Amazon Subscribe & Save: Is it Worth it for Your Brand?

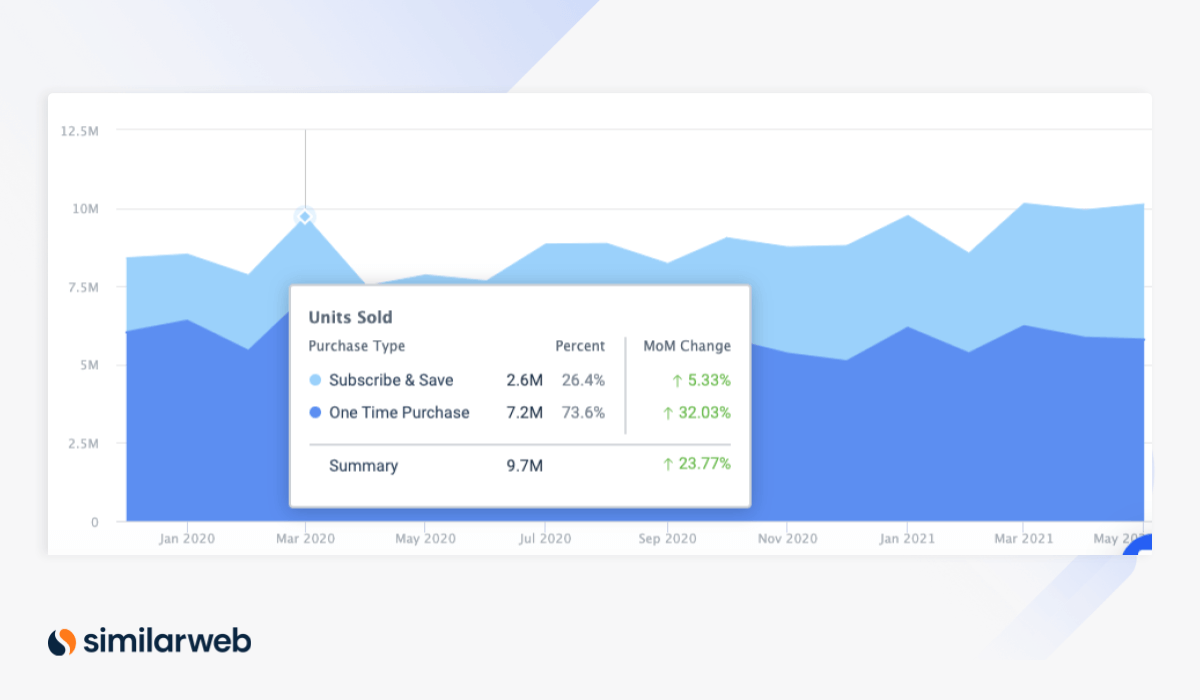

Subscribe & Save, Amazon’s subscription program can potentially be a major growth driver for brands. Consider this: From December 2019 to May 2021, grocery revenue on Amazon climbed over 50% from this feature alone. While increased online shopping due to the pandemic helped spur this boom, 52% of shoppers plan to continue to purchase groceries online after recovery. The popularity of such subscription programs is putting a spotlight on Subscribe & Save as a selling strategy for CPG brands.

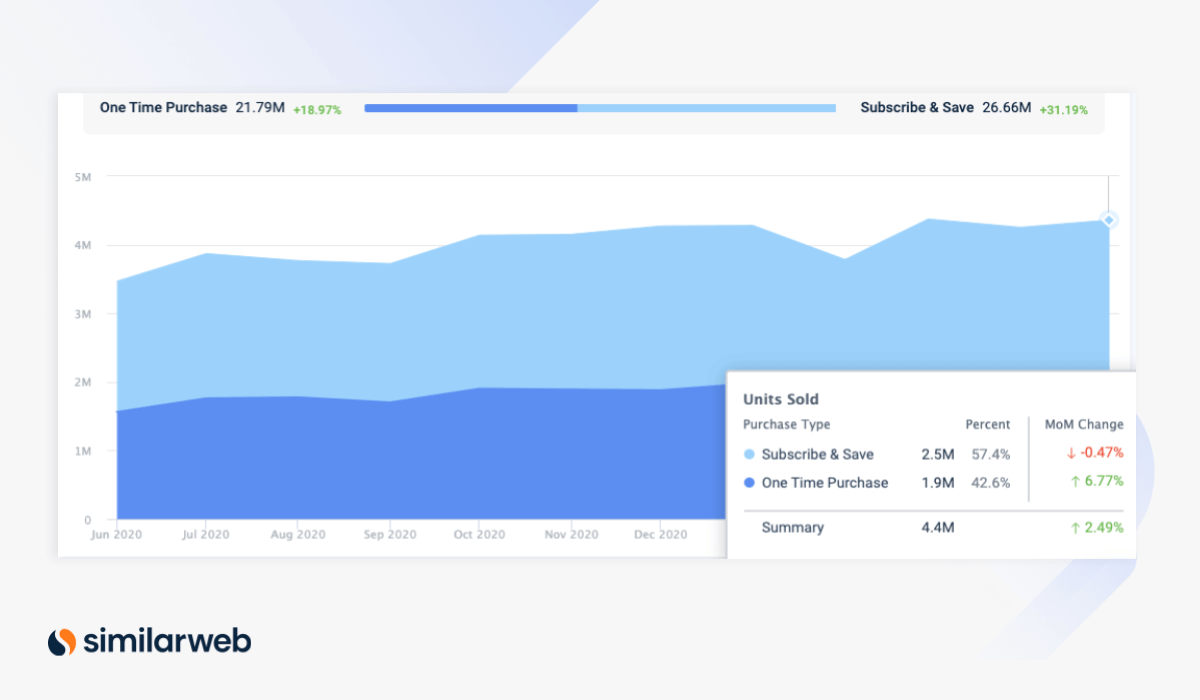

To help you determine if you should offer subscriptions, we’ll use Subscribe & Save insights, a new feature of Shopper intelligence, our eCommerce intelligence platform to analyze Amazon’s top categories.

What is Amazon Subscribe & Save?

Subscribe & Save is Amazon’s subscription model that allows customers to sign up for regular shipments of products at a discount. In order to participate, sellers must have a fulfillment by Amazon (FBA) account and be in good standing.

Pros

For sellers, key pros include:

-

- Increased customer loyalty as customers sign-up for recurring, scheduled deliveries of products that they use frequently.

- Reduced customer acquisition costs.

Cons

Brands may hesitate to offer Subscribe & Save due to the:

- Shrinking margins since sellers fund the base discount on deliveries offered to subscribers.

- Lack of performance data.

To help weigh the pros and cons, we recently added Subscribe & Save insights to Shopper Intelligence. This feature analyzes brand and category revenue and estimates how many customers are lost to Subscribe & Save to help you gauge if subscription program discounts are worth it for your brand.

Top Subscribe & Save categories on Amazon

Using Subscribe & Save insights we’ll analyze the top categories benefiting from the feature, and their products on Amazon.com, to see if Subscribe & Save is right for your brand.

1. Pet supplies

Pet supplies, particularly food, are everyday essentials for households with pets. This product needs to be restocked on a regular basis, making pet supply brands strong candidates for Subscribe & Save.

Twenty-eight percent of revenue for Amazon pet supplies comes from subscriptions and this figure continues to grow – nearly 18% month-over-month (MoM) in May alone. The most popular pet supplies products are:

- Dog food: At nearly 58% of revenue, dog food has the highest Subscribe & Save rate across all Amazon.com categories. Its subscription rates are more than 20 percentage points (ppts) than “human food” (groceries) at 33.9%.

Subscribe & Save for Amazon dog food, one of the most popular categories for subscriptions (via Shopper Intelligence)

- Cat food: Subscription rates for cat food is also high (45.9%), but show signs of plateauing. In May 2021 cat food rates declined by 4% (MoM) while dog food increased by 7% (MoM).

Dry vs. wet food?

With a difference of only 2 ppts, 58% vs. 56%, respectively, both dry and wet dog food are strong fits for Subscribe &Save.

Key takeaways

- With more than half of revenue coming from subscriptions on Amazon.com, it’s clear that pet supply manufacturers should offer shoppers pet food subscriptions. Even if you don’t distribute on Amazon.com, chewy.com, and other retailers offer similar programs, like “Autoship & Save,” to enroll in.

- Because the majority of consumers already subscribe to pet food products on Amazon.com, dog and cat food brands need to create awareness for their brand somewhere else. Consumers are not using the Amazon marketplace as a search and discovery platform for pet food. If companies want to make customers switch to their own brand, they need to convince them outside of Amazon.

2. Vitamins and supplements: High dose of Amazon subscriptions

Thirty-eight percent of revenue for Amazon Vitamin & Supplements comes from Subscribe & Save, exceeding the pet supply category as a whole. While the Vitamins & Supplements segment matches dog food’s strong metrics, here is the biggest winner:

Supplements

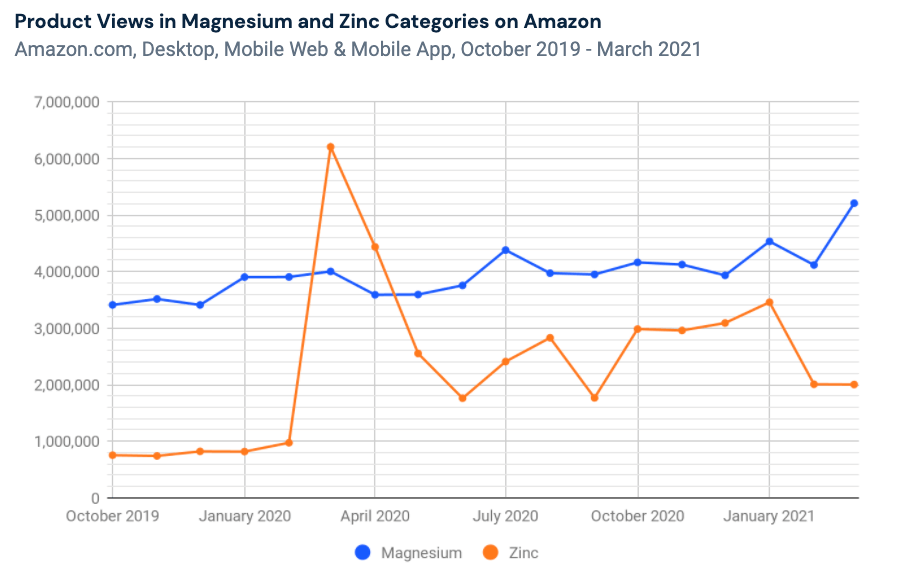

Subscriptions account for 43% of supplements’ revenue (versus just 33% for minerals within the category). Accelerated demand during the onset of COVID-19 contributed to these high numbers, when consumers started browsing (and buying) supplements like Zinc, to boost their immune systems.

Back in March 2020, subscription rates for supplements made up just over one quarter (26.4%) of overall revenue, rising to 43% in May 2021.

What’s fueling the demand?

Although the pandemic jumpstarted demand, the healthy, non-perishable nature of vitamins and supplements makes them practical products for subscriptions. Shoppers can get nutrition naturally through produce but supplements have a much longer “shelf life.”

We also suspect that once shoppers sign up for regular shipments of vitamins or supplements, many don’t bother to unsubscribe. This contributes to the continuous growth of category subscription revenue.

Key takeaways

- With nearly half of the revenue for supplements coming from Subscribe & Save, a number that continues to grow (+10.5% in May 2021), brands should consider offering consumers regular, discounted deliveries for vitamins and supplements. This can be through Amazon’s marketplace or even through direct-to-consumer (DTC ) channels.

- To help increase revenue, brands may want to consider offering bundles of individual vitamin and supplement products through Subscribe & Save. These may appeal to a large number of consumers ( half of U.S. adults) who take multivitamins, which have been under heat recently for not providing promised health benefits.

3. Grocery & gourmet

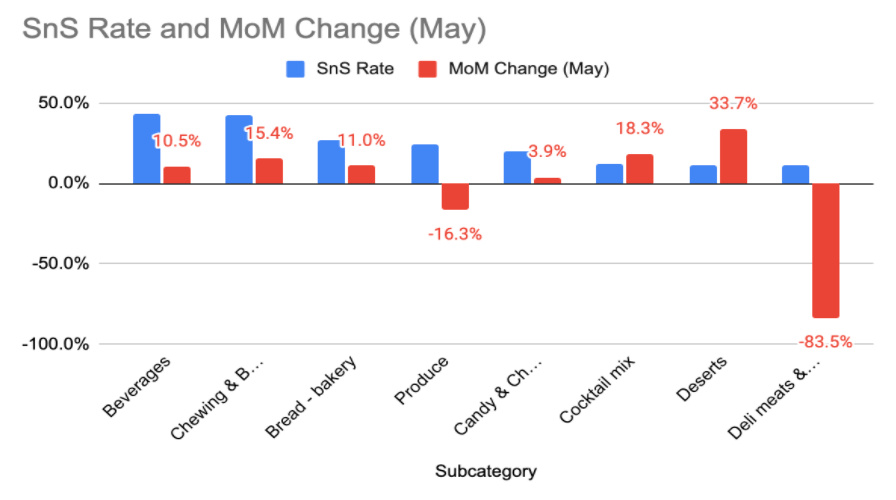

Although subscription rates have grown for Amazon groceries over the past 18 months, we also see that rates for some sectors are declining significantly as vaccinated consumers return to the grocery stores.

In May, subscriptions for deli meats and cheeses declined by 85%, and produce decreased by nearly 17%! Consumers prefer to purchase these fresh foods in person when they can buy them at local produce stands and delis. They are also not too difficult to transport, compared to other bulk items for the home and dog food.

Beverages, which can be a hassle to carry, have among the highest Subscribe & Save rates (43.1%) for groceries. Chewing & bubble gum is right behind (42.8%), in part due to the lack of in-store impulse purchases during the pandemic.

Chocolate, however, which is at the risk of melting, scores much lower (20.3%) with lower MoM growth (+3.9%) than gum (+15.4%).

Key takeaways

- Brands that sell items like fresh vegetables, fruit, cheese, and meat, in which there is a premium on freshness, should stay away from offering subscriptions. We anticipate these to decline further as more consumers return to in-store shopping.

- Heavy items, like beverages, and essentials, like gum, on the other hand, are Subscribe & Save candidates. While cocktail mixers are legit candidates, be aware that while cocktail mixers are legit, actual products like alcoholic beverages cannot be offered via Subscribe & Save.

More Subscribe & Save metrics

This is just a quick analysis of Amazon’s leading Subscribe & Save categories. To benchmark against additional category averages and products, download our benchmarks.

Also, get your own Subscribe & Save insights and other customer loyalty metrics by signing up for Shopper Intelligence, our eCommerce intelligence tool.

The ultimate edge in retail insight

Put the full picture at your fingertips to drive product views and sales