Block’s Cash App Offsets Soft Traffic for Square, Afterpay

In the second quarter, Block Inc.’s Square and Afterpay businesses saw traffic declines, but the company’s Cash App mobile wallet remained a strong performer. Block is set to report earnings on Wednesday, August 3.

With its name change from Square to Block at the end of 2021, Block Inc. signaled it wanted to make Bitcoin and applications of the blockchain more central to its business – but given the current cryptocurrency crash, the company is fortunate to have a solid foundation independent of crypto.

Key takeaways

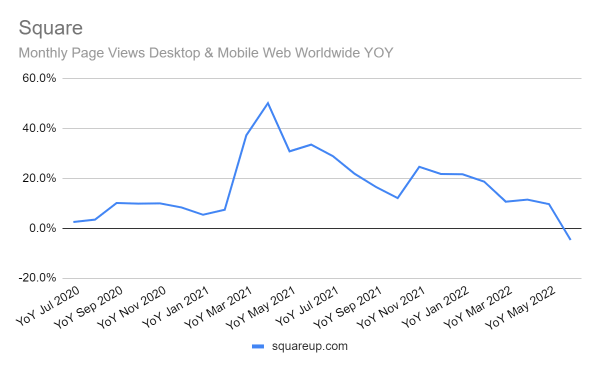

- Traffic to squareup.com, where Block’s Square merchant payments business is anchored, slowed in Q2. In June, page views were down 4.7% on a year-over-year basis, according to Similarweb estimates. Page views are one of the metrics our Investor Intelligence team follows most closely as a signal of merchant activity.

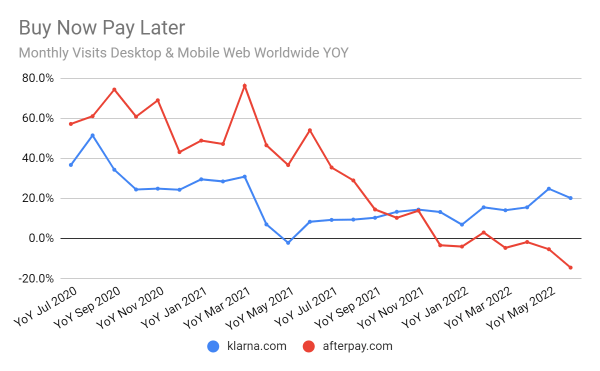

- By the same measure of page views, traffic to Block’s Afterpay Buy Now Pay Later consumer credit business was down 14.5% year over year.

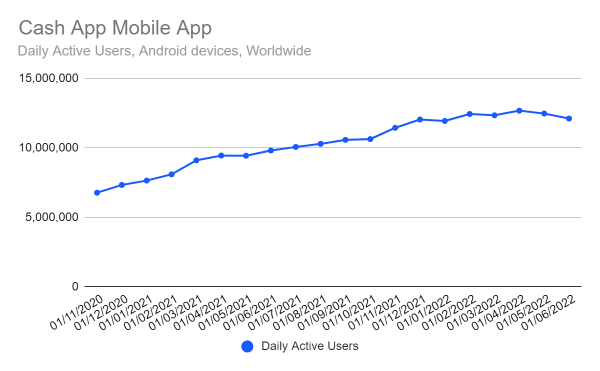

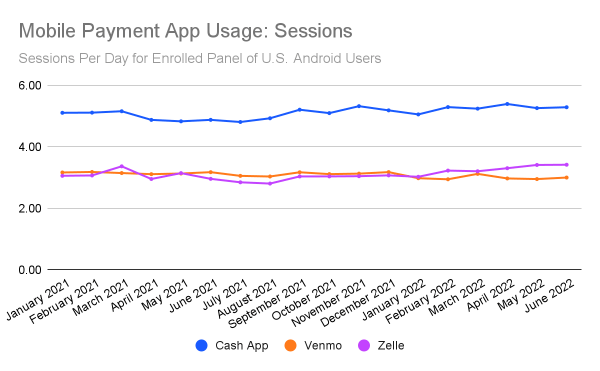

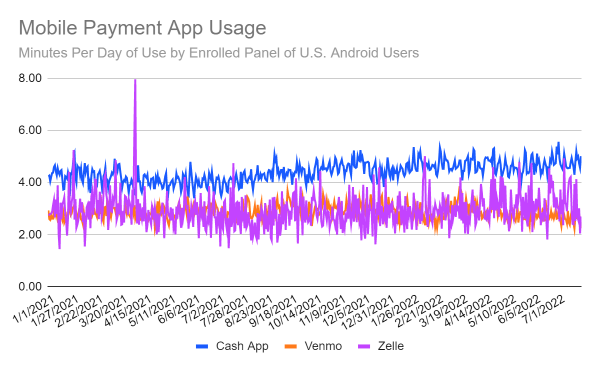

- Cash App adoption is up about 30% from where it was at the beginning of 2021, based on data from Similarweb’s enrolled panel of U.S. Android users, and engagement metrics are also trending up. The average number of sessions per day and time per day spent on the app are also higher than for competing apps like Venmo and Zelle.

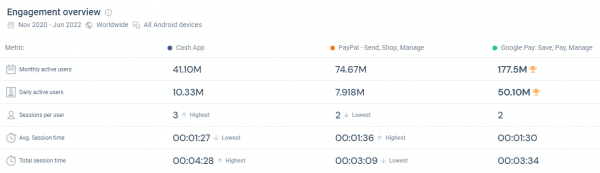

- Even where Cash App faces stiff competition from a platform owner, as with Google Pay on Android, PayPal remains a name to beat in digital payments. However, engagement metrics for Cash App are stronger than either of those two on Android, according to Similarweb estimates.

Block built its business around the Square credit card reader for mobile phones, which proved popular with small businesses and any business wanting to collect money in the field or on the store floor rather than from behind a retail counter. From there, it built a broader family of merchant services around the Square name before adding Cash App, a mobile wallet for person-to-person payments as well as retail payments. Cash App broadened to support more consumer banking and investment services, including buying and trading cryptocurrencies.

Square still represents 51% of Block’s gross profit ($661 million out of $1.3 billion in Q1 2022), but Cash App has been the fast growth part of the business.

In January, Block completed the acquisition of Afterpay, one of the leaders in Buy Now Pay Later consumer financing. Afterpay revenues are being reported as contributions to the Square and Cash App business lines.

Block CEO Jack Dorsey made his vision for the long-term value of Bitcoin a focus of the company’s investor day in May, even though the association with crypto may be undermining the company’s stock price. However, the crypto business is still more of an experimental side bet so far. In its last quarterly report, Block said less than 5% of gross profits were related to Bitcoin.

Square and Afterpay merchant business slows

Square’s mobile app credit card readers and complementary products continue to be a strong foundation for the company. However, when Square merchants are making fewer sales, that’s less business for Block, and turmoil in the economy is reflected in the traffic statistics.

Total page views to squareup.com, a sign of merchant activity, were down 4.7% on a year-over-year basis in June. In months prior, the domain had been seeing traffic grow, but more slowly (10.4% in April, 9.6% in May).

By the same measure, Block’s Afterpay BNPL business seems to be losing ground to its close rival Klarna. Afterpay attracted slightly more page views in June than Klarna, but was down 14.5% year over year by that metric. Klarna’s page view traffic has been trending higher and was up more than 20% in June.

The BNPL industry could wind up looking less attractive if economic turmoil leads to more consumers defaulting on the “pay later” part of the bargain. Apple’s planned entry into BNPL this fall as an additional feature of its Apple Pay platform could also make it harder to compete for BNPL customers who are iPhone users.

Mobile payment power

Over the past couple of years, Cash App has seen a strong upward trend in daily active users. The chart below shows the worldwide trend for Android, the platform for which we have the best data.

In the US, Cash App mobile adoption has increased by approximately 30% since January 2021, based on statistics gathered from Similarweb’s enrolled panel of Android users. The average time Cash App users spent per day on the app has increased by 15% over that same period. The average number of sessions per day and time spent using the app per day is also higher for Cash App than for Venmo and Zelle.

However, Cash App also competes with Google Pay and Apple Pay, which hold commanding positions on Android and iOS, respectively.

Based on Similarweb’s worldwide data for Android, Google Pay holds a big lead over Cash App in both monthly active and daily active users. So does PayPal. However, Cash app leads both competitors in sessions per user and total time spent per user.

In other words, those who use Cash App use it more regularly.

Cash App also growing on the web

On the web, where Cash App services are available at cash.app, the service is seeing growth at a time when traffic to Paypal, the most established digital payment service, is dropping. June monthly visits to cash.app were up 37% year over year, while traffic to paypal.com was down 16%. Cash App web traffic has been up consistently all year – by triple digits some months – while paypal.com traffic has seen declines. PayPal still gets more than 40 times as much traffic as Cash App, however, and Block is clearly more focused on winning mobile customers for Cash App.

Cash is good business

Block shows that making money off of managing money is good business. Despite facing economic headwinds, Square is a solid business, Cash App is a major player in digital wallets, and Afterpay represents a significant new bet on BNPL. If Bitcoin matures into a better tool for managing and exchanging money, Block will be ready – and may even help bring about the change away from boring, old fiat currencies.

The Similarweb Insights Newsroom is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Disclaimer: All data, reports and other materials provided or made available by Similarweb are based on data obtained from third parties, including estimations and extrapolations based on such data. Similarweb shall not be responsible for the accuracy of the materials and shall have no liability for any decision by any third party based in whole or in part on the materials.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!