What is Quantitative Data? Your Guide to Data-Driven Success

In the world of market research, quantitative data is the lifeblood that fuels strategic decision-making, product innovation and competitive analysis.

This type of numerical data is a vital part of any market research professional’s toolkit because it provides measurable and objective evidence for the effectiveness of market and consumer behavioral insights.

Here, we’ll dive into the different types of quantitative data and provide a step-by-step guide on how to analyze quantitative data for the biggest impact on business strategy, optimization of campaigns, product placement and market entry decisions. All with a little help from Similarweb.

Let’s dive right in!

What is quantitative data?

Simply put, quantitative data is strictly numerical in nature. It’s any metric that can be counted, measured or quantified, like length in inches, distance in miles or time in seconds, minutes, hours or days.

Basically, it’s the type of data that answers questions like ‘how many?’, ‘how much?’ or ‘how big or small?’.

If you’re a market research professional, we’re talking statistics like market share percentage, web traffic visits, product views and ROI – all the crucial data you need to accurately gauge market potential.

Quantitative vs. qualitative data: what’s the difference?

If quantitative data is concerned with numbers, qualitative data deals with more descriptive or categorical information that can’t be as easily measured.

Quantitative answers ‘how much’ but qualitative explains ‘why’ or ‘how’. This can be simple information like gender, eye color, types of cars or a description of the weather, i.e. very cold or rainy.

In business, qualitative data is information collected from things like research, open-ended surveys or questionnaires, interviews, focus groups, panels and case studies. Anything that delves into the underlying reasons, motivations and opinions that lie behind quantitative data.

Together, quantitative and qualitative data paint a reliable and robust picture. Quantitative data offers the assurance of fact and evidence, while qualitative data gives essential context and depth, and is able to capture more complex insight.

This match made in ‘data heaven’ leads to the best possible foundation for informed, data-driven decision making across the entire business.

Read our complete guide: The Difference Between Qualitative and Quantitative Research

What are the advantages and disadvantages of quantitative data?

Advantages of quantitative data:

✅ Accuracy and precision

Quantitative data is numerical, which allows for precise measurements and accuracy in the results. This precision is crucial for statistical analysis and making data-driven decisions where exact figures are key

✅ Simplicity

Numerical data can often be easier to handle and interpret compared to more complex qualitative data. Graphs, charts and tables can be used to represent quantitative data simply and effectively, making it accessible to a wider audience

✅ Reliability and credibility

Quantitative data can be collected and analyzed using standardized methods which increase the reliability of the data. This standardization helps in replicating studies, ensuring that results are consistent over time and across different researchers or studies

✅ Ease of comparability

Since quantitative data is numerical, it can be easily compared across different groups, time periods or other variables. This comparability is essential for trend analysis, forecasting, and competitive benchmarking/analysis

✅ Scalability

Quantitative research methods are generally scalable, meaning they can handle large sample sizes. This is particularly advantageous in studies where large data sets are required for generalizability of the findings

Disadvantages of quantitative data:

❌ Lack of context

What quantitative data has in precision, it lacks in broader context – or the “why” behind the data. While it shows the numbers and trends, it may not explain the underlying motives, emotions or experiences which are better captured by qualitative data

❌ Inflexibility

Once a quantitative data collection has begun, altering the process can be difficult or even impossible. This inflexibility can be a disadvantage if initial assumptions change or if unexpected factors arise

❌ Oversimplification

While the simplicity of quantitative data is certainly an advantage, it can also lead to oversimplification of complex issues. Reducing complex human behaviors or social phenomena to mere numbers can sometimes lead to the wrong conclusions or missed nuances

❌ Resource heavy

Quantitative research often requires significant resources in terms of time, money and expertise. Large-scale surveys and experiments necessitate comprehensive planning, robust data collection tools and sometimes sophisticated statistical analysis, making them very resource-intensive

❌ Surface-level insight

Quantitative data can provide broad overviews and identify trends but might not delve deep enough to extract truly useful insight. It tends to offer surface-level insights, which might be insufficient when detailed understanding or deep explorations of issues are required

Quantitative data examples

Quantitative data is an integral part of our day-to-day life, as well as being critical in a business sense. To get a clearer picture of what sort of information qualifies, let’s start with some more everyday examples of quantitative data before moving on to a few quantitative market research examples:

🌡️ Temperature: Most of us check the weather every day to decide what to wear and how to plan our activities; it’s also a critical metric for cooking and heating your home.

⚖️ Height and weight: Regular measurements can monitor growth in children or manage health and fitness in adults.

🕐 Time: We use time data to manage almost every part of our lives, from timing a morning commute or setting alarms for appointments, to making future plans.

⚡️ Speed: This helps in gauging how fast a vehicle travels, influencing travel time estimates and safety considerations.

📚 Test scores: Teachers and students use these to assess academic performance and areas of improvement.

❤️ Heart rate: Monitored during exercise or for health management, indicating physical exertion levels or potential medical conditions.

🥗 Calorie intake: Counting calories is a common method for managing diet and health

🚶 Number of steps: With fitness trackers, counting steps has become a popular way to gauge daily physical activity.

Ready for some market research-specific examples of quantitative data?

This type of data is absolutely indispensable in market research as it provides a foundation to analyze the market, consumer behavior and business performance. Here’s how market research professionals often leverage quantitative data:

- Sales volume and revenue: These metrics help businesses understand market demand and the financial success of their products and services

- Market share: This is a good example for quantitative data that helps companies gauge their competitive edge and market presence

- Conversion rates: Useful for evaluating the effectiveness of promotional activities and customer service initiatives

- Advertising spend and ROI: Businesses assess the profitability and effectiveness of their marketing campaigns

- Engagement rates: These metrics show how engaging online content is and how effectively it converts viewers into customers

- Web traffic: Analyzed to determine the effectiveness of online presence and digital marketing strategies

- Marketing channel performance: Evaluating direct, organic search, email, social media, paid search and referral traffic are vital for understanding the most lucrative marketing channels to invest in

What are the different types of quantitative data?

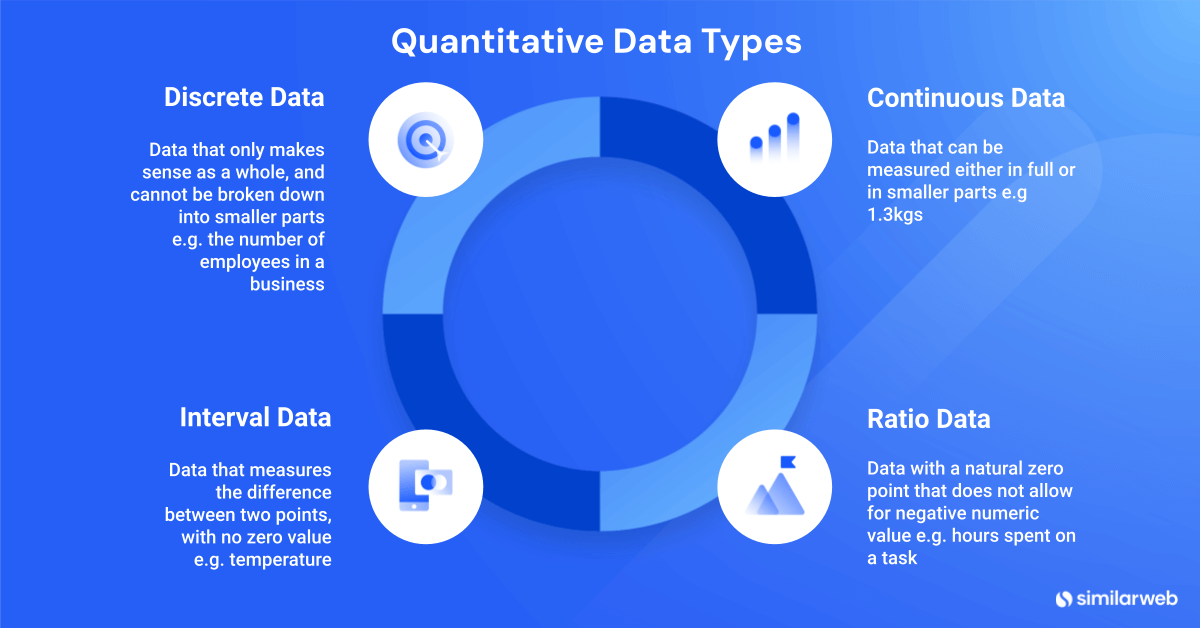

1) Discrete data

These are numbers that can’t be broken down into smaller parts and only make sense as a whole when you list them. This could be the number of employees in a business or sales volume, as you can’t have 1.3 of a person or half a unit sold.

2) Continuous data

This is the type of data that can be measured both in full or broken down into smaller parts, making it continuous. Examples of continuous data include height or weight metrics as it is possible to have 0.5 kilograms of flour. In business sense, something like revenue or advertising spend is continuous as it can be any value, including decimals.

3) Interval data

This type of quantitative data measures the difference between points and doesn’t have a real starting point or value of zero. For example, temperature always exists, even at zero degrees – which is merely a point on the temperature scale. But it’s still useful to be able to discuss the difference between 30 and 40 degrees.

4) Ratio data

Unlike interval data, ratio data has a natural zero point, which means that zero means nothing is there. This allows for the calculation of ratios. Examples of ratio data could be time spent doing a task (where 0 hours means no time was spent at all) or conversion or engagement rates (where 0% engagement means no interaction.)

5) Ordinal data

Though this type of data is technically qualitative, ordinal data can often be seen as quantitative, especially when used in statistical models. For example, in categories such as a customer satisfaction scale from 1 to 10, where higher numbers indicate higher satisfaction.

What are the main collection methods of quantitative data?

Most types of research simply would not be possible without quantitative data, and there are many different ways of collecting this type of information, depending on the context. To start, here are some broad ways of collecting quantitative data:

- Surveys

- Experiments

- Observations

- Document and record analysis

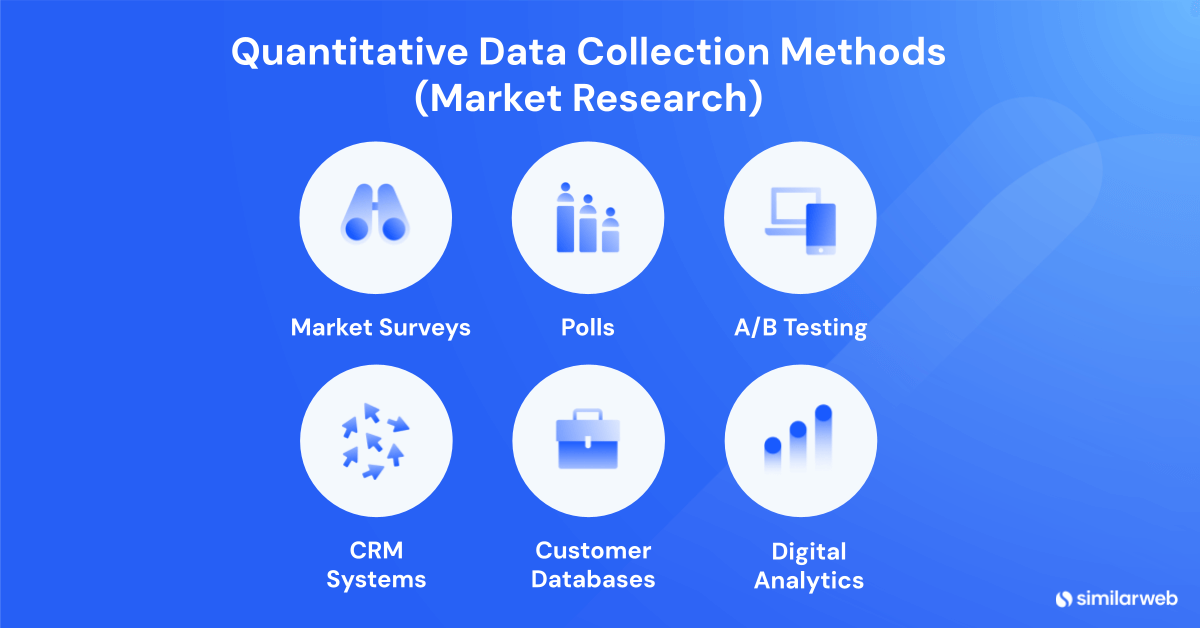

In the realm of market research, quantitative data will often be gathered to shed light on market dynamics, trends or consumer behavior. Here are some specific examples of how market research professionals may collect quantitative data:

Market surveys and polls – Surveys and polls are designed to gauge consumer opinions and preferences, and can gather large volumes of data from targeted demographics that can be used to enhance product development and marketing strategies.

Digital analytics – With tools like Google Analytics and Similarweb, market researchers can analyze online behavior and track website interactions, marketing channel engagement and online purchasing patterns.

Customer databases and CRM systems – Transactional data gathered by customer relationship management (CRM) systems can be used to better understand things like purchase behaviors, customer lifecycle and audience loyalty trends.

A/B testing – This is an experimental approach used extensively in digital marketing to compare two versions of something, such as a landing page or email subject line, to determine which performs better in terms of user engagement and conversion rates.

Why is quantitative data so important in market research?

It’s hard to imagine a world without quantitative data. It would likely be very tricky to do your job, depending on what industry you work in.

Indeed, quantitative data is often indispensable to businesses across a wide range of industries as it provides a solid foundation for analyzing trends, measuring the effectiveness of different strategies and predicting future outcomes. But that’s just the tip of the iceberg. Here’s why quantitative data is so critical, particularly within the realm of market research:

Data-driven decision making

Quantitative data takes away a lot of the guesswork and subjectivity when it comes to making important decisions. With numbers and statistics, businesses can move beyond conjecture and personal bias to make more objective, data-backed decisions. In market research, this is particularly important when deciding whether to enter a particular market or expand within an existing one.

This is where Similarweb steps in 👋

Similarweb’s platform offers powerful market research tools that streamline the gathering and analyzing of quantitative research, particularly useful when evaluating a potential new market or expanding within a current one.

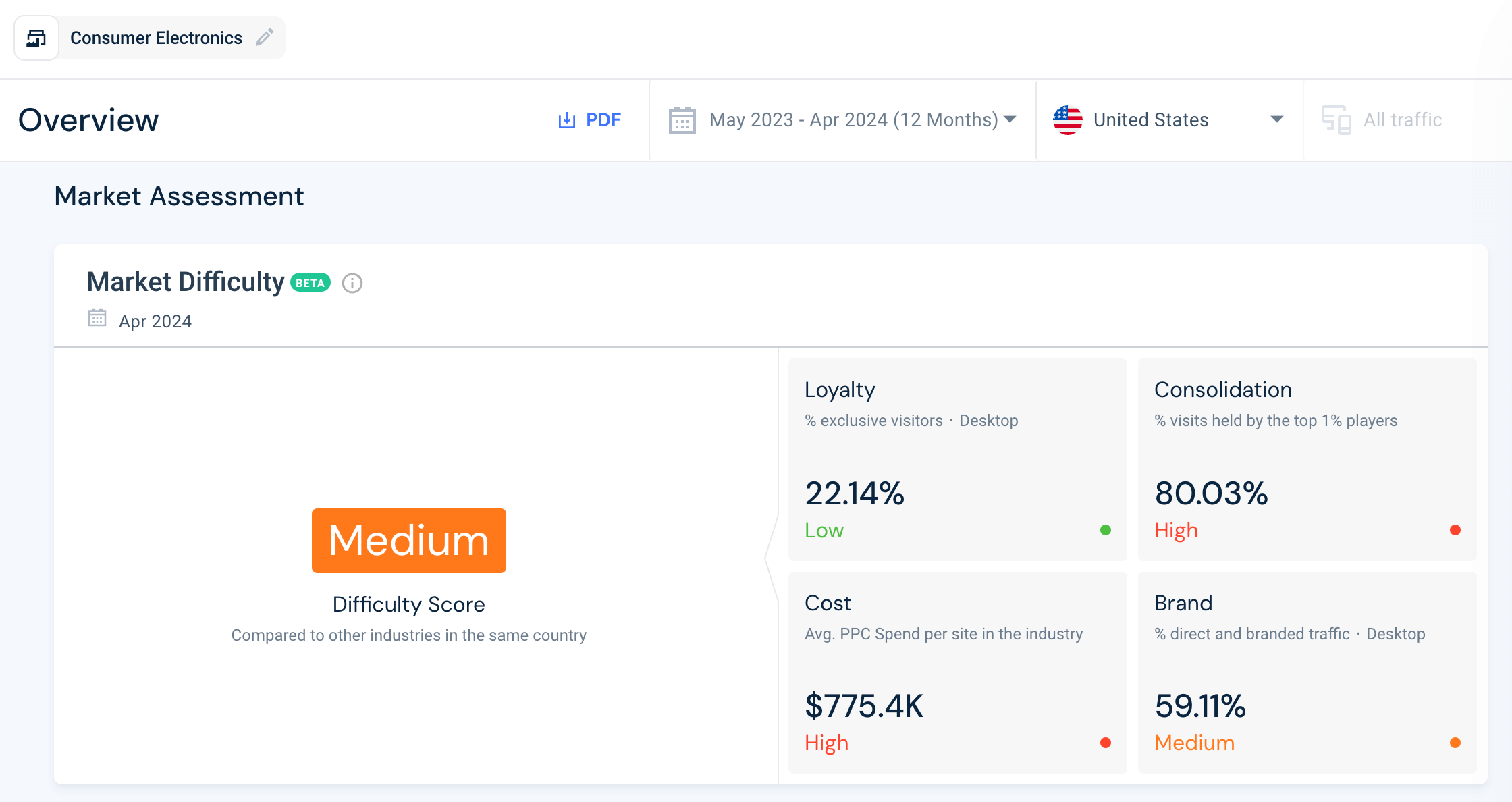

Market research professionals need look no further than Similarweb’s Market Analysis feature, which provides detailed insights into how challenging it may be to penetrate a particular market.

It does this by analyzing quantitative data surrounding competitor density, market saturation, and customer loyalty to get a robust picture of the competitive landscape.

As an example, here’s a snapshot of the market difficulty for the Consumer Electronics industry, using Market Analysis:

Here, we can see that based on a variety of analyzed quantitative data, market difficulty is ‘medium’, meaning it would be moderately challenging for new entrants to gain a foothold or existing players to increase market share, and would require time and investment.

You may think this means that an electronics company can simply choose whether on not to launch a new product or grow their market share based on this medium difficulty.

However, the devil is often in the details. When you break down the metrics on display and investigate further, more nuanced insights emerge about how a company can succeed in the market:

Loyalty

Audience loyalty in the Electronics and Technology industry – measured by the percentage of exclusive website visits (meaning the customers did not look at more than one brand) – is fairly low at 22.14%. Here’s a further breakdown, highlighting the top players:

This suggests that customers that are interested in Consumer Electronics sites are not particularly loyal to a single brand and will switch easily, indicating a price-driven market.

Therefore, a new market entrant should focus on developing unique value propositions, loyalty programs, or more competitive pricing models in order to gain traction in this otherwise difficult market.

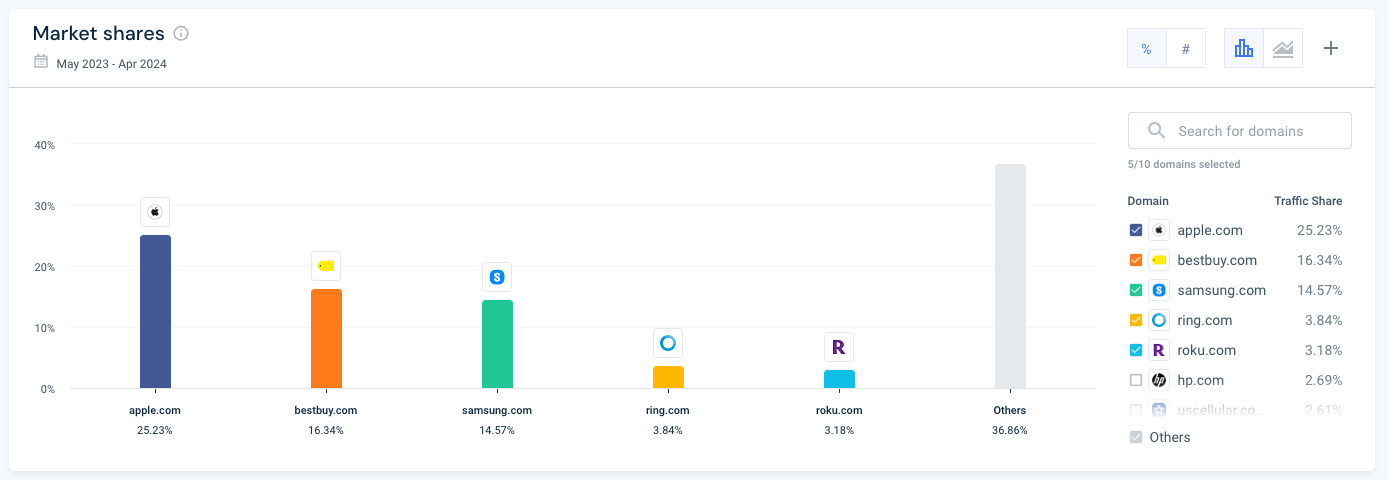

Consolidation

This engagement metric is concerned with the percentage of players that hold the most market share (measured in website visits). In this industry, the consolidation rate is high, with the top 1% of players getting a whopping 80.03% on website visits.

While this means the competitive landscape is dominated by a few large players (Apple, Samsung etc.,) smaller players may be able to edge their way in:

Indeed, with this information, new entrants can strategically focus on targeting niche segments within the wider industry or creating innovative strategies to set themselves apart from the usual suspects.

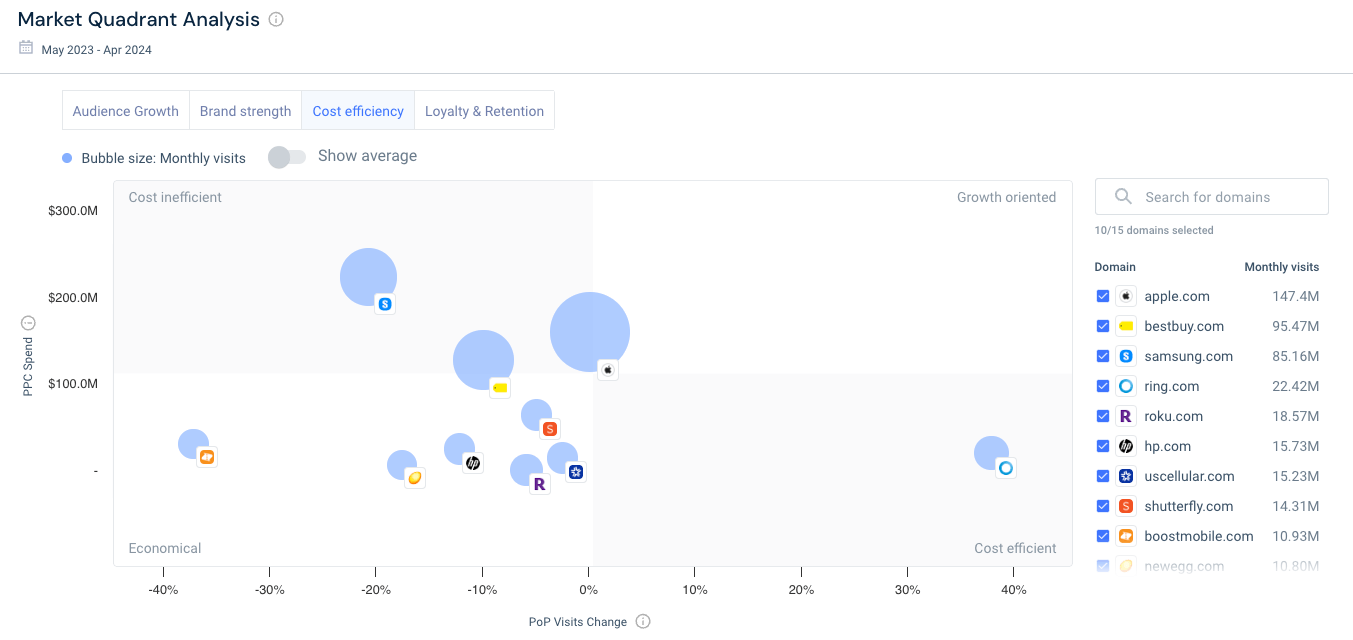

Average PPC Spend

The data suggests that, at a glance, there is a high average PPC spend within the Consumer Electronics industry, likely due to strong competition over high-value keywords and ad placements. This can outprice companies with a smaller budget or lead to wasted ad spend with little to no results.

Understanding the investment needed to compete on paid channels can encourage smaller companies to either target more cost-effective options, like more niche or long-tail keywords, or redirect spend to more lucrative marketing channels that will yield better results.

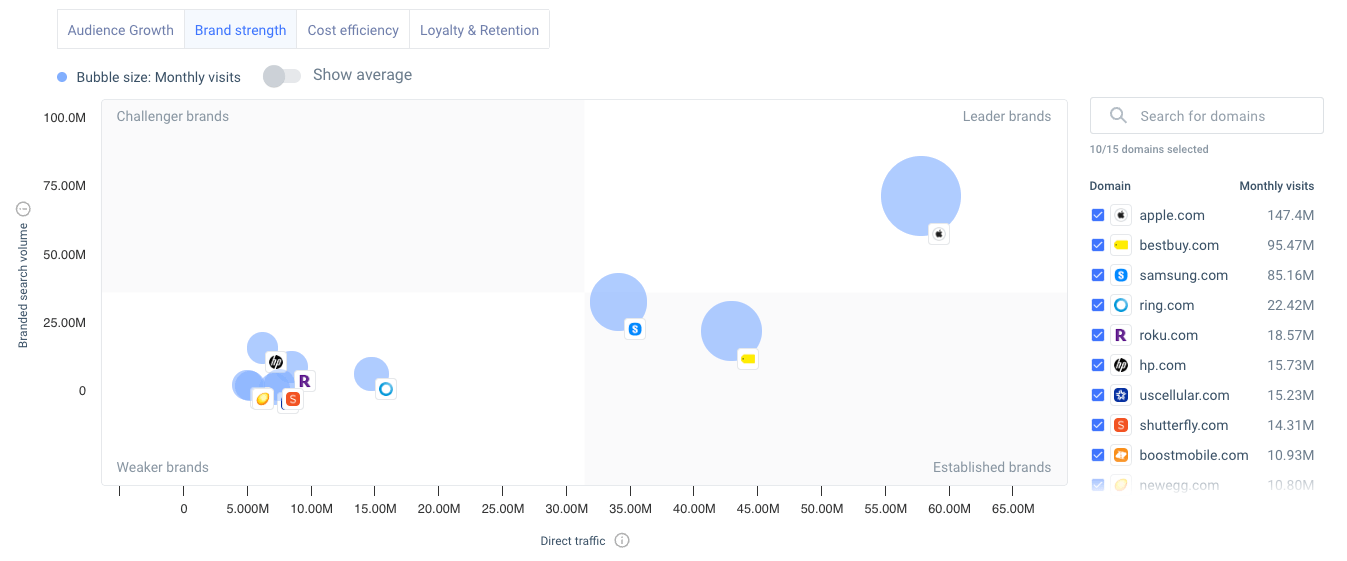

Brand strength

Interestingly, brand strength is measured as ‘medium’ at 59.11% for the Consumer Electronics industry, despite featuring household names like Apple and Samsung. Brand strength is calculated by the percentage of direct and branded traffic to the top websites in the industry:

This means it could be relatively tricky – but certainly not impossible – for new market entrants to build brand awareness.

With the understanding that strong brand recognition and marketing is effective in this industry, potential market entrants can focus significant effort on building a strong, yet unique, brand identity and decide on strategies that will help them cut through the noise, like influencer marketing and PR campaigns.

Understanding consumer behavior

Data analysis for quantitative data is like a compass for understanding what your customers are doing and what they want. Metrics like click-through rate, conversion rate, page visit duration, and bounce rate all tell a story about how engaged your customers are with your website and content. This is instrumental in refining marketing campaigns, improving product or service offerings and elevating the customer experience.

Want another shortcut to understanding consumer behavior and preferences? Similarweb delivers this (and more) with our Demand Analysis feature.

Demand Analysis offers a direct look into what consumers are searching for, the trends shaping their behaviors, and how they respond to various market stimuli.

By leveraging real-time and historical data on consumer search behavior, you can gain a detailed understanding of demand patterns and shifts in consumer interests.

Demand Analysis reveals trends through customized keyword lists. By leveraging these personalized insights, you can forecast demand within your category and track how it evolves over time. This enables you to identify—and potentially forecast—both significant macro trends and nuanced micro trends that are likely to influence your business.

Here’s how demand forecasting works using Similarweb:

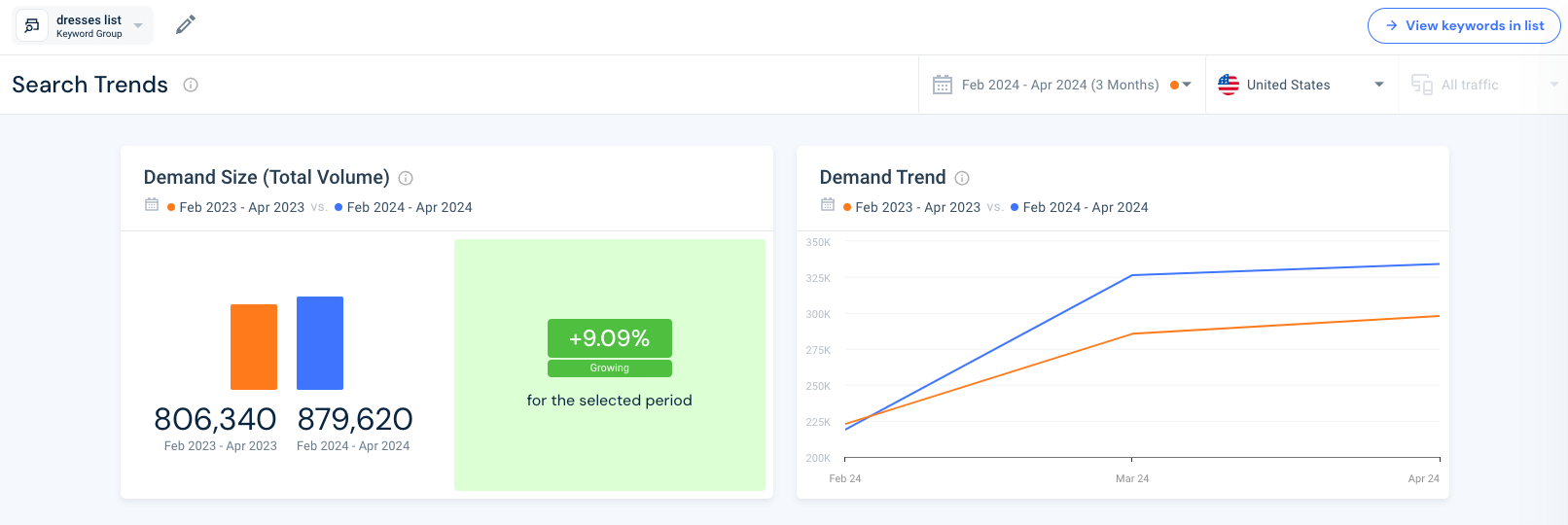

Let’s find out how popular the topic ‘dresses’ is based on real-time consumer searches and clicks. Based on a customized keyword list, we can see that demand for this topic has grown by 9.09% over the last three months:

With total searches for dress-related keywords rising by almost 10% in the last 3 months, we can clearly see the demand trend is steadily rising – to be expected as we enter the warmer months. Here, there is also the option to change the time period of comparison, for example to see how demand has changed Year over Year.

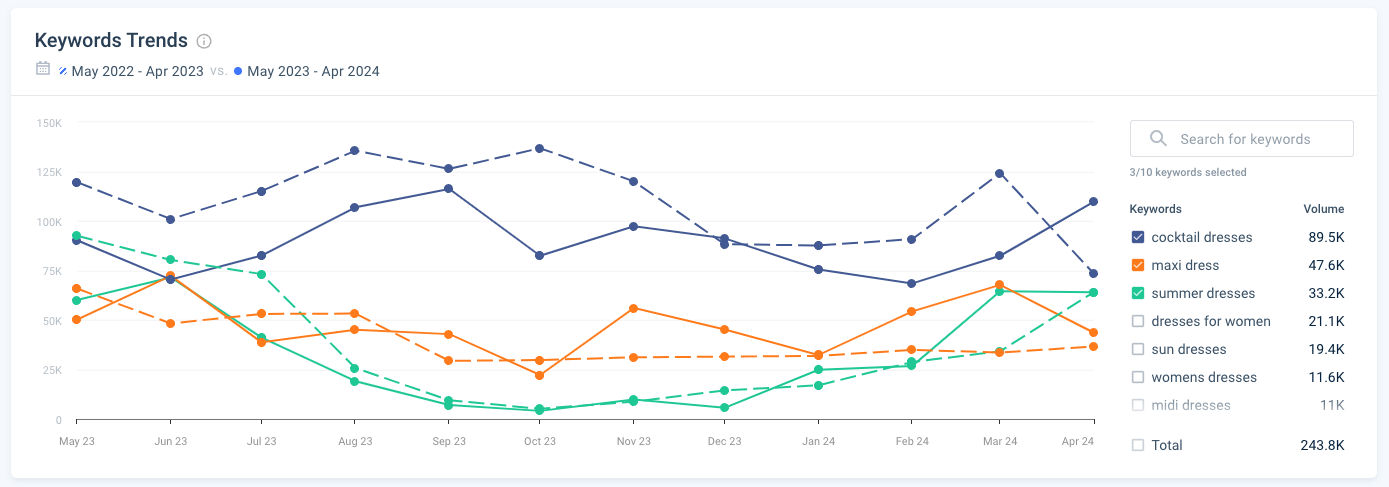

Looking at a YoY view of keyword trends, this graph reveals further key consumer insights surrounding demand for dresses, such as:

- The lowest search volumes are seen in more generic keywords like “dresses for women” and “women’s dresses,” which indicates that consumers are searching more specifically when looking online

- ‘Cocktail dresses’ has the highest search volume among the dress types, peaking at around 116K searches in Sept 2023 and then again in April 2024. However, there is a decrease of 8-30% during these peaks when compared with data from 2022

- The consistently high volume for dresses suggests strong, steady demand throughout the year, however the peak in September for ‘cocktail dresses’ and in November for ‘maxi dresses’ is not quite consistent with the expected seasonal trend, which could point to event-driven consumer demand or targeted marketing campaigns

Benchmarking performance/competitive analysis

Quantitative data analysis is also vital for comparing business performance against competitors, particularly industry leaders. By analyzing competitors’ data alongside their own, like product sales or views, marketing channel performance and engagement metrics, businesses and brands can benchmark their success and better gauge their position in the market. This also helps identify opportunities or areas of improvement.

When it comes to this kind of comparative quantitative data, Similarweb’s platform has it all.

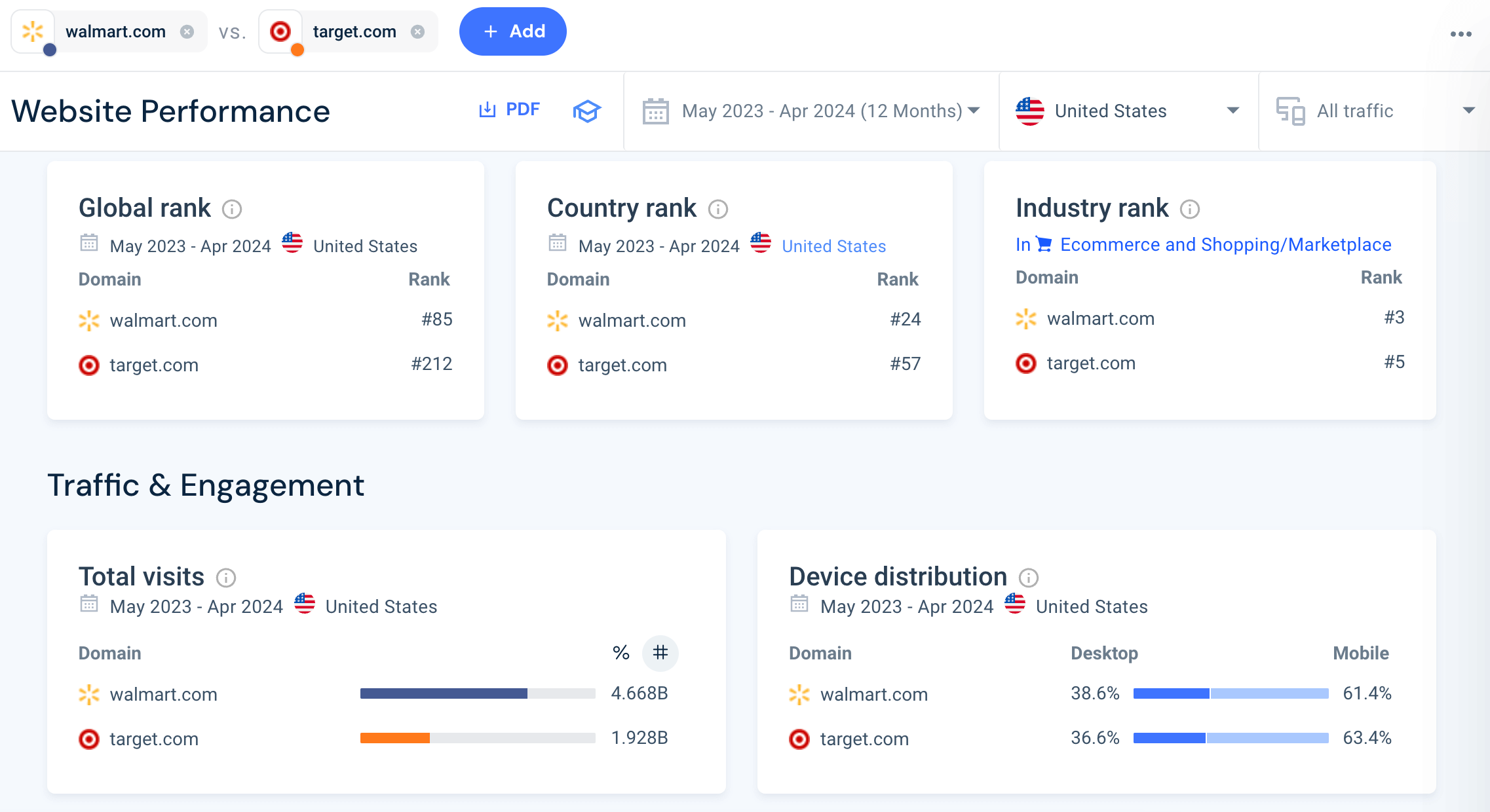

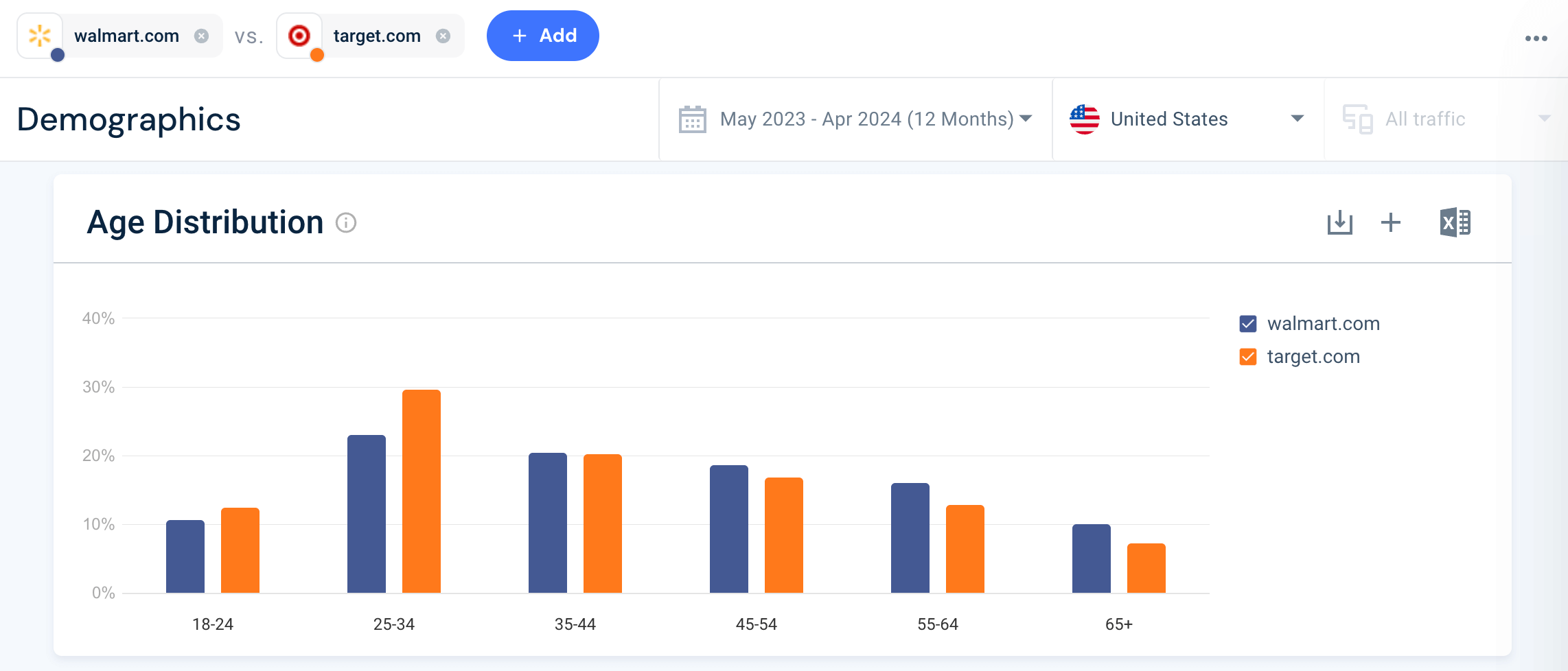

Let’s compare the website performance of two leading click-and-mortar retailers: walmart.com and target.com – using our Website Analysis feature.

Before diving into the nitty gritty, Similarweb offers an overview or snapshot of each company’s key performance metrics, displayed side-by-side for easier comparison:

With this initial overview, market research professionals can quickly gauge where they stand against their competitors in terms of market share, total website visits, desktop/mobile device distribution and how they compare in the global, country and industry arena.

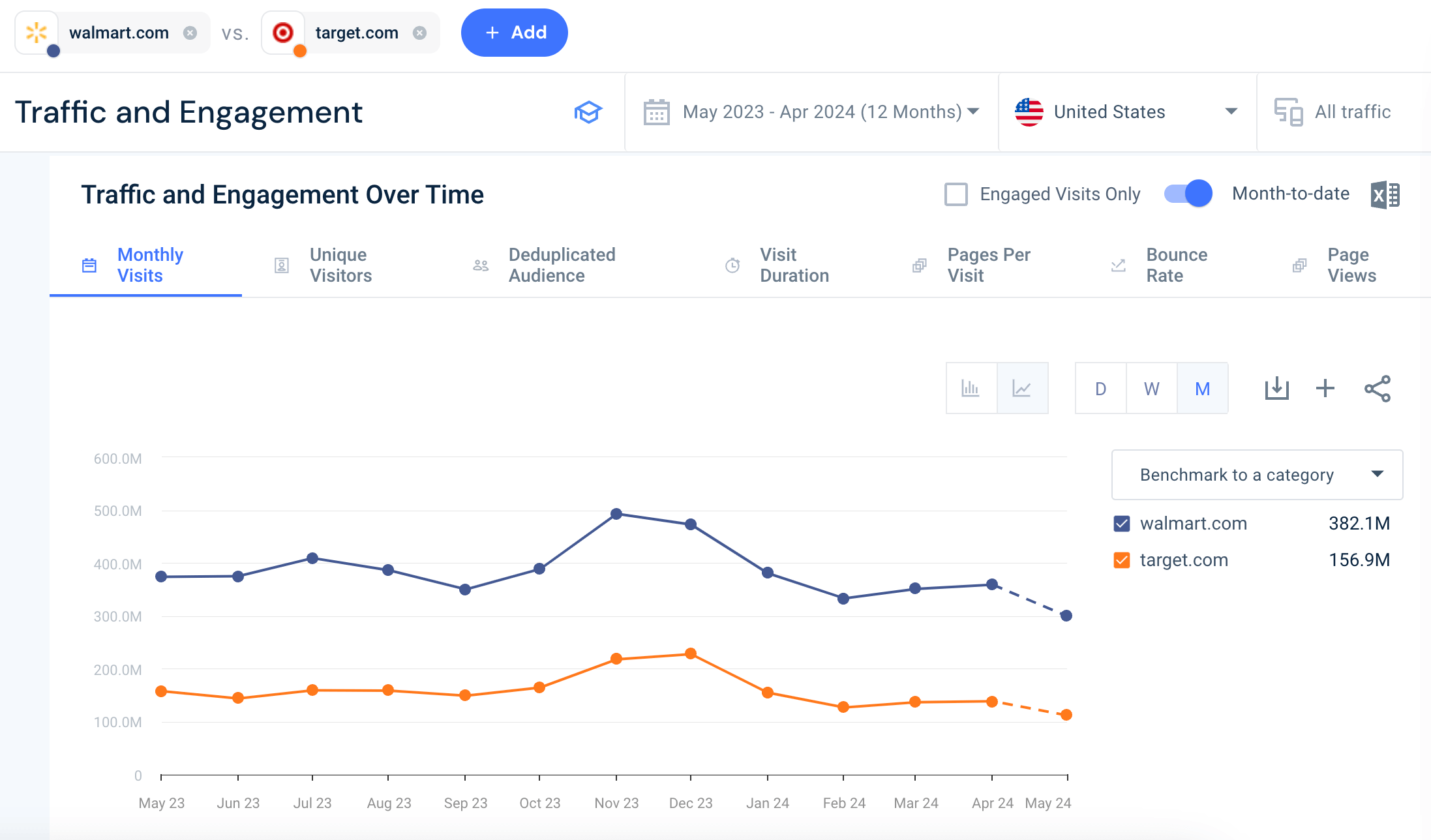

Diving into the data further, Website Analysis offers a look into high-level traffic and engagement metrics:

Here, there is the option to compare the website traffic trend of each competitor analyzed over a specific period. Then, they can view other engagement trends concerning visit duration, pages per visit, page views, and bounce rate.

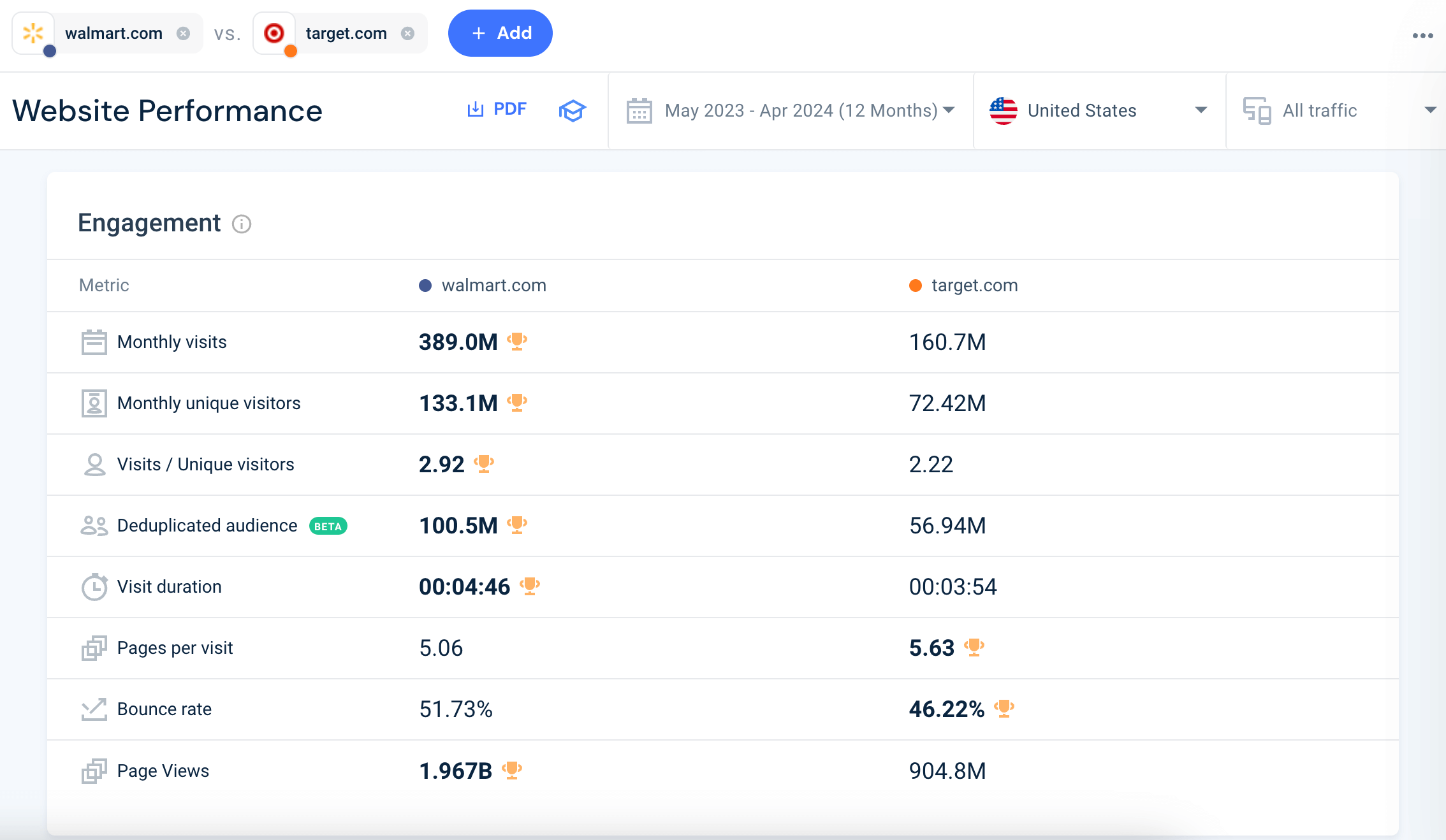

Alternatively, this data can be seen even more clearly under our specific Engagement segment:

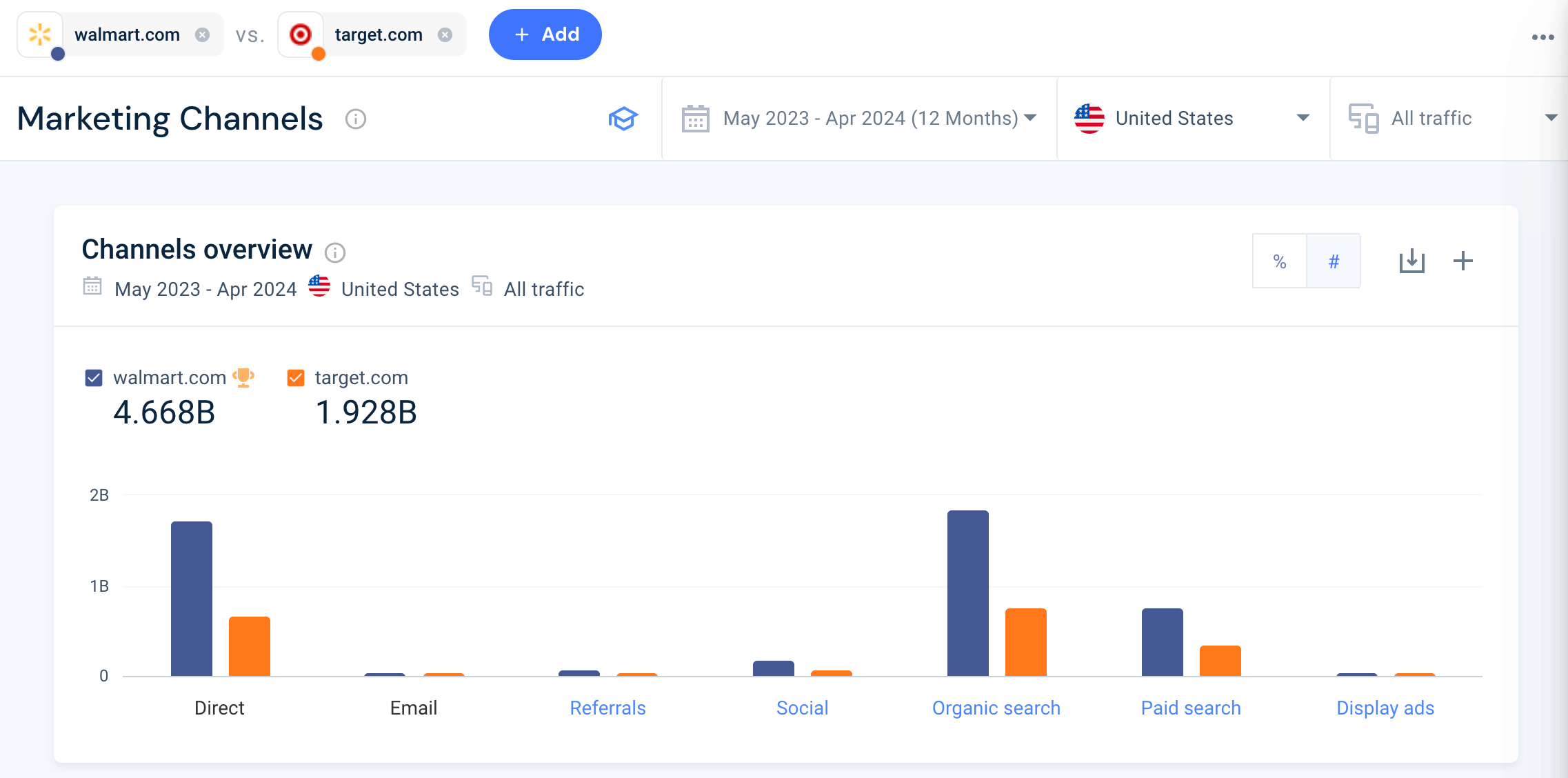

Next up, the Marketing Channels overview gives a snapshot into the performance of each competitors’ marketing channels, so businesses can compare their most successful traffic sources:

Walmart is the clear winner in this example, taking the lead across every channel. Target may use this information to understand the most lucrative channels to invest in based on their competitors’ success.

And finally, get one last snapshot of quantitative data in the form of some juicy audience demographics for more targeted strategies:

Tracking market trends

Understanding (and anticipating) market trends is one of the most important parts of market research. Trendspotting is possible by tracking certain quantitative data, such as sales numbers, market share, customer demographics, and purchase patterns over time. These data points can help provide clear insight into how a market is evolving, and what might be on the horizon. This is especially useful when forecasting future trends or demand for products and services.

Elevating the customer experience

Last but certainly not least, quantitative data is very useful in getting an idea of how satisfied customers are with a product or service. Gathering feedback via market research surveys can be used to fine-tune product features, elevate customer service, and enhance the user experience, sending customer satisfaction, loyalty, and sales through the roof.

That’s a wrap on quantitative data…

In market research, quantitative data is indispensable, fueling data-driven decisions, product innovation and competitive analysis. This type of data provides measurable, objective evidence crucial for assessing strategies, understanding consumer behaviors and predicting future trends.

Similarweb is a goldmine of quantitative data, showcasing the power of these metrics with its advanced analytical tools.

The platform’s Market Analysis feature, in particular, offers deep insights into market dynamics, empowering market research professionals to make data-driven decisions with more precision.

Whether exploring new markets or expanding existing ones, Similarweb provides the essential quantitative data needed to turn data into actionable insights and navigate the complexities of today’s dynamic landscape with confidence.

FAQs

What is quantitative data?

Quantitative data refers to any data that can be quantified and expressed numerically. This includes measurements, counts or other data that can be represented by numbers.

Why is quantitative data important in market research?

Quantitative data is crucial in market research as it provides a solid foundation for making objective decisions. It helps in analyzing trends, measuring the effectiveness of different strategies and predicting future outcomes. With quantitative data, businesses can take out the guesswork, allowing for more precise planning and assessment.

What’s the difference between quantitative and qualitative data?

Quantitative data involves numerical measurements and provides insights in terms of numbers and stats, allowing for statistical analysis and more concrete conclusions. Qualitative data is more descriptive and observational, providing deeper insights into thoughts, opinions, and motivations.

What are the different types of quantitative data?

Quantitative data is categorized into four main types. Discrete data consists of counts that cannot be meaningfully divided into smaller parts, such as the number of children in a family. Continuous data includes measurements that can be infinitely divided into finer increments, like weight.

Interval data involves measurements where the difference between values is meaningful but lacks a true zero point, such as temperature in Celsius. Lastly, ratio data is similar to interval data but includes a meaningful zero point, allowing for ratio calculations, examples include height, weight, and distance.

How can I find and analyze quantitative data using Similarweb?

Similarweb offers a variety of tools that help in discovering and analyzing quantitative data. Features like Market Analysis provide insights into market dynamics, including competitor density, market saturation and customer loyalty. To track consumer behavior, the Demand Analysis tool offers real-time data on search trends and keyword volumes, making it easier to gauge market demand and interest.

Track your digital metrics and grow market share

Contact us to set up a call with a market research specialist