Stock Intelligence

Stock Intelligence

You Don’t Need X-Ray Vision with Similarweb, the Must-Have Alternative Data Provider

The alternative data landscape is booming. There’s increased demand for both public and private investors to use alternative data sources. If you’re unfamiliar with alternative data, it’s defined as data from non-traditional sources used to obtain insight into the investment process. Using alternative data should ultimately augment analyses to make better investment decisions.

Popular types of alternative data include web traffic, app traffic, credit card data, email receipts, and geolocation data. The list of alternative data providers has tripled in the past decade and continues to grow.

If you haven’t invested in alternative data, you’re not the first. What you don’t want to be is last. The first question to ask yourself is: which alternative data provider should I invest in?

Many forms of alternative data are one-dimensional. Similarweb’s data presents endless use cases and allows for a holistic view of digital performance with real-time insights. Similarweb is the most crucial alternative data provider you need and here’s why.

Learn more about the top 10 Similarweb API use cases.

The ability to leap tall data stacks

More sophisticated hedge funds or private investors (venture capital and private equity) tend to use multiple alternative data providers for different datasets to input into their models or due diligence processes. You don’t want to rely on a dataset that serves a single purpose, a one-trick pony if you will. Credit card, email receipt, or geolocation data tend to not be impactful as standalone sources.

Similarweb data is powered by website and app traffic and there are countless ways to gauge digital performance of a company or industry. Tracking traffic growth and benchmarking to competitors or a sector is a crucial component in your analyses, whether performing due diligence on a private company or evaluating a public entity’s performance.

Website traffic data is powerful. It rivals other types of alternative data, like credit card data, and has stronger indicators or correlations. For example, coupling web traffic to a conversion page with an Average Order Value (AOV), aligns closer to revenue actuals. Let’s look at this in action.

Segment Analysis allows you to analyze traffic to any web page like a signup confirmation page. The streaming giant Netflix is a subscription service with an average subscription cost of $9.99. When you isolate traffic to the Netflix sign-up page and multiply it by the AOV, you’ll be left with a revenue estimate.

In the U.S.there were 217K unique devices that completed their Netflix subscription sign-up journey in May 2022 on desktop alone. You can assume that Netflix collected ~2.2M dollars from new subscribers that signed up through this channel.

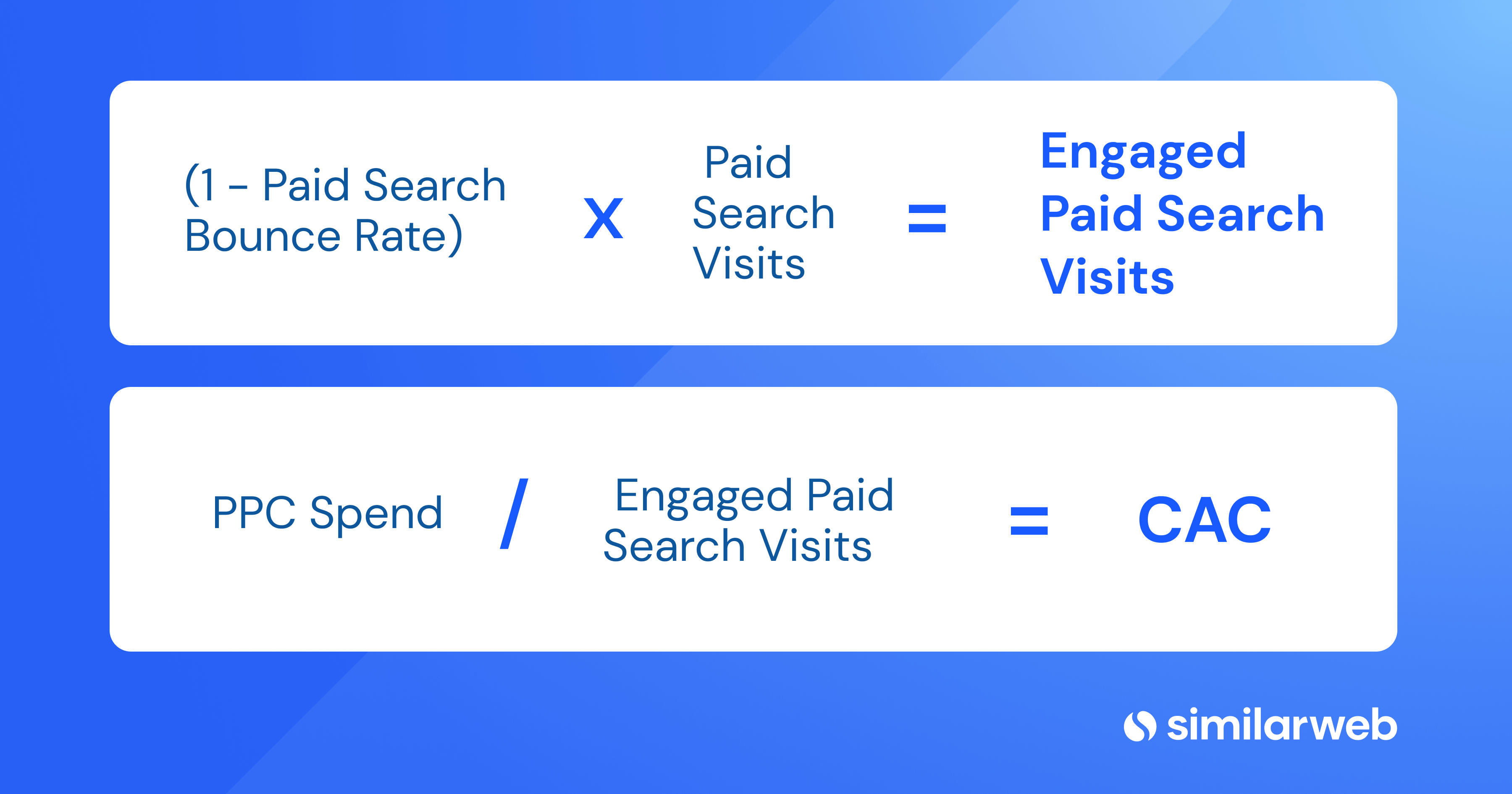

To calculate a proxy for Customer Acquisition Cost (CAC), you divide Pay Per Click (PPC) spend by engaged paid search visits or backtest reported marketing spend against paid traffic.

These are a few ways to get tremendous value from Similarweb web traffic and engagement data and strengthen your investment theses or process.

Read more: Subscription Business Metrics that Define Performance

Real-time data faster than a speeding train

Data latency is a huge factor in assessing company performance. What good is adding stale data to your model after earnings or receiving last quarter’s sector research when you’re already halfway through this quarter and your due diligence should have been done yesterday.

SaaS technology like Similarweb at your fingertips allows you to analyze performance in real-time. No more waiting for stale market research.

There’s no better example than the impact of COVID. Having the ability to track daily data as consumer behavior was shifting overnight allowed investors to stay on top of industry trends, KPIs and market shifts.

The ‘Last 28 Days’ filter lets Similarweb users see data added to the platform on the daily. They tracked and quantified the growth of consumer search trends like toilet paper or n95 masks and even monitored daily traffic to sites like grocery delivery service Instacart.

Instacart’s daily visits grew from 689K on March 1st 2020 to 1.81M by March 30th, highlighting newly formed behaviors. Importantly, behaviors that stuck.

Firms and analysts relying on expensive market research and reports would have waited months to understand these shifts and their impact. That’s too late to act.

The alternative data provider of steel

Coverage can be inconsistent with many alternative data providers. Many focus solely on the U.S. or are regional. Similarweb data has worldwide coverage, extracting data from 190+ countries and offers 59 country-level views. In today’s global economy, it’s essential that you’re able to view holistic performance and Similarweb helps you to do just that.

Similarweb data also encompasses desktop, mobile, and app traffic. This differs from many alternative data solutions since they tend to focus on one specific medium or channel. For example, investing in solely an app data provider only enables you a limited view rather than the complete insight.

And, because different firms are at different stages of data sophistication, Similarweb offers multiple points of access:

- Intuitive interface

- Investors API (Application Programming Interface) data feeds

- Bulk data delivery to S3 or Snowflake

Web traffic and engagement data don’t need a red cape

In the digital world we live in, you need digital market intelligence data to make the most well-informed investment decisions. There are many forms of alternative data and the number of vendors continues to grow significantly every year. To get the most out of your investment in alternative data, put your money behind a solution that is flexible, accessible, and can provide tremendous ROI. That’s a no-brainer.

Invest using the most insightful asset research

Leverage data used by 5,000+ companies to improve your strategy