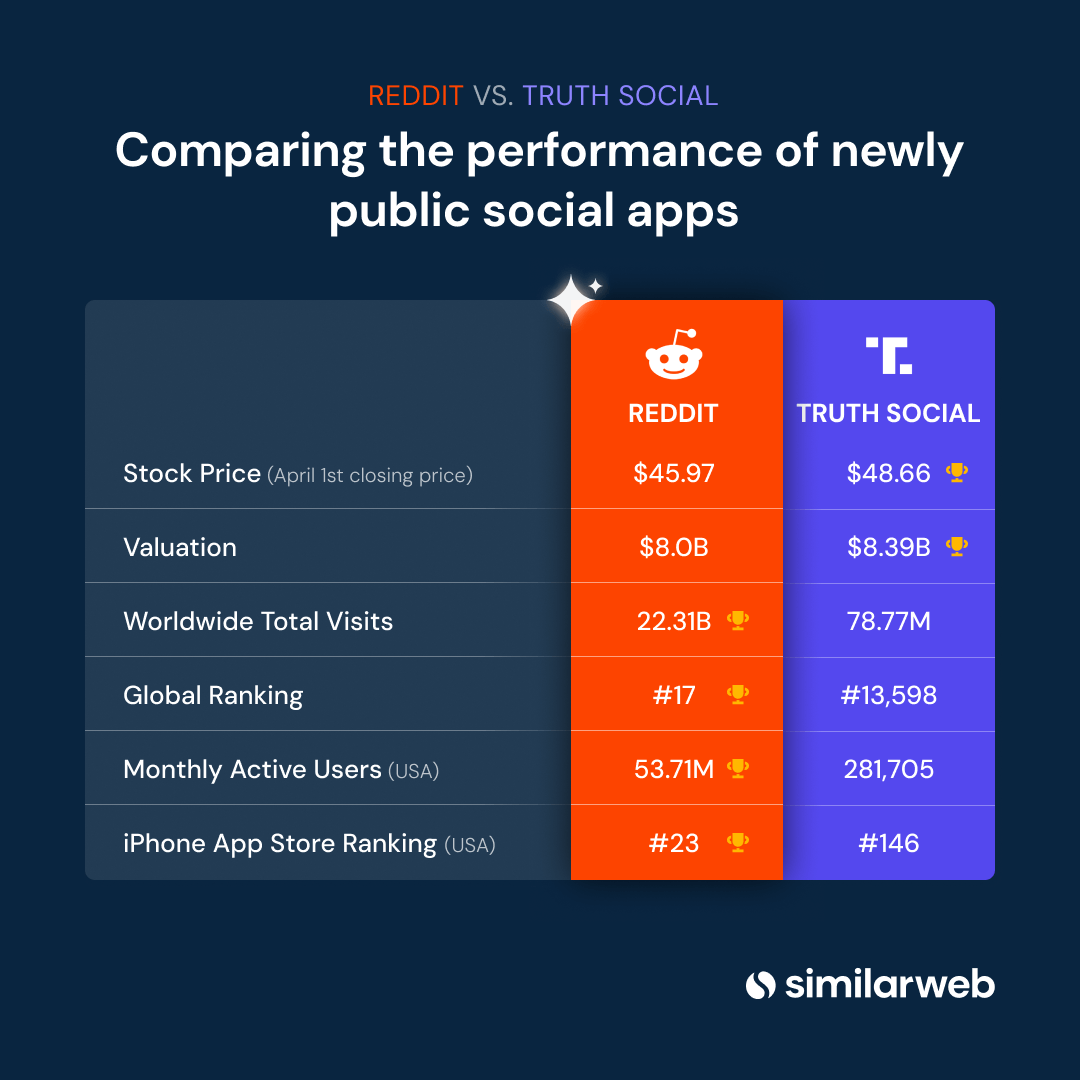

Compare that with Reddit, the other social media company to achieve a successful IPO in March, which, although faces a challenging path to profitability, at least has substantial advertising revenue. CNN notes that Reddit has never made a profit in 20 years of operations, reporting a net loss of $90.8 million in 2023, which was narrower than its $158.6 million loss in 2022. Sales reached $804 million, up 21% from $666.7 million in 2022. (See our related report on Reddit).

App usage down and web traffic increase unconvincing

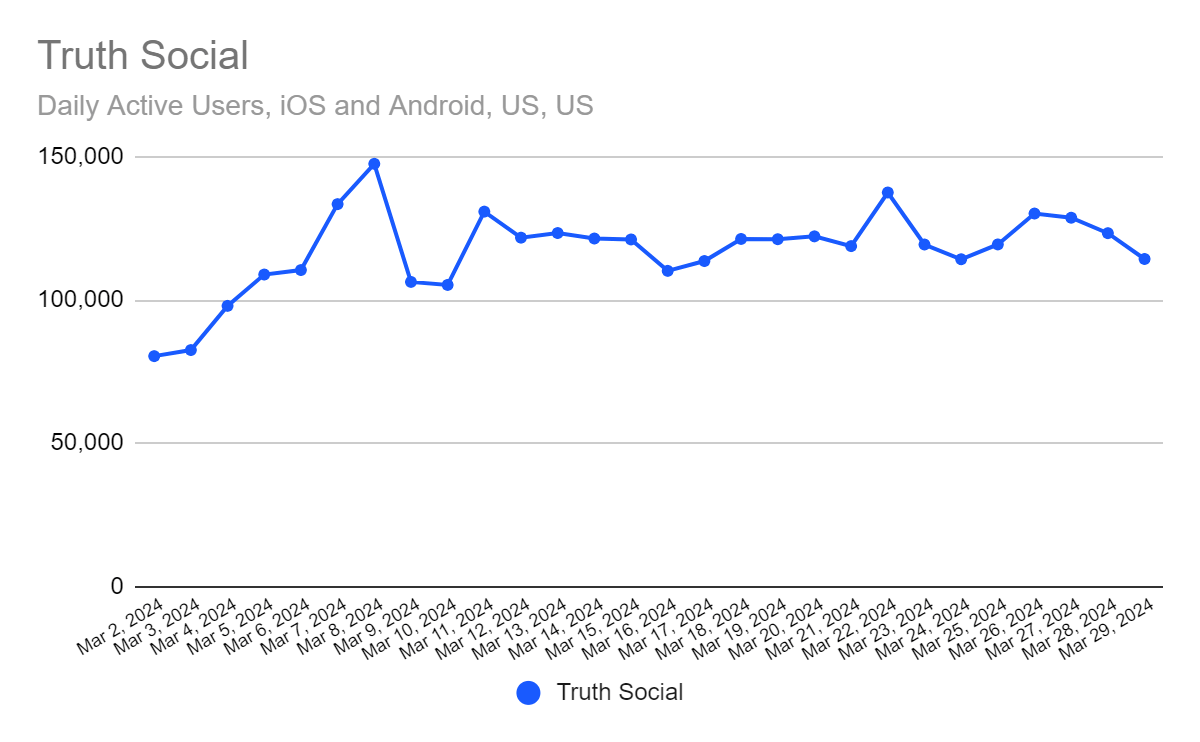

Based on daily active users for the iOS and Android apps combined within the US, usage was down 23% for the week ending Friday, March 29. Even during the peak of excitement over the IPO (plus the release of a Trump-branded Bible), TruthSocial’s usage was less than 1% higher than the previous week.

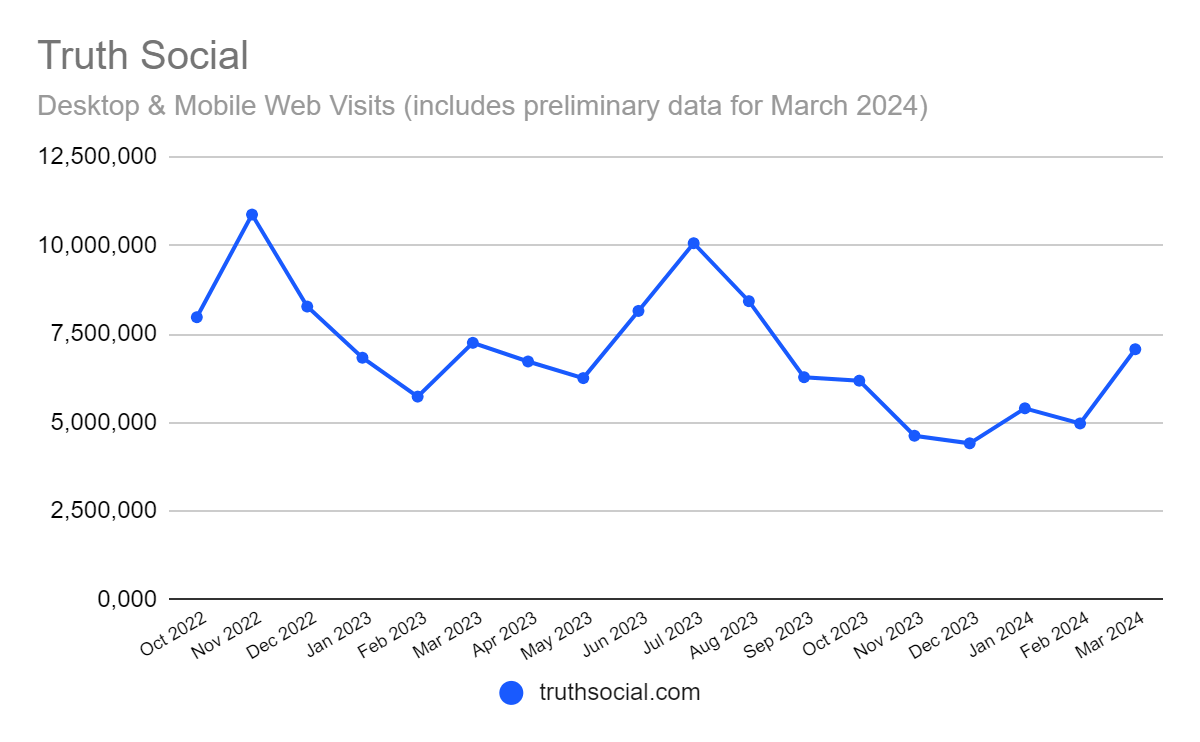

Web metrics were more positive, although web traffic includes people curious about Truth Social and its stock, not necessarily users. During the seven days leading up to March 29, visits to truthsocial.com were up 37% year-over-year and 46% week-over-week. However, web traffic was also down before the IPO, and preliminary estimates for the full month of March suggest traffic will be no higher than it was a year ago.

All of this makes it hard to see how Truth Social will gain a large social media audience that it can monetize with advertising, which is the company’s only source of revenue.

Reddit has hundreds of times more app users and web traffic than Truth Social. reddit.com’s web traffic was up about 17% in March. As Reddit’s experience shows, social media companies tend to lose money for years before they find a path to profitability. But Truth Social isn’t starting from a particularly strong base.

Not in the same league as other social sites

Ranked by US monthly active users (MAUs) for iOS and Android combined in February, here is how Reddit and Truth Social stack up in round numbers vs. key competitors:

| 142,409,000 | |

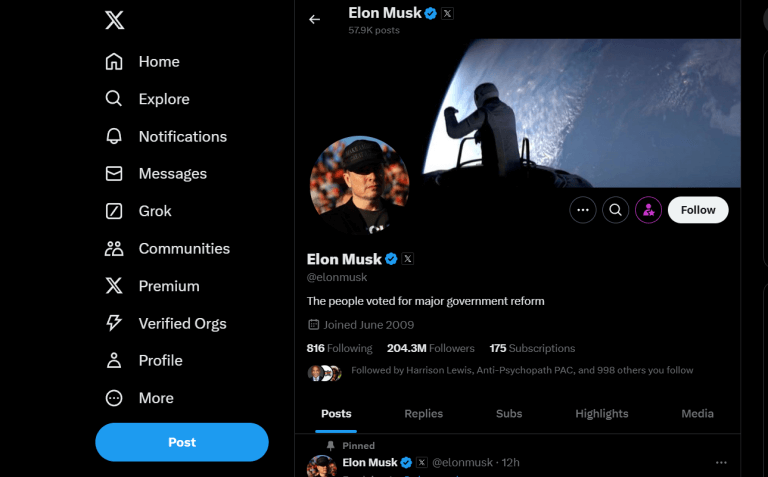

| X (formerly Twitter) | 74,996,000 |

| 71,812,000 | |

| Threads, an Instagram app | 7,244,000 |

| Truth Social | 494,000 |

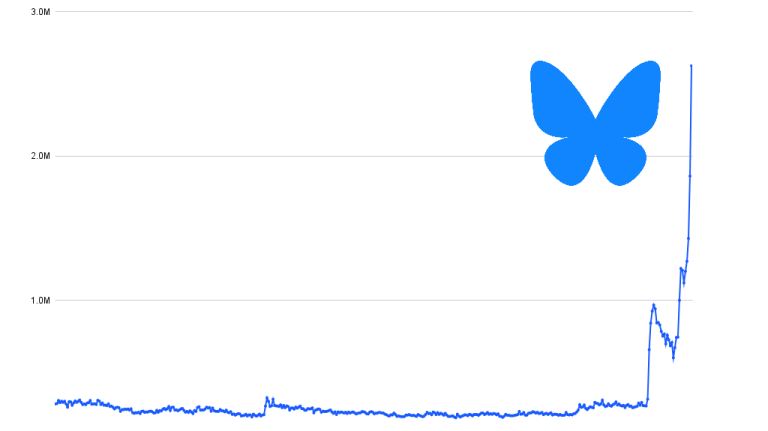

Comparing Daily Active Users (DAUs), MAUs, or recent downloads/installs for Truth Social vs. its most relevant competitor, X (formerly Twitter), we can see a 500-1,000x difference in user engagement and activity. Truth Social’s audience is far smaller than Threads, the alternative to X that Facebook owner Meta Platforms launched in July.

A meme stock on steroids

That Truth Social’s current valuation is disproportionate to its digital engagement and other fundamentals would seem obvious, says Tom Liu, a Vice President of Data Labs at Similarweb, who has been working with the Similarweb Stock Intelligence team on analysis of both Truth Social and Reddit. Yet somehow, it’s not obvious to the market, perhaps because of meme stock. Of course, Reddit is ground zero for the meme stock phenomenon, with speculators in its user base who might be boosting the stock today but ride a backlash against it tomorrow.

“Still, given a choice between the two, Reddit is a more plausible success story, with a unique business case that it has been building for years and a chance, now, to prove its value as an investment by capitalizing on a dedicated user base,” Liu says.

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com.

Contact: For more information, please write to press@similarweb.com.

Report By: David F. Carr, Editor, Insights News & Research

Disclaimer: All names, brands, trademarks, and registered trademarks are the property of their respective owners. The data, reports, and other materials provided or made available by Similarweb consist of or include estimated metrics and digital insights generated by Similarweb using its proprietary algorithms, based on information collected by Similarweb from multiple sources using its advanced data methodologies. Similarweb shall not be responsible for the accuracy of such data, reports, and materials and shall have no liability for any decision by any third party based in whole or in part on such data, reports, and materials.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!