Fastest-Growing Brands on Amazon Q3 2021

Revenue grew nearly 6% across Amazon categories reaching $85.4 billion in the third quarter (July – September). To determine the top Amazon brands and the consumer behavior driving their growth, our industry managers used data from Shopper Intelligence, our eCommerce solution, to analyze the fastest-growing brands based on quarter-over-quarter (QoQ) revenue growth in top Amazon categories. Read on to see which brands and related products are capturing consumer attention, and leave with some learnings for your holiday season strategy.

Consumer Electronics

- Philips Hue (+401.4%)

- Kyocera (+275.2%)

- Noot Products (211.8%)

- Roccat (+139.1%

- PNY (+133.2%)

Insights

1. Smart lighting shines brightest

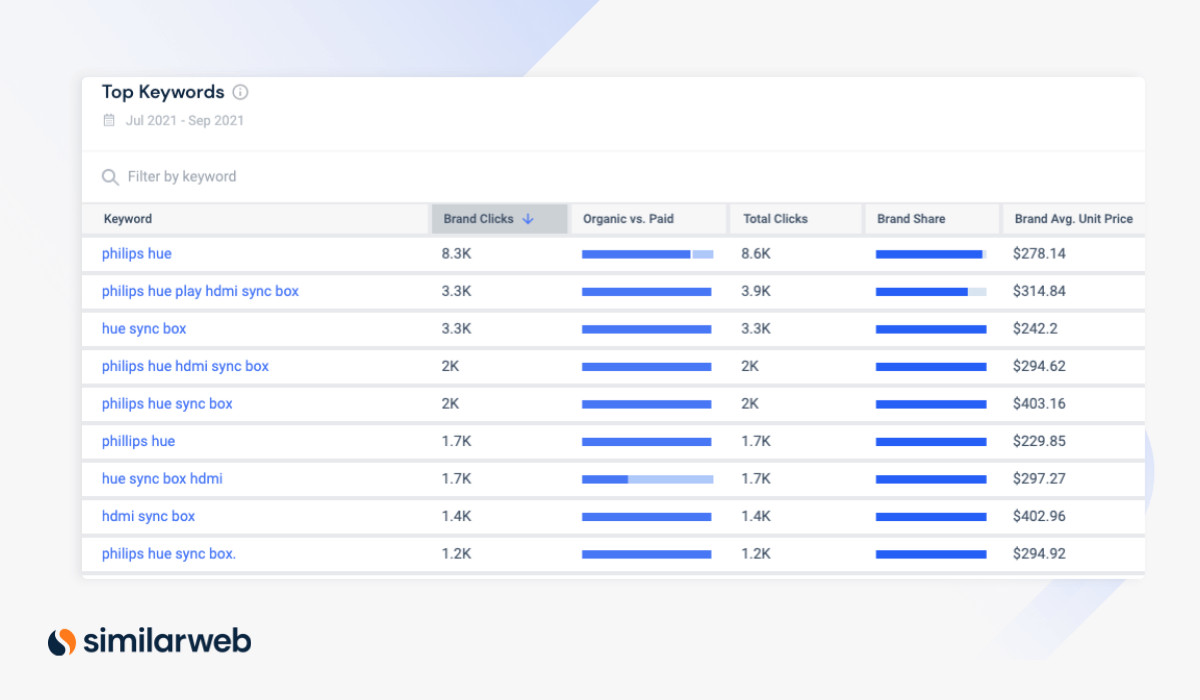

With revenue rising over 400% in Q3, Philips Hue is both the fastest-growing electronics brand and the fastest-growing across top Amazon categories. Consumers are searching for its smart lights by name – branded searches composed 85% of search clicks, more than the other top five electronics brands. With nearly 60% of branded search clicks, Roccat is the closest contender for brand recognition.

To boost their own rankings, Philips Hue’s competitors, like Kasa Smart and LIFX, may want to bid on Philips Hue branded terms.

2. Consumers get computer gaming literate

Non-branded gaming PC-related searches rose 62% year-over-year (YoY), reflecting an increased literacy of components. Searches for the latest components, like “ryzen 7,” “RTX 3080,” and “32gb ram gaming laptop,” grew by more than 500% while searches for related peripherals, like mice and keyboards, also climbed 15% YoY.

This shopper behavior helped propel the growth of gaming peripherals brand Roccat, fourth place, and gaming PC component brand, PNY, fifth place. It also shows shoppers are turning to lesser-known manufacturers to get ahold of top products amid shortages from household names like Nvidia.

3. Supply chain shortages are Nintendo’s gain

Shortages also helped drive Nintendo’s revenue to rise 120% to reach sixth place. Specifically, the wide unavailability of PS5 and Xbox Series X gaming consoles prompted the brand to ship 700,000 Nintendo Switch consoles this year. By owning 75% of software revenue on the console, it scored an additional $112 million, while Sony accounts for just 13% of software sales for PlayStation 4.

Circumstances continued to favor Nintendo throughout 2021, when it raked in $432 million in revenue in the first three quarters, surpassing both Xbox and Playstation at $193 million and $214 million respectively, and proving the positive impact the shortage ended up having on the brand.

4. Kids’ headphones are back-to-school essentials

Back-to-school season helped drive 211% growth of Noot Products, which specializes in children’s headphones, one of Q3’s most in-demand items. During this period, searches for “kids headphones” increased 125% QoQ.

Noot Products’ revenue growth exceeded that in Q3 last year (182%), showing that factors beyond seasonality drove growth.

Toys & Games

- Bluey (+134.4%)

- Kotobukiya (+103.3%)

- Yu-Gi-Oh! (103.1%)

- Temi (+99.5%)

- Tamagotchi (+91.5%)

Insights

1. Screentime opens up merchandising opportunities

Many hours of screen time over the past two years helped foster children’s strong affinity for entertainment and gaming characters. As such, the demand for related toys and games grew. Amazon’s fastest-growing brands reflect the intertwining of toys with entertainment.

Bluey, named after an animated children’s show soared 135% to the number one spot, followed by Kotobukiya, which manufactures TV, movie, and video game figurines, then Yu-Gi-Oh, which makes toys based on a Japanese gaming series.

The continued intertwining of toys and entertainment presents bright opportunities for digital productions to tailor their merchandising strategies accordingly. They can also use Amazon’s marketplace to make these products more discoverable to consumers, investing in Amazon PPC and Amazon SEO, particularly during seasons when toys are in high demand, like the holidays.

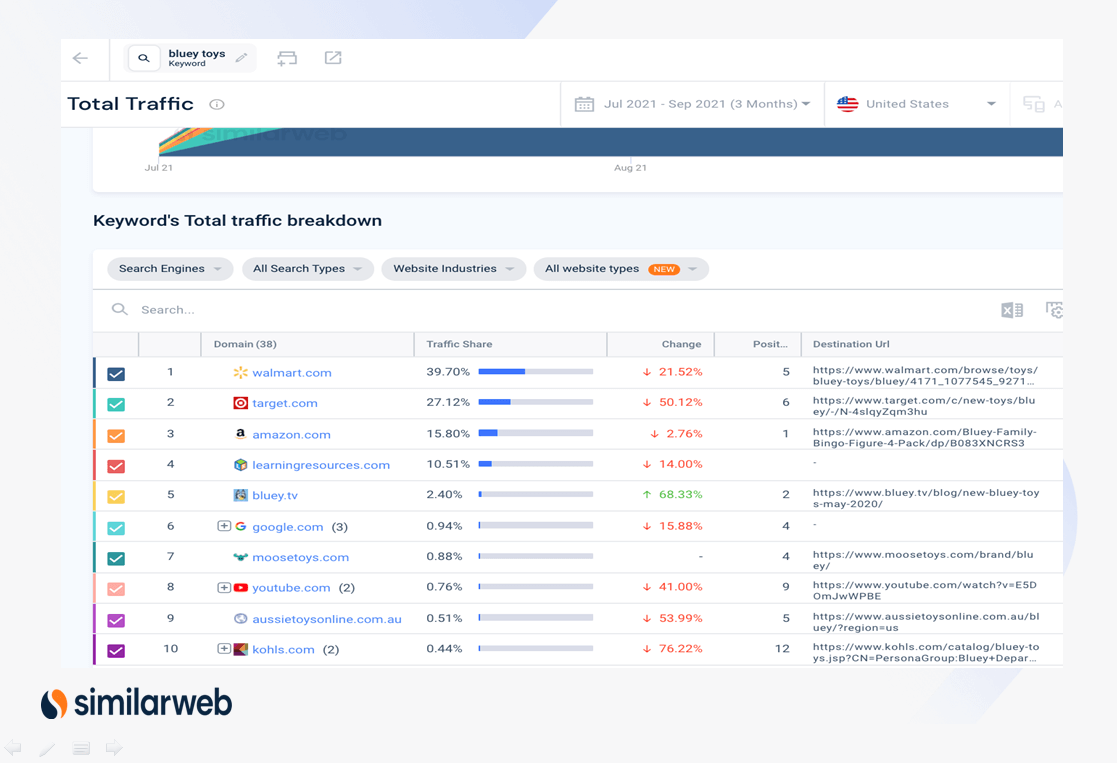

Despite being Amazon’s fastest-growing toy brand in Q3, traffic for the keyword “Bluey toys” to amazon.com declined nearly 3% at the same time, and even more so for nine out of the top 10 websites with the most traffic share for the term.

Bluey.tv, the D2C site, was the only website in the top 10 websites gaining traffic (66%) for the term during this time period, showing that consumers are increasingly turning directly to entertainment brands, rather than large retailers, for their favorite products.

2. Shopping earlier to prepare for shortages

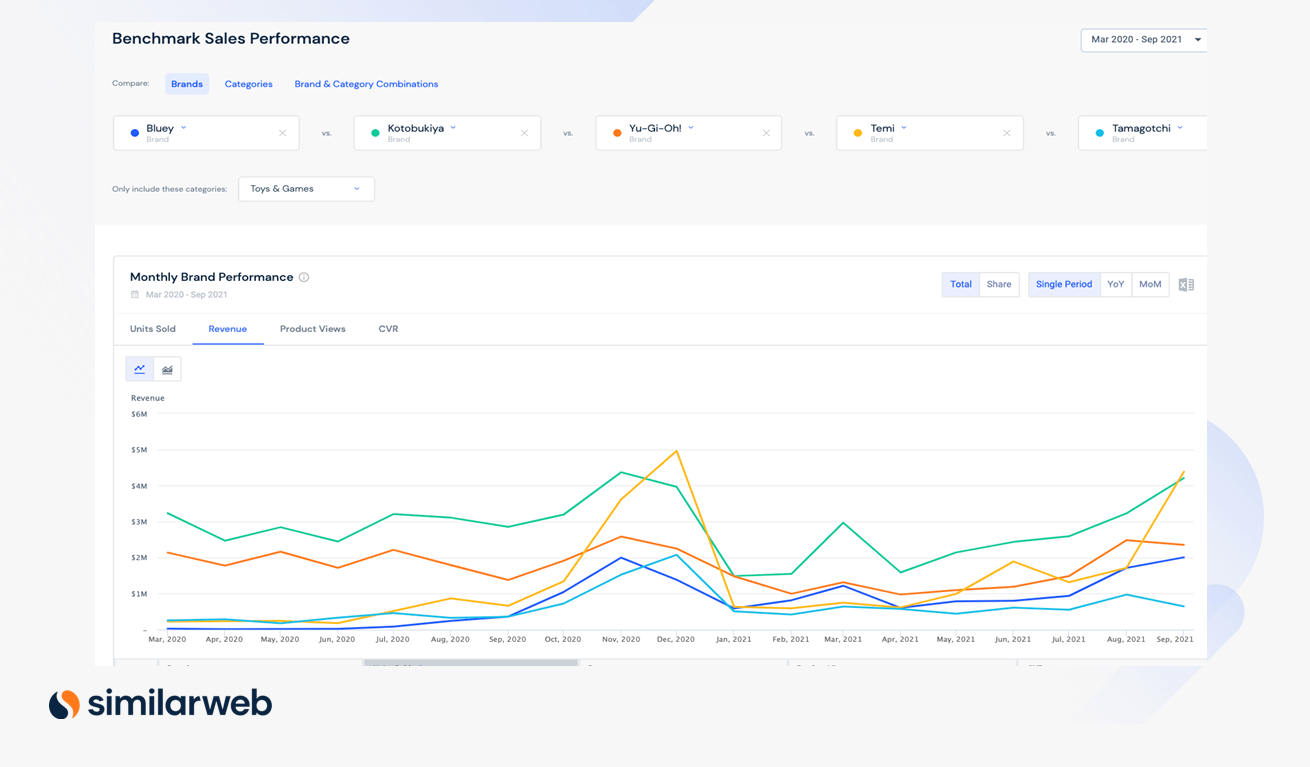

In September, Bluey generated $2 million in revenue on amazon.com, surpassing December 2020 levels by $600,000. Kotobukiya, with $4.2 million, also earned more in September than at the height of the holiday season. Even if they did not surpass December 2020 levels, revenue for other fastest-growing toy brands clearly did start creeping up in August.

This trend indicates that consumers started their holiday shopping earlier to prepare for toy shortages of the most sought-after brands deeper into the holiday season.

Beauty & Personal Care

- NNPCBT (+73.0%)

- Aquasonic (71.5%)

- BUYWOW (+68.6%)

- Chapstick (+66.6%)

- Arm & Hammer (+58.7%)

Insights

1. Still cool to cover face

Despite vaccine distribution to the majority of Americans and the lifting of mask mandates, the fastest-growing brand, NNPCBT, specializes in black, disposable face shields. Its 73% growth indicates continued high consumer demand for protection against the virus in Q3 – we suspect due to late summer outbreaks of the Delta variant.

2. Keep smiling, keep covering

Shoppers still want a top-notch smile behind the mask. Revenue for Aquasonic, which makes electric toothbrushes, grew 71.5%, helping it snag second place.

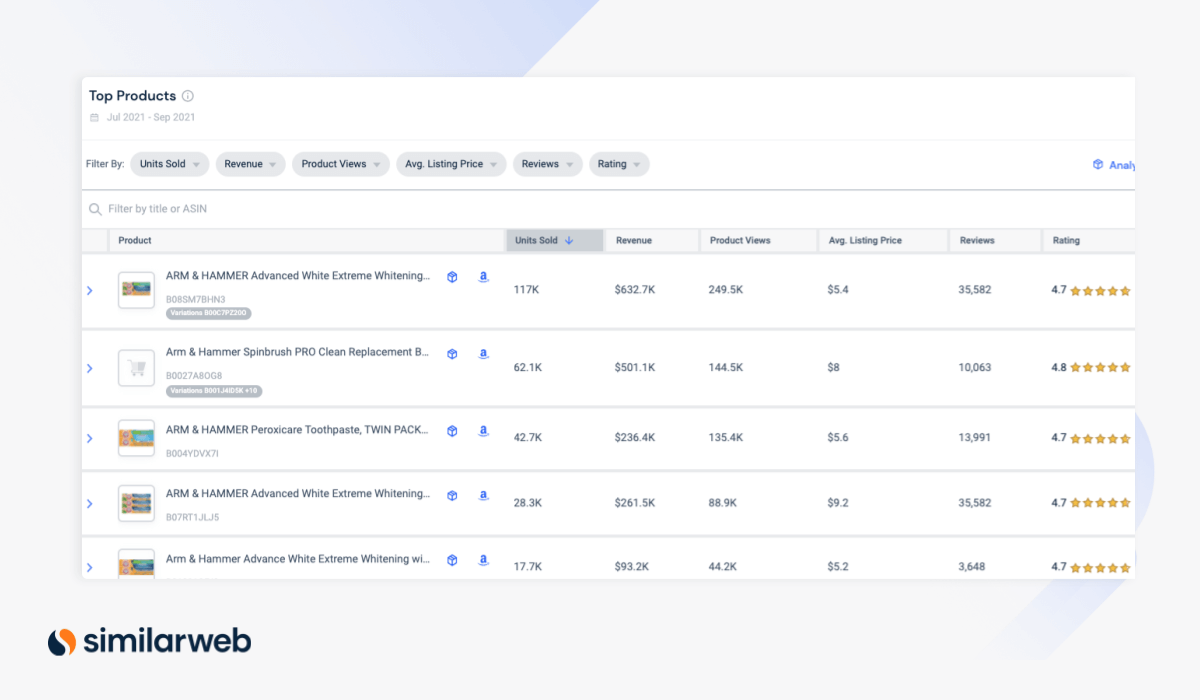

Top products for Arm & Hammer, ranked fifth, also ensure pearly whites. In order of revenue, top-sellers include:

- Advanced White Extreme Whitening

- Spinbrush Pro Clean Replacement Brush

- Advanced White Extreme Whitening (3 pack)

- Peroxicare Toothpaste

- Essentials Fluoride Free Toothpaste

3. Clamor for clean beauty

The clean beauty trend helped fuel the 68.6% growth of BUYWOW, which ranked third. Consumers are increasingly turning away from chemical ingredients such as parabens, silicones, and sulfates in their beauty regimens – something BUYWOW speaks to in its messaging.

For instance, its top-seller, WOW Apple Cider Vinegar Shampoo and Hair Conditioner, which generated $1.6 million in revenue in Q3, touts “No Parabens or Sulfates” in the title of its Amazon listing.

BUYWOW’s other top products emphasize natural ingredients, including vitamin C, red onion, and black seed.

Grocery & Gourmet

- Seapoint Farms (+505.3%)

- Liquid Death (+491.2%)

- Mrs. Wages (+413.0%)

- Keystone Meats (+327.9%)

- Miss Vickies (+289.1%)

Insights

1. Hunger to hoard

Illustrating fears of shortages, all fastest-growing brands are non-perishables with long shelf lives. Search clicks for Keystone Meats, ranked fourth, and B&M, ranked eighth, jumped to double digits, indicating higher brand awareness for their products: exclusively canned goods.

The growth of Mrs. Wages, Yogourmet, and The Sausage Maker, which ranked among the top five, indicates rising consumer demand to be specialty food self-sufficient, and not rely on manufacturers impacted by supply chain blips. These winners enable a D.I.Y. approach, allowing shoppers to pickle veggies, whip up yogurt, and make sausage at home – no waiting on orders needed.

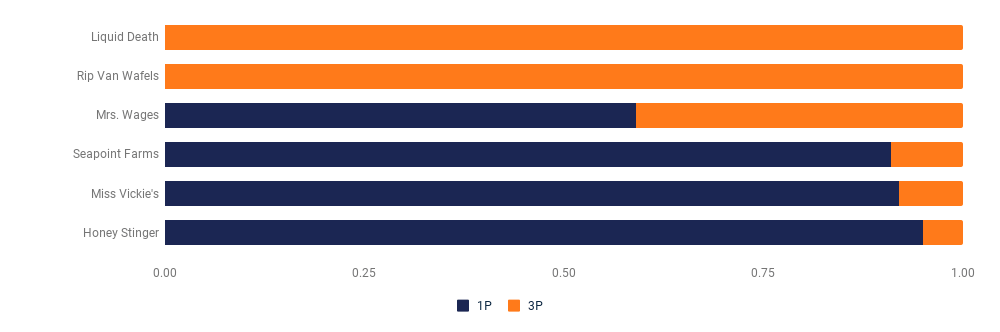

2. Third-party thirst

Liquid Death ranked second, is the only brand in the top five with purely third-party (3P) sales, which effectively complements its direct-to-consumer (D2C) business. Traffic to its D2C website is 13x the average across the 10 fastest-growing Grocery & Gourmet brands.

Fastest Growing Brand 1P vs. 3P Sales*

Amazon.com, Desktop, Mobile Web & Mobile App, Q3 21

This 3P strategy also complements the LA-based company’s aggressive promotions to “murder your thirst,” its memorable (if a bit menacing) motto. The strategy also supports Liquid Death’s drive to own all facets of the consumer relationship by partnering with LiveNation in May to sell Liquid Death across its venues and festivals in the U.S. Additionally, it teamed up with highest-growth brand Paqui for convenience store 7-Eleven’s “One Slice Challenge.”

Home & Kitchen

- HOMCOM (+144.8%)

- Bentgo (+143.2%)

- Thermos (+142.9%)

- Niagara Sleep Solution (134.4%)

- AmazonCommercial (+117.8%)

Insights

1. Bonkers for bento

Consumer behavior showed that shoppers are bonkers for bento. The term, which originated in Japan, refers to a single-portion home-packaged meal.

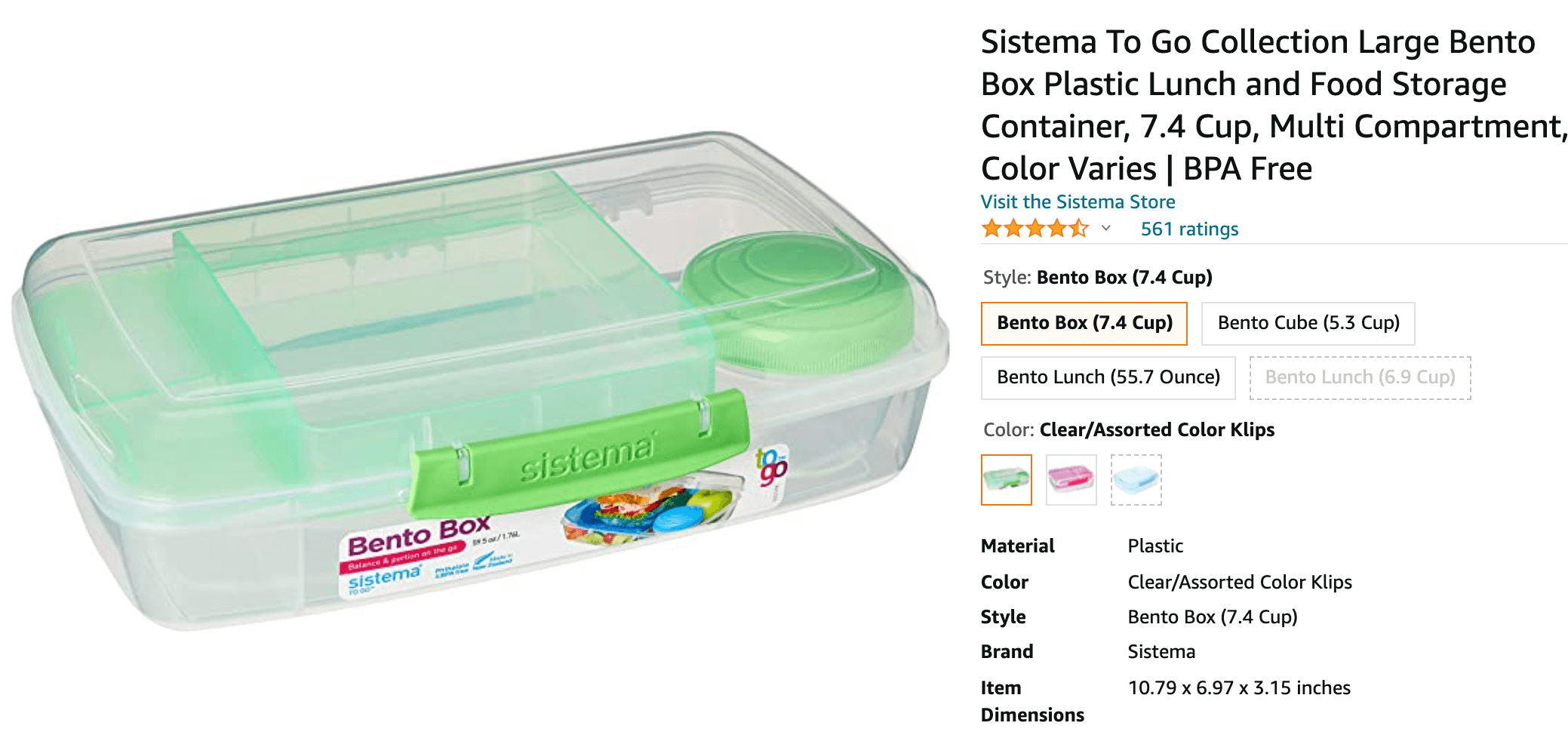

Bentgo bagged second place with its on-the-go bento-style lunch box offerings, while Sistema snatched sixth with its “large bento box” as the top-seller.

2. On the go for back to work and school

Both Bentgo and Sistema capitalized on the demand for portable food packaging as consumers returned to work and school. Thermos, in third place, leaned into the same trend, offering “Funtainers,” its best-selling product line, in bright colors with logos of Batman and other favorite superheroes to appeal to students going back to school.

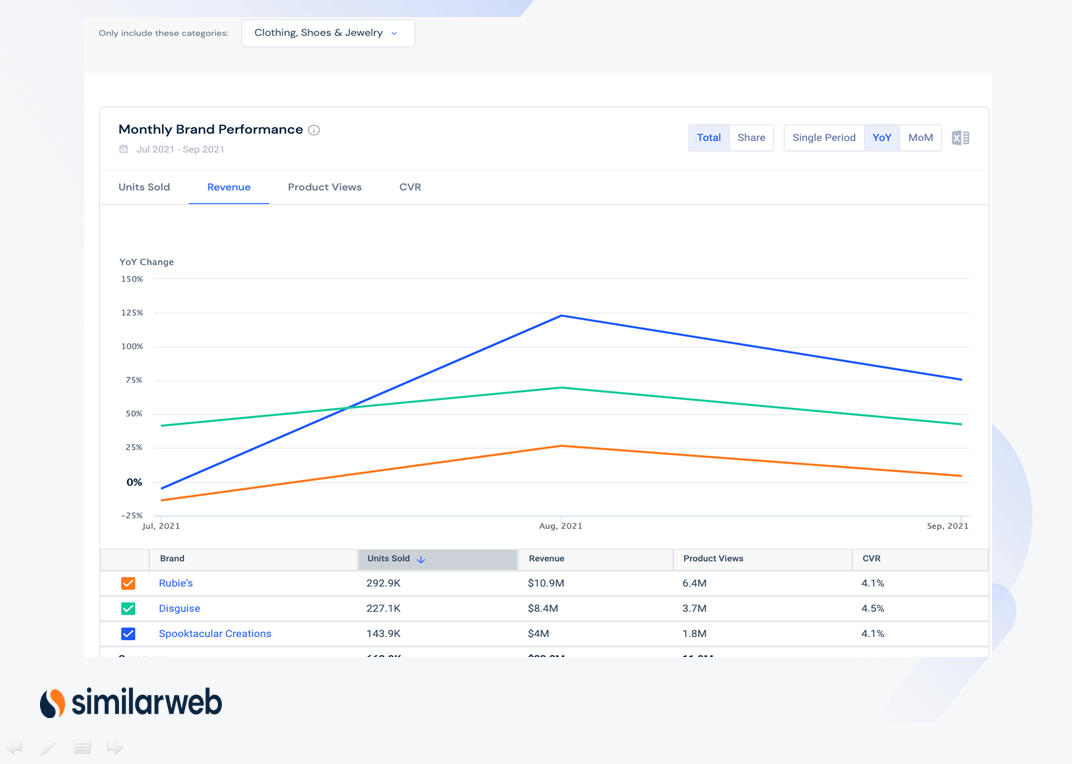

Clothing, Shoes, & Jewelry

- Spooktacular Creations (+632.1%)

- JanSport (+372.4%)

- French Toast (+354.8%)

- Disguise (+273.9%)

- Rubie’s (+267.3%)

Insights

1. Back-to-school bargains win

Top clothing brands also bet on back-to-school – revenue for backpack brand JanSport soared 372.4%, earning it second place.

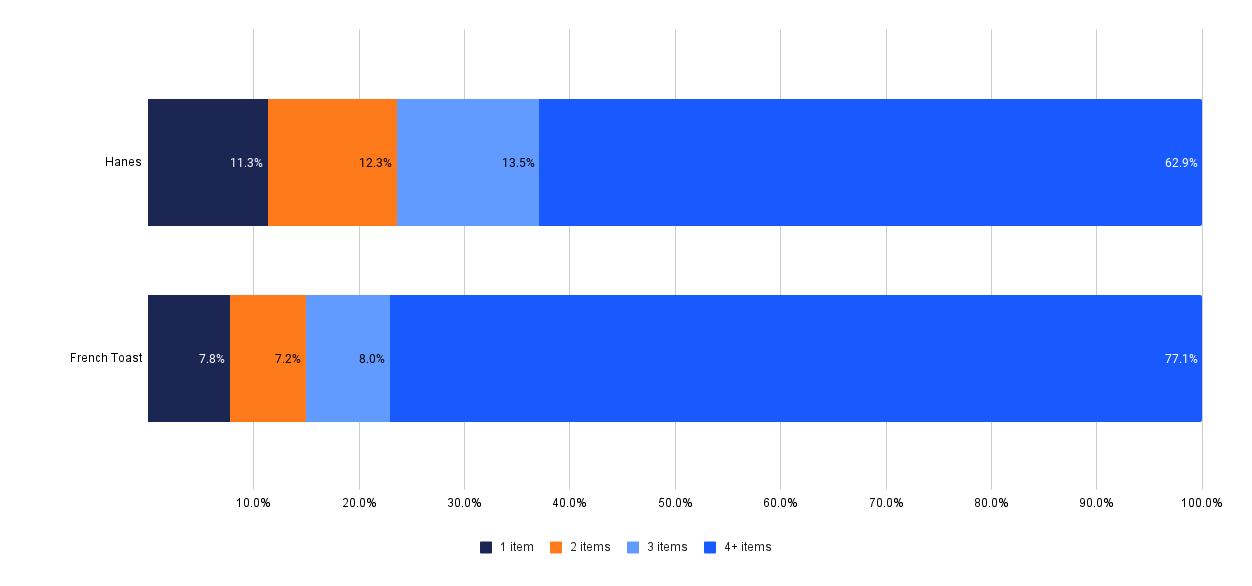

Despite a respectable revenue rise nearing 355%, French Toast trailed in third place. The clothing brand, which produces school uniform-style gear, generated $16 million in Q3 sales. Search traffic soared 157% higher YoY, showing the close alignment of the brand with the return to the classroom.

Among the top keywords for its category, French Toast took 58% of all search traffic relating to back-to-school.

It certainly didn’t hurt that the brand’s products cost 28% less than competing brands. The lowball prices made for an average $400 basket spend and 32% more spend than competitors.

Apparel Brands Basket Size on Amazon

Amazon.com, Desktop, Mobile Web & Mobile App, Q3, 2021

2. Hello (early) to Halloween

With the approach of the spooky season, the QoQ growth of costume brands may not be surprising. However, YoY growth indicates that consumers are very eager to dole out dollars on the perfect costume, early. Revenue YoY for all three of the top five costume-related brands, Spooktacular Creations, Disguise, and Rubie’s peaked in August, rather than in September, as in 2019 and 2020.

We suspect that pent-up demand for Halloween celebrations and supply chain-related sell-outs scared consumers to shop earlier and spend more this year.

Health & Household

- Sandhu’s (+245.2%)

- Santamedical (+189.6%)

- Xlear (+183.7%)

- EnerPleax (+169.6%)

- Munfix (+122%)

Insight

Need wellness to forget pandemic

The majority of the fastest-growing brands relate to wellness, similar to what we noticed among Q3’s fastest-growing D2C brands, and indicative of consumer enthusiasm to take care of their health amidst continued coronavirus threats.

Sandhu’s, a sports supplements brand, scored first place with immunity-boosting Zinc products as top-sellers. Second-place Santamedical makes oximeters, medical devices that detect blood oxygen levels and can help monitor symptoms of COVID-19.

Further indicating COVID-19 concerns are alive and well, EnerPleax, which specializes in cloth masks, nabbed fourth place.

Methodology

We calculated our lists of fastest-growing Amazon brands by using data from Similarweb Shopper Intelligence, our eCommerce solution that detects consumer and purchase behaviors across Amazon and online marketplaces.

Lists were based on Q3 vs. Q2 revenue growth and reviewed by our industry managers, who filtered brands based on factors like size and seasonality.

To get your own insights year-round to rank among the fastest-growing, sign up for a demo of Similarweb Shopper Intelligence.

The ultimate edge in retail insight

Put the full picture at your fingertips to drive product views and sales